Belgium BESS Financing: Navigating The Complex Merchant Market

Table of Contents

Understanding the Belgian BESS Market Landscape

Belgium's BESS market is experiencing significant growth, driven by the country's ambitious renewable energy targets and the need for grid stability. The government is actively promoting BESS deployment through various incentives and policies, creating a favorable environment for investment.

Key Market Drivers:

- Increased Renewable Energy Integration: Belgium's reliance on intermittent renewable sources like wind and solar necessitates effective energy storage solutions. BESS provides crucial grid balancing capabilities.

- Enhanced Grid Stability: BESS improves grid resilience by providing frequency regulation, voltage support, and ancillary services. This is vital for maintaining a reliable electricity supply.

- Energy Security: BESS contributes to energy independence by storing excess renewable energy for later use, reducing reliance on fossil fuel-based power generation.

- Demand-Side Management: BESS can participate in demand response programs, optimizing energy consumption and reducing peak demand.

Key Stakeholders:

- Energy Producers: Independent Power Producers (IPPs) and utilities are major investors in BESS projects, leveraging them to enhance their renewable energy portfolios.

- Grid Operators: Elia, the Belgian transmission system operator, plays a crucial role in integrating BESS into the electricity grid, defining grid connection requirements.

- Policy Makers: The Belgian government, through its various ministries and agencies, sets the regulatory framework and provides incentives for BESS deployment.

- Merchant Energy Traders: These players buy and sell electricity in the wholesale market and increasingly incorporate BESS into their trading strategies for arbitrage and ancillary services. This creates a significant investment opportunity within the merchant BESS market.

Exploring Financing Options for BESS Projects in Belgium

Securing funding for your BESS project requires a strategic approach, considering various financing options.

Bank Financing

Traditional bank loans remain a common financing source for BESS projects. However, securing such loans necessitates a robust business plan demonstrating project viability and strong financial projections.

- Required Documentation: Detailed technical specifications, environmental impact assessments, grid connection agreements, and comprehensive financial models.

- Typical Loan Terms: Loan tenures typically range from 5 to 15 years, with interest rates varying depending on project risk and market conditions. Credit ratings and strong financial guarantees are crucial.

- Due Diligence: Banks conduct thorough due diligence, assessing technical feasibility, regulatory compliance, and financial soundness before approving loans.

Equity Financing

Private equity and venture capital firms are increasingly investing in the BESS sector, attracted by the long-term growth potential and positive environmental impact. Their investment criteria focus on strong management teams, innovative technologies, and a clear path to profitability.

- Investment Criteria: Focus on strong returns, market potential, experienced management teams, and technological innovation.

- Benefits: Equity financing provides capital without the burden of debt repayment, enabling faster project deployment.

- Drawbacks: Equity investors often require a significant share of ownership and influence on decision-making.

Public Funding and Subsidies

The Belgian government offers various incentives to promote BESS deployment, including grants, subsidies, and tax benefits. These incentives significantly improve project viability and reduce upfront investment costs. Specific programs and eligibility criteria vary, so staying informed is crucial.

- Relevant Websites: [Insert links to relevant Belgian government websites offering BESS subsidies and incentives].

- Application Processes: Each program has specific application requirements and deadlines. Careful review is necessary for successful applications.

Green Bonds and Sustainable Finance

Green bonds and other sustainable finance instruments are gaining traction in funding BESS projects. Investors are increasingly seeking environmentally friendly projects, leading to a growing market for green finance solutions.

- Mechanism: Green bonds allow companies to raise capital specifically for green projects, attracting investors focused on sustainability.

- Advantages: Access to a wider pool of investors, improved brand reputation, and lower borrowing costs compared to traditional financing methods.

Navigating the Regulatory Landscape for BESS Financing in Belgium

Understanding the regulatory landscape is crucial for successful BESS financing in Belgium. This includes navigating permitting processes, grid connection requirements, and tax regulations.

- Permitting Processes: Obtain necessary permits and licenses for BESS installation and operation from regional and local authorities. Timely application and adherence to regulations are essential.

- Grid Connection: Secure grid connection agreements with Elia, the transmission system operator. This requires technical specifications, interconnection studies, and compliance with grid codes.

- Tax Incentives: Explore and leverage tax incentives offered at the federal, regional, and local levels to reduce the overall project cost.

- Regulatory Bodies: Familiarize yourself with the relevant regulatory bodies, including the CREG (Commission de Régulation de l'Électricité et du Gaz) and the Flemish, Walloon, and Brussels regional authorities.

Key Considerations for Successful BESS Financing in Belgium

Successful BESS financing requires careful planning and risk mitigation.

- Robust Business Plan: Develop a comprehensive business plan including detailed financial projections, market analysis, and risk assessment.

- Risk Assessment: Identify potential risks, including technology risks, regulatory changes, and market fluctuations, and develop mitigation strategies.

- Technology Selection: Choose appropriate BESS technology based on project requirements, cost-effectiveness, and long-term performance.

- Project Partners: Select experienced and reliable project partners, including technology providers, EPC contractors, and financiers.

- Operational & Maintenance: Plan for long-term operation and maintenance, incorporating costs into the financial model.

- Strong Team: Assemble a team with expertise in BESS technology, finance, and regulatory compliance.

Conclusion

Successfully securing financing for your Belgium BESS project requires careful planning and a deep understanding of the multifaceted merchant market. By exploring the various financing options, navigating the regulatory landscape, and considering the key aspects discussed in this article, you can significantly improve your chances of securing funding and contributing to Belgium's energy transition. Remember to leverage all available resources, including government incentives and expertise from financial institutions specializing in renewable energy and BESS projects. Start planning your Belgium BESS financing strategy today!

Featured Posts

-

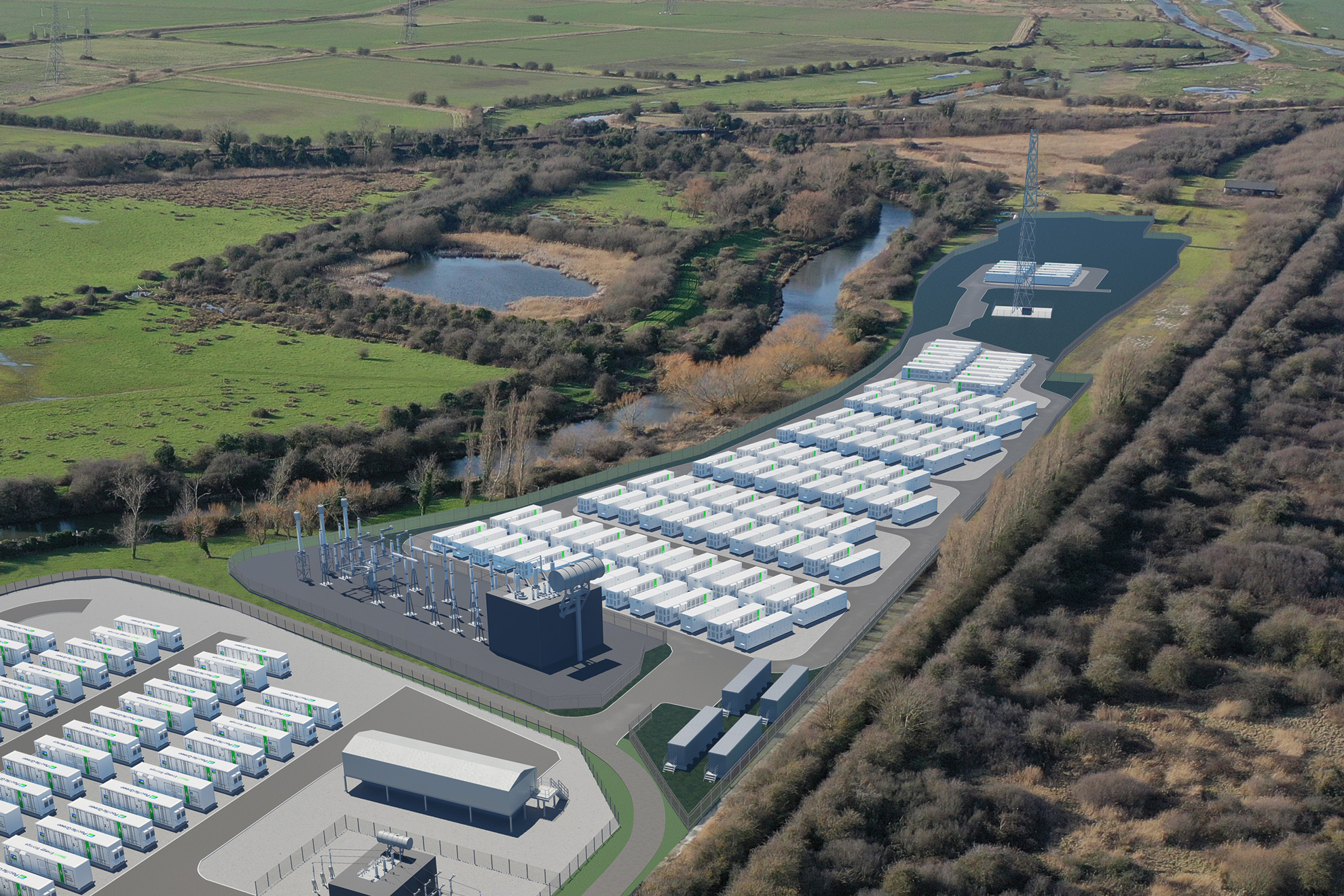

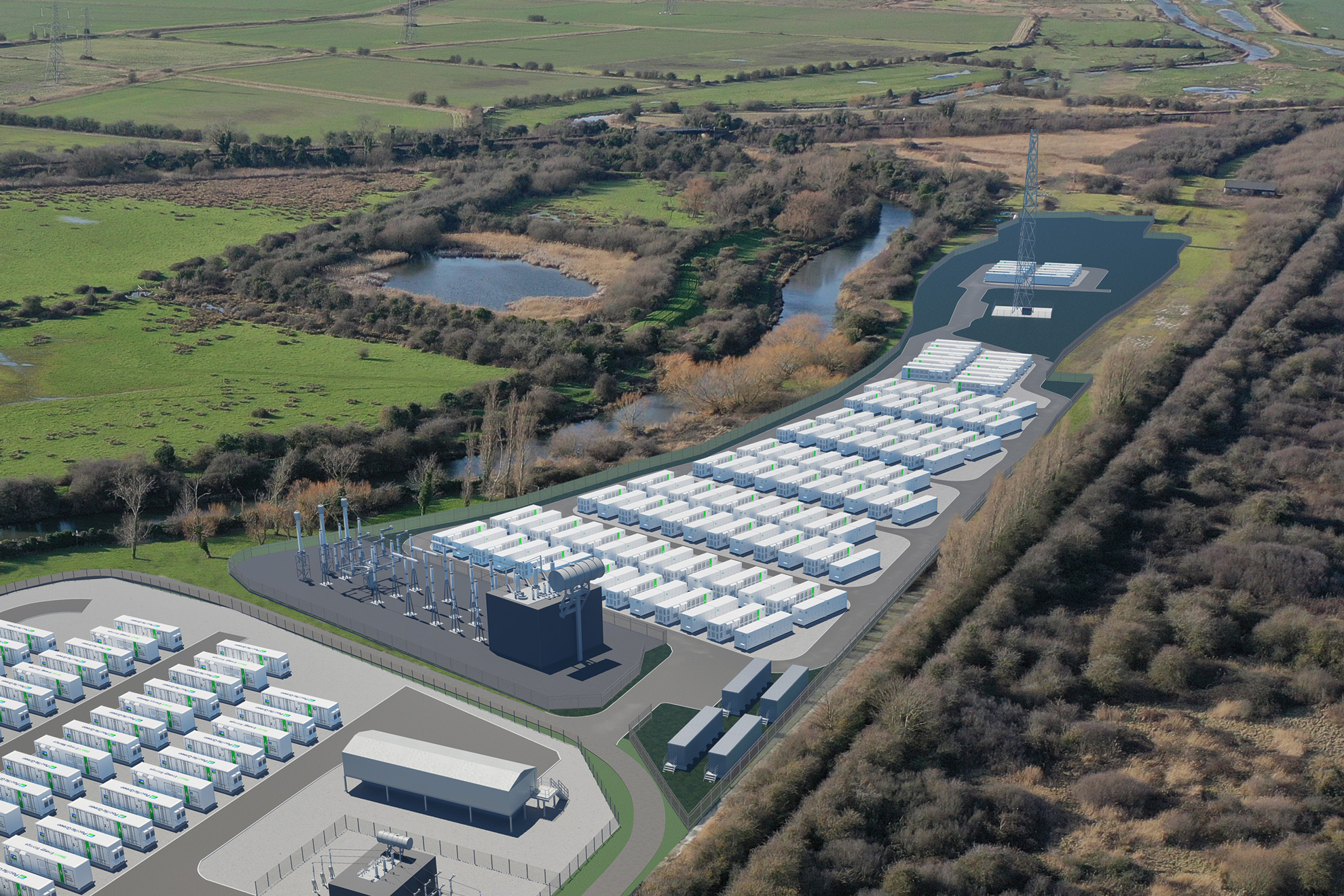

Eneco Un Parc De Batteries Gigantesque Ouvre Ses Portes A Au Roeulx

May 03, 2025

Eneco Un Parc De Batteries Gigantesque Ouvre Ses Portes A Au Roeulx

May 03, 2025 -

The Urgent Need For More Psychiatrists In Ghana A Mental Health Crisis

May 03, 2025

The Urgent Need For More Psychiatrists In Ghana A Mental Health Crisis

May 03, 2025 -

Harry Potter Remake Six Key Decisions That Will Make Or Break It

May 03, 2025

Harry Potter Remake Six Key Decisions That Will Make Or Break It

May 03, 2025 -

Fortnite Community Outraged By Backwards Music Update

May 03, 2025

Fortnite Community Outraged By Backwards Music Update

May 03, 2025 -

Is A Valorant Mobile Game Coming From The Pubg Mobile Team

May 03, 2025

Is A Valorant Mobile Game Coming From The Pubg Mobile Team

May 03, 2025