Aritzia On Tariffs: No Price Increases Planned, Company Adapts

Table of Contents

Aritzia's Stance on Tariff-Related Price Hikes

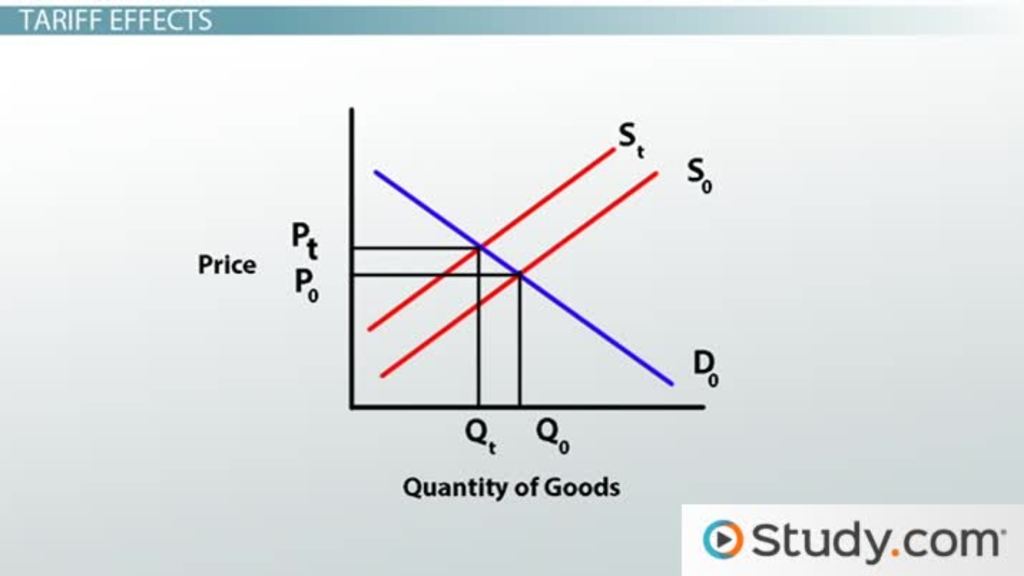

Aritzia has publicly declared its commitment to absorbing the increased costs associated with tariffs, avoiding any price increases for its consumers. This bold stance positions the company favorably in the minds of its customers, demonstrating a commitment to value and affordability. However, maintaining this pricing structure presents significant challenges to Aritzia's profitability. The company likely faces a squeeze on its margins, necessitating strategic adjustments to its operations.

- Specific quote from Aritzia's official statement or press release: (Insert a verifiable quote here from an official Aritzia source regarding their tariff strategy and commitment to avoiding price increases). This quote should be properly attributed.

- Analysis of the company's financial performance in relation to tariffs: Aritzia's financial reports (once released post-tariff implementation) will be crucial for analyzing the true impact of this strategy on their profit margins. Analysts will likely be closely monitoring their quarterly earnings to see the extent to which they are absorbing these costs.

- Comparison with other retailers' responses to similar tariff situations: Many competitors have opted to pass tariff costs directly to consumers through price increases. Aritzia's decision to absorb these costs sets it apart, potentially gaining a competitive edge in the market.

Strategic Adjustments to Mitigate Tariff Impacts

To offset the increased costs from tariffs without raising prices, Aritzia has implemented several strategic adjustments. These actions demonstrate the company's proactive and innovative approach to navigating these economic headwinds. These adjustments focus on enhancing efficiency and optimizing its supply chain.

- Examples of sourcing changes: Aritzia may have diversified its sourcing, shifting production to countries with more favorable trade agreements or lower labor costs. This could involve moving manufacturing from higher-tariff regions to others with lower or no tariffs.

- Details about supply chain improvements and efficiency gains: Aritzia may have invested in technology to improve inventory management, reduce waste, and streamline logistics. This could include implementing AI-powered forecasting tools to improve demand planning and reduce excess inventory.

- Mention any investments made in technology or infrastructure to reduce costs: Investments in automation and improved supply chain management systems are likely crucial components of Aritzia's strategy to offset tariff costs. These investments might not be immediately visible but are key to long-term cost reduction.

Long-Term Implications for Aritzia and the Fashion Industry

Aritzia's strategy of absorbing tariff costs carries significant long-term implications for both the company and the broader fashion industry. While the short-term impact on profitability is clear, the long-term effects are less certain.

- Potential impact on Aritzia's profit margins: The company's profit margins are likely to be compressed in the short-term. The long-term sustainability of this approach depends on Aritzia's ability to offset these costs through increased efficiency and volume.

- Analysis of the competitive landscape and Aritzia's market positioning: Aritzia's strategy could provide a significant competitive advantage, attracting price-sensitive customers who might otherwise choose cheaper alternatives.

- Predictions about future tariff impacts on the fashion industry: The fashion industry is likely to continue facing tariff-related challenges. Aritzia's approach serves as a case study for other companies, highlighting the need for agile supply chain management and efficient cost control.

Consumer Perception and Brand Loyalty in the Face of Tariffs

Aritzia's decision to absorb tariff costs instead of raising prices is likely to be viewed favorably by its customers. This transparency builds trust and strengthens brand loyalty.

- Discussion of consumer sentiment towards Aritzia's actions: Social media monitoring and customer surveys could reveal positive consumer sentiment towards Aritzia's decision, enhancing brand image and reputation.

- Analysis of potential impact on customer retention rates: By prioritizing affordability and value, Aritzia could see increased customer loyalty and retention rates, potentially outweighing the short-term impact on profitability.

- Examples of other brands' success (or failure) in managing similar situations: Studying how other brands handled similar situations – some successfully absorbing costs, others passing them on – provides valuable insights into the effectiveness of Aritzia’s approach.

Conclusion: Navigating the Tariffs: Aritzia's Adaptable Approach

Aritzia's response to tariffs demonstrates a commitment to its customers and a proactive approach to navigating economic challenges. By absorbing increased costs and strategically adjusting its operations, Aritzia is successfully navigating the complex landscape of international trade without sacrificing its commitment to providing affordable, stylish clothing. Key takeaways include the company’s commitment to avoiding price increases, its successful implementation of strategic supply chain adjustments, and the potential for long-term benefits regarding brand loyalty and market positioning.

To learn more about Aritzia's tariff strategy and how the company is adapting to the evolving retail landscape, visit Aritzia's website [insert link here] and follow their official statements on related news. Understanding "Aritzia's Response to Tariffs" provides valuable insights into navigating economic uncertainties in the fashion industry. We recommend staying updated on Aritzia's financial performance to better assess the long-term sustainability of this pricing strategy.

Featured Posts

-

An Often Overlooked Collaboration Spike Lee And Denzel Washingtons Early Success

May 06, 2025

An Often Overlooked Collaboration Spike Lee And Denzel Washingtons Early Success

May 06, 2025 -

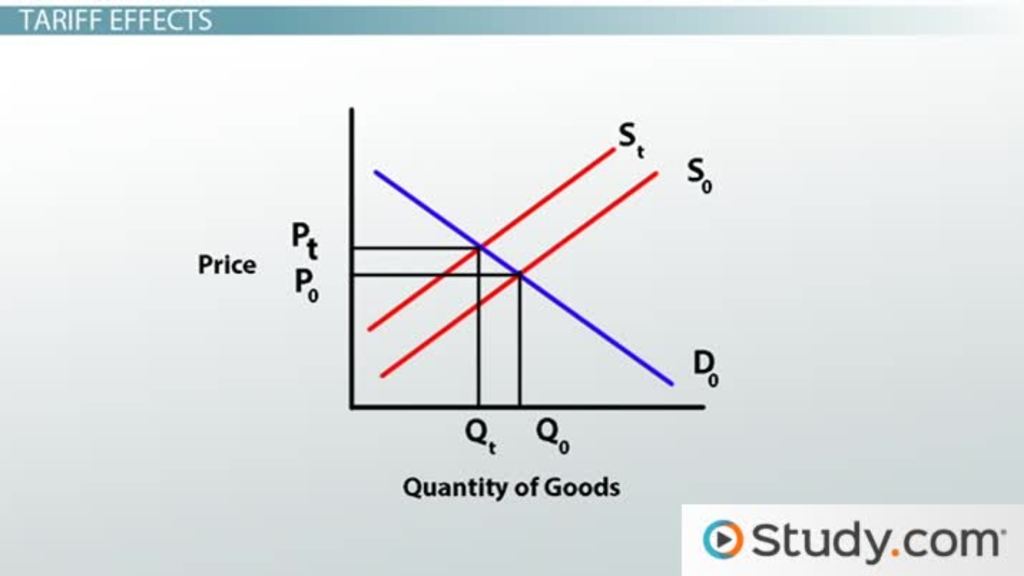

Ayo Edebiri And Will Sharpe Apple Tv Casts Prodigies For New Show

May 06, 2025

Ayo Edebiri And Will Sharpe Apple Tv Casts Prodigies For New Show

May 06, 2025 -

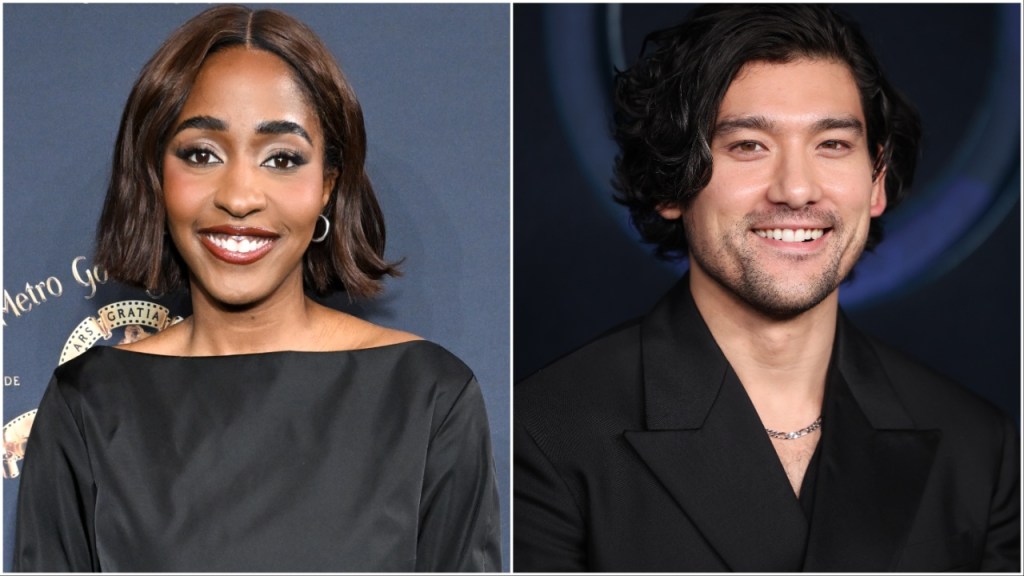

Azerbaydzhan Zakriv Ofis Vvs U Baku Prichini Ta Naslidki

May 06, 2025

Azerbaydzhan Zakriv Ofis Vvs U Baku Prichini Ta Naslidki

May 06, 2025 -

Rachel Zegler At The Met Gala Snow White Controversy And Star Studded Guest List

May 06, 2025

Rachel Zegler At The Met Gala Snow White Controversy And Star Studded Guest List

May 06, 2025 -

Piala Asia U 20 Iran Raih Kemenangan Besar 6 0 Lawan Yaman

May 06, 2025

Piala Asia U 20 Iran Raih Kemenangan Besar 6 0 Lawan Yaman

May 06, 2025