Bank Of Canada Interest Rate Outlook: Impact Of Tariffs And Employment Data

Table of Contents

The Influence of Tariffs on the Bank of Canada Interest Rate Outlook

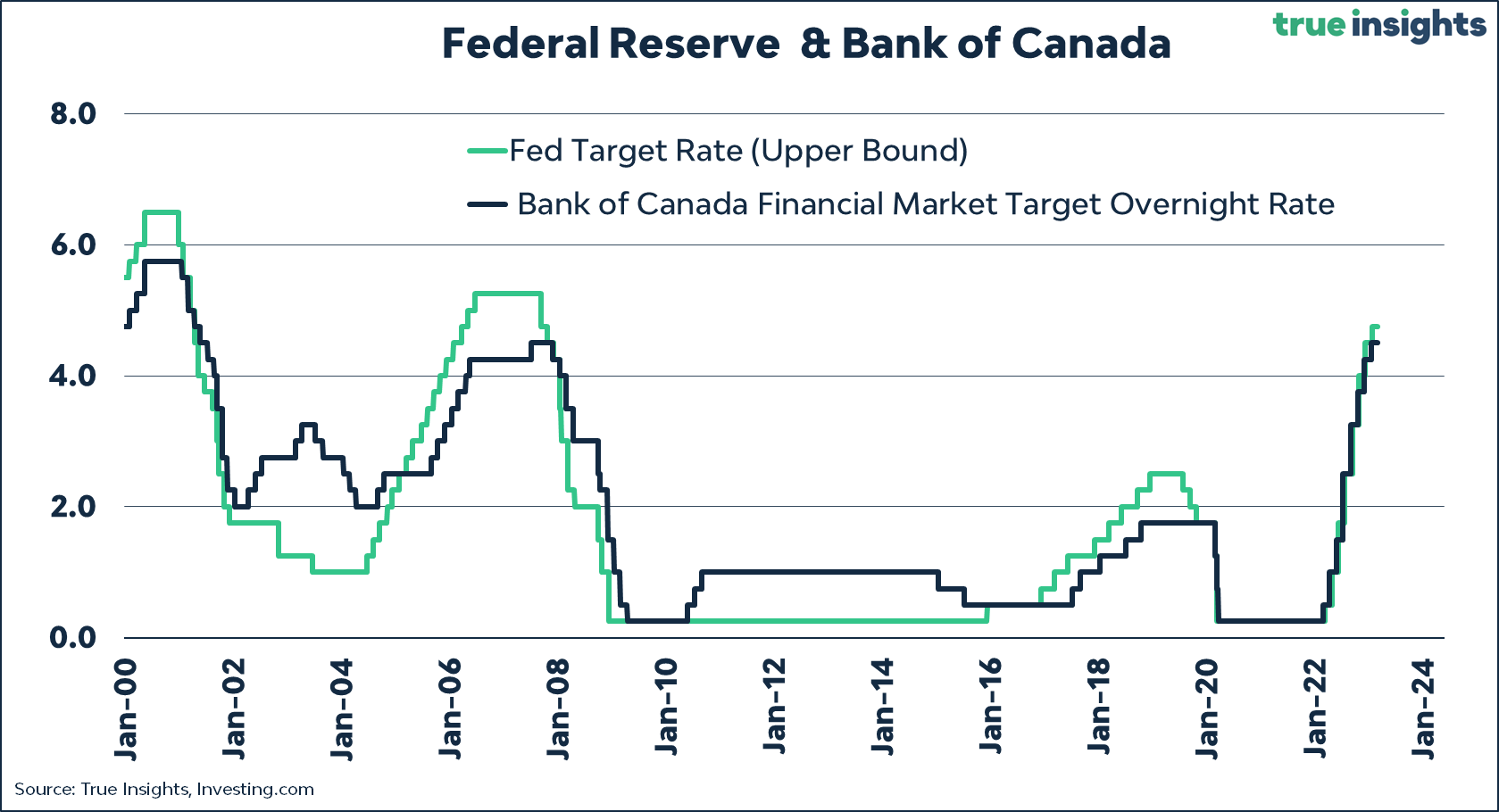

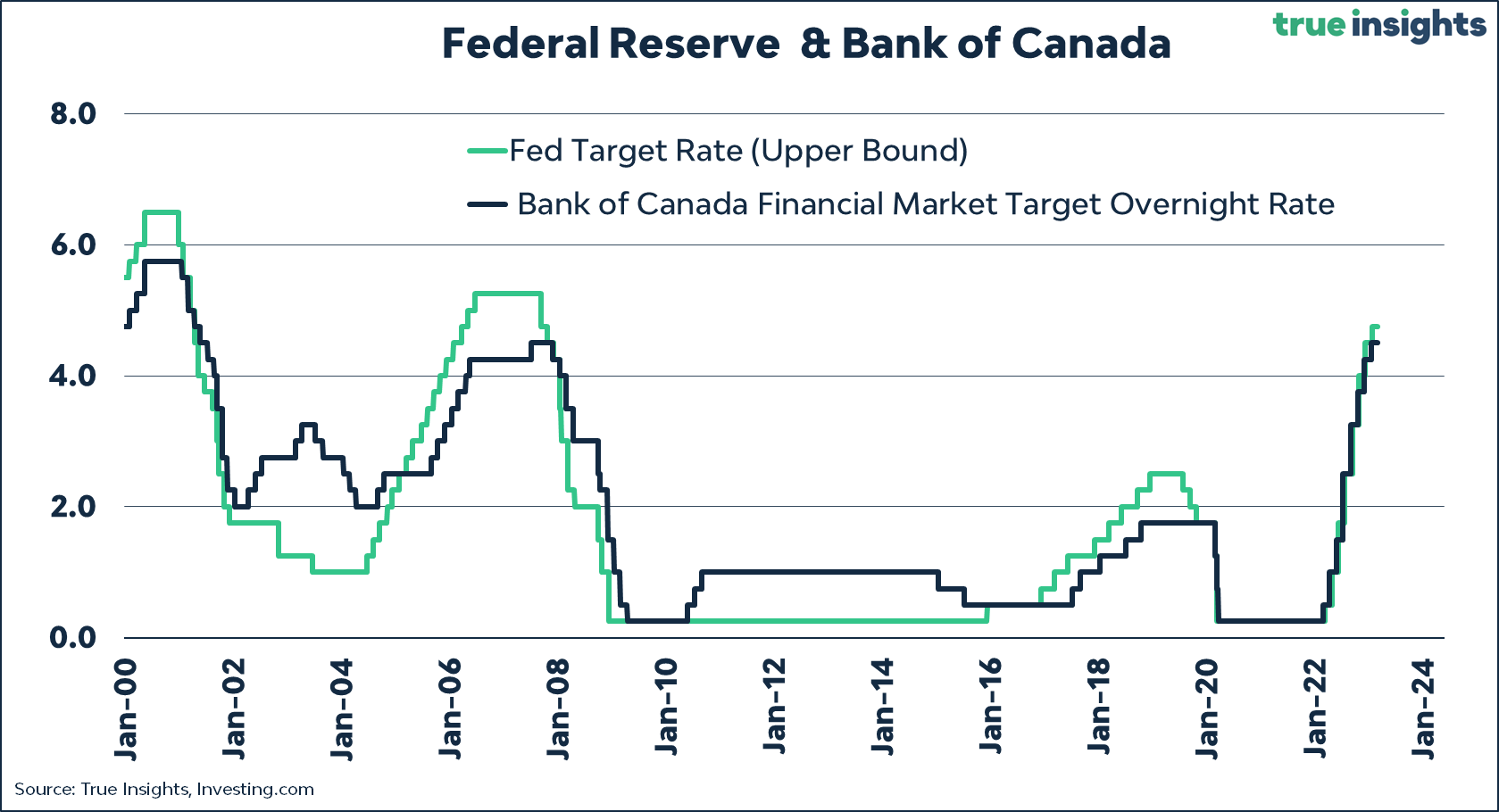

Tariffs and trade wars significantly impact the Bank of Canada interest rate outlook. The resulting economic uncertainty and inflationary pressures heavily influence the central bank's monetary policy decisions.

Impact of Trade Wars on Inflation

Trade disputes and the imposition of tariffs lead to increased import costs for Canadian businesses and consumers. This increase in prices directly contributes to inflationary pressures, making goods and services more expensive. The Bank of Canada, mandated to control inflation and maintain price stability, faces a challenging task when dealing with tariff-induced inflation. This complication necessitates a careful assessment of the overall economic climate before adjusting interest rates.

- Increased prices for imported goods: Higher tariffs translate directly into higher prices for consumers, reducing purchasing power.

- Potential for supply chain disruptions: Trade wars can disrupt established supply chains, leading to shortages and further price increases.

- Reduced consumer spending due to higher prices: Increased prices dampen consumer confidence and spending, impacting economic growth.

- Impact on Canadian businesses reliant on imports/exports: Businesses heavily reliant on imports for production or exports for sales face significant challenges navigating tariff barriers and fluctuating exchange rates.

Uncertainty and Investor Sentiment

The uncertainty surrounding tariffs significantly impacts investor confidence and investment decisions. Businesses are hesitant to invest in expansion or new projects when faced with unpredictable trade policies. This reduced investment can lead to slower economic growth and a weakened Canadian dollar.

- Decreased business investment due to uncertainty: Uncertainty creates a risk-averse environment, discouraging businesses from committing to long-term investments.

- Potential capital flight: Investors may move their capital to more stable economies, weakening the Canadian dollar.

- Weakening of the Canadian dollar: A weaker Canadian dollar can increase the cost of imports, further fueling inflation.

- Impact on foreign direct investment: Uncertainty can deter foreign investors from committing capital to the Canadian economy.

Employment Data and its Role in Shaping the Bank of Canada Interest Rate Outlook

Employment data provides crucial insights into the overall health of the Canadian economy and significantly informs the Bank of Canada's interest rate decisions. Strong employment growth often indicates a healthy economy, while high unemployment suggests a need for stimulative measures.

Job Growth and Inflationary Pressures

Strong employment growth typically leads to increased consumer spending, as more people have jobs and disposable income. This increased demand can put upward pressure on prices, contributing to inflationary pressures. The Bank of Canada carefully monitors employment figures to gauge the overall strength of the economy and its potential impact on inflation.

- Unemployment rate and its impact on wage growth: Low unemployment can lead to increased wage growth, further contributing to inflationary pressures.

- Participation rate and its effect on the labor market: Changes in labor force participation affect the overall availability of workers and wage pressures.

- Relationship between employment and consumer confidence: High employment generally leads to higher consumer confidence and increased spending.

- Impact on inflation expectations: Strong employment and rising wages can lead to expectations of future inflation.

Wage Growth and Inflationary Expectations

The relationship between wage growth, inflation, and the Bank of Canada's interest rate decisions is complex. While strong wage growth can be positive for workers, it can also contribute to inflationary pressures if it outpaces productivity gains. The Bank of Canada must carefully balance its goals of full employment with its mandate to control inflation.

- Impact of wage increases on inflation: Rapid wage increases can lead to a wage-price spiral, where higher wages lead to higher prices, leading to further wage demands.

- Bank of Canada's inflation target: The Bank of Canada aims to maintain inflation within a specific target range, typically around 2%.

- Potential for wage-price spiral: A sustained increase in wages and prices can create an unsustainable cycle of inflation.

- Balancing full employment with inflation control: The Bank of Canada must strike a delicate balance between supporting employment and controlling inflation through interest rate adjustments.

Conclusion

The Bank of Canada interest rate outlook is significantly shaped by both the impact of tariffs and employment data. Tariffs introduce uncertainty and inflationary pressures, while employment figures provide insights into the overall health of the economy and its potential impact on inflation. The unpredictable nature of global trade and the inherent volatility of the Canadian economy make accurate forecasting challenging. Monitoring these factors is crucial for understanding future interest rate movements. Stay informed about the Bank of Canada's interest rate announcements and economic data releases to better manage your financial decisions related to the Bank of Canada interest rate outlook. For in-depth analysis, refer to the Bank of Canada's website and reputable financial news sources. Understanding the Bank of Canada interest rate outlook is vital for navigating the current economic climate.

Featured Posts

-

Nba Betting Knicks Vs Bulls Predictions Odds Comparison And Analysis Feb 20 2025

May 11, 2025

Nba Betting Knicks Vs Bulls Predictions Odds Comparison And Analysis Feb 20 2025

May 11, 2025 -

Broadcoms Extreme V Mware Price Increase At And T Details The 1 050 Jump

May 11, 2025

Broadcoms Extreme V Mware Price Increase At And T Details The 1 050 Jump

May 11, 2025 -

Ufc 315 A Montreal Aiemann Zahabi Et Jose Aldo Un Combat Plus Long Que 13 Secondes

May 11, 2025

Ufc 315 A Montreal Aiemann Zahabi Et Jose Aldo Un Combat Plus Long Que 13 Secondes

May 11, 2025 -

Por Que A Adaptacao De Quadrinhos Com Sylvester Stallone E Melhor Do Que Voce Imagina

May 11, 2025

Por Que A Adaptacao De Quadrinhos Com Sylvester Stallone E Melhor Do Que Voce Imagina

May 11, 2025 -

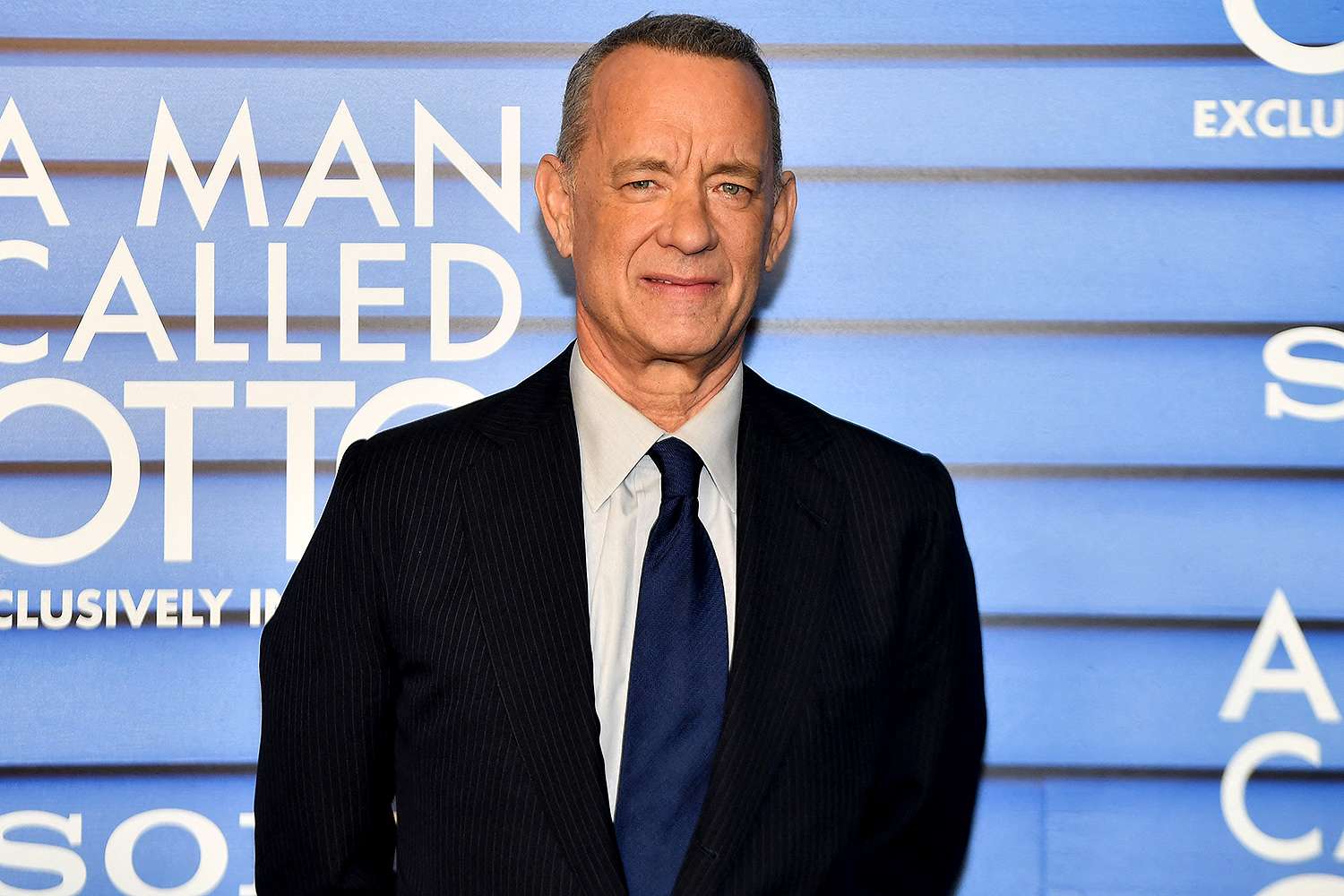

Tom Cruise Still Owes Tom Hanks 1 Will He Ever Pay Up

May 11, 2025

Tom Cruise Still Owes Tom Hanks 1 Will He Ever Pay Up

May 11, 2025