AT&T Sounds Alarm On Broadcom's VMware Deal: A 1,050% Price Jump

Table of Contents

AT&T's Opposition to the Broadcom-VMware Merger

AT&T's opposition to the Broadcom-VMware merger stems from concerns about reduced competition and potential price increases for vital services. They fear that Broadcom's acquisition of VMware will create a dominant player in the technology sector, potentially stifling innovation and leading to less competitive pricing for businesses like AT&T.

- Reduced Competition: AT&T likely worries that the combined entity will have undue market power, potentially leading to less choice and higher prices for networking solutions and other critical technologies.

- Increased Prices for Services: The concern is that with less competition, Broadcom/VMware could increase the price of their services, impacting AT&T's operational costs and potentially affecting their own pricing strategies.

- Impact on AT&T's Business Model: The merger could directly affect AT&T's business model, depending on their reliance on VMware's technologies and the potential for increased costs or reduced options. This could also create a ripple effect across the telecommunications sector.

While AT&T hasn't publicly released detailed statements with specific quotes, their actions suggest a serious concern about the implications of this merger for fair competition. Keywords: AT&T concerns, Broadcom VMware opposition, antitrust lawsuit, competition concerns, market dominance.

The 1,050% Price Jump: Analyzing the Valuation

The 1,050% price increase refers to the difference between VMware's pre-offer market capitalization and Broadcom's acquisition price. While the exact figures fluctuate based on market conditions, the sheer magnitude of the increase is undeniable. This dramatic jump wasn't solely based on VMware's intrinsic value; several other factors contributed:

- VMware's Strategic Importance: VMware holds a significant position in the virtualization and cloud computing markets. Its technology is crucial for many businesses, making it an attractive acquisition target.

- Synergies and Cost Savings: Broadcom likely anticipates significant cost savings and synergies by integrating VMware into its existing operations, justifying the high price tag.

- Market Speculation and Bidding Wars: The potential for a bidding war between Broadcom and other interested companies could have driven the price higher than initially anticipated.

- Premium for Certainty: The certainty of acquisition likely attracted a premium offer, rewarding shareholders for foregoing potential future growth.

Such a large price increase can trigger significant market reactions, including potential scrutiny from regulators, increased investor interest, and potential ripple effects on valuations of similar companies. Keywords: VMware valuation, Broadcom offer, price increase analysis, market capitalization, financial implications.

Antitrust Concerns and Regulatory Scrutiny

The Broadcom-VMware merger is facing significant antitrust scrutiny due to the potential for creating a dominant player in several key technology sectors.

- Potential for Monopoly Power: The combined entity could control a substantial portion of the market for virtualization, cloud computing, and other related technologies, raising concerns about potential monopolies.

- Regulatory Investigations: Antitrust authorities in various jurisdictions are likely conducting thorough investigations to assess the potential impact on competition.

- Potential Lawsuits and Challenges: Companies and industry experts expressing concerns about the merger may file lawsuits or challenges against the acquisition, delaying or even preventing its completion.

- Impact on the Tech Landscape: The outcome of these investigations will have a major impact on the future competitive landscape of the tech industry. A blocked merger would send a strong message about antitrust enforcement.

The outcome will set a precedent for future large-scale technology mergers. Keywords: Antitrust laws, regulatory hurdles, merger approval, competition commission, government intervention.

The Future of VMware and the Broader Tech Landscape

The Broadcom-VMware merger will significantly impact the future of VMware's products and services, as well as the broader tech landscape.

- Integration and Product Roadmap: Broadcom will likely integrate VMware's technologies into its existing portfolio, potentially leading to changes in product development and support.

- Potential for Innovation: While some fear reduced competition, others believe the combined resources could drive innovation in certain areas.

- Reshaping the Tech Landscape: This acquisition represents a significant step towards consolidation in the tech industry, potentially leading to further mergers and acquisitions.

- Alternative Outcomes: If the deal is blocked, it could trigger a reshuffling of alliances and potentially lead to different strategic partnerships in the industry.

This merger is a watershed moment that underscores the ongoing consolidation within the tech sector, shaping industry trends and technological innovation. Keywords: Future of VMware, tech industry consolidation, market disruption, technological innovation, industry trends.

Conclusion: The Implications of the Broadcom-VMware Deal and the Road Ahead

AT&T's concerns regarding reduced competition and potential price increases highlight the significant implications of the Broadcom-VMware deal. The unprecedented 1,050% price jump underscores the strategic value of VMware and raises important questions about antitrust enforcement and market dominance. The ongoing regulatory challenges will determine the ultimate fate of this landmark acquisition. Stay tuned for further updates on the Broadcom-VMware acquisition and its potential impact on the competitive landscape. Follow our updates on the latest developments in this landmark deal. Keywords: Broadcom VMware deal, future of technology, merger implications, regulatory updates, tech market analysis.

Featured Posts

-

Mls Injury News Martinez And White Unavailable For Saturdays Match

May 15, 2025

Mls Injury News Martinez And White Unavailable For Saturdays Match

May 15, 2025 -

Fthina Kaysima Pliris Katalogos Pratirion Stin Kypro

May 15, 2025

Fthina Kaysima Pliris Katalogos Pratirion Stin Kypro

May 15, 2025 -

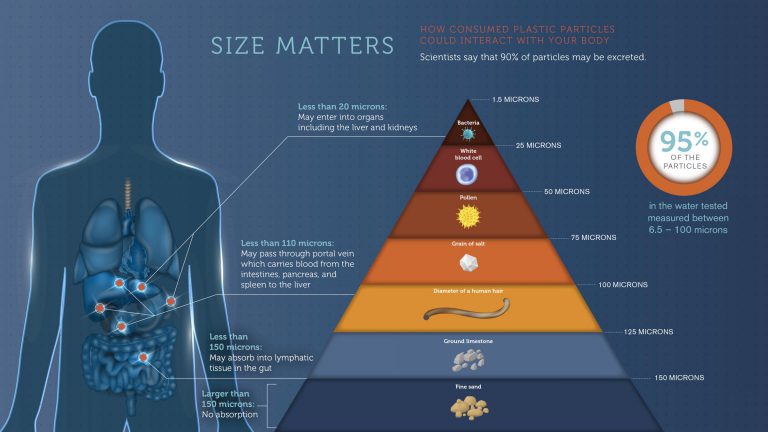

Presenza Di Microplastiche Nell Acqua Una Mappa Del Rischio

May 15, 2025

Presenza Di Microplastiche Nell Acqua Una Mappa Del Rischio

May 15, 2025 -

Kid Cudis Personal Items Sell For Stunning Amounts At Auction

May 15, 2025

Kid Cudis Personal Items Sell For Stunning Amounts At Auction

May 15, 2025 -

In Quale Tipo Di Acqua Si Trovano Maggiori Quantita Di Microplastiche

May 15, 2025

In Quale Tipo Di Acqua Si Trovano Maggiori Quantita Di Microplastiche

May 15, 2025