BigBear.ai Faces Securities Lawsuit: What Investors Need To Know

Table of Contents

Understanding the Allegations in the BigBear.ai Lawsuit

The core allegations in the BigBear.ai lawsuit center around claims of securities fraud, alleging misleading statements and material misstatements to investors. Plaintiffs contend that BigBear.ai engaged in deceptive practices, painting a rosier picture of its financial health and prospects than reality warranted. These accusations have significant ramifications for investor confidence and the future trajectory of the company. Key accusations outlined in the lawsuit include:

-

Allegations of misleading statements regarding financial performance: Plaintiffs claim that BigBear.ai's financial reporting misrepresented its actual performance, potentially overstating revenue or understating expenses. This could involve manipulating key performance indicators (KPIs) to project a more favorable image to potential investors.

-

Claims of misrepresentation of contracts or revenue streams: The lawsuit may allege that BigBear.ai either misrepresented the value or likelihood of securing specific contracts or inaccurately reported revenue generated from existing contracts, misleading investors about the company's financial stability.

-

Accusations of failing to disclose material risks to investors: A critical aspect of the lawsuit may focus on BigBear.ai's alleged failure to adequately inform investors of significant risks associated with its business operations or financial position. This omission of material information could be viewed as a violation of securities laws.

Potential Impact on BigBear.ai Stock and Investors

The BigBear.ai securities lawsuit carries significant potential ramifications for both the company's stock price and its investors. The immediate impact is likely to be stock market volatility, with potential for a decline in BigBear.ai stock price as investor confidence erodes. In the short-term, investors might experience losses depending on the extent of the stock price drop.

-

Potential for stock price volatility and decline: The uncertainty surrounding the lawsuit will likely create volatility in BigBear.ai's stock price, leading to potentially significant losses for investors who hold the stock.

-

Impact on investor confidence and future investment: The negative publicity surrounding the lawsuit could severely damage investor confidence, making it difficult for BigBear.ai to attract future investments, potentially hindering its growth and long-term prospects.

-

Legal costs and financial repercussions for BigBear.ai: Defending against the lawsuit will undoubtedly incur substantial legal costs for BigBear.ai, potentially impacting its financial performance and ability to invest in future projects. A large settlement or judgment could severely strain its finances.

What Investors Should Do Next

For investors affected by the BigBear.ai lawsuit, decisive action is crucial to protect their interests. It is vital to stay informed and consider professional guidance.

-

Monitor the stock price and news related to the lawsuit: Keep a close eye on BigBear.ai's stock price fluctuations and stay updated on any developments in the lawsuit through reputable financial news sources.

-

Consider consulting with a financial advisor: Seeking advice from a qualified financial advisor can provide personalized guidance on managing your investment portfolio during this uncertain period.

-

Explore options for participating in a class-action lawsuit (if applicable): If the lawsuit becomes a class-action, investors may have the option to participate and potentially recover some of their losses. Legal counsel can advise on this.

-

Review investment portfolio and assess risk tolerance: This lawsuit underscores the importance of regularly reviewing your investment portfolio and assessing your risk tolerance. Diversification can help mitigate potential losses from individual investments.

Understanding Your Rights as a BigBear.ai Investor

Investors have rights protected under securities laws. These laws aim to protect investors from fraudulent or misleading practices by publicly traded companies. It's important to understand your rights and the recourse available to you if you believe you've been harmed by unlawful conduct. Familiarize yourself with the regulations enforced by the Securities and Exchange Commission (SEC) and seek legal counsel if you believe your rights have been violated.

Conclusion

The BigBear.ai securities lawsuit presents significant challenges for investors. Understanding the allegations, assessing the potential impact on the BigBear.ai stock, and knowing your rights as an investor are critical steps in protecting your investment. The potential for stock price volatility and the long-term effects on the company's financial health and investor confidence underscore the need for careful consideration and proactive measures. Stay informed about the ongoing BigBear.ai securities lawsuit and take the necessary steps to protect your investment. Consult with legal and financial professionals for personalized advice tailored to your specific circumstances.

Featured Posts

-

Tampoy Otan O Erotas Ginetai Apagoreymenos

May 20, 2025

Tampoy Otan O Erotas Ginetai Apagoreymenos

May 20, 2025 -

Paa 28 33 Millions De Tonnes Traitees En 2022

May 20, 2025

Paa 28 33 Millions De Tonnes Traitees En 2022

May 20, 2025 -

Experiencia Amazonica Festival Da Cunha Em Manaus Idealizado Por Isabelle Nogueira

May 20, 2025

Experiencia Amazonica Festival Da Cunha Em Manaus Idealizado Por Isabelle Nogueira

May 20, 2025 -

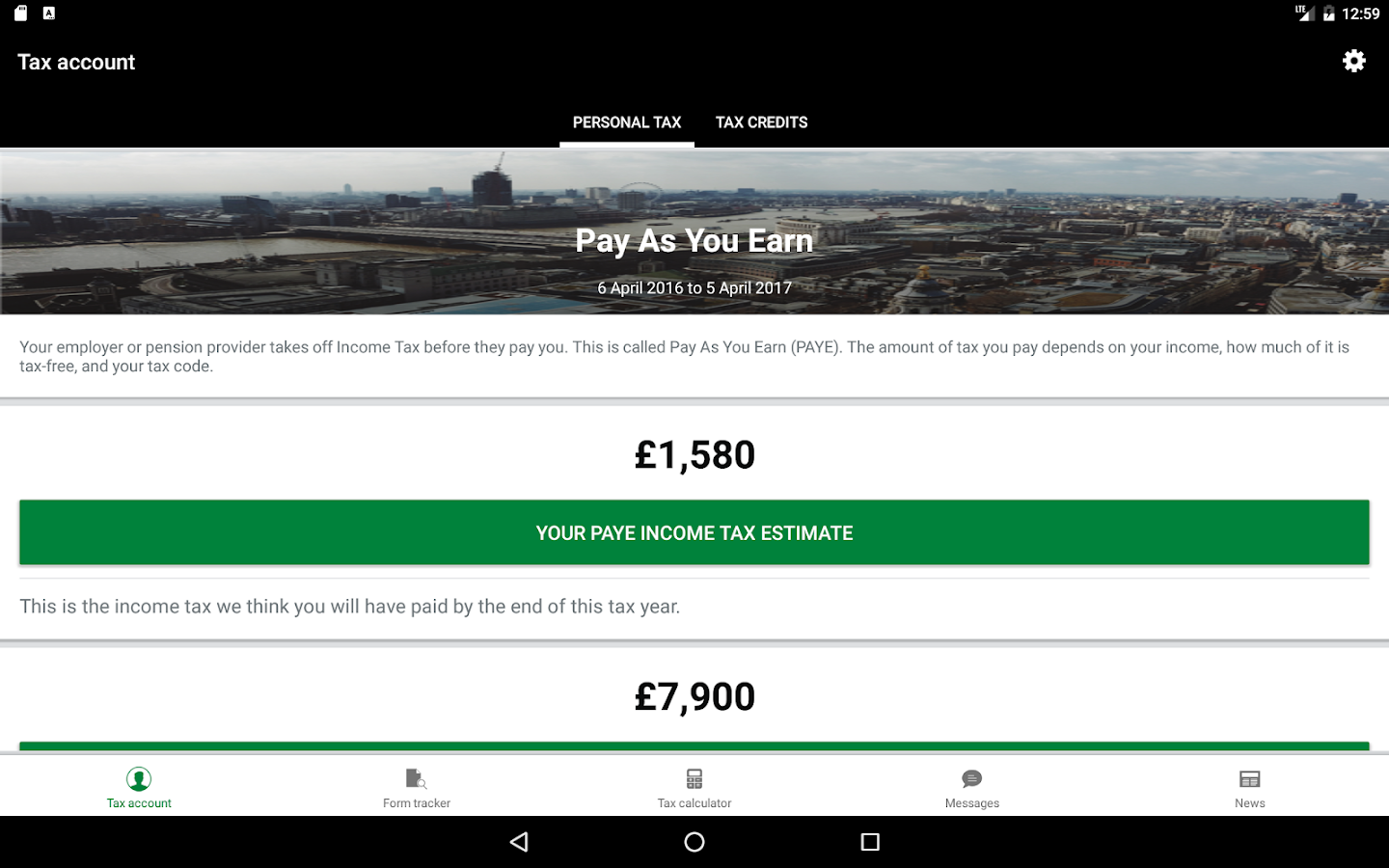

Hmrc To Implement Voice Recognition For Faster Call Handling

May 20, 2025

Hmrc To Implement Voice Recognition For Faster Call Handling

May 20, 2025 -

Fenerbahce Nin Yeni Transferi Tadic Ve Talisca Arasindaki Gerilim

May 20, 2025

Fenerbahce Nin Yeni Transferi Tadic Ve Talisca Arasindaki Gerilim

May 20, 2025