Assessing The Damage: Trump Tariffs And India's Solar Exports To Southeast Asia

Table of Contents

The Impact of Section 201 Tariffs on Indian Solar Manufacturers

The Section 201 tariffs, implemented by the Trump administration in 2018, imposed duties on imported solar cells and modules. The rationale behind these tariffs was to protect the US domestic solar industry from what was perceived as unfair competition, primarily from China. However, these tariffs had unintended and far-reaching consequences for global solar supply chains, significantly impacting Indian solar manufacturers.

-

Increased costs for Indian solar manufacturers due to tariff-affected imported components: Many Indian solar manufacturers relied on imported cells and modules, often from China, which became considerably more expensive due to the tariffs. This increased their production costs, making their products less competitive internationally.

-

Reduced competitiveness in international markets, particularly Southeast Asia: The higher production costs directly impacted India's ability to compete on price in the burgeoning Southeast Asian solar market, where cost-effectiveness is a major factor for project developers.

-

Loss of market share to Chinese competitors who were less affected: Chinese solar manufacturers, while initially impacted, were better positioned to absorb the costs or find alternative supply chains. This allowed them to maintain their price competitiveness and gain market share in Southeast Asia at the expense of Indian companies.

-

Specific examples and data: Adani Green Energy, a major Indian player, for example, faced challenges in securing competitively priced components, leading to delays and cost overruns in some of its projects. While precise export volume reduction data is difficult to isolate due to the complexity of global trade data, anecdotal evidence from industry reports suggests a significant decline in Indian solar exports to Southeast Asia during this period.

-

Impact on employment: The reduced competitiveness and loss of market share led to job losses and slowed growth within the Indian solar manufacturing sector, hindering the overall development of the renewable energy sector in India.

Southeast Asia's Shifting Solar Landscape

Southeast Asia witnessed a period of rapid solar energy sector growth before the Trump tariffs, driven by increasing energy demands and a commitment to renewable energy targets. However, the tariffs significantly altered the landscape.

-

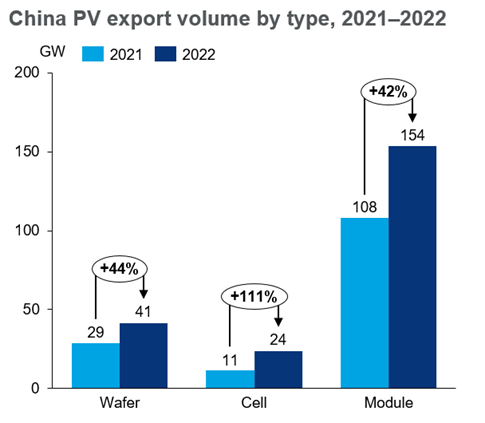

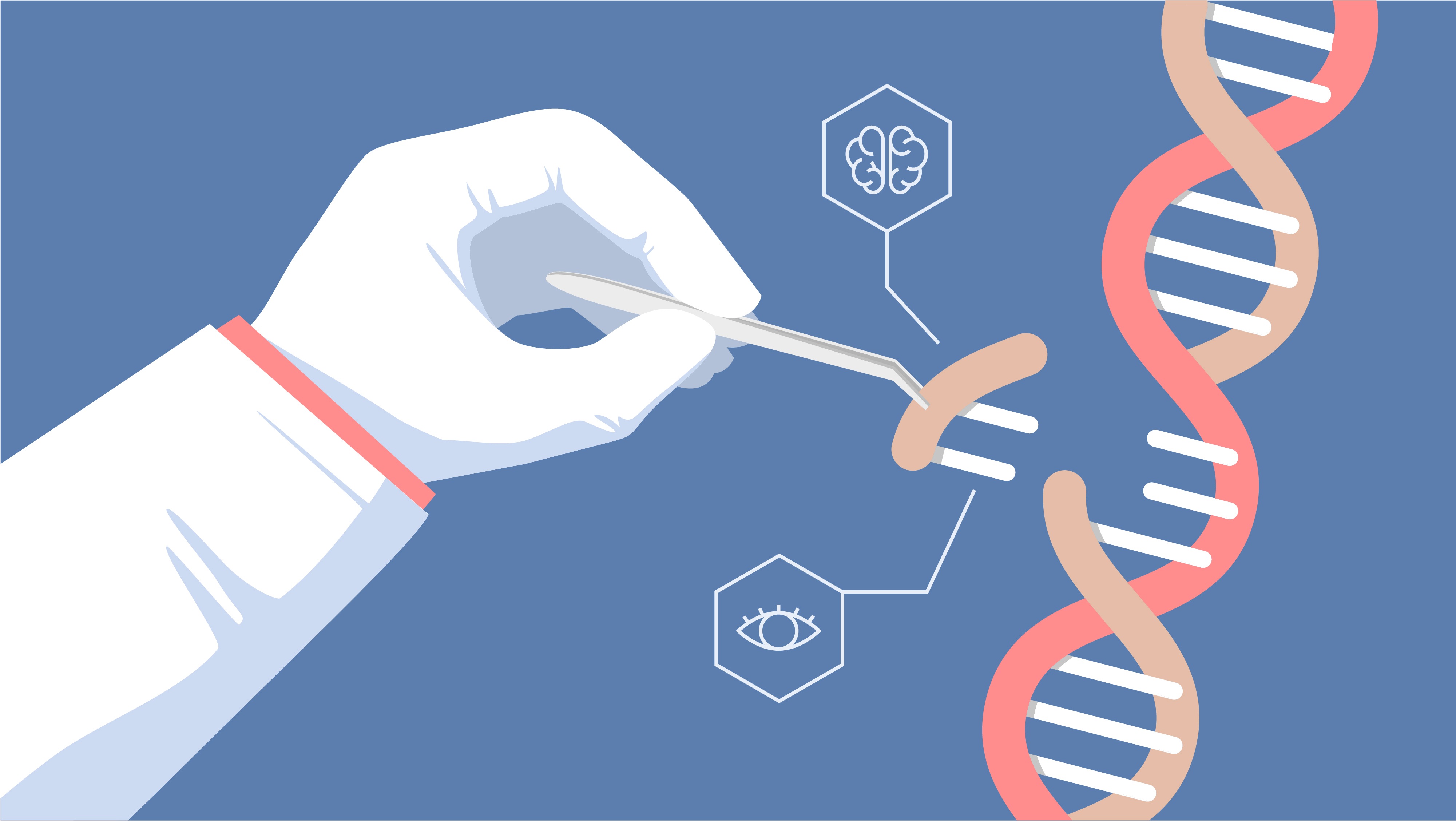

Increased reliance on Chinese solar manufacturers due to lower prices: The tariffs created a pricing advantage for Chinese solar companies, leading to a significant increase in their market share across Southeast Asia. Countries like Vietnam, Thailand, and the Philippines, which were rapidly expanding their solar capacity, increasingly turned to Chinese suppliers for their projects.

-

Impact on the diversity of solar suppliers in the region – reduced options: The shift towards Chinese dominance reduced the diversity of suppliers in the region, creating potential vulnerabilities for energy security. This concentrated dependence on a single major supplier carries inherent risks.

-

Potential long-term implications for energy security in Southeast Asian nations: Over-reliance on a single supplier for crucial energy infrastructure components can create geopolitical vulnerabilities. Disruptions in the Chinese supply chain could have cascading effects on Southeast Asian nations' energy projects.

-

Specific country analysis and data: Vietnam, for instance, saw a dramatic increase in solar installations using Chinese-made equipment. Data from the International Energy Agency (IEA) and similar sources can be used to illustrate this shift in market share. The same trend can be observed in other Southeast Asian countries.

-

Geopolitical implications: The increased dependence on China for solar energy infrastructure has significant geopolitical ramifications, creating potential leverage for China in its relations with Southeast Asian nations.

Long-Term Economic Consequences for India

The Trump tariffs resulted in significant missed opportunities for India's solar industry.

-

Lost revenue and potential for growth in the Southeast Asian market: The inability to effectively compete in Southeast Asia meant substantial lost revenue and hampered the growth potential of Indian solar manufacturers.

-

Impact on India's renewable energy goals and ambitions: The setback in the solar sector hindered India's broader renewable energy goals and ambitions, impacting its commitment to reducing carbon emissions and diversifying its energy mix.

-

Potential for future trade disputes and their consequences: The experience underscores the risks associated with over-reliance on specific markets and highlights the need for proactive strategies to diversify exports and mitigate future trade risks.

-

Indian government's response and policy changes: The Indian government responded with various policy initiatives aimed at boosting domestic manufacturing and enhancing competitiveness, including incentives and support programs for the solar industry. The effectiveness of these measures remains a subject of ongoing analysis.

-

Potential for future competitiveness: For India to regain competitiveness, it needs to focus on technological innovation, cost reductions, and strategic partnerships to reduce reliance on imported components and strengthen its position in the global solar market.

The Role of Bilateral Trade Agreements

Bilateral and multilateral trade agreements play a crucial role in shaping the landscape of India's solar exports.

-

Potential for preferential trade agreements to help Indian manufacturers: Favorable trade agreements with Southeast Asian nations could reduce tariffs and create a more level playing field for Indian solar manufacturers.

-

Challenges in negotiating favorable terms with Southeast Asian nations: Negotiating such agreements requires careful consideration of competing interests and involves complex diplomatic processes.

-

Specific trade agreements and relevance: The Regional Comprehensive Economic Partnership (RCEP), for instance, while not solely focused on solar, has implications for trade in the sector. Analyzing its impact on Indian solar exports to Southeast Asia is crucial.

Conclusion

The Trump tariffs inflicted significant damage on India's solar exports to Southeast Asia, resulting in lost market share, missed economic opportunities, and a heightened reliance on Chinese manufacturers in the region. Understanding the lasting impact of these tariffs is crucial for policymakers and industry players alike. Moving forward, India must strategically address the challenges, focusing on diversifying its export markets, improving its competitiveness through technological advancements and cost optimization, and leveraging bilateral trade agreements to regain a significant share in the burgeoning Southeast Asian solar market. Further research into the Trump Tariffs and India's Solar Exports to Southeast Asia is vital to developing effective long-term solutions and ensuring a sustainable future for India's solar sector.

Featured Posts

-

Sierra Leone Immigration Chief Sacked Details Emerge

May 30, 2025

Sierra Leone Immigration Chief Sacked Details Emerge

May 30, 2025 -

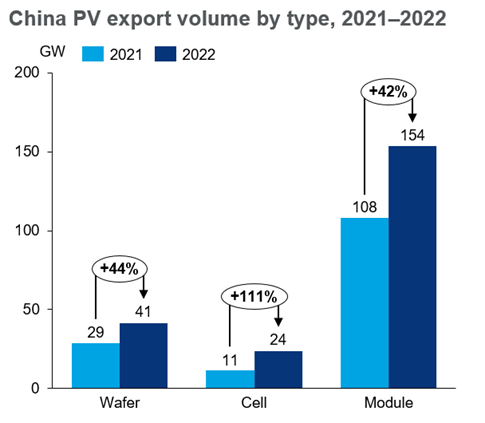

Polands Runoff Election Key Indicator For The Rise Of Maga Style Politics In Europe

May 30, 2025

Polands Runoff Election Key Indicator For The Rise Of Maga Style Politics In Europe

May 30, 2025 -

Pop Up Store Bts Fechas Direccion Y Como Llegar A La Experiencia Army

May 30, 2025

Pop Up Store Bts Fechas Direccion Y Como Llegar A La Experiencia Army

May 30, 2025 -

Crispr Gene Editing Enhanced Accuracy And Efficacy Through Novel Modification

May 30, 2025

Crispr Gene Editing Enhanced Accuracy And Efficacy Through Novel Modification

May 30, 2025 -

100 000 Signatures Petition To Remove Jon Jones Title Gains Momentum

May 30, 2025

100 000 Signatures Petition To Remove Jon Jones Title Gains Momentum

May 30, 2025