Are You Selling On EBay, Vinted, Or Depop? Watch Out For HMRC Nudge Letters

Table of Contents

2. Understanding Your Tax Obligations When Selling Online (eBay, Vinted, Depop)

H2: Profit vs. Hobby: Determining Your Tax Liability

The first step in understanding your online selling tax implications is determining whether your activities constitute a hobby or a business. HMRC scrutinizes various factors to make this distinction. Casual selling, perhaps the occasional clear-out of unwanted items, usually doesn't trigger a tax liability. However, consistent sales, particularly of high-value items, point towards a business activity, which requires tax returns and potential VAT registration.

Capital Gains Tax (CGT) is another critical aspect. Selling personal possessions at a profit generally attracts CGT only if the profit significantly exceeds the initial purchase price and if you are regularly selling items for profit. Regular trading, however, is subject to Income Tax.

- Examples triggering tax liability:

- Consistent sales of multiple items over a prolonged period.

- High-value sales exceeding a certain threshold (£1,000+ annually, for example).

- Use of professional accounting software or dedicated business accounts for managing sales.

- Advertising your goods professionally, beyond a casual listing.

- Regularly sourcing items specifically for resale.

H2: What Income Needs to Be Declared?

All income generated from your online sales must be declared to HMRC. This includes the total amount received from sales, less any platform fees deducted by eBay, Vinted, or Depop.

Fortunately, you can deduct allowable expenses to reduce your taxable income.

- Allowable Expenses:

- Packaging materials (envelopes, boxes, bubble wrap)

- Postage and shipping costs

- Advertising fees (boosting listings, paid promotions)

- Materials used to repair or improve items before sale (within reason).

- Subscription fees for selling platforms (if applicable).

H2: Record Keeping: Your Essential Defence Against HMRC

Meticulous record-keeping is crucial. It provides irrefutable evidence of your income and expenses, protecting you from penalties. If you receive an HMRC nudge letter, having detailed records will significantly simplify the process.

-

Methods for Tracking Sales & Expenses:

- Spreadsheets (Excel, Google Sheets): ideal for simple operations.

- Accounting software (Xero, Quickbooks): scalable for larger volumes of transactions.

- Dedicated notebooks (for smaller-scale operations).

-

Crucial Information to Record:

- Date of sale

- Item sold (description and unique identifier)

- Income received (including any fees)

- Expenses incurred (receipts are essential)

- Buyer’s details (name and address - useful for disputes, not necessarily for HMRC)

H2: Different Tax Implications for Different Platforms

While the core tax principles remain consistent, each platform has nuances in fee structures and reporting requirements. eBay, for instance, might provide sales summaries, but you'll still need comprehensive records. Vinted and Depop often operate on a simpler structure but still require accurate sales tracking.

- Key Differences:

- eBay: Offers detailed transaction records, but managing expenses is still your responsibility.

- Vinted: Focuses on individual sales, requiring careful tracking of individual items sold.

- Depop: Similar to Vinted, individual item tracking is vital, and accurate expense management is paramount.

3. Responding to an HMRC Nudge Letter: A Step-by-Step Guide

H2: Understanding the Content of an HMRC Nudge Letter

An HMRC nudge letter typically requests clarification regarding your income and expenses from online selling. It’s a friendly warning – but ignoring it can lead to significant problems. The letter will likely specify the tax year under review and the amount of income discrepancy they've identified.

- Common Requests:

- Confirmation of income from online sales.

- Details of expenses incurred.

- Verification of any tax already paid.

- Request for supporting documentation.

H2: Gathering Your Financial Records

Responding accurately and promptly is key. Before contacting HMRC, gather all necessary documents.

- Necessary Documents Checklist:

- Bank statements showing sales proceeds.

- Sales records from each platform (eBay, Vinted, Depop).

- Receipts for expenses (packaging, postage, advertising).

- Any other relevant financial documentation.

H2: Contacting HMRC

Respond to the letter using the preferred method outlined (often online). If you're unsure about any aspect, seek professional advice from a tax accountant.

- Contact Methods:

- HMRC online portal

- HMRC helpline

- Registered letter

4. Conclusion: Avoiding HMRC Penalties – Take Action Now!

Ignoring your tax obligations concerning online selling can lead to substantial penalties, including interest charges, late payment penalties, and potentially, a full investigation. Understanding your responsibilities regarding "HMRC nudge letters," accurate record-keeping, and timely responses is critical. Regularly review your sales records, ensure you understand your tax bracket, and proactively address any potential discrepancies. Don't ignore your HMRC nudge letter; addressing it promptly and professionally can prevent serious issues. If you're unsure, seek professional accounting advice to ensure you're fully compliant. Avoid an HMRC nudge letter by staying organized and informed.

Featured Posts

-

Miami Hedge Fund Managers Us Ban Immigration Fraud Allegations

May 20, 2025

Miami Hedge Fund Managers Us Ban Immigration Fraud Allegations

May 20, 2025 -

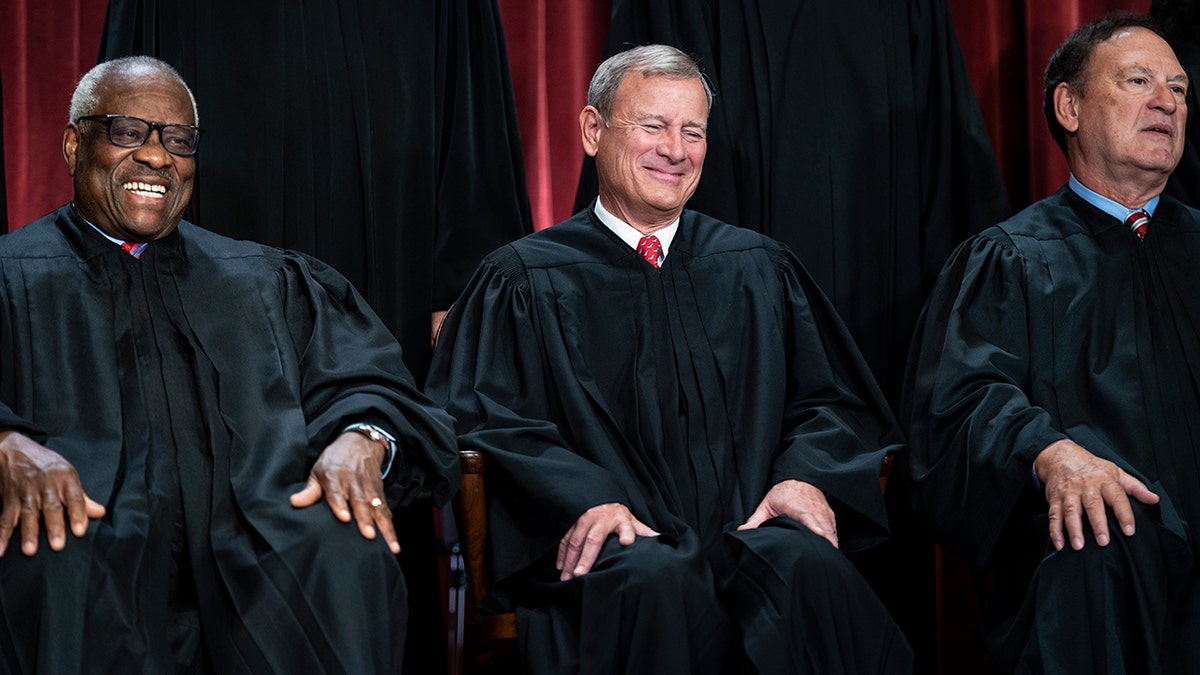

Three Decades Of Service Reflecting On Alito And Roberts Supreme Court Careers

May 20, 2025

Three Decades Of Service Reflecting On Alito And Roberts Supreme Court Careers

May 20, 2025 -

Cote D Ivoire La Bcr Intensifie Ses Controles Dans Les Marches D Abidjan

May 20, 2025

Cote D Ivoire La Bcr Intensifie Ses Controles Dans Les Marches D Abidjan

May 20, 2025 -

Top 12 Ai Stocks Reddit Investor Sentiment

May 20, 2025

Top 12 Ai Stocks Reddit Investor Sentiment

May 20, 2025 -

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 20, 2025

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 20, 2025