BigBear.ai Holdings, Inc. (BBAI): Analyst Downgrade And Growth Concerns

Table of Contents

Reasons Behind the Analyst Downgrade of BBAI Stock

The analyst downgrade of BBAI stock stems from several interconnected concerns. These concerns paint a picture of a company facing significant headwinds in its efforts to achieve sustainable growth and profitability.

-

Concerns about revenue growth and profitability: Analysts have expressed apprehension about BigBear.ai's ability to consistently deliver strong revenue growth. Profitability remains a challenge, with margins potentially squeezed by intense competition and the high cost of developing and deploying advanced AI solutions. [Insert link to a relevant news article or analyst report here, if available].

-

Increased competition in the AI market: The AI market is becoming increasingly crowded, with both established tech giants and nimble startups vying for market share. BigBear.ai faces stiff competition from companies with deeper pockets and potentially broader technological capabilities. This competitive pressure directly impacts the company's ability to secure and retain lucrative contracts.

-

Challenges in securing new contracts: Securing new government and commercial contracts is paramount for BigBear.ai's growth. Recent difficulties in this area have fueled concerns about the company's ability to sustain its revenue pipeline. This could be due to factors such as increased regulatory scrutiny, more stringent bidding processes, or simply a more competitive landscape.

-

Concerns about the company's financial performance: Analysts are scrutinizing BigBear.ai's financial statements, focusing on metrics like debt levels, cash flow, and operating expenses. High debt levels coupled with slow revenue growth can significantly impact the company's long-term sustainability and investor confidence. [Insert link to a relevant financial report or analysis here, if available].

Analyzing BigBear.ai's Growth Prospects

Despite the recent downgrade, BigBear.ai operates in a rapidly expanding market with significant long-term potential. The company's future success hinges on its ability to address the challenges highlighted above and capitalize on emerging opportunities.

-

Market size and growth potential for AI solutions: The market for AI-powered solutions, particularly within government and commercial sectors, is experiencing explosive growth. This presents a significant opportunity for BigBear.ai if it can successfully position itself for market share gains.

-

BigBear.ai's competitive advantages: BigBear.ai possesses certain competitive advantages, including its established client relationships and its expertise in specific AI applications within the government sector. However, the company needs to actively leverage these advantages to differentiate itself from competitors.

-

Potential for new product development and market expansion: Innovation and diversification are crucial for BigBear.ai's long-term survival. Developing new AI-driven products and expanding into new market segments are key strategies for sustaining growth.

-

The company's strategy for overcoming current challenges: BigBear.ai's management needs to articulate a clear and convincing strategy for overcoming the current challenges, including improving profitability, securing new contracts, and managing competition effectively. Transparency and effective communication with investors are vital.

Assessing the Impact on BBAI Stock Price

The analyst downgrade has already had a noticeable impact on the BBAI stock price. [Insert chart or graph illustrating BBAI stock price movements here, if possible]. The magnitude and duration of this impact depend on several factors.

-

Investor sentiment and market reaction: Negative analyst reports can significantly impact investor sentiment, potentially leading to a sell-off and downward pressure on the stock price.

-

The impact on the company's valuation: The downgrade could lead to a reassessment of BigBear.ai's valuation, potentially resulting in a lower stock price.

-

Potential short-term and long-term price movements: The short-term impact might be a sharp decline, while the long-term impact will depend on BigBear.ai's ability to address the underlying concerns and demonstrate sustainable growth.

-

Comparison to competitors' stock performance: Comparing BBAI's performance to that of its competitors within the AI sector provides valuable context for understanding the market's reaction to the downgrade.

Risk Factors for BigBear.ai Investors

Investing in BBAI stock carries substantial risk following the recent downgrade. Potential investors should carefully consider the following:

-

Further downgrades from other analysts: More negative analyst reports could further depress BBAI's stock price.

-

Missed earnings expectations: Failure to meet or beat earnings expectations can trigger additional selling pressure.

-

Increased competition leading to reduced market share: Intensifying competition could erode BigBear.ai's market share and hinder growth.

-

Inability to secure funding or secure profitable contracts: Difficulties in securing funding or profitable contracts could severely impact the company's financial health and stock price.

Conclusion

The analyst downgrade of BigBear.ai (BBAI) stock highlights significant concerns about the company's revenue growth, profitability, and competitive landscape. While the AI market offers considerable long-term potential, BigBear.ai faces substantial challenges that need to be addressed effectively. The potential impact on BBAI stock price is considerable, and investors should be aware of the inherent risks involved.

Conduct your own due diligence on BigBear.ai (BBAI) before making any investment decisions. Carefully consider the risks before investing in BBAI, and stay informed about BigBear.ai's future growth prospects by reviewing the company's financial statements, reading analyst reports, and following news related to BBAI and the broader AI industry. Remember that investing in BBAI stock involves significant risk, and past performance is not indicative of future results.

Featured Posts

-

Germany Aims For Victory Against Italy In Quarterfinals

May 20, 2025

Germany Aims For Victory Against Italy In Quarterfinals

May 20, 2025 -

Ecco Alcune Opzioni Per Il Titolo Seo Friendly

May 20, 2025

Ecco Alcune Opzioni Per Il Titolo Seo Friendly

May 20, 2025 -

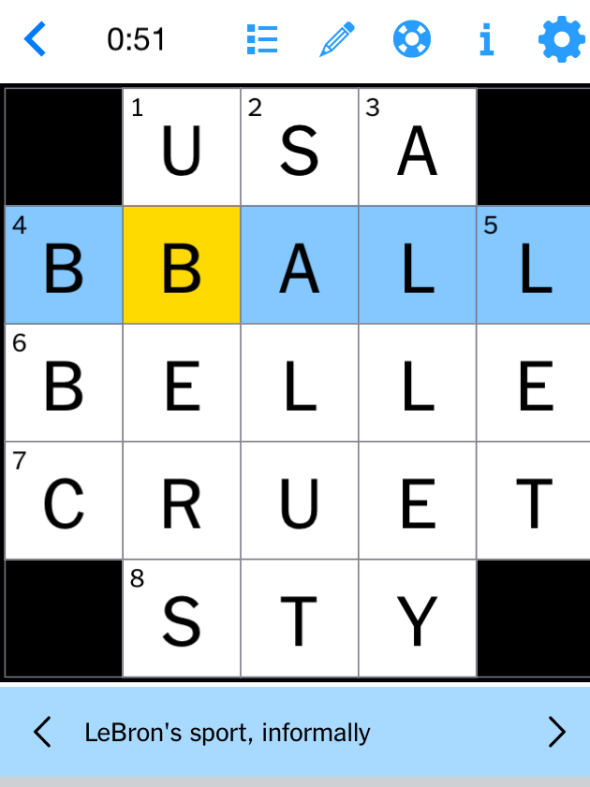

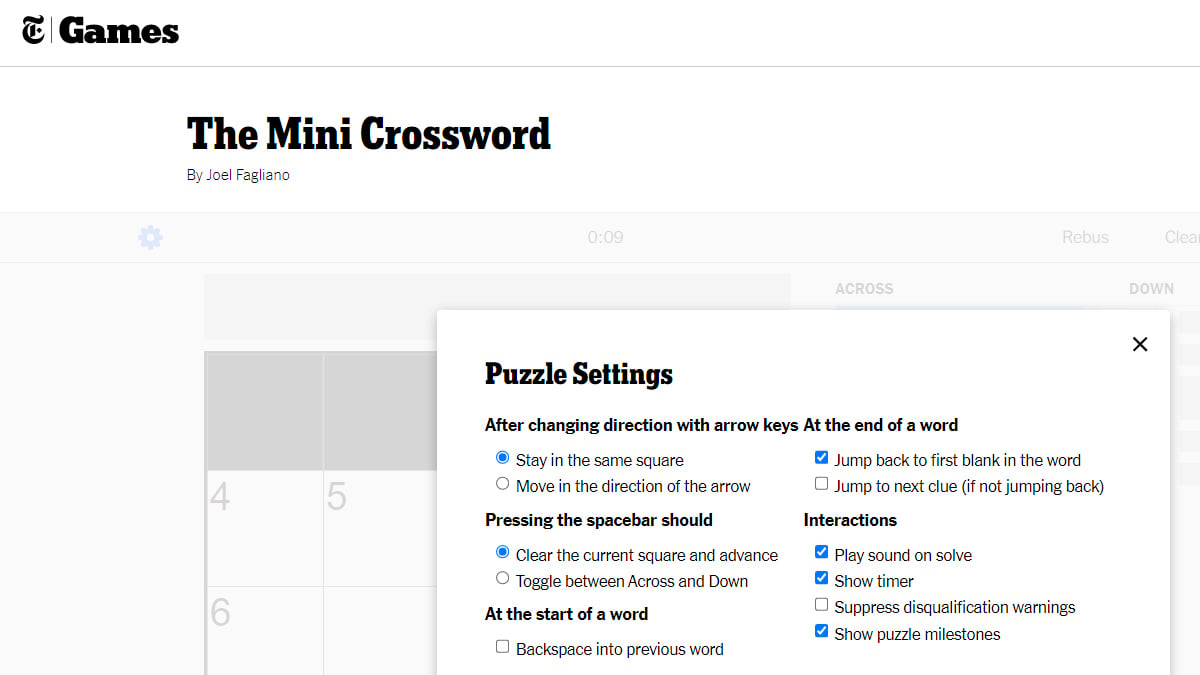

Nyt Mini Crossword Answers For March 18 Complete Solution Guide

May 20, 2025

Nyt Mini Crossword Answers For March 18 Complete Solution Guide

May 20, 2025 -

Sueper Lig Dusan Tadic 100 Maca Ulasti

May 20, 2025

Sueper Lig Dusan Tadic 100 Maca Ulasti

May 20, 2025 -

March 20 2025 Nyt Mini Crossword Answers And Clues

May 20, 2025

March 20 2025 Nyt Mini Crossword Answers And Clues

May 20, 2025