BigBear.ai Holdings, Inc.: Securities Lawsuit Filed

Table of Contents

Details of the Securities Lawsuit Against BigBear.ai

The lawsuit against BigBear.ai, [specify the case number if available], is a [class action/individual claim – specify the type of lawsuit]. The plaintiffs, [mention the plaintiffs or plaintiff groups], allege [mention the defendants – BigBear.ai, specific executives, etc.]. The core allegations revolve around claims of securities fraud and the dissemination of misleading statements. These alleged misrepresentations, according to the plaintiffs, were material and caused investors significant financial harm.

- Specific examples of alleged misleading statements or omissions: [Provide concrete examples cited in the lawsuit, e.g., "inflated revenue projections," "misleading statements regarding contract wins," etc. Avoid legal jargon if possible; explain in simple terms].

- Timeline of events leading to the lawsuit: [Outline the key dates and events leading to the filing of the lawsuit. This could include specific press releases, financial reports, or other announcements.]

- The potential damages being sought: [State the amount of damages the plaintiffs are seeking, if specified in the lawsuit filings.]

Potential Impact on BigBear.ai Stock Price and Investors

The securities lawsuit against BigBear.ai is likely to create significant volatility in the company's stock price. In the short term, we can expect fluctuations depending on market sentiment and the progression of the legal proceedings. The long-term effects depend heavily on the outcome of the lawsuit and the company's ability to manage the reputational damage and legal costs. Investor confidence will undoubtedly be impacted, potentially leading to investor losses for those who hold BigBear.ai stock.

- Historical stock price fluctuations in relation to similar events: [Compare the current situation with past instances where similar lawsuits impacted comparable companies; provide examples of stock price reactions.]

- Expert opinions on the likely market reaction: [If available, cite opinions from financial analysts or experts on the potential impact on the stock price.]

- Advice for investors on how to manage their portfolios: [Offer general advice on risk management and portfolio diversification in light of the lawsuit, such as considering diversifying holdings or seeking professional financial advice].

The Legal Process and Expected Timeline

The legal process will likely involve several stages, starting with the discovery phase where both sides gather evidence. This will be followed by [mention other potential stages, e.g., settlement negotiations, mediation, or a trial]. The timeline is difficult to predict precisely, but a realistic estimate might be [provide a reasonable time frame – e.g., "12-24 months," or "several years," depending on the complexity of the case]. The potential outcomes include a settlement, a court judgment in favor of the plaintiffs, or a dismissal of the lawsuit.

- Key deadlines in the legal process: [Mention any significant deadlines mentioned in the court documents or news reports, if available.]

- Potential scenarios and their implications: [Explore different possible outcomes of the lawsuit and their respective impacts on BigBear.ai's stock price and investors.]

- Resources for investors seeking legal advice: [Provide links to relevant resources, such as legal aid organizations or websites providing information about securities litigation.]

BigBear.ai's Response to the Lawsuit

BigBear.ai has [summarize the company's official response to the lawsuit, referencing press releases or statements if available]. The company's strategy appears to be [analyze their approach – are they fighting the case aggressively, seeking a settlement, etc.?]. [Include any statements made by company representatives or their legal counsel].

- Key points from the company's response: [List the most important points from BigBear.ai's official statements.]

- Assessment of the strength of their defense: [Offer a neutral assessment of the company's legal defense, avoiding overly speculative claims.]

- Any changes in company leadership or strategy as a result: [Note any changes in leadership or company strategy that might have occurred in response to the lawsuit.]

Conclusion: Understanding the BigBear.ai Securities Lawsuit and Protecting Your Investments

The securities lawsuit against BigBear.ai presents significant risks and uncertainties for investors. Understanding the details of the allegations, the potential impact on the stock price, and the legal process is crucial for making informed decisions. Staying informed about the developments in this case is paramount. Consider diversifying your investment portfolio to mitigate risks and consult with a financial advisor for personalized guidance.

Remember to carefully monitor the BigBear.ai stock and other related securities, and always seek professional financial advice before making any investment decisions. Staying updated on the BigBear.ai lawsuit and its implications is key to protecting your investments.

Featured Posts

-

Is Western Separation A Realistic Goal For Saskatchewan A Political Panel Discussion

May 21, 2025

Is Western Separation A Realistic Goal For Saskatchewan A Political Panel Discussion

May 21, 2025 -

Manchester City Eyes Arsenal Great To Take Over From Guardiola

May 21, 2025

Manchester City Eyes Arsenal Great To Take Over From Guardiola

May 21, 2025 -

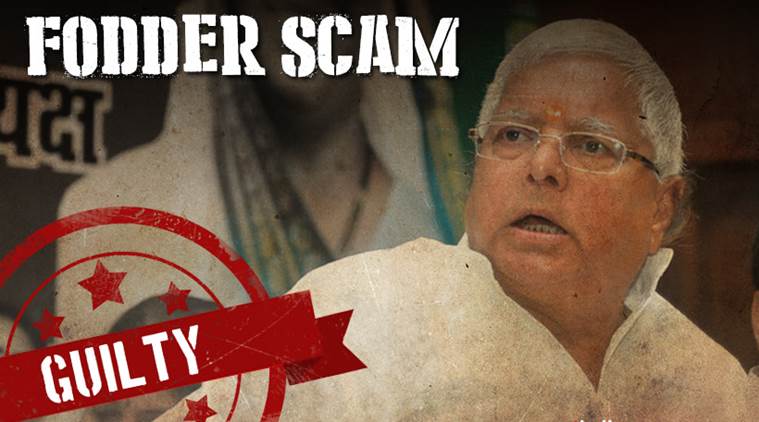

Navys Top Brass Convicted A Major Corruption Case Verdict

May 21, 2025

Navys Top Brass Convicted A Major Corruption Case Verdict

May 21, 2025 -

Juergen Klopps Return To Liverpool Before The Season Finale

May 21, 2025

Juergen Klopps Return To Liverpool Before The Season Finale

May 21, 2025 -

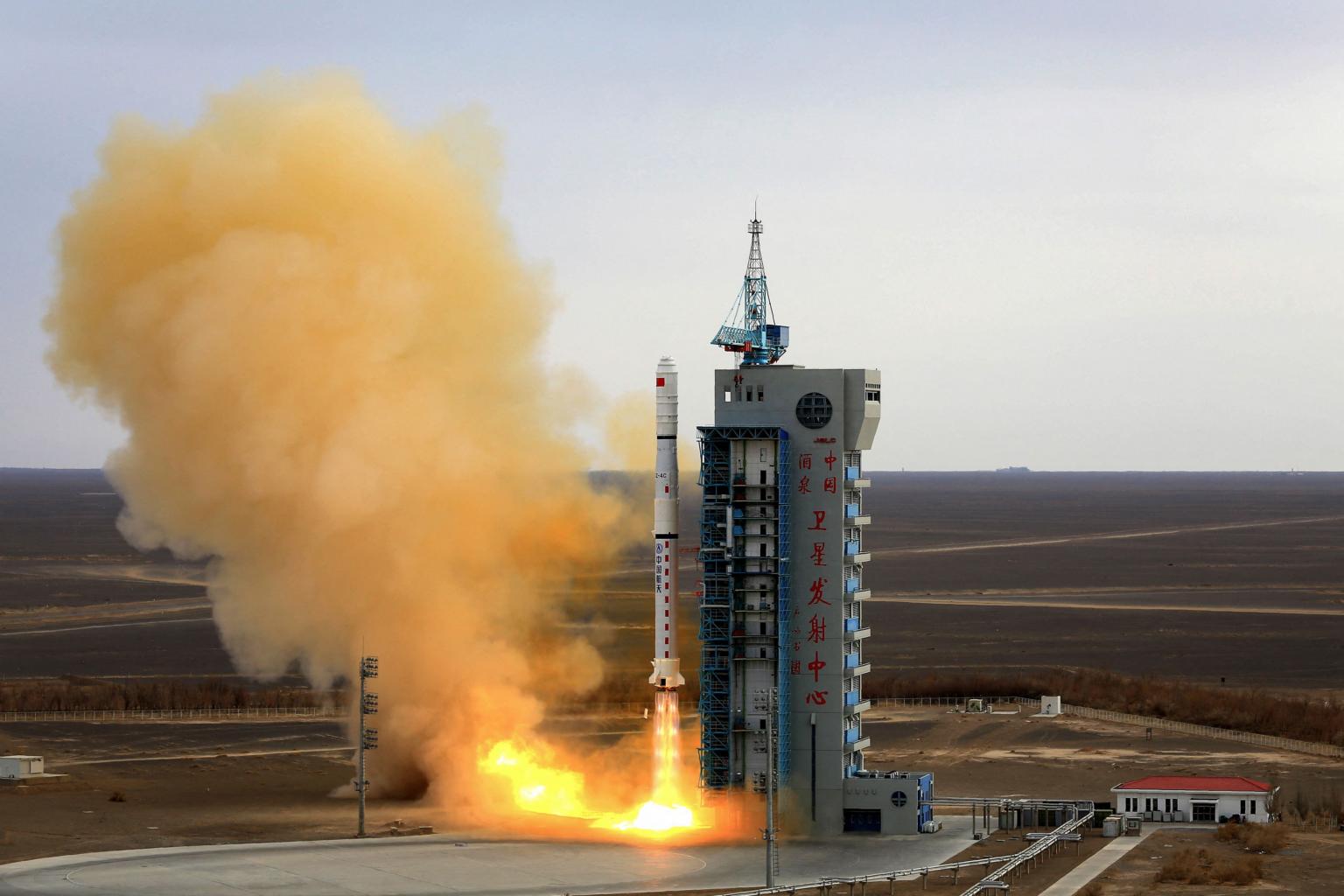

China Launches Initiative For Space Based Supercomputing

May 21, 2025

China Launches Initiative For Space Based Supercomputing

May 21, 2025