BigBear.ai (BBAI): 17.87% Drop Highlights Revenue Miss And Leadership Concerns

Table of Contents

Revenue Miss and Disappointing Financial Performance

BigBear.ai's recent financial results revealed a significant revenue miss, falling considerably short of analysts' expectations. This shortfall significantly impacted BBAI's financial projections and cast doubt on its projected future growth. Several factors contributed to this disappointing performance:

- Intense Competition: The AI and government contracting sectors are highly competitive. BigBear.ai faces stiff competition from established players with extensive resources and market share. This competition makes securing new contracts and maintaining profitability challenging.

- Contract Award Delays: Delays in securing government contracts are common in this industry, impacting revenue streams and creating uncertainty in financial forecasting. These delays are likely to have exacerbated the revenue shortfall experienced by BBAI.

- Scaling Challenges: Expanding operations, especially in a rapidly evolving technological landscape like AI, presents unique challenges. BigBear.ai may be experiencing difficulties scaling its operations effectively to meet the demands of the growing market. This could directly impact its ability to secure and deliver on larger contracts.

The impact of this revenue miss on BBAI's financial results is significant. Investors are now questioning the company's ability to meet its growth targets and achieve profitability in the near future. Analyzing BigBear.ai revenue growth against competitors is crucial for investors trying to gauge its future trajectory in the competitive landscape of AI revenue growth and government contracting revenue generation.

Leadership Changes and Uncertainty

Recent leadership changes at BigBear.ai have added to the uncertainty surrounding the company's future. Any departure of key executives, especially in senior management positions, can impact investor confidence and company strategy. The departure of experienced leadership can lead to:

- Strategic Shifts: New leadership may bring changes in strategic direction, potentially disrupting ongoing projects and delaying future growth.

- Loss of Institutional Knowledge: Experienced executives often possess crucial institutional knowledge vital for navigating complex government contracting processes and maintaining client relationships. Their absence can create gaps that impact BBAI's operations.

- Investor Concerns: Leadership instability raises concerns about succession planning and the long-term sustainability of the company's operations. This uncertainty is a major factor driving down investor confidence in BBAI.

The lack of clarity regarding the long-term leadership strategy at BigBear.ai has further contributed to the negative sentiment surrounding the BBAI stock price. The market is clearly reacting to the perceived uncertainty surrounding the executive team and its impact on BigBear.ai leadership.

Market Sentiment and Investor Reaction

The market's reaction to BigBear.ai's disappointing financial performance and leadership changes was swift and severe. A significant sell-off followed the release of the earnings report, reflecting widespread negative sentiment among investors. Key indicators of this negative market reaction include:

- High Sell-Off Volume: The high volume of BBAI stock being sold indicates a significant loss of investor confidence.

- Decreased Trading Activity: This may reflect investor hesitancy to engage with the stock until greater clarity emerges.

- Negative Analyst Ratings and Price Target Adjustments: Many financial analysts have revised their ratings and price targets for BBAI stock downwards, further impacting investor sentiment.

The combination of these factors has created a negative feedback loop, exacerbating the initial stock price drop and hindering any near-term recovery for the BBAI stock price.

Comparison to Competitors

Comparing BigBear.ai's performance to its key competitors in the AI and government contracting sectors reveals a significant gap in revenue growth and market share. This competitive analysis highlights the challenges BBAI faces in maintaining its position in this competitive market. Key competitors are achieving better results in both revenue growth and market share, emphasizing the challenges faced by BigBear.ai. Understanding this competitive landscape is vital for investors seeking to assess the realistic trajectory of BBAI's future performance against its rivals.

Conclusion

The 17.87% drop in BigBear.ai (BBAI) stock price is a direct consequence of a confluence of negative factors: a substantial revenue miss, concerns surrounding leadership changes, and a resulting negative market sentiment. These issues raise serious questions about BBAI's short-term and long-term prospects. Investors need to carefully weigh the risks and potential opportunities before making any investment decisions. The outlook for BBAI remains uncertain, and investors should closely monitor future developments and financial releases. Stay informed about BigBear.ai's (BBAI) future developments by following our financial news and analysis, paying close attention to any improvements in revenue generation, leadership stability, and overall market reaction to future announcements. Understanding the evolving dynamics of the BBAI stock price is crucial for navigating the complexities of the AI and government contracting sectors.

Featured Posts

-

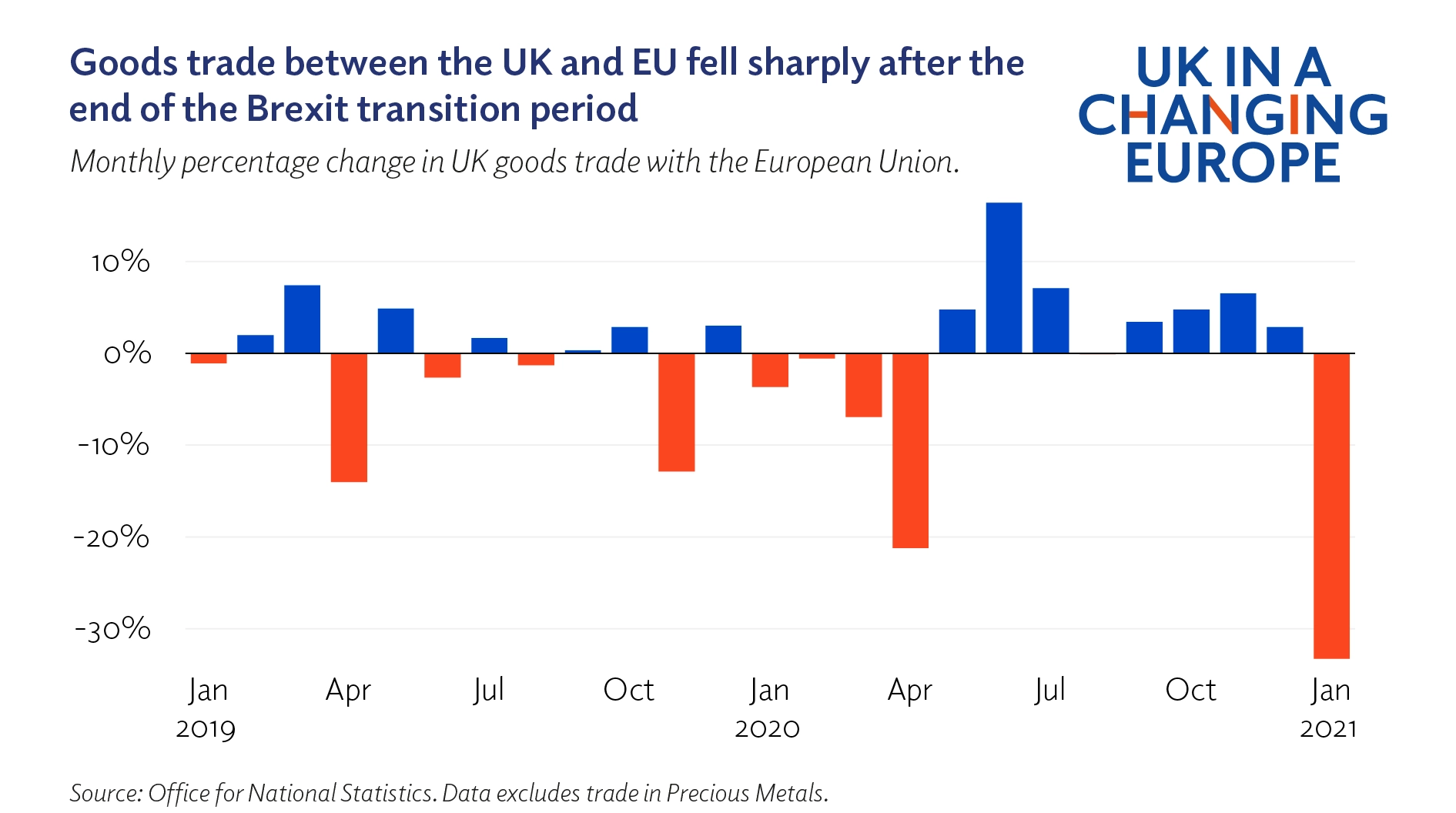

Brexit And The Uk Luxury Goods Sector Export Challenges

May 20, 2025

Brexit And The Uk Luxury Goods Sector Export Challenges

May 20, 2025 -

Tonci Tadic O Pregovorima Putinov Plan I Njegovi Ciljevi

May 20, 2025

Tonci Tadic O Pregovorima Putinov Plan I Njegovi Ciljevi

May 20, 2025 -

Tweede Kind Voor Jennifer Lawrence Recente Ontwikkelingen

May 20, 2025

Tweede Kind Voor Jennifer Lawrence Recente Ontwikkelingen

May 20, 2025 -

Dortmunds Beier Scores Twice In Win Over Mainz

May 20, 2025

Dortmunds Beier Scores Twice In Win Over Mainz

May 20, 2025 -

Mick Schumacher Soltero Y Buscando Pareja En App De Citas Tras Separacion

May 20, 2025

Mick Schumacher Soltero Y Buscando Pareja En App De Citas Tras Separacion

May 20, 2025