As Markets Swooned, Pros Sold—and Individuals Pounced: A Market Analysis

Table of Contents

Professional Investor Behavior During the Market Decline

Professional investors, with their access to sophisticated analytical tools and a deeper understanding of market mechanics, reacted to the downturn with a calculated approach, prioritizing risk management.

Reasons for Professional Selling

Several factors contributed to the selling spree among professional investors:

- Risk aversion strategies and portfolio rebalancing: Faced with increased volatility, professionals implemented risk mitigation strategies, adjusting their portfolios to reduce exposure to potentially losing assets. This often involved selling some holdings to rebalance their risk profile.

- Meeting client redemption requests: Many institutional investors manage funds for clients. During market downturns, clients may request redemptions, forcing professionals to sell assets to meet these demands. This is a significant factor in market liquidity.

- Taking profits from previous gains: Some professionals took the opportunity to lock in profits from previous investments, recognizing that further gains might be unlikely in the short term. This strategic move aims to preserve capital.

- Shifting towards less volatile asset classes: The increased uncertainty prompted many professionals to shift investments toward safer havens like government bonds, reducing overall portfolio risk. This flight to safety is a common reaction to market turmoil.

- Short-term predictions of further market declines: Based on their analysis, some professionals anticipated further declines and proactively sold assets to avoid greater losses, reflecting a more pessimistic short-term outlook.

Selling Strategies Employed

Professional investors employed various strategies to manage their risk during the selloff:

- Strategic selling of overvalued assets: Professionals identified and sold assets deemed overvalued, aiming to limit potential losses and reposition their portfolios for future growth.

- Hedging strategies to mitigate potential losses: Sophisticated hedging techniques, involving derivative instruments, were employed to reduce exposure to market risk and protect against potential losses.

- Utilizing derivative instruments to protect portfolios: Options, futures, and swaps were strategically used to safeguard portfolios against adverse price movements. This demonstrates a nuanced understanding of market instruments.

- Increased use of stop-loss orders: These orders automatically sell assets when they reach a predetermined price, limiting potential losses. Stop-loss orders provide a safety net against unexpected market drops.

- Diversification of investment portfolios to reduce risk: Professional investors diversified across multiple asset classes, sectors, and geographies to reduce their dependence on any single investment and limit risk.

Individual Investor Behavior: The "Pouncing" Phenomenon

In stark contrast to the professionals, many individual investors displayed a remarkably aggressive buying behavior during the market downturn. This "pouncing" phenomenon warrants a closer look.

Reasons for Increased Individual Investment

Several factors contributed to the increased investment activity among individual investors:

- "Fear of missing out" (FOMO) driving impulsive decisions: The rapid price drops fueled a sense of urgency and fear of missing out on potential gains, leading to impulsive buying decisions. FOMO is a significant psychological factor driving market behavior.

- Belief that the market downturn presents a buying opportunity (value investing): Many individual investors saw the downturn as a chance to acquire assets at discounted prices, believing that the market was undervaluing certain companies. This reflects a value investing approach.

- Increased access to online brokerage accounts and trading platforms: The proliferation of user-friendly online trading platforms has made investing more accessible to a wider audience, contributing to increased participation during the downturn.

- Impact of social media and online investment communities: Social media and online forums often amplify market sentiment, potentially influencing individual investors' decisions, both positively and negatively.

- Averaging down strategies by purchasing more shares at lower prices: Some investors used the opportunity to buy more shares of stocks they already owned, lowering their average purchase price. This is a common strategy but involves significant risk.

Risks Associated with Individual Investor Actions

While the "pouncing" phenomenon might seem opportunistic, it carries substantial risks:

- Lack of sufficient market knowledge and experience leading to poor investment choices: Many individual investors lack the expertise to navigate market volatility effectively, potentially leading to poor investment decisions.

- Emotional decision-making (greed, fear): Emotions like fear and greed often cloud judgment, resulting in impulsive trades and potentially significant financial losses.

- Failure to conduct thorough due diligence before investing: Without proper research and analysis, investors may overlook critical risks associated with their investments.

- Overexposure to specific sectors or individual stocks: Concentrating investments in a limited number of assets increases risk, potentially leading to substantial losses if those assets underperform.

- Potential for significant financial losses: The market's unpredictable nature makes it crucial for investors to understand the potential for significant financial losses, especially during volatile periods.

Analyzing the Market Data and Trends

A thorough market analysis requires examining key market indicators and understanding their implications.

Key Market Indicators During the Downturn

Analyzing the following metrics offers critical insights:

- Analysis of stock market indices (e.g., S&P 500, Dow Jones): Tracking the performance of major indices reveals the overall market trend and its volatility.

- Examination of bond yields and interest rate movements: Interest rate changes significantly impact investor behavior and market valuations.

- Tracking investor sentiment through surveys and economic data: Analyzing investor confidence levels and economic forecasts provides context for market movements.

- Assessment of market volatility using metrics like VIX: The VIX (Volatility Index) measures market uncertainty, offering valuable insight into risk levels.

- Identifying sectors that were disproportionately impacted by the downturn: Analyzing which sectors performed better or worse during the downturn highlights specific market trends.

Long-term Implications of the Divergent Investor Behavior

The differing approaches taken by professional and individual investors have significant long-term implications:

- Potential impact on future market trends and price movements: The actions of both groups collectively shape future market direction.

- Shifting dynamics in the investment landscape: The events may reshape investor behavior and influence investment strategies.

- Long-term consequences for individual investors’ portfolios: The outcomes will determine the success or failure of individual investment strategies.

- Analysis of historical market events to identify similar patterns: Studying past market crashes can offer valuable insights and lessons learned.

- Predicting future market behavior based on the current trends: While not precise, analyzing current trends can inform future investment strategies.

Conclusion

The contrasting behaviors of professional and individual investors during the recent market swoon highlight a complex interplay of factors, from sophisticated risk management strategies to emotional decision-making. This detailed market analysis underscores the crucial need for informed decision-making, regardless of market conditions. Understanding the underlying reasons behind these divergent approaches provides invaluable insights for investors navigating future market fluctuations. Conduct your own thorough market analysis, considering all relevant factors, to make informed investment decisions. Remember, responsible investing, supported by comprehensive market analysis, is key to long-term success.

Featured Posts

-

The China Factor Challenges And Opportunities For Luxury Car Brands

Apr 28, 2025

The China Factor Challenges And Opportunities For Luxury Car Brands

Apr 28, 2025 -

The Overseas Highway Your Guide To Driving Through The Florida Keys

Apr 28, 2025

The Overseas Highway Your Guide To Driving Through The Florida Keys

Apr 28, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Events In Upcoming Book

Apr 28, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Events In Upcoming Book

Apr 28, 2025 -

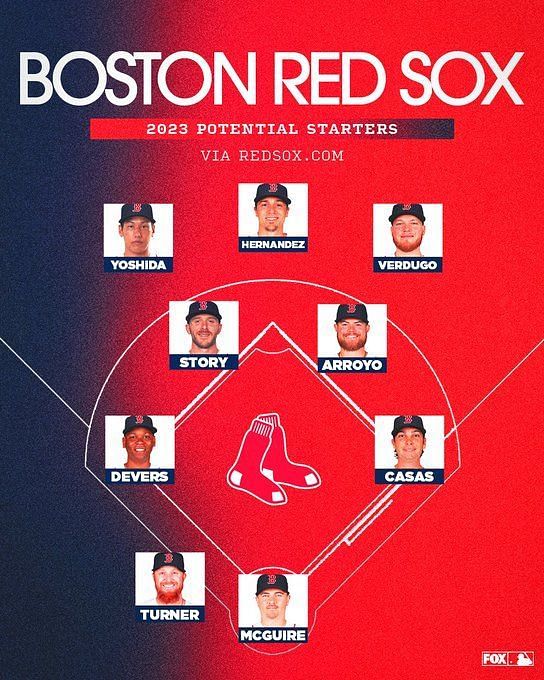

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 28, 2025

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 28, 2025

Latest Posts

-

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025