Bank Of Canada Interest Rate Outlook: Job Losses From Tariffs Prompt Rate Cut Predictions

Table of Contents

The Impact of Tariffs on the Canadian Economy

Job Losses and Economic Slowdown

The ongoing trade disputes have undeniably impacted the Canadian job market. According to Statistics Canada, [insert specific data on job losses attributed to tariffs, if available. Otherwise, use a placeholder like: "recent reports suggest a significant number of job losses in key sectors..."]. These losses are not evenly distributed, with certain regions and industries experiencing a more pronounced negative impact.

- Specific sectors affected: Manufacturing, particularly automotive parts and aluminum production, has been significantly hit. The agriculture sector has also faced challenges due to retaliatory tariffs on Canadian goods.

- Regional disparities in job losses: Provinces heavily reliant on exporting goods affected by tariffs, such as Ontario and British Columbia, are experiencing higher unemployment rates compared to other regions.

- Impact on consumer confidence: The uncertainty surrounding the trade war and the resulting job losses have negatively impacted consumer confidence, leading to reduced spending and a dampening effect on economic growth. This reduced consumer spending further contributes to slower GDP growth. Keywords: Canadian economy, trade war, tariff impact, job market, economic growth, GDP

Inflationary Pressure and its Relation to Interest Rates

The impact of tariffs on inflation is complex. While some tariffs might lead to higher prices for imported goods (inflationary pressure), others could lead to reduced demand and lower prices (deflationary pressure). The net effect is difficult to predict and depends on many factors including the specific goods affected, the elasticity of demand, and the ability of businesses to absorb the increased costs.

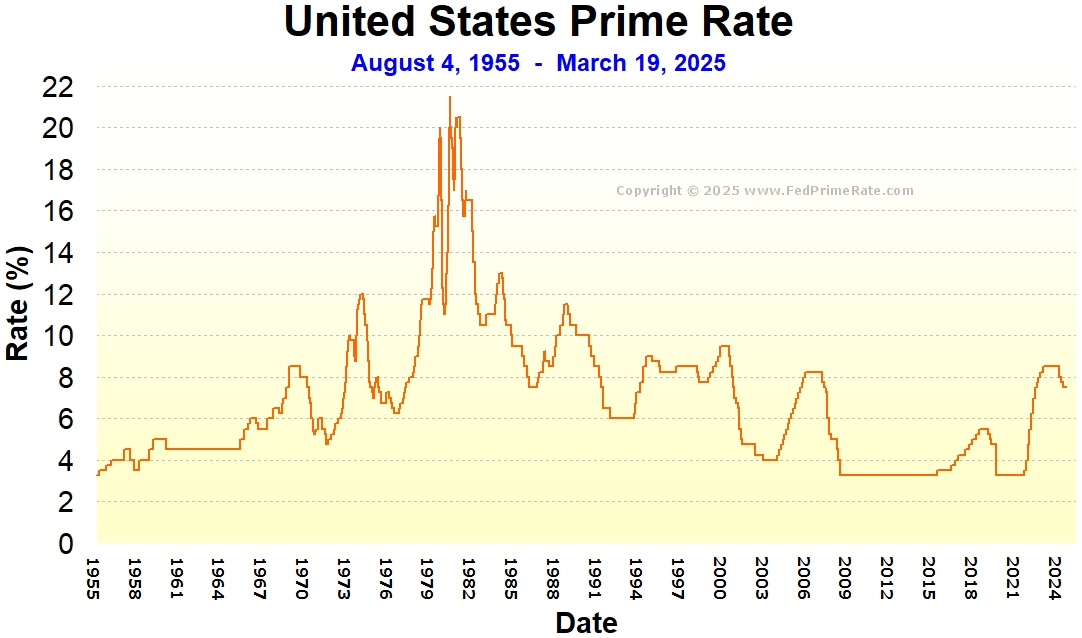

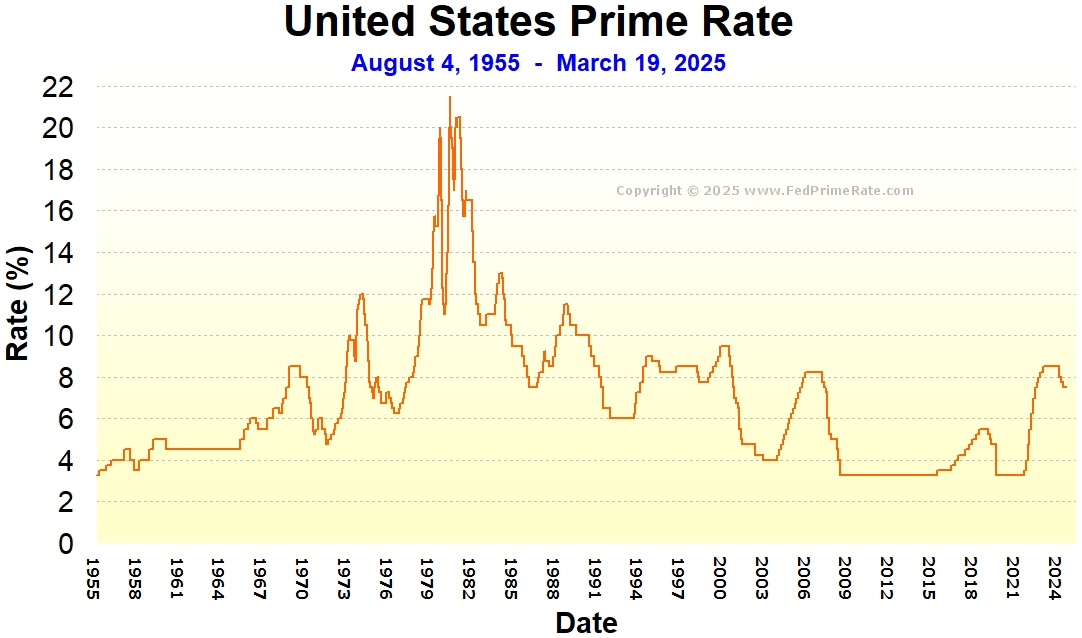

- Relationship between inflation and interest rates: The Bank of Canada's mandate is to maintain price stability through controlling inflation. Generally, higher inflation leads to interest rate increases to cool down the economy. Conversely, lower inflation might lead to interest rate cuts to stimulate growth.

- The Bank of Canada's inflation target: The Bank of Canada aims to keep inflation at around 2%. [Insert current inflation rate data from a reputable source]. Deviation from this target significantly influences monetary policy decisions.

- Current inflation rates: [Insert relevant data here, clearly stating the source]. This data will be crucial in understanding whether inflationary pressures are justifying a rate cut or hike. Keywords: Inflation, CPI, Bank of Canada mandate, monetary policy

Analyst Predictions and Market Sentiment Regarding Bank of Canada Interest Rate

Expert Opinions on Rate Cuts

The possibility of a Bank of Canada interest rate cut is a subject of ongoing debate among economists and financial analysts. [Insert names and affiliations of prominent economists] have expressed differing opinions. Some believe a rate cut is necessary to counteract the economic slowdown caused by tariffs and job losses. Others argue that a rate cut is premature or unnecessary, citing concerns about potential inflationary pressures or the need to assess the full extent of the economic impact of tariffs.

- Quotes from analysts: [Insert relevant quotes from analysts highlighting differing views and rationale].

- Predictions for timing and magnitude of potential rate cuts: Some analysts predict a rate cut as early as [date], while others suggest a wait-and-see approach. The magnitude of any potential rate cut is also debated, with predictions ranging from [percentage] to [percentage].

- Differing opinions and rationale behind them: The diversity of opinion reflects the complexity of the situation and the uncertainty surrounding future economic developments. Keywords: Economic forecast, interest rate prediction, monetary policy, rate cut expectation, market sentiment

Market Reactions to Economic Data

Recent economic data releases and tariff announcements have elicited mixed reactions in the stock market and the Canadian dollar.

- Stock market indices performance: [Insert data on relevant stock market indices, such as the S&P/TSX Composite Index]. Decreases often indicate investor concern about the economic outlook.

- Canadian dollar exchange rate fluctuations: The Canadian dollar's value has been volatile recently, reflecting uncertainty about the economy. [Insert data on CAD exchange rates]. A weakening dollar might indicate lower investor confidence.

- Investor sentiment indicators: Various investor sentiment indicators, such as surveys of investor confidence, can provide further insights into market reactions. Keywords: Canadian dollar, stock market, investor confidence, currency exchange rate, market volatility

Potential Alternatives and the Bank of Canada's Toolkit

Other Monetary Policy Tools

The Bank of Canada possesses a range of monetary policy tools beyond interest rate adjustments.

- Quantitative easing: This involves the Bank of Canada purchasing government bonds to increase the money supply and lower long-term interest rates.

- Forward guidance: This involves communicating the Bank of Canada's intentions regarding future interest rate changes to influence market expectations.

- Other unconventional monetary policies: In exceptional circumstances, the Bank of Canada might consider other unconventional measures. Keywords: Quantitative easing, unconventional monetary policy, forward guidance, monetary policy tools

Factors Influencing the Bank of Canada's Decision

The Bank of Canada's decision regarding interest rates is influenced by a multitude of factors beyond tariffs and job losses.

- Global economic conditions: Global economic growth and uncertainty play a significant role.

- Housing market trends: The health of the housing market is a key consideration.

- Oil prices: Fluctuations in oil prices significantly affect the Canadian economy.

- Consumer spending: Levels of consumer spending are a vital indicator of economic health. Keywords: Global economy, housing market, oil prices, consumer spending, economic indicators

Conclusion

The impact of tariffs on the Canadian economy, particularly the job losses in key sectors, has raised significant concerns about the need for a Bank of Canada interest rate cut. While the analysis presents a strong case for a rate reduction to stimulate growth, other factors, such as inflation and global economic conditions, will significantly influence the Bank of Canada’s final decision. The likelihood of a rate cut remains uncertain, with expert opinions varying widely. However, the current economic climate suggests that a rate cut is a strong possibility to counteract the negative effects of the trade war and bolster economic activity.

To stay informed about the Bank of Canada’s decisions and future announcements related to the Bank of Canada interest rate and its impact on the Canadian economy, regularly check reputable financial news sources for updates on Bank of Canada interest rate changes and monitoring Bank of Canada rates.

Featured Posts

-

Relationship Revelations Maya Jama Discusses Her Past With Stormzy

May 14, 2025

Relationship Revelations Maya Jama Discusses Her Past With Stormzy

May 14, 2025 -

Judd Sisters Docuseries Revealing Family History And Challenges

May 14, 2025

Judd Sisters Docuseries Revealing Family History And Challenges

May 14, 2025 -

Maya Jama Confirms Romance With Footballer Ruben Diaz

May 14, 2025

Maya Jama Confirms Romance With Footballer Ruben Diaz

May 14, 2025 -

Fallecimiento De Jose Mujica Reflexiones Sobre Su Liderazgo En Uruguay

May 14, 2025

Fallecimiento De Jose Mujica Reflexiones Sobre Su Liderazgo En Uruguay

May 14, 2025 -

Dont Hate The Playaz Building A Respectful Community In Online Games

May 14, 2025

Dont Hate The Playaz Building A Respectful Community In Online Games

May 14, 2025