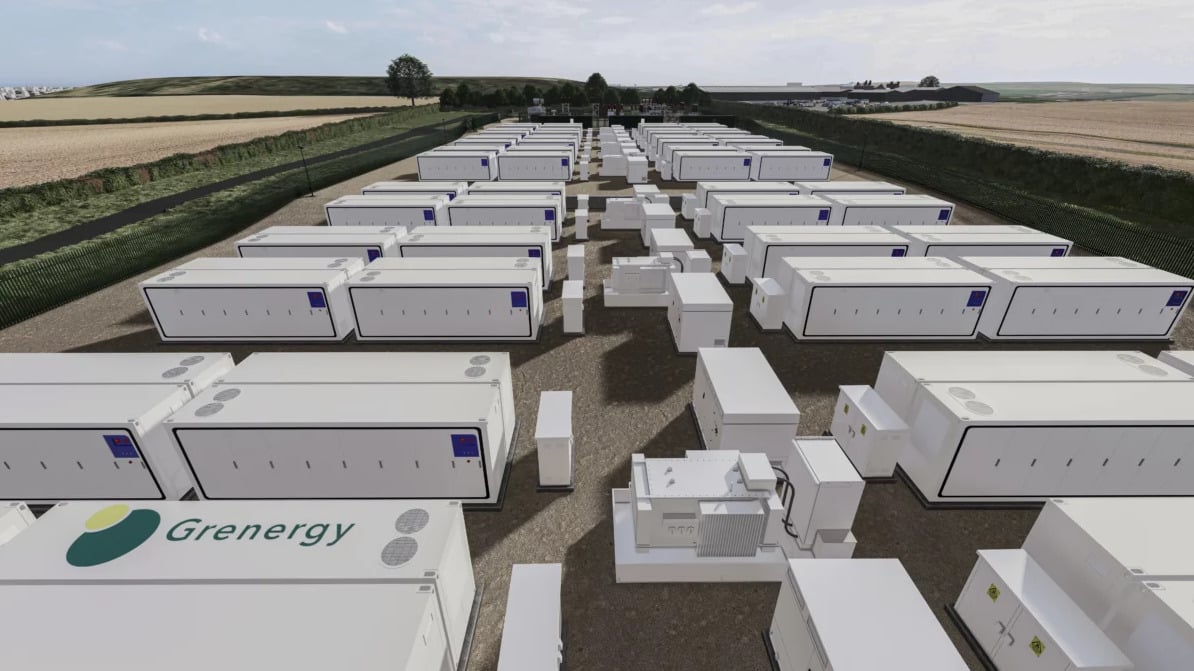

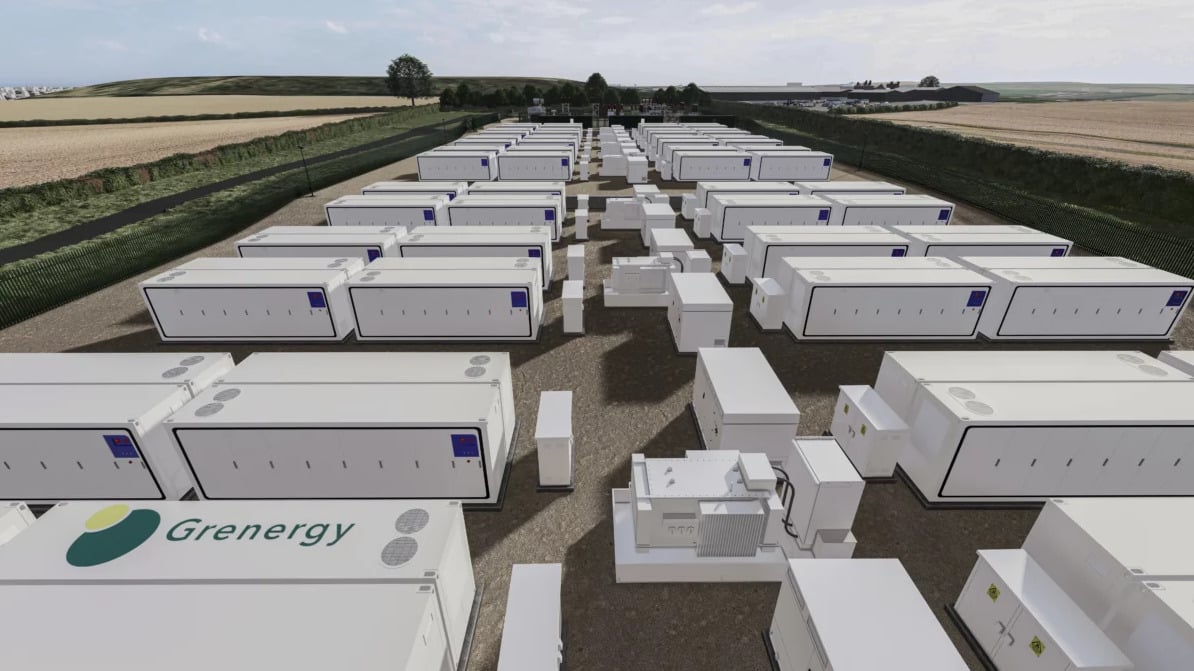

Belgium's Energy Market: Financing Options For A 270MWh BESS

Table of Contents

Understanding the Belgian Energy Market and BESS Incentives

The Belgian energy market is undergoing a significant transformation, driven by the increasing adoption of renewable energy sources and the urgent need for grid stabilization. This creates a favorable environment for large-scale BESS projects, such as the proposed 270MWh system. However, understanding the intricacies of the market and available incentives is essential for securing project financing.

Governmental Support and Subsidies

The Belgian government actively promotes renewable energy and energy storage through various policies and financial incentives. These initiatives aim to accelerate the energy transition and enhance grid reliability.

- Specific Grants and Tax Incentives: The Belgian government offers several grants and tax breaks specifically designed for renewable energy projects, many of which extend to BESS installations. These incentives can significantly reduce the upfront capital costs, making projects more financially attractive to investors. The exact amounts and eligibility criteria vary depending on the project's location and specific characteristics.

- Feed-in Tariffs: While not as prevalent as in some other European countries, Belgium offers specific feed-in tariffs for renewable energy generation, which can indirectly benefit BESS projects by increasing the value of the stored energy.

- Regional Variations: It's crucial to note that regional variations exist within Belgium. Flanders, Wallonia, and Brussels each have their own energy policies and incentives, impacting the overall financing landscape for a 270MWh BESS project. Thorough research into regional-specific support schemes is critical.

- Example: The Green Deal: Belgium's "Green Deal" is a comprehensive national strategy aiming to achieve climate neutrality. This initiative includes specific targets for renewable energy and energy storage, making BESS projects a key component of the overall plan. Funding opportunities related to this initiative should be explored.

Regulatory Landscape and Permitting

Navigating the regulatory landscape is a crucial aspect of securing financing for a large-scale BESS project in Belgium. The permitting process can be complex and time-consuming, potentially impacting project timelines and financial projections.

- Permitting Process: The process involves obtaining various permits and approvals from different authorities, including environmental permits, grid connection permits, and building permits. Each permit has its own set of requirements and timelines.

- Regulatory Hurdles: Understanding and addressing regulatory hurdles early in the project development phase is crucial. Delays in obtaining permits can lead to increased costs and financing challenges.

- Grid Connection Regulations: Securing grid connection is a critical aspect, and regulations surrounding this process will significantly impact project financing. The cost of grid connection and the timeframe involved must be carefully assessed and incorporated into the financial model.

- Influence on Financiers: A streamlined and well-documented permitting process demonstrates project readiness and reduces risk for potential financiers, making the project more attractive and increasing the likelihood of securing funding.

Exploring Financing Avenues for a 270MWh BESS

Securing financing for a 270MWh BESS project requires a multi-faceted approach, considering various funding sources and their associated advantages and disadvantages.

Equity Financing

Equity financing involves attracting investors who provide capital in exchange for an ownership stake in the project.

- Private Equity Investment: Private equity firms specializing in renewable energy and infrastructure projects are potential investors in large-scale BESS projects. Their investment criteria typically focus on factors like project viability, risk profile, and potential returns.

- Potential Investors: Several Belgian and European private equity firms with a focus on renewable energy could be potential partners. Identifying investors with a proven track record in similar projects is crucial.

- Advantages: Equity financing can provide substantial capital and potentially reduce the debt burden on the project.

- Disadvantages: Equity financing dilutes ownership and may require sharing profits with investors.

Debt Financing

Debt financing involves securing loans from financial institutions to fund the project.

- Commercial Banks and Specialized Institutions: Commercial banks and specialized financial institutions offering project finance or corporate loans are key players in BESS project financing.

- Loan Structures: Different loan structures, such as project finance loans, corporate loans, and mezzanine financing, can be considered, each with its own terms and conditions.

- Interest Rates and Loan Terms: Interest rates and loan terms are crucial factors affecting the project's financial viability. Negotiating favorable terms is crucial.

- Challenges: Securing debt financing for a large-scale project like a 270MWh BESS can be challenging due to the perceived risk associated with new technologies and market volatility.

Public-Private Partnerships (PPPs)

Public-private partnerships can leverage the financial resources and expertise of both the public and private sectors.

- Involvement of Belgian Government or Regional Authorities: PPPs offer the opportunity to partner with the Belgian government or regional authorities, potentially providing access to public funds and reducing financial risk.

- Benefits: PPPs can offer risk-sharing, access to public funds, and enhanced project credibility.

- Risks: PPPs can be complex to negotiate and require careful consideration of contractual arrangements.

Green Bonds and Sustainable Finance

Green bonds are increasingly used to finance renewable energy projects, including BESS.

- Eligibility Criteria: Meeting specific criteria related to environmental sustainability is crucial for green bond eligibility.

- Benefits: Green bonds can attract environmentally conscious investors, offering potential access to a broader pool of capital.

- Examples: Several successful green bond issuances for similar renewable energy projects can serve as examples.

Due Diligence and Risk Mitigation

Thorough due diligence and risk mitigation are crucial for attracting investors and securing financing.

Technical Due Diligence

A comprehensive technical assessment of the BESS project is vital.

- Battery Technology: The chosen battery technology, its lifespan, performance guarantees, and maintenance requirements should be carefully evaluated.

- Integration with the Grid: The integration of the BESS with the existing grid infrastructure must be carefully considered.

Financial Due Diligence

Robust financial modeling and risk assessment are essential for securing funding.

- Financial Modeling: A detailed financial model that accurately reflects the project's revenue streams, operating costs, and potential risks is crucial.

- Risk Assessment: Identifying and mitigating potential risks, such as technological risks, regulatory changes, and market price volatility, is vital. Sensitivity analysis should be performed.

- Impact on Investor Decisions: A comprehensive risk assessment and mitigation strategy will significantly impact investor confidence and increase the likelihood of securing financing.

Conclusion

Securing financing for a 270MWh BESS project in Belgium's dynamic energy market requires a comprehensive strategy that considers governmental incentives, regulatory hurdles, and diverse funding options. This article highlighted various pathways, from equity and debt financing to PPPs and green bonds. By conducting thorough due diligence and mitigating potential risks, project developers can significantly improve their chances of securing the necessary funding. Understanding the specifics of the Belgian energy market and its unique incentives is paramount for success. Begin planning your 270MWh BESS project in Belgium today and explore the diverse financing options available to make your vision a reality. Contact us to learn more about optimizing your financing strategy for your Belgian BESS project.

Featured Posts

-

Esir Yakinlarinin Israil Meclisi Protestosu Guevenlik Goerevlileriyle Arbede

May 03, 2025

Esir Yakinlarinin Israil Meclisi Protestosu Guevenlik Goerevlileriyle Arbede

May 03, 2025 -

Fortnite Chapter 6 Season 2 Everything You Need To Know About The Launch

May 03, 2025

Fortnite Chapter 6 Season 2 Everything You Need To Know About The Launch

May 03, 2025 -

Alan Rodens Contributions To The Spectator A Deep Dive Into His Writings

May 03, 2025

Alan Rodens Contributions To The Spectator A Deep Dive Into His Writings

May 03, 2025 -

Fortnite Cowboy Bebop Bundle Price Get Faye Valentine And Spike Spiegel Skins

May 03, 2025

Fortnite Cowboy Bebop Bundle Price Get Faye Valentine And Spike Spiegel Skins

May 03, 2025 -

Edinburgh Fringe 2025 Pussy Riots Maria Alyokhina Stages New Play

May 03, 2025

Edinburgh Fringe 2025 Pussy Riots Maria Alyokhina Stages New Play

May 03, 2025