BigBear.ai Holdings (BBAI): Exploring The Reasons Behind The 2025 Market Crash

Table of Contents

Macroeconomic Factors Contributing to a Potential BBAI Decline in 2025

Global Economic Uncertainty

- Rising interest rates: Increased borrowing costs can stifle economic growth, impacting investment in technology sectors like AI.

- Inflation concerns: Persistent inflation erodes purchasing power and can lead to decreased consumer and business spending, negatively affecting demand for AI solutions.

- Potential recessionary pressures: A global recession would significantly reduce investment in discretionary spending, including AI technologies.

- Geopolitical instability (e.g., war in Ukraine, trade wars): Global conflicts create uncertainty and can disrupt supply chains, impacting the overall economic climate and investor confidence.

These macroeconomic factors can negatively impact investor sentiment and lead to a broader market downturn, affecting even seemingly strong companies like BBAI. The AI sector, while promising, is not immune to the effects of a volatile market. Reduced investment capital in times of economic uncertainty directly translates to decreased funding opportunities for AI companies, including BigBear.ai.

Increased Competition in the AI Sector

- Competition from established tech giants (Google, Amazon, Microsoft): These giants possess vast resources and established market positions, posing a significant challenge to smaller players like BBAI.

- Emergence of new AI startups: The AI landscape is dynamic, with new startups constantly emerging, potentially disrupting existing market leaders.

- Pressure on pricing and profit margins: Intense competition can lead to price wars, squeezing profit margins and impacting the overall financial health of companies like BBAI.

The intense competition in the rapidly evolving AI market could erode BBAI's market share and profitability, potentially contributing to a stock price decline. Companies like Google, with their extensive cloud infrastructure and vast data sets, present a formidable challenge. Similarly, the constant emergence of innovative AI startups adds further pressure on market share and profitability for established players.

Company-Specific Risks for BigBear.ai Holdings (BBAI) in 2025

Dependence on Government Contracts

- Risks associated with government budget cuts: Changes in government spending priorities can directly impact BBAI's revenue streams.

- Changing procurement priorities: Shifting government focus to other areas could reduce demand for BBAI's services.

- Delays in contract awards: Unforeseen delays in awarding contracts can lead to revenue shortfalls and impact BBAI's financial performance.

- Competition for government contracts: BBAI faces intense competition from other defense contractors and technology firms vying for the same government contracts.

BBAI's significant reliance on government contracts creates vulnerability. The unpredictable nature of government spending and procurement processes makes this a significant risk factor.

Technological Advancements and Disruption

- Rapid pace of technological change in AI: The AI field is characterized by rapid innovation, making it crucial for BBAI to constantly adapt.

- Potential for disruptive technologies to render BBAI's offerings obsolete: New breakthroughs in AI could render BBAI's current technology less competitive.

- Need for continuous innovation and adaptation: BBAI must invest heavily in research and development to remain at the forefront of AI advancements.

The risk of BBAI's technology becoming outdated is substantial. Staying ahead of the curve in this rapidly evolving landscape requires significant and ongoing investment in research and development. Failure to adapt could lead to a significant loss of market share and profitability.

Financial Performance and Debt Levels

- BBAI's current financial health: A thorough analysis of BBAI's financial statements is essential to assess its resilience to market downturns.

- Debt-to-equity ratio: High levels of debt can increase financial vulnerability during economic uncertainty.

- Profitability margins: Sustainable profitability is essential for weathering market fluctuations.

- Cash flow projections: Positive cash flow is crucial for maintaining operational stability and investing in future growth.

Examining BBAI's financial stability, including its debt levels and profitability, is crucial in assessing its potential vulnerability during a market downturn. A detailed analysis of these financial indicators provides insights into the company’s long-term sustainability.

Mitigation Strategies for Investors Concerned About BBAI in 2025

Diversification

- Spreading investments across different asset classes and sectors: Diversification reduces the overall risk associated with a single investment.

This fundamental investment principle helps mitigate the risk of significant losses if BBAI underperforms.

Thorough Due Diligence

- Conducting in-depth research on BBAI’s financials, competitive landscape, and future prospects: Independent research is crucial for making informed investment decisions.

Independent research and analysis are vital to understanding the true risk profile of BBAI and the AI sector as a whole.

Risk Management Techniques

- Using stop-loss orders: Stop-loss orders limit potential losses by automatically selling the stock if it falls below a predetermined price.

- Hedging strategies: Hedging involves using financial instruments to offset potential losses from an investment.

Implementing risk management strategies can significantly reduce the impact of potential losses.

Conclusion

Predicting a market crash for BigBear.ai Holdings (BBAI) in 2025 requires careful consideration of macroeconomic factors, competitive pressures, and the company's specific vulnerabilities. While no one can foresee the future with certainty, understanding these potential risks allows investors to make informed decisions. The AI sector, while promising, is subject to significant risks, and understanding the potential pitfalls associated with investing in BBAI is crucial for responsible investing.

Call to Action: While this article explores potential risks associated with BigBear.ai Holdings (BBAI) and a potential 2025 market crash, thorough due diligence and a diversified investment strategy are crucial for navigating the complexities of the AI market. Continue your research on BigBear.ai and other AI stocks to make informed investment choices. Remember, understanding the potential risks associated with BBAI is key to responsible investing.

Featured Posts

-

Michael Strahans Interview Strategy Navigating The Intense Ratings Competition

May 20, 2025

Michael Strahans Interview Strategy Navigating The Intense Ratings Competition

May 20, 2025 -

Ferrari Addresses Leclercs Imola Gp Future

May 20, 2025

Ferrari Addresses Leclercs Imola Gp Future

May 20, 2025 -

China Assembles Space Based Supercomputer Capabilities And Implications

May 20, 2025

China Assembles Space Based Supercomputer Capabilities And Implications

May 20, 2025 -

France Eurovision 2024 La Chanson De Louane Revelee

May 20, 2025

France Eurovision 2024 La Chanson De Louane Revelee

May 20, 2025 -

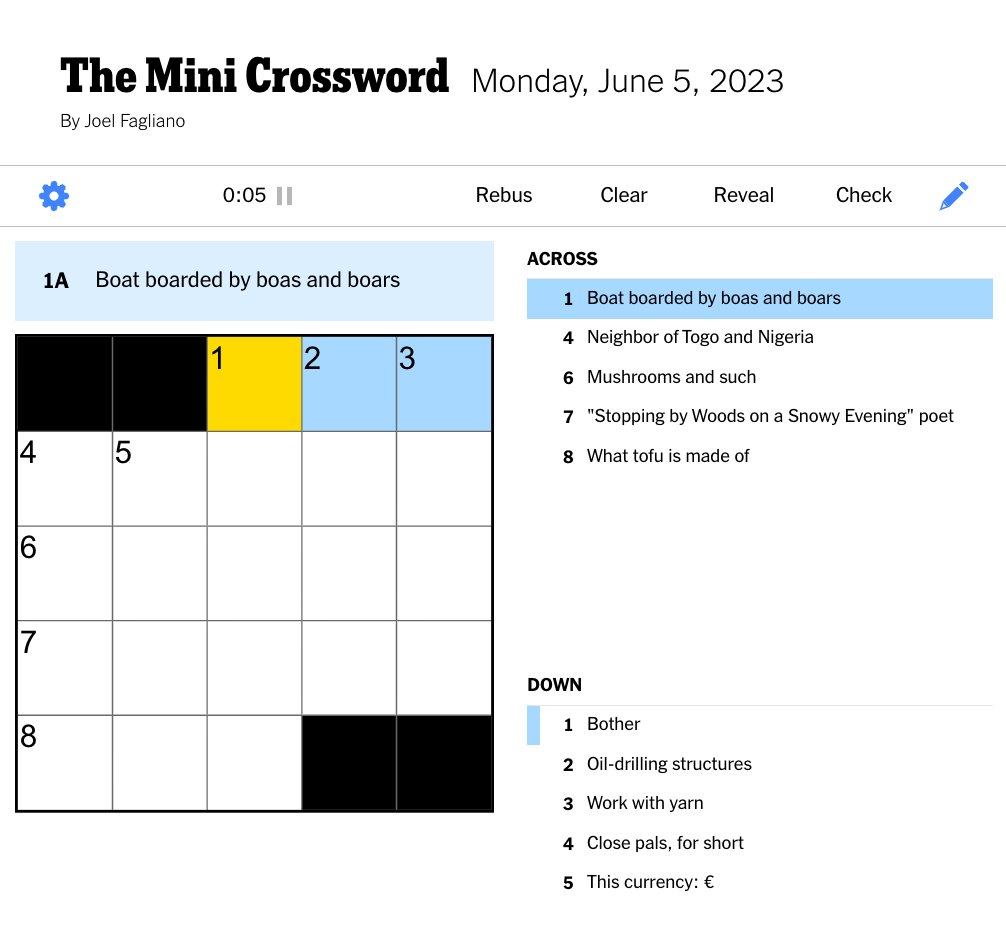

Nyt Mini Crossword Solution March 31st

May 20, 2025

Nyt Mini Crossword Solution March 31st

May 20, 2025