Australian Dollar Vs. New Zealand Dollar: Options Market Signals

Table of Contents

Analyzing Implied Volatility (IV) in AUD/NZD Options

Implied volatility (IV) is a crucial metric in options trading. It reflects the market's expectation of future price fluctuations in the underlying asset – in this case, the AUD/NZD exchange rate. A higher IV suggests greater uncertainty and potential for significant price swings, while a lower IV indicates more stability and a lower likelihood of substantial price movements.

-

Interpreting High IV: High implied volatility in AUD/NZD options might signal upcoming economic announcements, political uncertainty, or significant market events that could impact the exchange rate. This presents both opportunity and risk. Traders might consider strategies like selling covered calls or buying volatility (e.g., straddles or strangles) to profit from expected price swings.

-

Interpreting Low IV: Conversely, low implied volatility implies market confidence and a relatively predictable price range. Traders might utilize strategies such as buying covered puts to generate income while protecting against downside risk.

-

Utilizing IV Data: Reliable options data providers like Bloomberg Terminal, Refinitiv Eikon, and TradingView offer tools to access and analyze implied volatility data for AUD/NZD options. Understanding the historical IV context is also vital; comparing current IV levels to historical averages can reveal whether the market is currently over or undervalued in terms of volatility. While the VIX index tracks volatility in the US stock market, its principles regarding the interpretation of volatility levels are directly applicable to understanding the IV of AUD/NZD options.

Interpreting Put/Call Ratios in AUD/NZD Options

Put and call options are fundamental tools in options trading. Call options grant the buyer the right, but not the obligation, to buy the underlying asset (AUD/NZD) at a specific price (strike price) by a specific date (expiration date). Put options grant the buyer the right, but not the obligation, to sell the underlying asset at a specific price by a specific date. The put/call ratio, derived from the volume or open interest of puts and calls, offers insights into market sentiment.

-

High Put/Call Ratio (Bearish Sentiment): A high put/call ratio suggests a prevailing bearish sentiment. More traders are buying put options (betting on a price decline) than call options (betting on a price increase). This could indicate a potential downward trend in the AUD/NZD exchange rate.

-

Low Put/Call Ratio (Bullish Sentiment): A low put/call ratio suggests a bullish market outlook. More traders are buying call options, anticipating a price rise in the AUD/NZD pair.

-

Interpreting Put/Call Ratio Levels: Different sources provide data on put/call ratios. Analyzing the ratio across different strike prices and expiration dates can give a more nuanced view of market sentiment. A persistently high put/call ratio, for example, might be a strong bearish signal.

Utilizing Options Greeks (Delta, Gamma, Vega) in AUD/NZD Trading

Options Greeks are sensitivity measures that describe how the price of an option changes in response to changes in various factors. Effectively using them enhances risk management and strategy refinement.

-

Delta: Measures the change in an option's price for every $1 change in the price of the underlying asset (AUD/NZD). A delta of 0.50, for example, means the option price is expected to move by $0.50 for every $1 move in the AUD/NZD rate.

-

Gamma: Measures the rate of change of Delta. It shows how sensitive Delta is to changes in the underlying asset's price. High Gamma signifies that Delta will change significantly with price movements.

-

Vega: Measures the sensitivity of an option's price to changes in implied volatility. A high Vega means the option's price will be significantly affected by changes in implied volatility.

-

Practical Examples: A trader could use Delta to estimate potential profit or loss, Gamma to adjust their position sizing based on expected volatility changes, and Vega to protect against unexpected volatility spikes.

Considering Economic Indicators and News Events

Macroeconomic factors significantly influence the AUD/NZD exchange rate. Interest rate decisions by the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ), inflation data, GDP growth figures, and employment reports all impact the currency pair's value.

-

Fundamental Analysis: Successful AUD/NZD options trading requires combining options market signals with fundamental analysis. Understanding the economic factors driving the exchange rate is crucial.

-

Identifying Relevant News: Monitoring news releases from the RBA and RBNZ, along with key economic indicators, allows for informed trading decisions. Reputable financial news sources (Reuters, Bloomberg, etc.) provide timely information.

-

Key Economic Indicators: Pay close attention to:

- RBA and RBNZ interest rate decisions.

- Australian and New Zealand inflation data (CPI).

- GDP growth rates for both countries.

- Employment figures and unemployment rates.

Conclusion: Mastering AUD/NZD Options Market Signals for Profitable Trading

Successfully trading AUD/NZD options requires a comprehensive approach. This article highlighted the significance of analyzing implied volatility, put/call ratios, options Greeks, and integrating economic news into your trading strategy. By combining options market signals with solid fundamental analysis, you can significantly improve your decision-making process and manage risk effectively. To further refine your AUD/NZD options trading strategies and achieve better results, consider exploring advanced options trading strategies and resources specializing in Australian Dollar/New Zealand Dollar options trading. Remember, consistent learning and adapting to market conditions are vital for long-term success in the dynamic world of forex trading.

Featured Posts

-

Watch Gypsy Rose Life After Lockup Full Episodes Online

May 06, 2025

Watch Gypsy Rose Life After Lockup Full Episodes Online

May 06, 2025 -

Deconstructing Suki Waterhouses On This Love Exploring The Songs Lyrics

May 06, 2025

Deconstructing Suki Waterhouses On This Love Exploring The Songs Lyrics

May 06, 2025 -

Independence Day Activities Fun For The Whole Family

May 06, 2025

Independence Day Activities Fun For The Whole Family

May 06, 2025 -

Daughter Of Demi Moore And Ashton Kutchers Stepfather Relationship A Cryptic Comment And Its Aftermath

May 06, 2025

Daughter Of Demi Moore And Ashton Kutchers Stepfather Relationship A Cryptic Comment And Its Aftermath

May 06, 2025 -

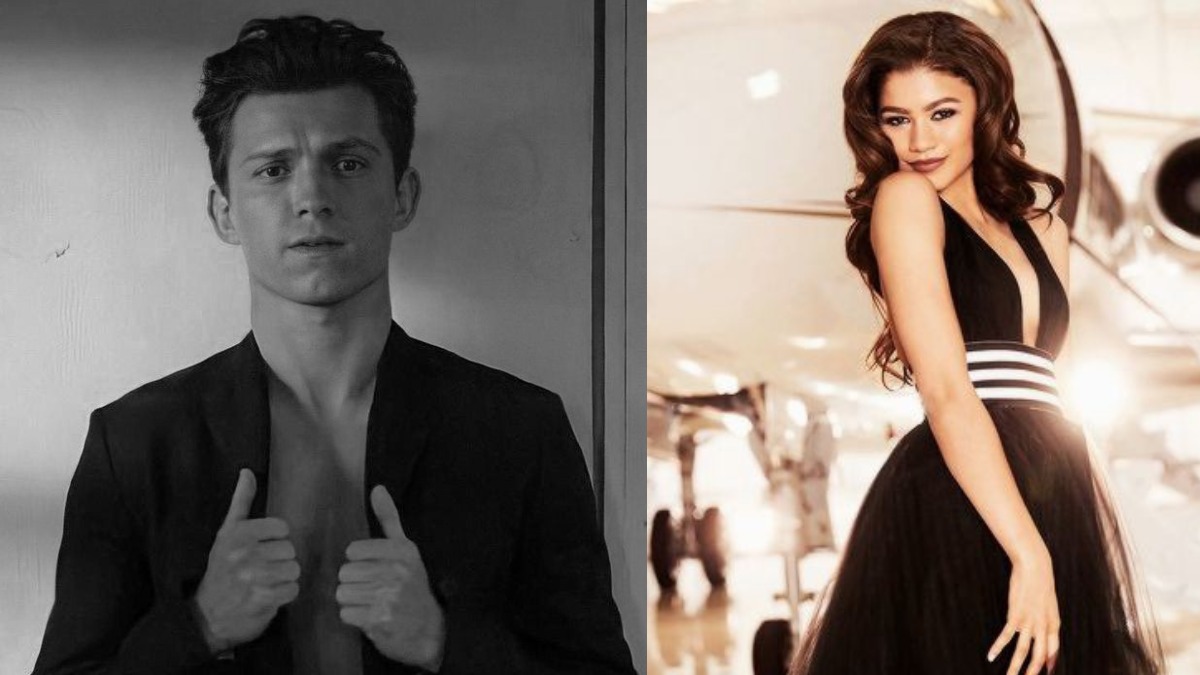

Zendayas Wedding To Tom Holland Overshadowed By Family Drama

May 06, 2025

Zendayas Wedding To Tom Holland Overshadowed By Family Drama

May 06, 2025