BigBear.ai Holdings, Inc. (NYSE: BBAI): Penny Stock Potential For Skyrocketing Growth?

Table of Contents

BigBear.ai's Business Model and Growth Prospects

AI-Powered Solutions for Government and Commercial Clients

BigBear.ai's core business revolves around providing AI-driven solutions to a diverse clientele. Their offerings include:

- AI-driven analytics: BigBear.ai leverages advanced algorithms to analyze massive datasets, providing actionable insights for clients across various industries.

- Data science solutions: The company offers expertise in data mining, machine learning, and predictive modeling to help clients make better-informed decisions.

- Cybersecurity solutions: With the increasing threat of cyberattacks, BigBear.ai's cybersecurity offerings are becoming increasingly valuable to both government and commercial clients.

BigBear.ai serves a range of clients, including:

- Defense and intelligence agencies: Providing critical AI-powered solutions for national security.

- Commercial enterprises: Offering data analytics and cybersecurity solutions to improve efficiency and protect sensitive information.

The demand for AI solutions in these sectors is experiencing explosive growth, creating a favorable environment for BigBear.ai's expansion. This growing market presents significant opportunities for revenue growth and increased market share for BBAI.

Competitive Advantages and Market Position

BigBear.ai differentiates itself through:

- Technological leadership: The company boasts a team of highly skilled data scientists and engineers, constantly developing cutting-edge AI technologies.

- Strategic partnerships: Collaborations with key players in the industry provide access to new markets and technologies.

- Deep domain expertise: BigBear.ai possesses extensive knowledge and experience in the sectors it serves, allowing it to tailor solutions to specific client needs.

While the competitive landscape is crowded, BigBear.ai's focus on specific niche markets and its strong technological capabilities give it a competitive edge. Assessing its exact market share requires further in-depth research, but the potential for expansion in the rapidly growing AI market is undeniable.

Financial Performance and Future Projections

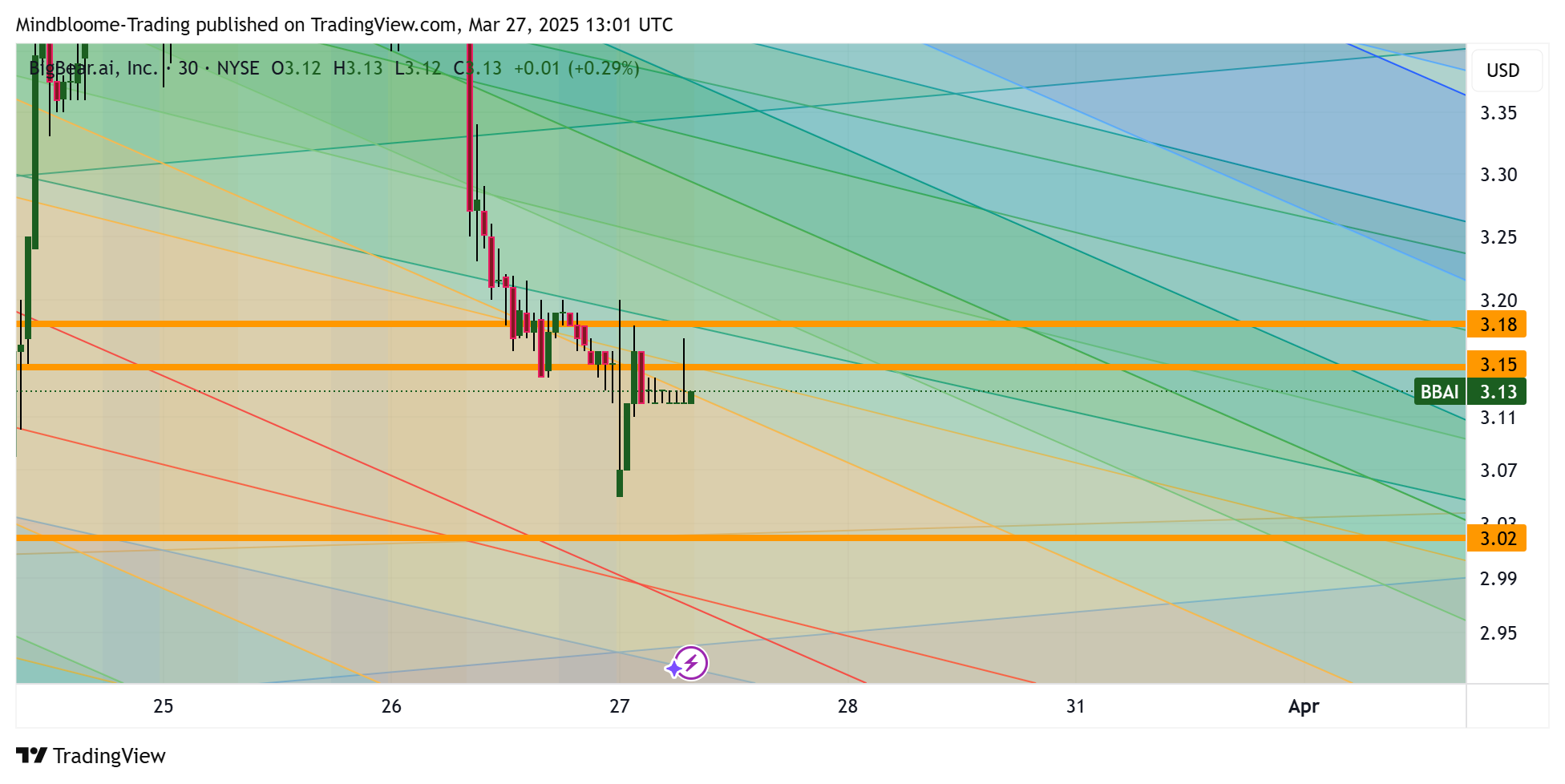

Analyzing BigBear.ai's financial performance requires reviewing its recent financial reports, paying close attention to key metrics like revenue growth, earnings, and debt levels. While past performance does not guarantee future results, analyzing trends can offer insights into potential future growth. It's crucial to consult financial news sources and analyst reports for up-to-date information on financial projections and price targets. Remember to interpret financial data with caution and consider consulting with a financial advisor before making any investment decisions. Visual aids like charts depicting revenue growth and earnings over time can provide a clearer picture of BBAI's financial trajectory.

Risks Associated with Investing in BBAI

Volatility and Market Risk

Penny stocks, by their nature, are highly volatile. BBAI's stock price can fluctuate significantly in response to market trends, news events, and company-specific developments. Investors should be prepared for significant price swings and potential losses. Understanding the inherent risks of penny stock volatility is paramount before investing in BBAI or any similar stock.

Financial Risk and Company-Specific Risks

Investing in BBAI also entails financial risks related to the company's financial health. Factors to consider include:

- Debt levels: High levels of debt can impact profitability and increase financial risk.

- Cash flow: Consistent positive cash flow is vital for sustained growth and stability.

- Competition: The AI market is highly competitive, and BigBear.ai faces competition from established players and emerging startups.

- Technological disruptions: Rapid technological advancements can render existing technologies obsolete, posing a risk to BigBear.ai's competitive advantage.

- Management decisions: The effectiveness of the company's management team is crucial for its success.

Conclusion: Is BBAI a Smart Penny Stock Investment?

BigBear.ai presents a compelling case for growth, fueled by the rising demand for AI solutions in government and commercial sectors. However, investing in BBAI, like any penny stock, carries significant risk. The volatility of the stock price, coupled with the inherent financial and company-specific risks, necessitates a cautious approach.

Before investing in BigBear.ai (BBAI) or any other penny stock, thorough due diligence is essential. This includes reviewing the company's financial statements, understanding its business model and competitive landscape, and assessing the overall market risk. Remember, this article is for informational purposes only and does not constitute financial advice. Conduct your own comprehensive research and consider consulting with a qualified financial advisor before making any investment decisions regarding BigBear.ai (BBAI) and other penny stocks. Remember that responsible investing involves understanding both the potential rewards and the inherent risks involved.

Featured Posts

-

Eurovision 2025 Finalists A Hypnotic To Atrocious Ranking

May 20, 2025

Eurovision 2025 Finalists A Hypnotic To Atrocious Ranking

May 20, 2025 -

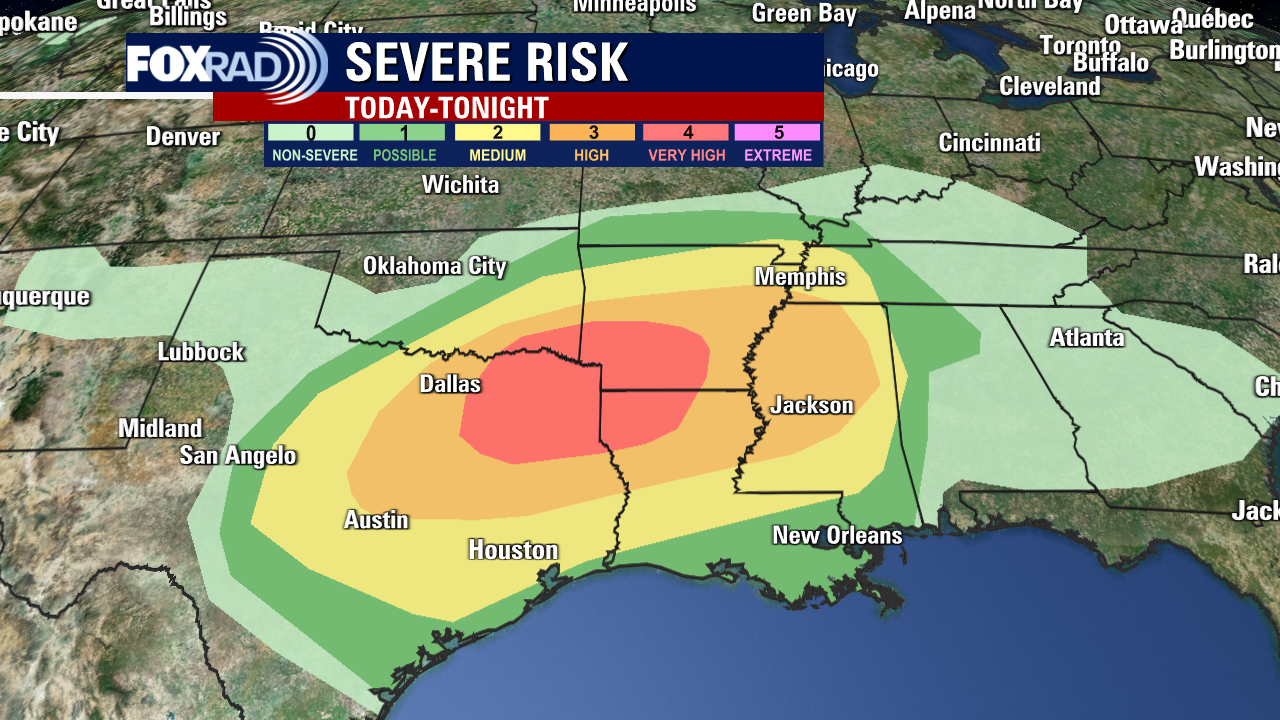

Important Weather Update Strong Winds And Severe Storms Imminent

May 20, 2025

Important Weather Update Strong Winds And Severe Storms Imminent

May 20, 2025 -

Conquering The World Alone A Beginners Guide To Solo Travel

May 20, 2025

Conquering The World Alone A Beginners Guide To Solo Travel

May 20, 2025 -

Finding Comfort In Breezy And Mild Temperatures

May 20, 2025

Finding Comfort In Breezy And Mild Temperatures

May 20, 2025 -

Agatha Christies Poirot A Critical Examination Of His Cases

May 20, 2025

Agatha Christies Poirot A Critical Examination Of His Cases

May 20, 2025