Bajaj Twins Drag, Geopolitical Uncertainty: Sensex, Nifty 50 Daily Close

Table of Contents

Bajaj Twins' Impact on the Market

The poor performance of Bajaj Auto and Bajaj Finserv significantly impacted the Sensex and Nifty 50 indices. Their combined negative influence created a ripple effect across various sectors, contributing to the overall market downturn.

- Stock Price Performance: Bajaj Auto saw its share value decline by 2.5%, while Bajaj Finserv experienced a 3% drop. These substantial percentage changes directly influenced the market indices, pulling down the overall performance.

- Reasons for Poor Performance: Analysts cite several potential factors contributing to the Bajaj Twins' underperformance. Disappointing quarterly profit reports, coupled with concerns about future growth prospects in the automobile and financial services sectors, likely fueled negative investor sentiment. Increased market speculation regarding upcoming regulatory changes also played a role.

- Ripple Effect: The downturn in the Bajaj Twins' stock prices created a negative sentiment spillover, particularly impacting the auto and financial sectors. Investors adopted a more cautious approach, leading to a broader sell-off across related stocks.

Geopolitical Uncertainty and its Influence

Geopolitical headwinds added another layer of complexity to the day's market movements. Rising global tensions and economic uncertainties played a significant role in increasing market volatility.

- Global Events: Increasing tensions in Eastern Europe and ongoing trade disputes between major global powers contributed to investor anxiety. Predictions of a global economic slowdown further fueled market concerns.

- Investor Sentiment: The uncertainty stemming from these geopolitical events created a climate of fear among investors, leading to risk aversion and a preference for safer investments. This resulted in a significant sell-off in riskier assets, including stocks.

- Inflation and Interest Rates: Persistent inflation and the subsequent increase in interest rates by central banks globally added to the economic uncertainty. Higher interest rates make borrowing more expensive, impacting business investments and potentially slowing economic growth. This uncertainty contributed to the negative market sentiment.

Sensex and Nifty 50 Daily Close Analysis

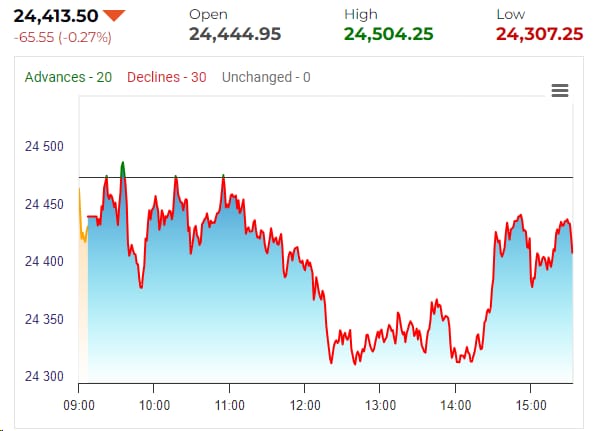

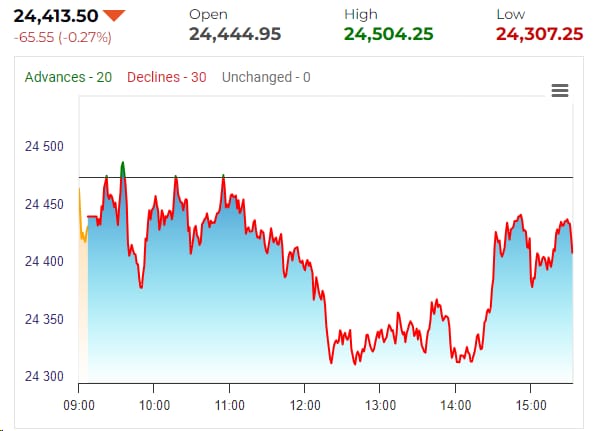

The Sensex closed at [Insert Sensex Closing Price], representing a [Insert Percentage Change]% decrease compared to the previous day's close. Similarly, the Nifty 50 ended the day at [Insert Nifty 50 Closing Price], showing a [Insert Percentage Change]% decline.

- Daily Movements: [Insert a chart or graph visually representing the Sensex and Nifty 50 movements throughout the day].

- Comparison to Previous Performance: This daily decline marks a continuation of a downward trend observed over the past week/month (adjust accordingly based on actual market data).

Sector-wise Performance

The impact of the Bajaj Twins' performance and geopolitical uncertainty wasn't uniform across all sectors. While the auto and financial sectors were particularly affected, other sectors also experienced varying degrees of decline.

- Financial Sector: Naturally, the financial sector, heavily influenced by Bajaj Finserv's performance, faced the most significant decline.

- Auto Sector: Bajaj Auto's underperformance weighed heavily on the auto sector, dragging down related stocks.

- IT Sector: The IT sector demonstrated relative resilience compared to other sectors, showing a smaller decline.

- FMCG Sector: The fast-moving consumer goods (FMCG) sector also showed a degree of resilience, but still experienced a slight drop, reflecting the overall negative market sentiment.

Conclusion

Today's market closure reflects a complex interplay between domestic and global factors. The poor performance of Bajaj Auto and Bajaj Finserv ("Bajaj Twins") significantly impacted the Sensex and Nifty 50, while prevailing geopolitical uncertainty exacerbated the negative market sentiment. The overall decline highlights the interconnectedness of global and domestic events in influencing the Indian stock market.

Key Takeaways: The day's trading underscores the importance of monitoring both domestic company performance and global geopolitical events when assessing market trends. Diversification and a careful understanding of risk are crucial for navigating market volatility.

Call to Action: Stay updated on the daily performance of the Sensex and Nifty 50 and understand the factors influencing the Indian stock market. Check back tomorrow for the latest market analysis and insightful perspectives on the Indian stock market!

Featured Posts

-

Trumps Kennedy Center Visit Les Miserables Cast Weighs Boycott

May 09, 2025

Trumps Kennedy Center Visit Les Miserables Cast Weighs Boycott

May 09, 2025 -

Vu Bao Hanh Tre O Tien Giang Loi Khai Day Du Cua Bao Mau

May 09, 2025

Vu Bao Hanh Tre O Tien Giang Loi Khai Day Du Cua Bao Mau

May 09, 2025 -

The Crossroads Of Ai Apples Next Move

May 09, 2025

The Crossroads Of Ai Apples Next Move

May 09, 2025 -

Hertls Injury Potential Impact On Vegas Golden Knights

May 09, 2025

Hertls Injury Potential Impact On Vegas Golden Knights

May 09, 2025 -

Stricter Uk Visa Requirements Aimed At Curbing Immigration Abuse

May 09, 2025

Stricter Uk Visa Requirements Aimed At Curbing Immigration Abuse

May 09, 2025

Latest Posts

-

Dijon Psg Fin De Serie En Arkema Premiere Ligue

May 09, 2025

Dijon Psg Fin De Serie En Arkema Premiere Ligue

May 09, 2025 -

Arkema Premiere Ligue Victoire Difficile Du Psg Contre Dijon

May 09, 2025

Arkema Premiere Ligue Victoire Difficile Du Psg Contre Dijon

May 09, 2025 -

Psg Brise La Serie De Dijon En Arkema Premiere Ligue

May 09, 2025

Psg Brise La Serie De Dijon En Arkema Premiere Ligue

May 09, 2025 -

Arkema Premiere Ligue Paris Saint Germain Met Fin A La Serie De Dijon

May 09, 2025

Arkema Premiere Ligue Paris Saint Germain Met Fin A La Serie De Dijon

May 09, 2025 -

Participer A Une Collecte De Cheveux A Dijon

May 09, 2025

Participer A Une Collecte De Cheveux A Dijon

May 09, 2025