Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Desjardins' Rationale Behind the Prediction

Desjardins' prediction of three additional Bank of Canada rate cuts stems from a careful analysis of several key economic indicators pointing towards a potential economic slowdown. Their reasoning is based on a confluence of factors affecting the Canadian economy's performance and stability.

-

Analysis of Recent Inflation Figures and Their Trajectory: While inflation has shown signs of cooling, Desjardins believes it's still above the Bank of Canada's target range, necessitating further interest rate cuts to stimulate economic activity without fueling excessive inflation. They're closely monitoring the persistence of inflation and its potential to impact future economic growth.

-

Assessment of the Current Unemployment Rate and Its Implications: While the unemployment rate remains relatively low, Desjardins anticipates a potential rise in job losses as businesses adjust to slower economic growth. This, coupled with persistent inflationary pressures, fuels their prediction of further rate cuts to mitigate the impact on employment.

-

Evaluation of GDP Growth and Potential Recessionary Risks: Desjardins' analysis suggests a weakening GDP growth rate, signaling a potential recessionary risk. Further rate cuts are seen as a preventative measure to stimulate economic growth and stave off a potential economic downturn.

-

Consideration of Global Economic Factors Influencing the Canadian Economy: Global economic uncertainty, including potential recessionary risks in major economies, is a significant factor in Desjardins' prediction. These external pressures further support their assessment of the need for additional monetary easing through rate cuts.

Impact of Rate Cuts on Mortgage Rates

The anticipated Bank of Canada rate cuts will undoubtedly influence mortgage rates, affecting both those looking to secure a new mortgage and those considering refinancing.

-

Potential Decrease in Variable Mortgage Rates: Variable-rate mortgages are directly tied to the Bank of Canada's prime rate. Therefore, three rate cuts will likely translate into a notable decrease in variable mortgage payments, making homeownership more accessible for many Canadians.

-

Possible Impact on Fixed Mortgage Rates (Potentially Less Significant): While fixed mortgage rates are not directly tied to the Bank of Canada's prime rate, they are influenced by it indirectly. A decrease in the prime rate can lead to lower fixed mortgage rates, although the impact is usually less immediate and pronounced than on variable rates.

-

Opportunities for Refinancing Existing Mortgages at Lower Rates: Homeowners with existing mortgages will have an excellent opportunity to refinance at lower rates, reducing their monthly payments and potentially saving significant amounts of money over the life of their mortgage.

-

The Potential Effect on the Housing Market and Home Affordability: Lower mortgage rates are expected to stimulate the housing market, boosting demand and potentially impacting home prices. This could increase home affordability for some but also exacerbate existing concerns about housing affordability in certain markets.

Implications for Borrowers and Businesses

Reduced interest rates will have a ripple effect across the Canadian economy, influencing borrowing costs for both individuals and businesses.

-

Reduced Borrowing Costs for Consumers Leading to Increased Spending: Lower interest rates make borrowing cheaper for consumers, encouraging increased spending on goods and services, thereby potentially stimulating economic growth.

-

Potential Boost in Business Investment Due to Lower Interest Rates: Businesses are more likely to invest in expansion and new projects when borrowing costs are low. Reduced interest rates can lead to increased capital expenditure and job creation.

-

Increased Credit Availability for Both Consumers and Businesses: Lower rates encourage lenders to offer more credit, making it easier for consumers and businesses to access funds for various purposes.

-

The Potential for Stimulating Economic Growth: The combined effect of increased consumer spending and business investment driven by lower borrowing costs can lead to a significant boost in economic activity.

Counterarguments and Potential Risks

While Desjardins' prediction seems plausible, there are counterarguments and potential risks associated with further rate cuts.

-

Persistence of Inflationary Pressures Despite Rate Cuts: Rate cuts could potentially fuel inflationary pressures if they don't effectively address underlying economic issues contributing to inflation. This would negate the intended positive effects and potentially worsen the economic situation.

-

Potential for Currency Devaluation Due to Reduced Interest Rates: Lower interest rates can make the Canadian dollar less attractive to foreign investors, leading to currency devaluation and potentially impacting import and export prices.

-

Uncertainty Surrounding the Effectiveness of Rate Cuts in Stimulating Economic Growth: The effectiveness of rate cuts depends on various economic factors, and there's no guarantee that they will successfully stimulate growth in the current uncertain climate. A miscalculation could lead to unintended negative consequences.

Conclusion

Desjardins' prediction of three more Bank of Canada rate cuts carries significant implications for the Canadian economy. Potential benefits include lower mortgage rates, reduced borrowing costs for consumers and businesses, and a potential boost in economic activity. However, there are also risks, including persistent inflationary pressures, currency devaluation, and uncertainty regarding the effectiveness of the rate cuts. Staying informed about future Bank of Canada rate cuts and their implications for your personal finances is paramount. Monitor the Bank of Canada's announcements and consult with a financial advisor to navigate the changing landscape of interest rates. Understanding the potential impact of Bank of Canada rate cuts is crucial for making informed financial decisions.

Featured Posts

-

Exclusive Unveiling Sam Altman And Jony Ives New Device

May 23, 2025

Exclusive Unveiling Sam Altman And Jony Ives New Device

May 23, 2025 -

Just In Time Jonathan Groffs Shot At Tony Award Glory

May 23, 2025

Just In Time Jonathan Groffs Shot At Tony Award Glory

May 23, 2025 -

Kieran Culkin Discusses His Casting In A Real Pain By Jesse Eisenberg

May 23, 2025

Kieran Culkin Discusses His Casting In A Real Pain By Jesse Eisenberg

May 23, 2025 -

Review Siren A Captivating Beach Thriller With A Strong Cast

May 23, 2025

Review Siren A Captivating Beach Thriller With A Strong Cast

May 23, 2025 -

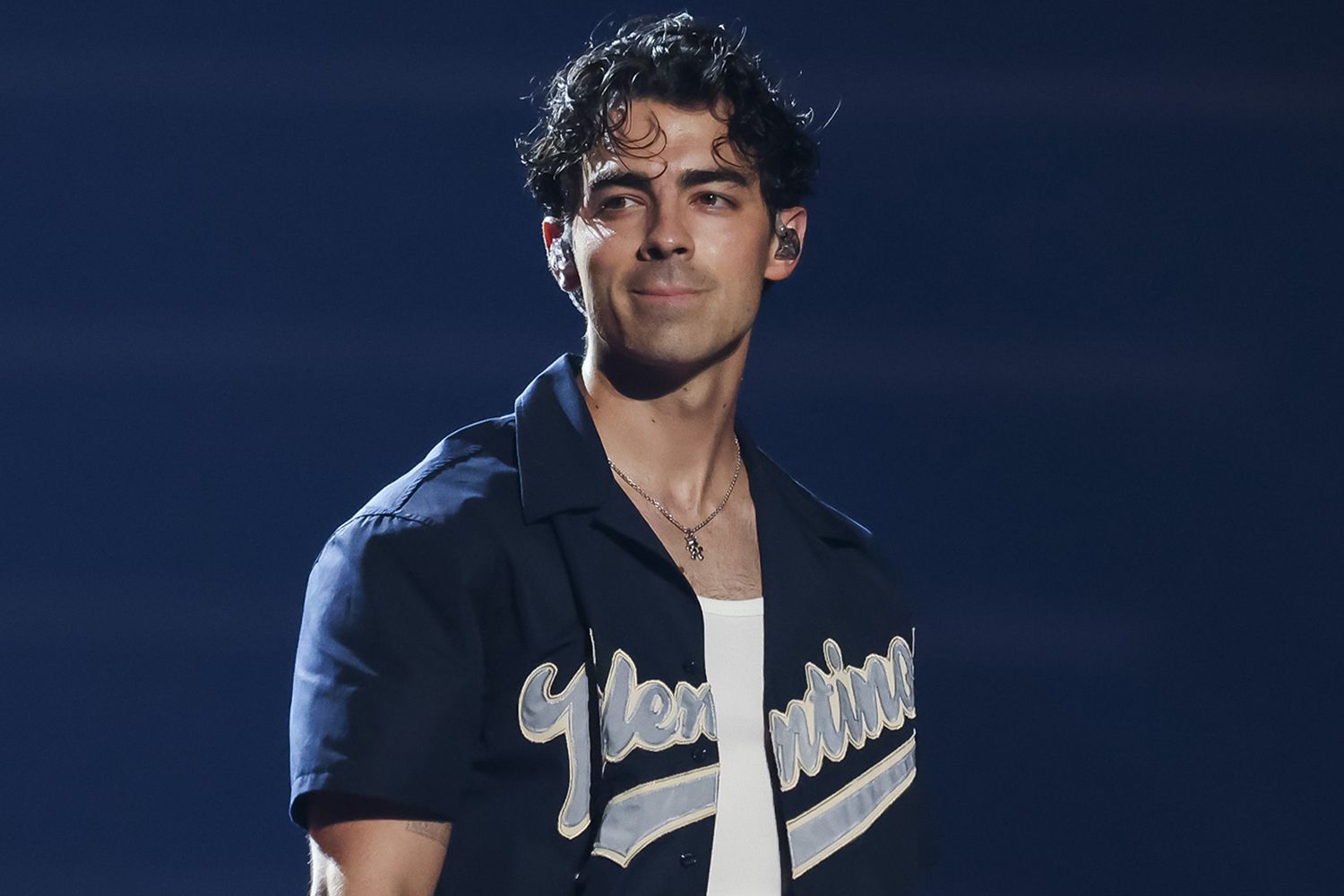

Joe Jonas How He Handled A Couples Argument About Him

May 23, 2025

Joe Jonas How He Handled A Couples Argument About Him

May 23, 2025