BigBear.ai (BBAI): Growth Uncertainty Prompts Analyst Downgrade - What's Next?

Table of Contents

The Analyst Downgrade: Reasons and Implications

A leading analyst firm recently downgraded its rating for BBAI stock, citing concerns about revenue growth, intensifying competition within the AI sector, and the company's path to profitability. This negative assessment had an immediate impact on BBAI's stock price, causing a significant percentage drop. The downgrade also negatively affected investor sentiment and confidence, leading to increased market volatility around the BBAI stock price.

- Specific concerns: The analyst firm highlighted concerns about BBAI's ability to consistently secure large contracts, the challenges posed by established competitors in the data analytics and AI solutions market, and a slower-than-anticipated path to profitability.

- Stock price impact: Following the downgrade, BBAI's stock price experienced a [Insert Percentage]% decline, reflecting investors' immediate reaction to the negative news.

- Market capitalization impact: The decrease in stock price resulted in a substantial reduction in BBAI's overall market capitalization, further emphasizing the seriousness of the downgrade.

The analyst rating change significantly impacted investor sentiment. Many investors, especially those with lower risk tolerance, reacted by selling their BBAI holdings, creating downward pressure on the BBAI stock price. This highlights the importance of understanding analyst ratings and their influence on market perception.

BigBear.ai's Business Model and Growth Prospects

BigBear.ai's core business model centers around providing advanced AI and data analytics solutions to government and commercial clients. They offer a range of services, from data integration and analysis to the development of AI-powered applications for various sectors. While the company holds a strong position in certain niche markets, the competitive landscape is crowded, with established players and numerous startups vying for market share.

- Key clients and contracts: BBAI boasts a portfolio of government and commercial clients, with some significant contracts contributing substantially to its revenue. However, the reliance on a few key contracts can present a risk.

- Competitive advantages and disadvantages: BBAI’s strength lies in its specialized AI and data analytics expertise. However, its smaller size compared to major tech firms presents a competitive disadvantage in terms of resources and market reach.

- Growth potential: The potential for growth lies in expanding its market reach into new sectors, leveraging technological advancements like generative AI, and securing strategic partnerships. Successful expansion into new markets or sectors could boost revenue and overall market share, positively impacting the BBAI stock price.

- Technological advancements and innovations: BBAI's success hinges on its ability to stay at the forefront of AI technology and data analytics innovation. Continued investment in R&D is crucial to maintain a competitive edge.

Analyzing the Risks and Opportunities for BBAI Investors

Investing in BBAI stock presents both significant risks and potential rewards. The recent analyst downgrade highlights the inherent uncertainties associated with the company's growth trajectory. Investors need to carefully assess their risk tolerance before making any investment decisions.

- Financial performance risks: BBAI's financial performance has been volatile, and future results are uncertain, posing significant risk to investors. Revenue growth needs to be consistent for long-term success.

- Competitive risks: Intense competition from larger, more established players in the AI and data analytics market presents a substantial threat.

- Potential upside: Successful contract wins, technological breakthroughs, or expansion into new high-growth markets could significantly boost BBAI's financial performance and, subsequently, the BBAI stock price.

- Risk mitigation strategies: Diversification of investments, a thorough understanding of the company's financial statements, and setting realistic expectations can help mitigate some of the risks involved.

What to Expect Next for BigBear.ai (BBAI)

Predicting the future of BBAI stock is challenging, given the current uncertainty. However, we can examine potential short-term and long-term scenarios. Several factors could influence BBAI's performance: new contracts, successful product launches, strategic partnerships, and overall market trends.

- Short-term price predictions (with caveats): Predicting short-term price movements is inherently speculative. However, a cautious approach suggests potential volatility until investor confidence is restored.

- Long-term growth potential: The long-term potential depends on BBAI's ability to execute its strategic plans, adapt to market changes, and maintain a competitive edge in the AI and data analytics sector.

- Factors that could influence future performance: Key factors influencing BBAI's future performance include successful contract wins, technological advancements, and improving financial performance indicators such as revenue growth and profitability.

Conclusion: BigBear.ai (BBAI): A Cautious Approach?

The analyst downgrade of BBAI stock underscores the considerable uncertainty surrounding the company's future growth. While BigBear.ai operates in a high-growth sector with considerable potential, the challenges posed by competition and the need to demonstrate consistent profitability are significant. Thorough due diligence, including a careful review of the company's financial statements and future projections, is crucial before investing in BBAI stock.

Based on our analysis, a cautious approach is recommended. Investors should carefully weigh the risks and potential rewards before committing capital. While the long-term potential for growth exists, the near-term outlook remains uncertain. Before making any investment decisions concerning BBAI stock, we strongly encourage you to conduct further research. Visit BigBear.ai's investor relations page for more detailed financial information and updates. Conduct your own in-depth BBAI stock analysis, considering different investment strategies for investing in BBAI, and carefully assess the BigBear.ai outlook. Remember, this information is for informational purposes only and not financial advice.

Featured Posts

-

Goretzka Included In Germanys Nations League Team Nagelsmanns Selection

May 21, 2025

Goretzka Included In Germanys Nations League Team Nagelsmanns Selection

May 21, 2025 -

Le Hellfest Investit Le Noumatrouff Programmation Musicale A Mulhouse

May 21, 2025

Le Hellfest Investit Le Noumatrouff Programmation Musicale A Mulhouse

May 21, 2025 -

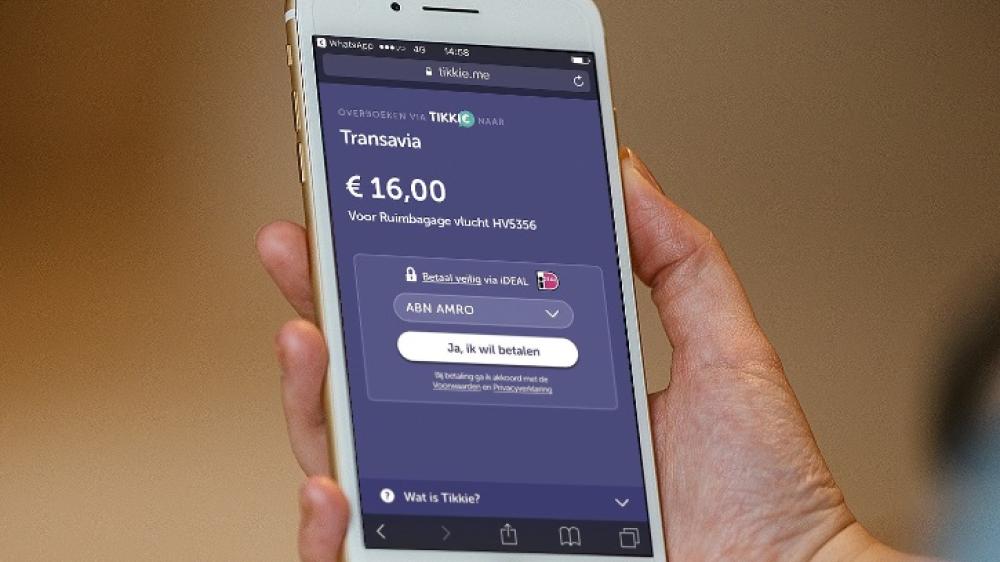

Tikkie Gebruiken Een Handleiding Voor Nederlandse Bankieren

May 21, 2025

Tikkie Gebruiken Een Handleiding Voor Nederlandse Bankieren

May 21, 2025 -

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 21, 2025

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 21, 2025 -

Jacob Friis Era Boerjar Med Bortaseger En Kamp Mot Malta

May 21, 2025

Jacob Friis Era Boerjar Med Bortaseger En Kamp Mot Malta

May 21, 2025