BBAI Stock: Negative Q1 Earnings Impact Share Price

Table of Contents

BBAI Q1 Earnings Report: A Detailed Breakdown

The BBAI Q1 earnings report revealed concerning financial results, significantly impacting investor sentiment and the BBAI share price. Let's break down the key figures:

-

Revenue Decline: BBAI reported a significant year-over-year decline in revenue, falling from [Insert previous year's Q1 revenue figure] to [Insert current year's Q1 revenue figure]. This represents a [Insert percentage] decrease, significantly lower than analyst expectations of [Insert analyst expectation figure].

-

Earnings Per Share (EPS): The reported EPS was [Insert EPS figure], a sharp decrease compared to [Insert previous year's Q1 EPS figure]. This substantial drop reflects the overall weakness in the company's financial performance during the quarter.

-

Net Income: Net income plummeted to [Insert net income figure], a dramatic fall from [Insert previous year's Q1 net income figure]. This underscores the severity of the negative earnings and the challenges faced by BBAI during Q1.

-

Operating Margin: The operating margin contracted to [Insert operating margin figure], indicating a decline in profitability and efficiency. This reflects increased costs or reduced sales relative to operating expenses. This contraction is a key area of concern for investors analyzing BBAI's financial health.

-

Significant Changes: [Insert details about any significant changes in operating expenses, one-time charges, or unusual items affecting earnings. Be specific with numbers and context].

Factors Contributing to Negative Earnings

Several factors contributed to BBAI's disappointing Q1 earnings. Understanding these underlying issues is crucial for assessing the company's future prospects.

-

Macroeconomic Factors: The current macroeconomic environment, characterized by [mention specific factors like inflation, rising interest rates, recessionary fears], negatively impacted consumer spending and overall market demand, directly affecting BBAI's sales and profitability.

-

Competitive Pressures: Increased competition from [mention competitors] put pressure on BBAI's market share and pricing strategies, impacting revenue generation. The competitive landscape is a significant factor that needs to be carefully monitored.

-

Supply Chain Issues: [Describe the impact of supply chain disruptions, including specific examples of shortages or delays impacting production and costs]. These challenges further squeezed profit margins and hampered BBAI's ability to meet demand.

-

Internal Challenges: [Discuss any internal operational challenges that contributed to the negative earnings, such as inefficiencies, restructuring costs, or management decisions]. Transparency in addressing these internal issues is key to regaining investor confidence.

-

Strategic Decisions: [Analyze any strategic decisions made by the company that may have contributed negatively to the earnings. Were there significant investments that didn't yield immediate returns? Did they miss key market opportunities?].

Market Reaction and Share Price Volatility

The release of BBAI's Q1 earnings report triggered a significant negative market reaction.

-

Stock Price Drop: Following the earnings announcement, BBAI stock experienced a [Insert percentage]% drop in its share price, highlighting investor dissatisfaction with the financial results.

-

Trading Volume: Trading volume surged significantly on the day of and following the announcement, reflecting heightened investor activity and uncertainty surrounding the company's future.

-

Analyst Ratings: Several analysts downgraded their ratings and price targets for BBAI stock, further contributing to the negative sentiment. [Mention specific analyst downgrades and revised price targets].

-

Investor Sentiment: Investor sentiment turned decidedly negative, reflecting concern over the company's financial performance and future prospects. Negative sentiment has the potential to further depress the BBAI share price.

-

Sector Comparison: [Compare BBAI's performance with other companies in the same sector to see if the downturn was unique to BBAI or a broader industry trend].

Future Outlook and Potential Implications for BBAI Stock

The future outlook for BBAI stock remains uncertain, dependent on the company's ability to address the challenges outlined above.

-

Long-Term Prospects: BBAI's long-term growth potential hinges on its ability to navigate the current macroeconomic headwinds, enhance its competitive position, and streamline its operations to improve profitability.

-

Future Catalysts: Potential catalysts for positive investor sentiment include [mention potential positive developments, e.g., new product launches, successful cost-cutting measures, improved market share].

-

Risk Assessment: Investing in BBAI stock at the current price involves significant risk, given the uncertainty surrounding its future performance and the ongoing challenges facing the company.

-

Investor Recommendations: Based on the current situation, investors should exercise caution and carefully assess their risk tolerance before investing in or holding BBAI stock. Diversification is advised.

-

Alternative Investments: Investors may consider exploring alternative investment opportunities within the same sector or other less volatile sectors.

Conclusion

This article analyzed the impact of BBAI's negative Q1 earnings on its share price, exploring the contributing factors and market reactions. The negative results, influenced by macroeconomic conditions, competition, and internal challenges, led to significant share price volatility and concern among investors. While the current situation presents challenges, understanding the underlying causes and potential for future recovery is crucial for informed investment decisions. Continue to monitor BBAI stock and its performance closely, staying updated on future earnings reports and market analysis to make sound judgments regarding your investment strategy. Stay informed on all aspects of BBAI stock to navigate the market effectively.

Featured Posts

-

Vanja I Sime Najbolja Kombinacija Iz Gospodina Savrsenog Nove Fotografije

May 21, 2025

Vanja I Sime Najbolja Kombinacija Iz Gospodina Savrsenog Nove Fotografije

May 21, 2025 -

Understanding The D Wave Quantum Qbts Stock Price Jump This Week

May 21, 2025

Understanding The D Wave Quantum Qbts Stock Price Jump This Week

May 21, 2025 -

Open Ais Chat Gpt Under Ftc Scrutiny Implications For Users And The Future Of Ai

May 21, 2025

Open Ais Chat Gpt Under Ftc Scrutiny Implications For Users And The Future Of Ai

May 21, 2025 -

French Skies Witness Mysterious Red Lights Analysis And Possible Explanations

May 21, 2025

French Skies Witness Mysterious Red Lights Analysis And Possible Explanations

May 21, 2025 -

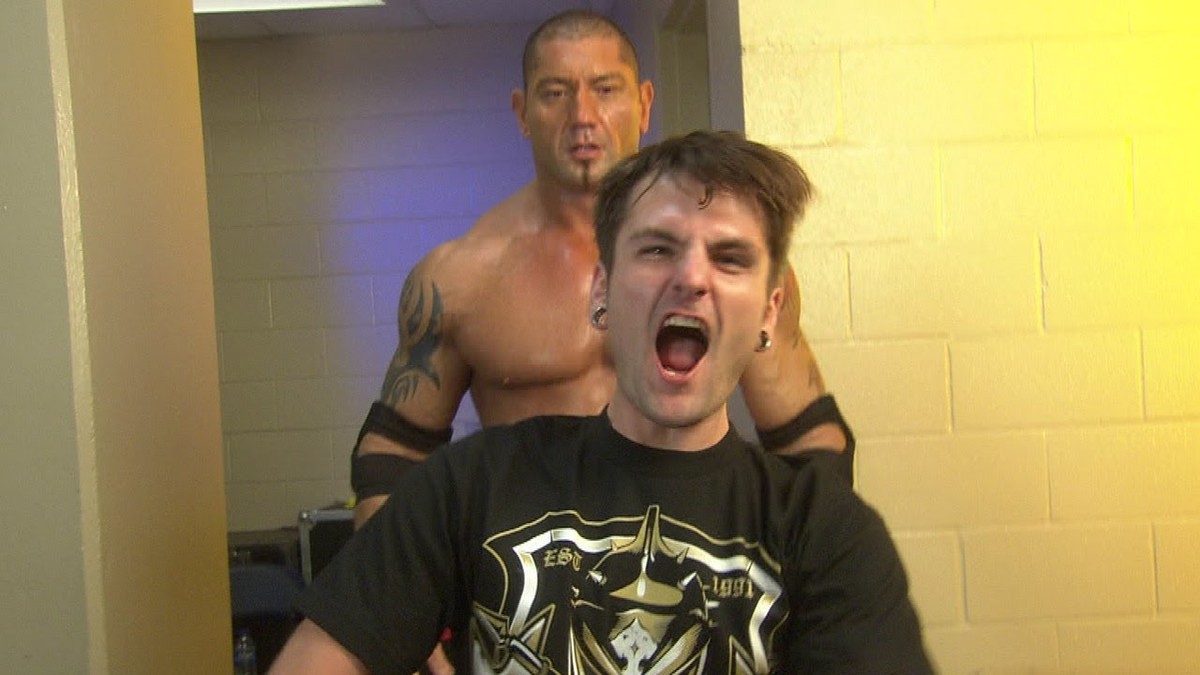

Wwe Segment With Tony Hinchcliffe Receives Negative Backstage Feedback

May 21, 2025

Wwe Segment With Tony Hinchcliffe Receives Negative Backstage Feedback

May 21, 2025