AT&T Highlights Extreme Cost Increase Following Broadcom's VMware Bid

Table of Contents

The Financial Impact on AT&T

The financial impact of Broadcom's VMware acquisition on AT&T is significant. While precise figures haven't been publicly released by AT&T in detail, reports suggest a dramatic increase in licensing fees and associated transition costs. This translates to a substantial hit to their bottom line, potentially impacting profitability and investment strategies.

- Specific examples of increased expenses: Reports indicate a potential double-digit percentage increase in software licensing costs for AT&T's VMware-dependent infrastructure. This includes expenses related to migrating to new versions and integrating updated systems.

- Potential impact on AT&T's profitability: The increased costs directly impact AT&T’s operating margins, potentially reducing profits and shareholder returns. This could lead to reduced investment in new technologies and infrastructure.

- Comparison to previous years’ spending on similar services: Analysts are comparing this sudden cost increase to previous years, highlighting the unprecedented nature of the financial burden placed upon AT&T and other telecommunication companies relying heavily on VMware solutions. Internal documents (if available) should be referenced here to strengthen this point.

Broadcom's VMware Acquisition: A Deeper Dive

Broadcom's $61 billion acquisition of VMware represents a significant consolidation of power in the technology sector. The strategic rationale hinges on Broadcom's ambition to expand its enterprise software portfolio and leverage VMware's virtualization technology to enhance its existing infrastructure offerings. This move positions Broadcom to become a dominant player in the enterprise software market.

- Key benefits Broadcom expects to gain from the VMware acquisition: Broadcom anticipates significant synergies, including increased market share, cross-selling opportunities, and enhanced profitability through economies of scale. They also gain access to VMware's vast customer base.

- Potential challenges and regulatory hurdles Broadcom might face: The acquisition is subject to regulatory scrutiny from antitrust authorities worldwide, who will assess its potential impact on competition and market dominance. Concerns regarding potential monopolistic practices are being closely examined.

- How this acquisition impacts the broader tech landscape: This merger signifies a major shift in the tech landscape, with potential implications for other software providers and the overall competitive dynamics within the enterprise software market.

Impact on AT&T's Services and Customers

The cost increase resulting from Broadcom's VMware acquisition is likely to have far-reaching consequences for AT&T's services and its customer base. The increased operational expenses could lead to several potential outcomes.

- Potential price increases for AT&T's services: To offset the increased costs, AT&T might be forced to raise prices for its various services, potentially impacting customer affordability and potentially driving customers to competitors.

- Possible changes to service offerings: To maintain profitability, AT&T may need to streamline its service offerings, potentially reducing features or functionalities available to customers.

- Impact on customer satisfaction and retention: Price hikes and service reductions could lead to decreased customer satisfaction and higher churn rates, negatively affecting AT&T's long-term sustainability.

Industry-Wide Implications

The ramifications of Broadcom's VMware acquisition extend far beyond AT&T. Many telecommunications companies rely on VMware technologies, suggesting a potential industry-wide increase in costs.

- The potential for increased costs across the telecom industry: Telecom providers worldwide are likely facing similar cost pressures, potentially triggering a domino effect of price increases and service alterations across the sector.

- The impact on competition and innovation within the sector: The increased costs could stifle competition and hinder innovation, as companies grapple with higher operational expenses and reduced margins.

- Potential future acquisitions or mergers triggered by this event: This acquisition could trigger a wave of consolidation within the telecommunications and technology sectors, as companies seek to achieve economies of scale and enhance their competitive positions.

Conclusion: Analyzing the Fallout of AT&T's Cost Increase

In conclusion, Broadcom's acquisition of VMware has resulted in a substantial cost increase for AT&T, highlighting the significant impact of this merger on the telecom industry. This cost increase has the potential to negatively affect AT&T’s profitability, service offerings, and customer satisfaction. The broader implications for the industry include potential price increases, reduced competition, and a wave of further consolidation. Staying informed about developments concerning AT&T's cost increase following Broadcom's VMware bid is crucial. Follow reputable financial news sources and industry analysts for updates. Share your thoughts and analysis on this critical development in the comments below. Let's continue the conversation about the fallout from AT&T’s increased costs following this major acquisition.

Featured Posts

-

Teylor Svift Rekordnye Prodazhi Vinila Za Poslednee Desyatiletie

May 27, 2025

Teylor Svift Rekordnye Prodazhi Vinila Za Poslednee Desyatiletie

May 27, 2025 -

Processo Seletivo Prefeitura Na Bahia Oferece 87 Vagas Com Salarios De Ate R 4 Mil

May 27, 2025

Processo Seletivo Prefeitura Na Bahia Oferece 87 Vagas Com Salarios De Ate R 4 Mil

May 27, 2025 -

Survivor 48 Finale Tonights Episode Streaming And Tv Options

May 27, 2025

Survivor 48 Finale Tonights Episode Streaming And Tv Options

May 27, 2025 -

Behind The Scenes Carrie Underwood And Taylor Swifts Reported Feud

May 27, 2025

Behind The Scenes Carrie Underwood And Taylor Swifts Reported Feud

May 27, 2025 -

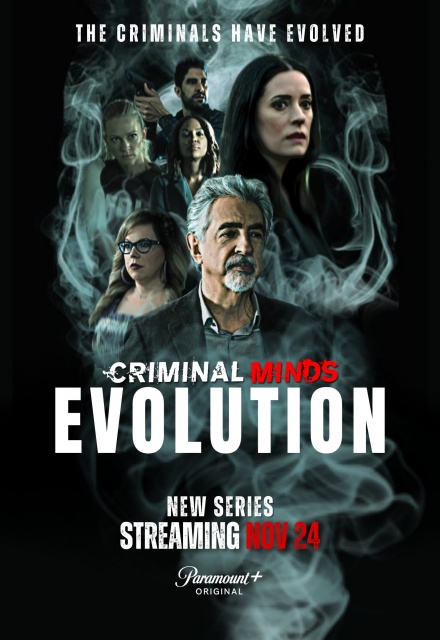

Criminal Minds Evolution Season 18 Where To Stream

May 27, 2025

Criminal Minds Evolution Season 18 Where To Stream

May 27, 2025