Bank Of Canada To Resume Rate Cuts Following Job Losses Attributed To Tariffs

Table of Contents

The Impact of Tariffs on Canadian Employment

The escalating trade war has significantly impacted Canadian employment, with the Tariff Impact Canada Jobs particularly acute in specific sectors. Manufacturing and agriculture have been hardest hit, experiencing substantial job losses and a general economic slowdown. This isn't simply a direct impact; the ripple effect is significant, affecting related industries and creating a broader economic downturn.

-

Quantifiable Data: Statistics Canada reported a loss of X,XXX jobs in the manufacturing sector in the last quarter, with a further Y,YYY jobs lost in agriculture. These numbers represent a Z% decline compared to the same period last year.

-

Examples of Companies Impacted: Company A, a major manufacturer, announced layoffs of several hundred employees due to reduced orders stemming from tariff increases. Similarly, Farm B, a large agricultural producer, reported significant losses and reduced production, leading to job cuts.

-

Ripple Effect Analysis: The job losses in manufacturing have directly impacted related industries such as transportation and logistics, leading to further unemployment. The reduced consumer spending resulting from job losses further exacerbates the problem.

-

Visualizations: [Insert chart or graph visualizing job loss trends across various sectors]

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's current Bank of Canada Monetary Policy involves a key interest rate of [insert current interest rate]. This rate reflects the Bank's assessment of the current economic climate. Previous rate cuts, implemented in [insert dates], aimed to stimulate economic activity, but their full impact is still being assessed. The current inflation rate of [insert current inflation rate] is a key factor influencing the Bank's decision-making, as it strives to maintain its inflation target of [insert inflation target].

-

Current Interest Rate: The Bank of Canada's key interest rate is currently set at [insert current rate].

-

Summary of Previous Rate Changes: The Bank previously lowered rates by [insert percentage] on [insert date] and again by [insert percentage] on [insert date].

-

Inflation Target Explanation: The Bank aims to keep inflation at [insert target] percent, on average, over the medium term.

-

Economic Indicators: Current economic indicators, including GDP growth, unemployment, and inflation, suggest [summarize the current economic situation based on these indicators].

Predicting Future Bank of Canada Rate Cuts

Predicting future Bank of Canada Rate Cut Predictions is complex and involves analyzing various economic factors and expert opinions. Market forecasts currently vary, with some analysts suggesting further rate cuts are imminent while others remain cautious. The timing and magnitude of any potential cuts depend on several factors, including the evolution of the trade situation, the performance of the Canadian economy, and the response of the government’s fiscal policies.

-

Expert Opinions: Economist X believes that further rate cuts are likely within the next [timeframe], while Economist Y anticipates a more cautious approach from the Bank.

-

Predictions on Timing and Size: Some market analysts predict a rate cut of [percentage] by [date], while others forecast a less aggressive approach.

-

Government Fiscal Policy: Government spending and tax measures could influence the Bank of Canada's decision regarding rate cuts.

-

Market Sentiment: Current market sentiment suggests [summarize the overall market feeling towards future interest rate changes].

Risks and Opportunities Associated with Rate Cuts

Further rate reductions offer potential benefits but also carry significant Rate Cut Risks Canada. While stimulating economic growth and boosting employment are key objectives, there are potential drawbacks.

-

Potential Benefits: Lower interest rates could make borrowing cheaper for businesses and consumers, potentially stimulating investment and consumption, leading to increased economic activity and employment.

-

Potential Drawbacks: Rate cuts can lead to increased inflation, weakening of the Canadian dollar, and potentially increased national debt. Furthermore, it could discourage savings and increase consumer debt.

-

Impact on Different Segments: The effect of rate cuts would differ across various income groups and sectors. Lower-income households with significant debt may benefit, while savers might face reduced returns.

Conclusion

The impact of tariffs on Canadian jobs, the Bank of Canada's current monetary policy stance, and the predictions for future rate cuts are all interconnected. While rate cuts offer a potential tool to stimulate the economy and counter the negative effects of tariffs, they also carry risks. Understanding the potential benefits and drawbacks is crucial for businesses and individuals alike.

Call to Action: Stay informed about the evolving situation and the Bank of Canada's response. Regularly check for updates on Bank of Canada rate cuts and their impact on the Canadian economy. Monitor key economic indicators and expert analysis to understand the implications for your financial planning. Understanding the intricacies of Bank of Canada monetary policy is key to navigating these uncertain times.

Featured Posts

-

Bellators Freire Set For Jose Aldo Fight

May 12, 2025

Bellators Freire Set For Jose Aldo Fight

May 12, 2025 -

Juan Sotos Loyalty To Aaron Judge Questioned A Performance Analysis

May 12, 2025

Juan Sotos Loyalty To Aaron Judge Questioned A Performance Analysis

May 12, 2025 -

The Yankees Lineup Shuffle Where Will Aaron Judge Bat

May 12, 2025

The Yankees Lineup Shuffle Where Will Aaron Judge Bat

May 12, 2025 -

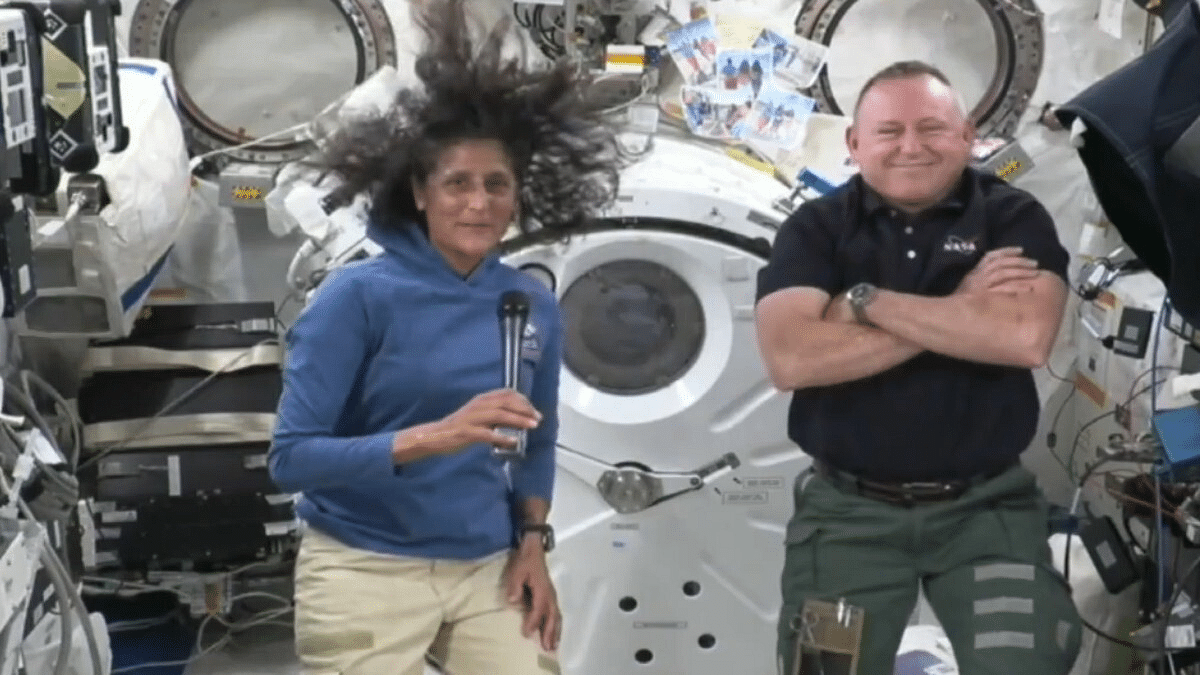

Astronauts Extended Space Mission A Cbs News Report

May 12, 2025

Astronauts Extended Space Mission A Cbs News Report

May 12, 2025 -

Yankees Pummel Pirates Another Judge Homer Frieds Gem

May 12, 2025

Yankees Pummel Pirates Another Judge Homer Frieds Gem

May 12, 2025