Are We In A Housing Crisis? Record Low Home Sales

Table of Contents

Record Low Home Sales: A Symptom of a Deeper Problem?

The recent decline in home sales figures is more than just a statistical blip; it's a potent indicator of underlying issues within the housing market. Data reveals a significant downturn compared to previous years, suggesting a fundamental shift in buyer behavior and market dynamics. This isn't a uniform decline, however; the impact varies geographically.

- Specific examples of cities/regions with significant sales drops: For instance, several major metropolitan areas like San Francisco and New York City have experienced double-digit percentage drops in sales compared to the previous year. Smaller markets in certain states have also seen significant decreases.

- Comparison of current sales figures to historical data: A comparison of current sales figures to historical averages clearly shows a downward trend, exceeding normal seasonal fluctuations.

- Mention of any government reports or market analyses supporting the data: Reports from the National Association of Realtors (NAR) and other reputable sources confirm this nationwide slowdown in sales activity.

This substantial drop in sales isn't an isolated event but a symptom of a larger, more complex problem affecting housing affordability and accessibility for many.

High Housing Prices and Unaffordability: Fueling the Crisis?

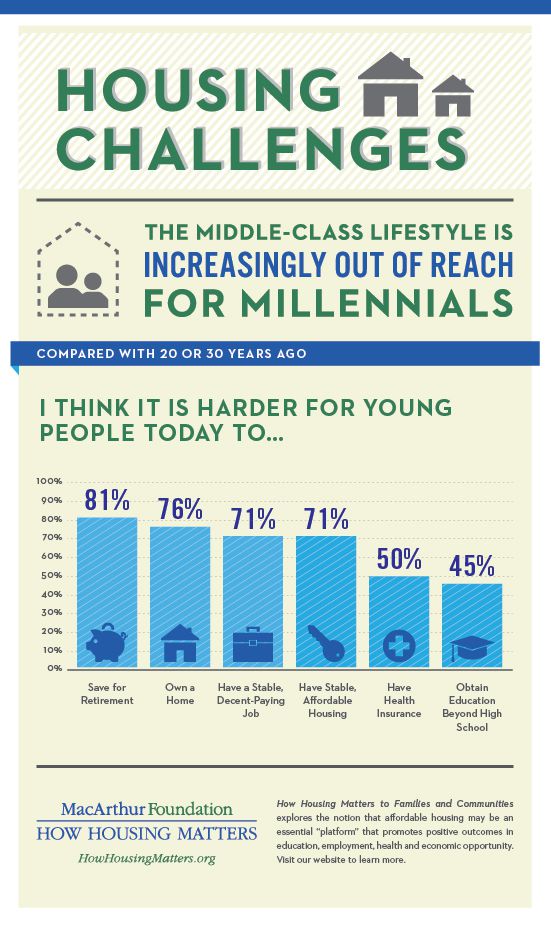

Soaring housing prices, significantly outpacing wage growth, are a major contributor to the current market turmoil. The concept of housing affordability hinges on the relationship between home prices and household income. Key indicators, such as the price-to-income ratio and mortgage affordability index, paint a bleak picture.

- Statistics on median home prices in various locations: Median home prices in many desirable areas have reached record highs, making homeownership increasingly unattainable for many.

- Comparison of price-to-income ratios: Price-to-income ratios, which compare median home prices to median household incomes, are significantly higher than historical averages in many regions.

- Discussion of the impact of rising interest rates on affordability: The recent surge in interest rates has further exacerbated the affordability crisis, making mortgages considerably more expensive and reducing the purchasing power of buyers.

Several factors have contributed to these high prices, including: limited inventory, increased building costs due to inflation and supply chain issues, and strong buyer competition in certain markets.

Limited Housing Inventory: Exacerbating the Housing Shortage

The current housing shortage is another critical factor fueling the potential housing crisis. A lack of available homes for sale significantly restricts supply, driving prices upward and making it even harder for potential buyers to compete.

- Statistics on the current housing shortage: Reports consistently show a severe shortage of homes on the market across many areas, contributing directly to the record low home sales.

- Discussion of zoning regulations and their effect on housing supply: Restrictive zoning laws in many communities limit the construction of new housing units, further contributing to the shortage.

- Mention of initiatives to encourage new construction: While some initiatives aim to increase housing supply, they often fall short of addressing the scale of the problem.

The limited inventory exacerbates the problem of record low home sales, creating a vicious cycle of high prices and low availability.

The Impact of Rising Interest Rates on the Housing Market

The Federal Reserve's efforts to combat inflation through interest rate hikes have had a significant impact on the housing market. Higher interest rates translate to higher mortgage payments, reducing the number of potential buyers who can afford to purchase a home.

- Historical data illustrating the correlation between interest rates and home sales: Historically, there's a clear inverse relationship: higher interest rates tend to lead to lower home sales.

- Analysis of the impact of current interest rates on buyer demand: Current interest rates have significantly dampened buyer demand, contributing directly to the record low home sales.

- Predictions for future trends based on interest rate projections: The outlook depends on future interest rate adjustments, but continued high rates suggest the housing market slowdown might persist.

This tightening of monetary policy has significantly altered the housing market landscape, reinforcing the pressures leading to record low home sales.

Conclusion: Navigating the Current Housing Crisis: What's Next?

In summary, record low home sales are a clear symptom of a broader housing crisis characterized by high prices, limited inventory, and decreased affordability exacerbated by rising interest rates. These interconnected factors have created a challenging environment for both buyers and sellers. The outlook remains uncertain, with potential future trends heavily dependent on economic conditions, interest rate policies, and efforts to increase housing supply.

To navigate this complex situation, staying informed is crucial. Regularly monitor housing market trends, utilize affordability calculators to assess your personal situation, and explore options like first-time home buyer programs if you're planning to enter the market. Understanding the dynamics of this potential housing crisis and record low home sales is essential to make informed decisions about your real estate goals.

Featured Posts

-

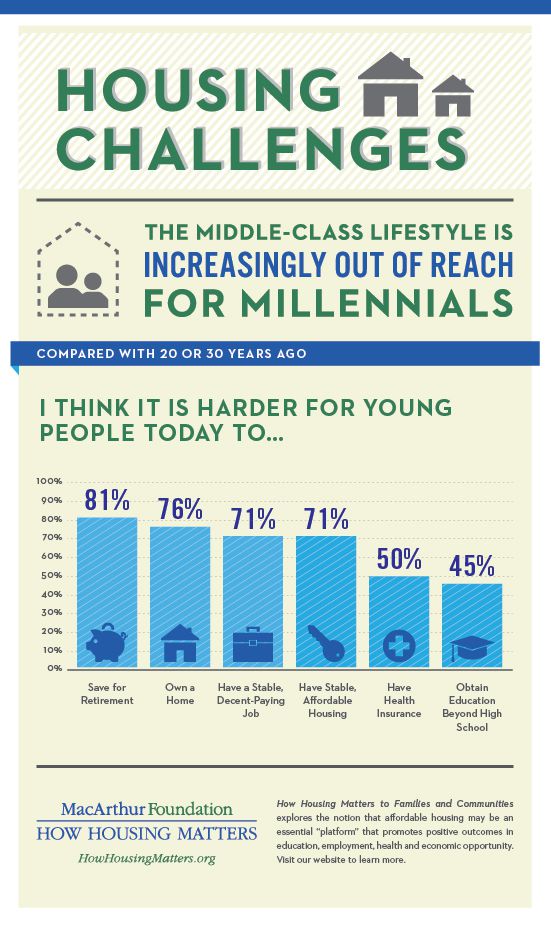

Six More Measles Cases Confirmed In Kansas Public Health Alert

May 30, 2025

Six More Measles Cases Confirmed In Kansas Public Health Alert

May 30, 2025 -

Presidente Da Fecomercio Defende Cidadania Baiana Para Ronaldo Caiado

May 30, 2025

Presidente Da Fecomercio Defende Cidadania Baiana Para Ronaldo Caiado

May 30, 2025 -

Trump Zelenski Analiza Kluczowych Punktow Rozmowy

May 30, 2025

Trump Zelenski Analiza Kluczowych Punktow Rozmowy

May 30, 2025 -

Gorillaz 25th Anniversary Your Guide To The House Of Kong Exhibition

May 30, 2025

Gorillaz 25th Anniversary Your Guide To The House Of Kong Exhibition

May 30, 2025 -

Family Fun At The Royal Bath And West Show Half Term Show Packs And Activities

May 30, 2025

Family Fun At The Royal Bath And West Show Half Term Show Packs And Activities

May 30, 2025