Auto Sales In China: Why BMW, Porsche, And Others Are Facing Difficulties

Table of Contents

Economic Headwinds and Shifting Consumer Spending

The slowdown in auto sales in China is intrinsically linked to broader economic trends.

Slower Economic Growth

China's economic growth has moderated in recent years, directly impacting consumer confidence and discretionary spending. This translates into a reduced pool of high-net-worth individuals willing to invest in luxury vehicles.

- Reduced GDP growth directly translates to fewer high-net-worth individuals willing to purchase luxury vehicles. The shrinking number of potential buyers significantly impacts sales volume for premium brands.

- Increased uncertainty in the economy leads to delayed purchase decisions. Consumers are more hesitant to make large, non-essential purchases when economic prospects appear uncertain.

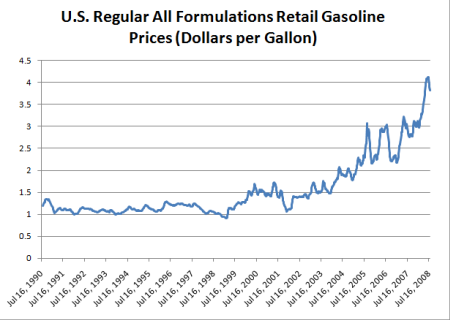

Rising Living Costs and Inflation

Increased inflation and rising living costs are putting a strain on household budgets, making luxury car purchases less of a priority.

- Higher fuel prices and maintenance costs add to the overall ownership expense of a luxury vehicle, making them less attractive to budget-conscious consumers.

- Consumers are prioritizing essential spending over luxury items. With increased pressure on household finances, discretionary spending on luxury goods like automobiles is often the first to be cut.

The Rise of Domestic Automakers and Increased Competition

The challenge for international luxury brands is further compounded by the rapid rise of domestic Chinese automakers.

Strong Domestic Brands

Chinese automakers are rapidly innovating, offering technologically advanced and stylish vehicles at competitive price points, directly challenging established international players.

- Brands like BYD, NIO, and Xpeng are gaining significant market share with innovative electric vehicles (EVs), appealing to a tech-savvy consumer base.

- Domestic brands often offer better after-sales service and localized features, catering to the specific needs and preferences of the Chinese market. This localized approach is a key differentiator.

Intense Price Competition

The influx of domestic brands has led to intense price competition, squeezing profit margins for international automakers.

- Price wars and discounting strategies erode profitability for luxury brands, forcing them to make difficult choices between maintaining brand prestige and competing on price.

- Maintaining brand prestige while competing on price is a difficult balancing act. Luxury brands must carefully manage their pricing strategies to avoid damaging their brand image.

Evolving Consumer Preferences and Market Trends

Beyond economic factors and competition, shifting consumer preferences are also impacting auto sales in China.

The Electric Vehicle Revolution

The growing preference for electric vehicles (EVs) in China presents a significant opportunity and challenge for international brands.

- Chinese consumers are early adopters of EVs, demanding advanced technology, long-range capabilities, and innovative features. This necessitates significant investment in EV development and infrastructure.

- International brands need to significantly invest in their EV portfolios to remain competitive. Failure to do so will lead to further market share erosion.

Shifting Brand Loyalty

Younger generations of Chinese consumers are less brand-loyal and more focused on value, technology, and the overall ownership experience.

- Emphasis on technological features and personalized experiences is crucial for attracting this demographic. This requires a shift in marketing and product development strategies.

- Strong digital marketing strategies are necessary to reach this tech-savvy demographic effectively. Digital channels are essential for engaging younger consumers.

Conclusion

The slowdown in auto sales in China poses significant challenges for luxury car brands. Economic headwinds, the rise of powerful domestic competitors, and evolving consumer preferences are reshaping the market. To succeed, international automakers must adapt by investing heavily in electric vehicle technology, implementing competitive pricing strategies, and tailoring their products and marketing to resonate with the unique needs and preferences of Chinese consumers. Understanding the complexities of the Chinese automotive market and actively adapting to its dynamic nature is crucial for regaining momentum and achieving long-term success. Further research into the intricacies of auto sales in China is essential for anyone operating or planning to operate in this crucial market.

Featured Posts

-

Why Did Core Weave Inc Crwv Stock Fall On Thursday

May 22, 2025

Why Did Core Weave Inc Crwv Stock Fall On Thursday

May 22, 2025 -

50 Cent Decrease In Virginia Gasoline Prices A Year Of Change

May 22, 2025

50 Cent Decrease In Virginia Gasoline Prices A Year Of Change

May 22, 2025 -

Occasionmarkt Bloeit Abn Amro Registreert Aanzienlijke Verkoopstijging

May 22, 2025

Occasionmarkt Bloeit Abn Amro Registreert Aanzienlijke Verkoopstijging

May 22, 2025 -

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025 -

Clisson Le Theatre Tivoli En Images A La Decouverte D Un Lieu Du Loto Du Patrimoine 2025

May 22, 2025

Clisson Le Theatre Tivoli En Images A La Decouverte D Un Lieu Du Loto Du Patrimoine 2025

May 22, 2025