Bank Of Canada Rate Cuts: Economists Predict Renewed Action Amid Tariff Job Losses

Table of Contents

The Impact of Tariffs on the Canadian Job Market

Tariffs, designed to protect domestic industries, often have unintended consequences, particularly for export-oriented economies like Canada's. The tariff impact Canada is already being felt, with specific sectors bearing the brunt of the economic fallout.

- Manufacturing: The manufacturing sector, a cornerstone of the Canadian economy, is particularly vulnerable. Increased tariffs on Canadian goods exported to key trading partners lead to reduced demand and, consequently, job losses.

- Agriculture: The agricultural sector faces similar challenges. Tariffs on Canadian agricultural exports to international markets diminish profitability and threaten the livelihoods of farmers and agricultural workers.

- Ripple Effect: The job losses in these key sectors have a ripple effect throughout the economy. Reduced employment translates to lower consumer spending, impacting other businesses and contributing to a broader economic slowdown.

Statistics paint a concerning picture. Reports indicate a significant rise in Canadian unemployment in tariff-affected sectors. For example, recent data suggests a [insert hypothetical percentage]% increase in unemployment in manufacturing since the implementation of [mention specific tariff]. This decline in employment directly impacts consumer confidence and spending, further exacerbating the economic impact tariffs. Understanding the full extent of job losses tariffs is crucial for informed policymaking.

Economists' Forecasts for Bank of Canada Rate Cuts

Faced with the growing economic challenges, many economists are predicting Bank of Canada rate cuts as a necessary tool to stimulate the economy. The forecasts vary in terms of timing and magnitude.

- Timing: Some economists predict rate cuts as early as [insert hypothetical date], while others anticipate a more cautious approach, waiting for further economic data before intervening.

- Magnitude: Predictions regarding the size of the rate cuts also differ, ranging from [insert hypothetical percentage]% to [insert hypothetical percentage]%, depending on the severity of the economic downturn.

These rate cut predictions are driven by several key economic indicators:

- Inflation: Low inflation rates provide the Bank of Canada with room to cut interest rates without triggering significant inflationary pressure.

- GDP Growth: Slowing GDP growth signals a weakening economy, necessitating stimulative measures.

- Consumer Confidence: Decreased consumer confidence, reflecting worries about job security and economic prospects, further supports the argument for rate cuts.

Economists argue that Bank of Canada interest rate forecasts for rate cuts are essential to counteract the negative impacts of tariffs and prevent a deeper economic contraction. The rationale rests on the belief that lower interest rates will incentivize borrowing and investment, thereby stimulating economic activity. The effectiveness of such monetary policy Canada will, however, depend on various factors, including consumer and business confidence.

Potential Economic Consequences of Rate Cuts

Bank of Canada rate cuts, while intended to boost the economy, are not without potential risks and drawbacks.

Potential Benefits:

- Increased Borrowing and Investment: Lower interest rates make borrowing cheaper for businesses and consumers, encouraging investment and spending.

- Stimulated Economic Activity: Increased borrowing and spending can lead to higher economic growth and job creation.

Potential Risks:

- Inflation: If rate cuts are too aggressive, they could lead to increased inflation, eroding purchasing power.

- Asset Bubbles: Lower interest rates can inflate asset prices, creating the potential for asset bubbles that could burst, causing further economic instability.

Analyzing the effectiveness of past interest rate cut effects in similar economic situations is critical. Historical data suggests that rate cuts can be effective in stimulating economic growth, but their impact can vary depending on the specific circumstances and the overall economic climate. The monetary policy effectiveness will depend on many factors beyond simply cutting rates.

Alternative Economic Strategies Besides Rate Cuts

While Bank of Canada rate cuts are a key tool, they are not the only option available. The government could implement alternative economic strategies to mitigate the impact of tariffs and support job growth.

- Fiscal Policy: The government could adopt expansionary fiscal policies, such as increased government spending on infrastructure projects or targeted tax cuts to stimulate demand. This government intervention could directly address job losses in specific sectors. Analyzing the economic stimulus packages from previous periods provides lessons and informs strategy.

- Trade Negotiations: Actively engaging in trade negotiations to reduce or eliminate tariffs would be a more direct approach to addressing the root cause of job losses.

The choice between rate cuts and alternative strategies, such as fiscal policy Canada, involves weighing their respective pros and cons in the current economic context. A balanced approach may be the most effective solution.

Navigating the Uncertainty – The Need for Bank of Canada Rate Cuts and Beyond

In conclusion, the potential for significant job losses due to tariffs is a serious concern for the Canadian economy. Economists' predictions of Bank of Canada rate cuts reflect the urgency of the situation. While these cuts offer potential benefits, they also carry risks, emphasizing the need for careful consideration. Understanding the complex interplay between tariffs, job losses, and monetary policy is crucial. We must also consider alternative economic strategies to ensure a robust and sustainable economic future.

To stay informed, it's vital to monitor the Bank of Canada's announcements regarding Bank of Canada rate cuts and their implications for the Canadian economy. Consult resources such as the Bank of Canada website, reputable financial news outlets, and economic forecasting institutions to stay abreast of the latest economic data and analyses. Staying informed about developments related to Bank of Canada rate cuts is crucial for both Canadian businesses and individuals navigating this period of economic uncertainty.

Featured Posts

-

Documenting Floridas Gators Filming In Natural Springs

May 12, 2025

Documenting Floridas Gators Filming In Natural Springs

May 12, 2025 -

Teen Mom And Beyond Examining Farrah Abrahams Post Show Trajectory

May 12, 2025

Teen Mom And Beyond Examining Farrah Abrahams Post Show Trajectory

May 12, 2025 -

From Flight Attendant To Pilot Overcoming Gender Barriers In Aviation

May 12, 2025

From Flight Attendant To Pilot Overcoming Gender Barriers In Aviation

May 12, 2025 -

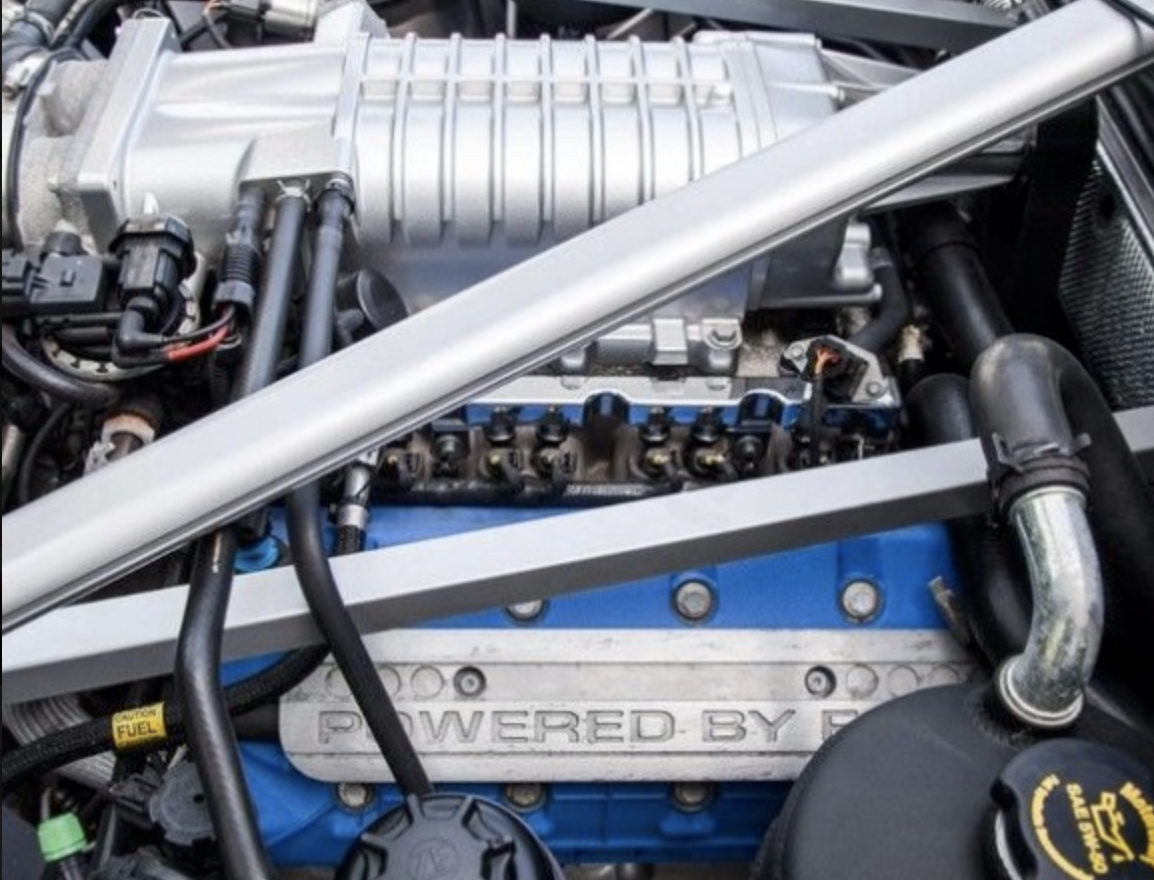

Reviving A Legend Lynx And The First Generation Ford Gt

May 12, 2025

Reviving A Legend Lynx And The First Generation Ford Gt

May 12, 2025 -

Inside Prince Andrews Palace Life Accounts Of A Difficult Personality

May 12, 2025

Inside Prince Andrews Palace Life Accounts Of A Difficult Personality

May 12, 2025