Bank Of Canada's April Interest Rate Decision: Impact Of Trump Tariffs

Table of Contents

The Bank of Canada's April interest rate decision held significant weight, particularly given the lingering uncertainty surrounding the impact of former President Trump's tariffs on the Canadian economy. This article will analyze the decision, exploring how the threat of trade wars influenced the Bank's monetary policy choices and what it means for Canadian businesses and consumers. We'll examine the pre-decision economic landscape, the Bank's announcement, the subsequent impact, and the long-term implications for Canada's economic trajectory.

The Pre-Decision Economic Landscape

Keywords: Canadian economy, GDP growth, inflation rate, unemployment rate, trade war, US-Canada trade

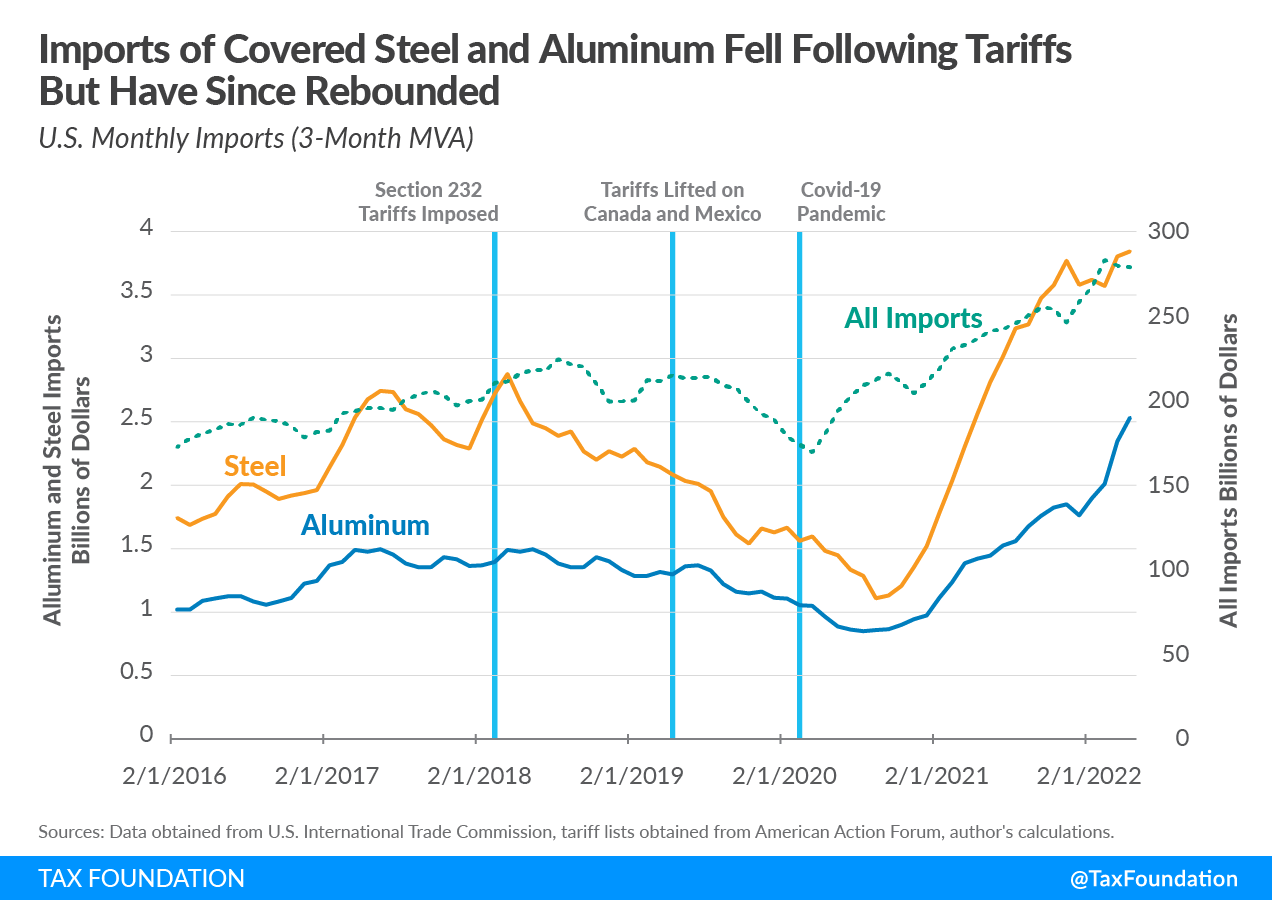

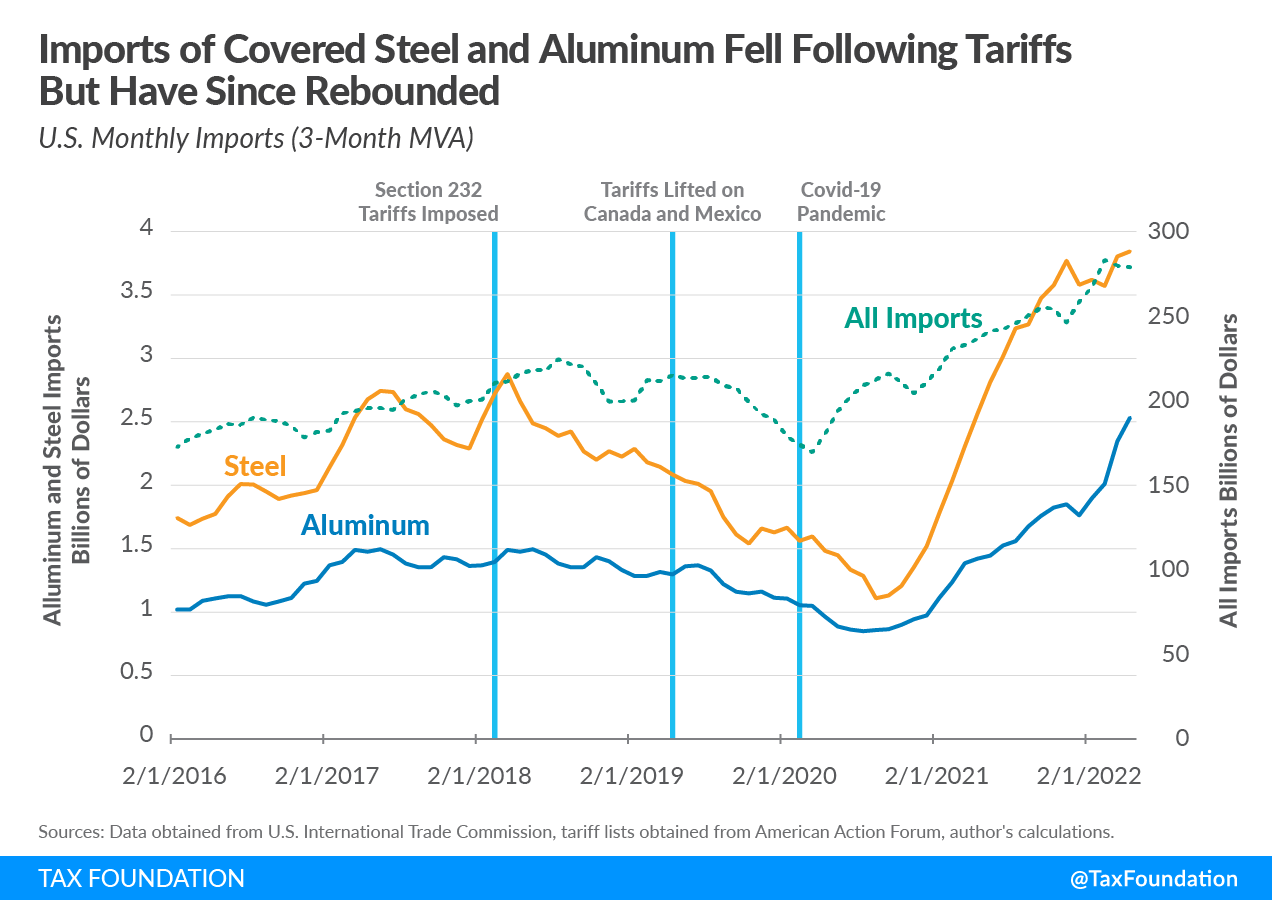

Leading up to the April interest rate decision, the Canadian economy presented a mixed picture. While GDP growth remained relatively stable, albeit slightly below its potential, inflation remained stubbornly low, hovering below the Bank of Canada's target of 2%. Unemployment figures, while generally positive, showed some regional disparities. The shadow of Trump's tariffs loomed large, creating significant uncertainty in the market.

- Impact of Trump Tariffs: Trump's tariffs, particularly those targeting key Canadian exports like lumber, agricultural products, and aluminum, had a demonstrable negative impact on specific sectors. For instance, the forestry industry faced significant challenges due to reduced demand from the US, leading to job losses and decreased investment. The agricultural sector also experienced setbacks, with farmers struggling to compete in the face of increased import costs for American consumers. The overall effect was a dampening of economic activity and a significant increase in economic volatility. Quantifying the exact impact proved difficult due to the complex interplay of global economic factors, but analysts generally agreed that the tariffs represented a considerable headwind for the Canadian economy.

- Market Uncertainty: The trade tensions between the US and Canada created significant market volatility. Businesses faced difficulties in planning for the future, delaying investments and hiring decisions due to the unpredictable nature of trade policies. This uncertainty contributed to the overall cautiousness surrounding the Canadian economic outlook.

The Bank of Canada's April Rate Decision

Keywords: Interest rate decision, monetary policy, Bank of Canada announcement, policy rate, economic outlook

In April [Insert Year], the Bank of Canada [Insert Action: e.g., maintained, increased, decreased] its key policy interest rate to [Insert Rate]. [Insert Specifics from the actual announcement, e.g., The decision was largely anticipated by financial markets]. The Bank's official statement cited [Insert reasons from the official statement, e.g., concerns about the persistent weakness in inflation and the lingering effects of trade uncertainties].

- Influence of Trump Tariffs: The Bank's statement explicitly acknowledged the uncertainty caused by Trump’s tariffs and their impact on the Canadian economy. [Insert a quote from the Bank's statement directly addressing the tariff's impact on the decision]. The Bank's cautious approach reflected its assessment of the risks posed by trade disputes to economic stability and sustainable growth.

- Market Expectations: [Insert whether the decision was in line with market expectations, and explain why or why not. Include relevant data on market predictions before the announcement.]

Impact on Key Economic Indicators

Keywords: Inflation expectations, Canadian dollar, investment, consumer spending, economic growth forecast

The Bank of Canada's April interest rate decision had various ripple effects across key economic indicators.

- Inflation Expectations: The decision [Insert the effect on inflation expectations. E.g., was likely to keep inflation expectations anchored near the Bank's target] impacting consumer confidence and price stability.

- Canadian Dollar: The [Insert effect on Canadian Dollar. E.g., relatively stable Canadian Dollar] reflected the market's overall assessment of the Bank's policy stance.

- Investment and Consumer Spending: The [Insert effect on Investment and Consumer Spending. E.g., relatively unchanged interest rates] suggested limited immediate impacts on business investment decisions and consumer spending. However, the lingering uncertainty could still stifle investment in the long term.

- Economic Growth Forecast: The Bank's accompanying economic forecast likely [Insert changes to the economic growth forecast, e.g., revised its GDP growth projections downwards] reflecting the headwinds caused by external trade tensions.

Long-Term Implications for the Canadian Economy

Keywords: Economic stability, future interest rates, trade policy uncertainty, long-term economic growth, resilience of Canadian economy

The long-term implications of the April interest rate decision hinge significantly on the evolution of trade policy uncertainty.

- Ongoing Uncertainty: The persistent uncertainty surrounding international trade relations will continue to pose challenges to long-term economic growth. The Bank of Canada’s future interest rate decisions will likely depend on resolving this uncertainty and improving the predictability of global trade flows.

- Resilience of the Canadian Economy: Despite these challenges, the Canadian economy has demonstrated a degree of resilience to external shocks. However, prolonged trade tensions could lead to more significant adjustments in the long term, necessitating further adaptation by Canadian businesses and workers.

- Future Interest Rates: The Bank’s comments on future interest rates, as presented in the April statement, suggest a [Insert the outlook, e.g., data-dependent approach] monitoring key economic indicators closely before making any further adjustments.

Conclusion

The Bank of Canada's April interest rate decision reflected a cautious approach in the face of lingering uncertainty stemming from former President Trump's tariffs. While the immediate impact on key economic indicators appeared muted, the long-term implications are dependent on resolving trade policy uncertainty. The Bank's decision underscores the importance of close monitoring of inflation, GDP growth, and the overall economic climate.

Call to Action: Stay informed about future Bank of Canada interest rate decisions and their impact on your financial planning. Regularly check the Bank of Canada's website and reputable financial news sources for updates on monetary policy and the evolving economic landscape. Understanding the Bank of Canada's interest rate decisions is crucial for navigating the complexities of the Canadian economy, especially considering lingering impacts from past trade disputes.

Featured Posts

-

Analyzing The Effects Of Saudi Arabias Recent Abs Rule Change

May 02, 2025

Analyzing The Effects Of Saudi Arabias Recent Abs Rule Change

May 02, 2025 -

Israil De Meclis Oturumunda Esir Aileleri Ve Guevenlik Goerevlileri Arasindaki Olaylar

May 02, 2025

Israil De Meclis Oturumunda Esir Aileleri Ve Guevenlik Goerevlileri Arasindaki Olaylar

May 02, 2025 -

Analysis Duponts Masterclass Secures Frances Win Over Italy 11th Conduct

May 02, 2025

Analysis Duponts Masterclass Secures Frances Win Over Italy 11th Conduct

May 02, 2025 -

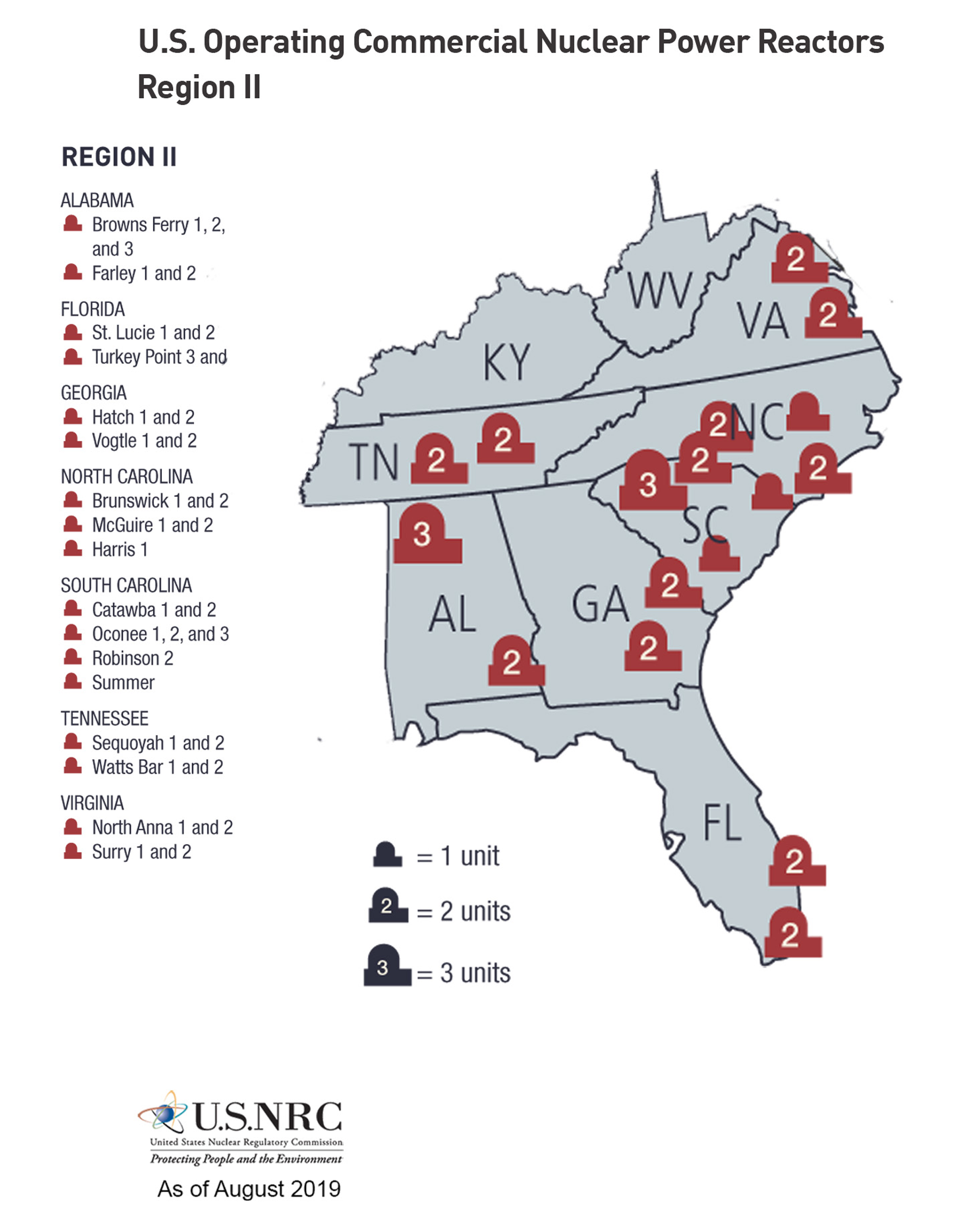

Power Uprate For Nuclear Reactors Understanding The Nrc Requirements

May 02, 2025

Power Uprate For Nuclear Reactors Understanding The Nrc Requirements

May 02, 2025 -

Understanding Tulsas Increasing Homeless Population Data And Perspectives From The Tulsa Day Center

May 02, 2025

Understanding Tulsas Increasing Homeless Population Data And Perspectives From The Tulsa Day Center

May 02, 2025