Berkshire Hathaway's Apple Holdings: Analyzing The Post-Buffett Era

Table of Contents

The Buffett Era: A Foundation of Success

Buffett's Investment Philosophy and its Application to Apple

Warren Buffett's value investing approach focuses on identifying undervalued companies with strong fundamentals and long-term growth potential. Apple, with its robust brand, fiercely loyal customer base, and consistently high profitability, perfectly aligned with this philosophy. Buffett recognized Apple's ability to generate significant cash flow, high profit margins, and recurring revenue streams from its expansive ecosystem of products and services.

- Strong Brand Recognition: Apple's brand loyalty is unparalleled, ensuring consistent demand for its products.

- High Profit Margins: Apple consistently delivers impressive profit margins, a key indicator of its efficient operations and pricing power.

- Recurring Revenue Streams: Services like iCloud, Apple Music, and the App Store provide a steady stream of revenue, reducing reliance on hardware sales alone.

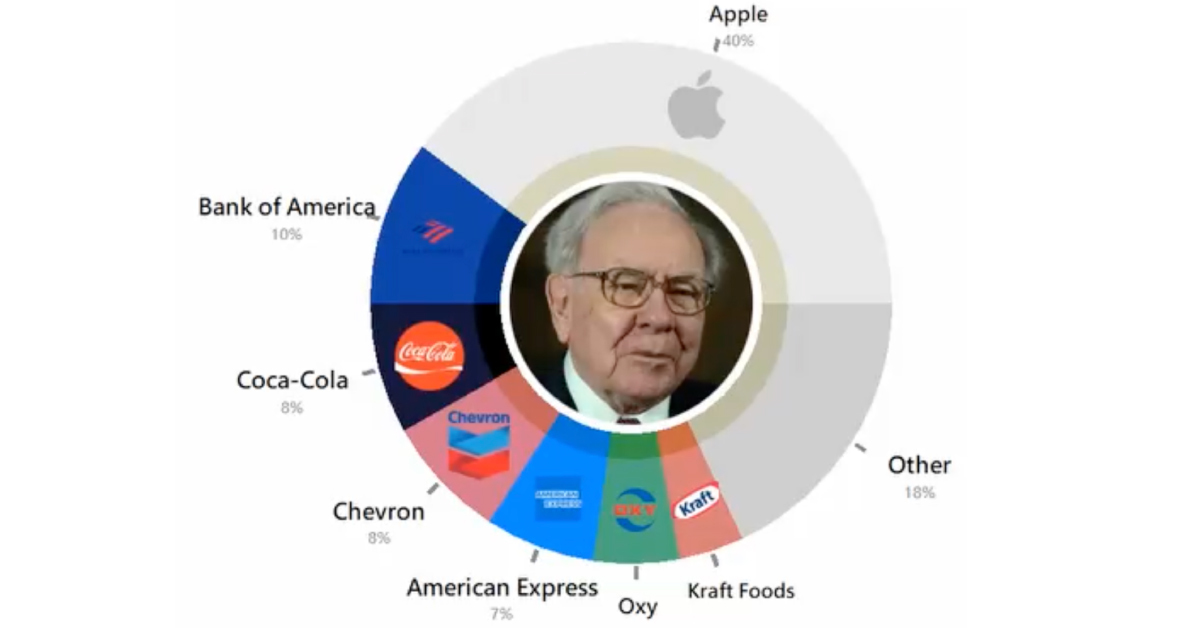

Berkshire Hathaway's Apple acquisition began gradually, starting in 2016, and quickly grew to become its largest holding, representing a significant portion of its overall portfolio. This strategic move significantly boosted Berkshire's returns.

The Impact of Apple on Berkshire Hathaway's Portfolio

The success of Apple has dramatically increased Berkshire Hathaway's overall portfolio value. The substantial returns from Apple investments have contributed significantly to Berkshire's consistent growth and strong financial performance.

- Significant Portfolio Share: Apple's weighting within Berkshire's portfolio is substantial, making it a key driver of overall performance.

- Exceptional Returns: The investment in Apple has yielded exceptional returns for Berkshire Hathaway, outpacing many other holdings.

- Strategic Diversification: While heavily weighted in Apple, Berkshire Hathaway maintains a diverse portfolio, mitigating risk associated with a single investment. Apple, however, has undeniably become a cornerstone of this diversification strategy.

The Post-Buffett Leadership: Navigating Uncharted Waters

Greg Abel's Approach to Investment Management

With Greg Abel assuming a more prominent role in Berkshire Hathaway's investment decisions, a shift in approach is anticipated. While Abel likely shares some of Buffett’s core values, his specific strategies may differ. This could impact the management and potential future direction of Berkshire's Apple holdings.

- Potential for Subtle Shifts: While the core principles of value investing might remain, the emphasis on specific sectors or investment criteria could change.

- Maintaining the Core Holding: It's highly likely that Apple will remain a core holding, given its consistent performance and profitability. However, the extent of investment might be subject to future evaluations.

- Enhanced Active Management: We might see a more active approach to managing the Apple stake, responding more dynamically to market fluctuations.

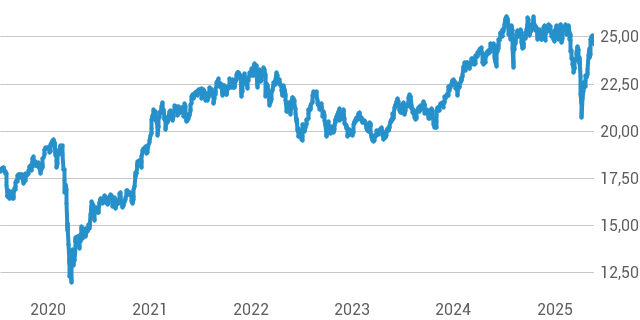

Market Volatility and its Effect on Apple's Value

External factors like economic downturns, geopolitical events, and technological disruptions significantly impact Apple's stock price and, consequently, Berkshire Hathaway's investment. Past market fluctuations have demonstrated the resilience of Apple's stock but also highlight the inherent risk involved in any significant investment.

- Economic Cycles: Recessions tend to negatively impact consumer spending, which could affect Apple's sales and stock price.

- Technological Disruption: The emergence of new competitors or disruptive technologies poses a threat to Apple's market dominance.

- Geopolitical Risks: International trade disputes and other geopolitical factors can influence Apple’s supply chains and overall performance.

Future Outlook: Maintaining or Diversifying the Apple Stake?

Potential Scenarios for Berkshire Hathaway's Apple Investment

Several scenarios are plausible for Berkshire Hathaway's future engagement with Apple.

- Maintaining the Current Holding: This would be the most conservative approach, leveraging the continued strength and profitability of Apple.

- Partial Divestment: A strategic decision to partially reduce the Apple stake might be considered to enhance portfolio diversification.

- Further Investment: Depending on market conditions and Apple’s future projections, Berkshire might choose to increase its Apple holdings.

Each scenario presents unique advantages and risks depending on prevailing market conditions and future Apple performance.

The Role of Technological Disruption

Emerging technologies like AR/VR and AI present both opportunities and risks for Apple and, consequently, Berkshire Hathaway's investment.

- Potential for New Revenue Streams: Successful integration of these technologies into Apple's product ecosystem could unlock new revenue streams.

- Increased Competition: Rapid advancements in these fields could attract new, aggressive competitors, potentially impacting Apple's market share.

- Adaptation and Innovation: Apple's ability to adapt and innovate in response to these emerging technologies will be crucial for its long-term success.

Conclusion: Berkshire Hathaway's Apple Holdings: A Continuing Saga

Berkshire Hathaway's Apple holdings represent a pivotal investment in the post-Buffett era. While Apple's strength and consistent performance make it a likely cornerstone of the portfolio, the changing leadership and inherent market volatility necessitate continuous monitoring. The future trajectory hinges on a multitude of factors, from Greg Abel's investment approach to the impact of technological disruptions and overall market conditions. To stay informed, continue researching Berkshire Hathaway's Apple holdings, monitor market trends, and follow the evolution of the investment strategy under new leadership. Further in-depth analysis of Berkshire Hathaway's investment decisions and Apple's future performance can be found through reputable financial news sources and investment research firms.

Featured Posts

-

Rybakina O Forme Poka Ne Na Pike

May 24, 2025

Rybakina O Forme Poka Ne Na Pike

May 24, 2025 -

Ihanete Ugrayanlarin Aninda Intikam Alan Burclari

May 24, 2025

Ihanete Ugrayanlarin Aninda Intikam Alan Burclari

May 24, 2025 -

M56 Road Closure Current Traffic Conditions And Crash Updates

May 24, 2025

M56 Road Closure Current Traffic Conditions And Crash Updates

May 24, 2025 -

The End Of The Nfls Butt Push Ban What This Means For Players And Fans

May 24, 2025

The End Of The Nfls Butt Push Ban What This Means For Players And Fans

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 24, 2025