Autonomous Vehicles And Uber: An ETF Investment Strategy

Table of Contents

Understanding the Autonomous Vehicle Market and its Growth Potential

The autonomous vehicle market is experiencing explosive growth, driven by advancements in artificial intelligence, sensor technology, and machine learning. While still in its early stages, the potential is enormous, promising to reshape logistics, ride-sharing, and numerous other sectors. Key players beyond Uber include industry giants like Waymo (Alphabet's self-driving car project), Tesla, and several other smaller, innovative companies.

- Market size projections: Analysts predict the global autonomous vehicle market will reach hundreds of billions of dollars within the next 5-10 years, representing a significant investment opportunity.

- Government regulations: Government regulations surrounding AV testing and deployment vary across regions, impacting market growth timelines. Progressive regulatory frameworks are essential for fostering innovation and widespread adoption.

- Technological advancements: Continuous advancements in sensor technology (LiDAR, radar, cameras), artificial intelligence algorithms, and high-definition mapping are crucial drivers of market expansion, leading to safer and more reliable autonomous vehicles.

The disruptive potential of AVs is far-reaching. In logistics, self-driving trucks promise to increase efficiency and reduce transportation costs. In ride-sharing, autonomous vehicles could lead to lower fares and increased accessibility. The impact extends to various other sectors, creating significant long-term growth prospects for investors.

Uber's Position in the Autonomous Vehicle Landscape

Uber, a pioneer in the ride-sharing industry, has made significant investments in autonomous driving technology. While facing challenges, its strategic position within the evolving landscape presents both opportunities and risks for investors.

- Past projects and partnerships: Uber's history includes both in-house development and partnerships with other AV technology companies, demonstrating a commitment to this transformative technology.

- Current focus: Uber is currently focusing on integrating AV technology into its existing ride-sharing platform, aiming to improve efficiency, reduce costs, and enhance customer experience.

- Potential risks: Challenges remain, including regulatory hurdles related to safety and liability, as well as the significant technological and financial investment required for successful AV deployment. Competition from other established players and newcomers adds to the complexity of the market.

Identifying and Selecting Autonomous Vehicle ETFs

Exchange-Traded Funds (ETFs) provide a diversified and cost-effective way to gain exposure to the autonomous vehicle market. They offer a basket of stocks related to AV technology, reducing the risk associated with investing in individual companies.

- Types of Autonomous Vehicle ETFs: Some ETFs focus specifically on the AV sector, while others may offer broader exposure to technology companies involved in related fields such as AI or robotics. Geographically focused ETFs may also exist, providing exposure to specific regions leading in AV development.

- Selection criteria: When choosing an Autonomous Vehicle ETF, consider factors like the expense ratio (lower is better), the fund's size (larger funds often offer greater liquidity), and its historical performance (though past performance isn't indicative of future results).

- Examples and analysis: Research specific ETFs (e.g., Note: Include specific ETF ticker symbols here if available and relevant to your target audience. Always check for up-to-date information). Carefully analyze the ETF's holdings to understand your exposure to Uber and other key players in the autonomous vehicle space. Understanding the weighting of different companies within the ETF is crucial for making informed investment decisions.

- Thorough research: Before investing in any Autonomous Vehicle ETF, conduct thorough due diligence. Consider your investment goals, risk tolerance, and the ETF's investment strategy.

Risk Management in Autonomous Vehicle ETF Investing

Investing in emerging technologies like autonomous vehicles carries inherent risks. Effective risk management strategies are crucial for mitigating potential losses.

- Technological risks: Unforeseen technical challenges, slower-than-expected adoption rates, and technological disruptions can significantly impact the performance of AV-related investments.

- Regulatory risks: Changes in government regulations, safety standards, and liability laws can dramatically alter the landscape of the autonomous vehicle industry.

- Market risks: General market volatility can impact ETF prices, leading to potential losses even if the underlying companies are performing well.

Strategies for mitigating risk include diversification (investing across different ETFs and asset classes), dollar-cost averaging (investing a fixed amount at regular intervals), and staying informed about industry trends and regulatory developments.

Conclusion

Autonomous Vehicle ETFs offer a compelling investment opportunity for those seeking exposure to the potentially transformative autonomous vehicle market. Companies like Uber play a significant role in this evolving landscape, presenting both opportunities and challenges. However, it's crucial to remember that investing in this sector involves inherent risks. Through careful selection of ETFs, thorough research, and sound risk management strategies, investors can potentially capitalize on the growth potential of this exciting technology. Begin exploring the world of Autonomous Vehicle ETFs today and position yourself for the future of transportation. Learn more about diversifying your portfolio with strategic investments in Autonomous Vehicle ETFs and capitalize on the growth potential of this revolutionary technology.

Featured Posts

-

Detroit Tigers Riley Greene Hits Two Homers In Dramatic Ninth Inning Victory

May 18, 2025

Detroit Tigers Riley Greene Hits Two Homers In Dramatic Ninth Inning Victory

May 18, 2025 -

Pvvs Internal Battles A Test For Wilders Authority

May 18, 2025

Pvvs Internal Battles A Test For Wilders Authority

May 18, 2025 -

Conquering The Five Boro Bike Tour Training Gear And Route Strategies For Nyc

May 18, 2025

Conquering The Five Boro Bike Tour Training Gear And Route Strategies For Nyc

May 18, 2025 -

The It Ends With Us Legal Battle Taylor Swift And Blake Livelys Involvement Explained

May 18, 2025

The It Ends With Us Legal Battle Taylor Swift And Blake Livelys Involvement Explained

May 18, 2025 -

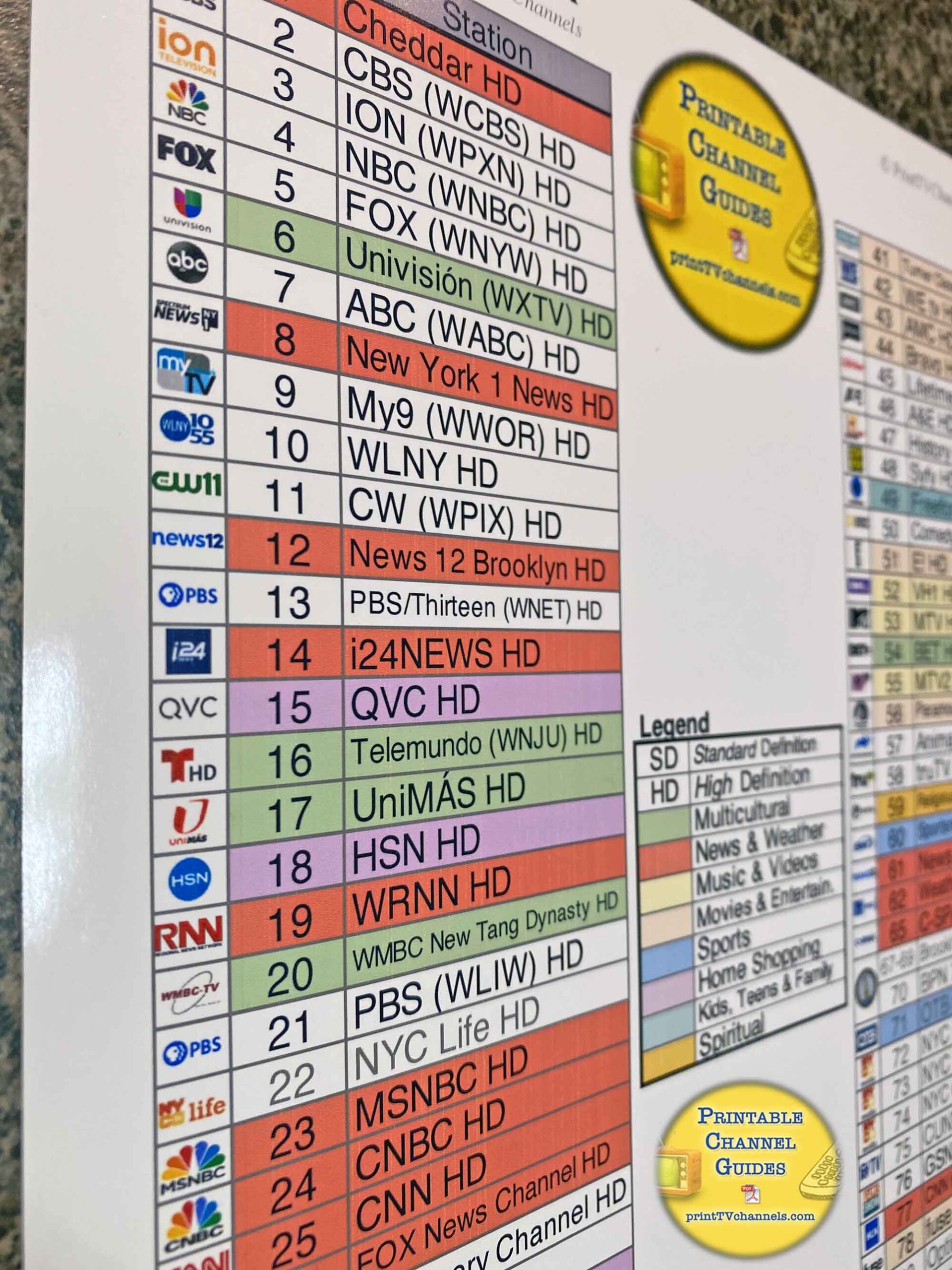

Easy A Bbc Three Hd Tv Guide And Listings

May 18, 2025

Easy A Bbc Three Hd Tv Guide And Listings

May 18, 2025

Latest Posts

-

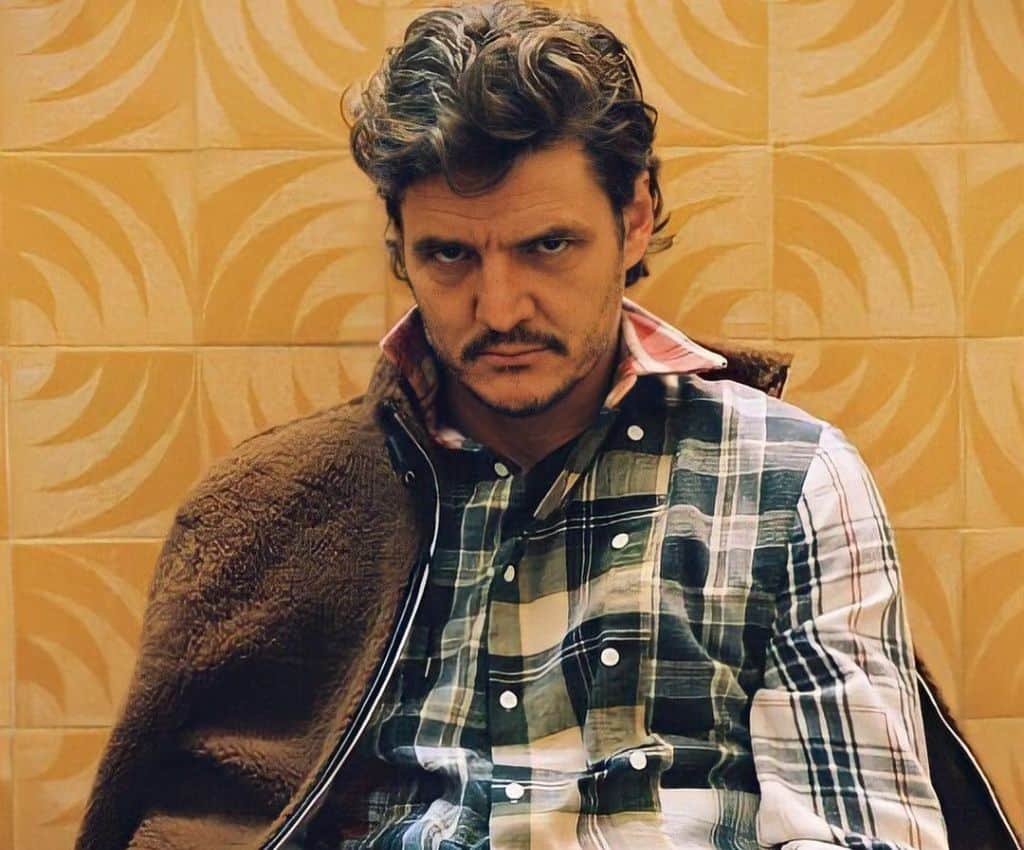

Pedro Pascals Captivating Performance Takes The Internet By Storm

May 18, 2025

Pedro Pascals Captivating Performance Takes The Internet By Storm

May 18, 2025 -

Pedro Pascals Latest Role Another Internet Sensation

May 18, 2025

Pedro Pascals Latest Role Another Internet Sensation

May 18, 2025 -

Pedro Pascal Internet Heartthrob In A World Of Fantasy

May 18, 2025

Pedro Pascal Internet Heartthrob In A World Of Fantasy

May 18, 2025 -

Jennifer Aniston Sends Birthday Wishes To Pedro Pascal Amidst Dating Speculation

May 18, 2025

Jennifer Aniston Sends Birthday Wishes To Pedro Pascal Amidst Dating Speculation

May 18, 2025 -

Fans Speculate Did Pedro Pascal Get Jaw Surgery Or Use Ozempic

May 18, 2025

Fans Speculate Did Pedro Pascal Get Jaw Surgery Or Use Ozempic

May 18, 2025