BigBear.ai Stock: A Detailed Look Before You Buy

Table of Contents

1. Introduction:

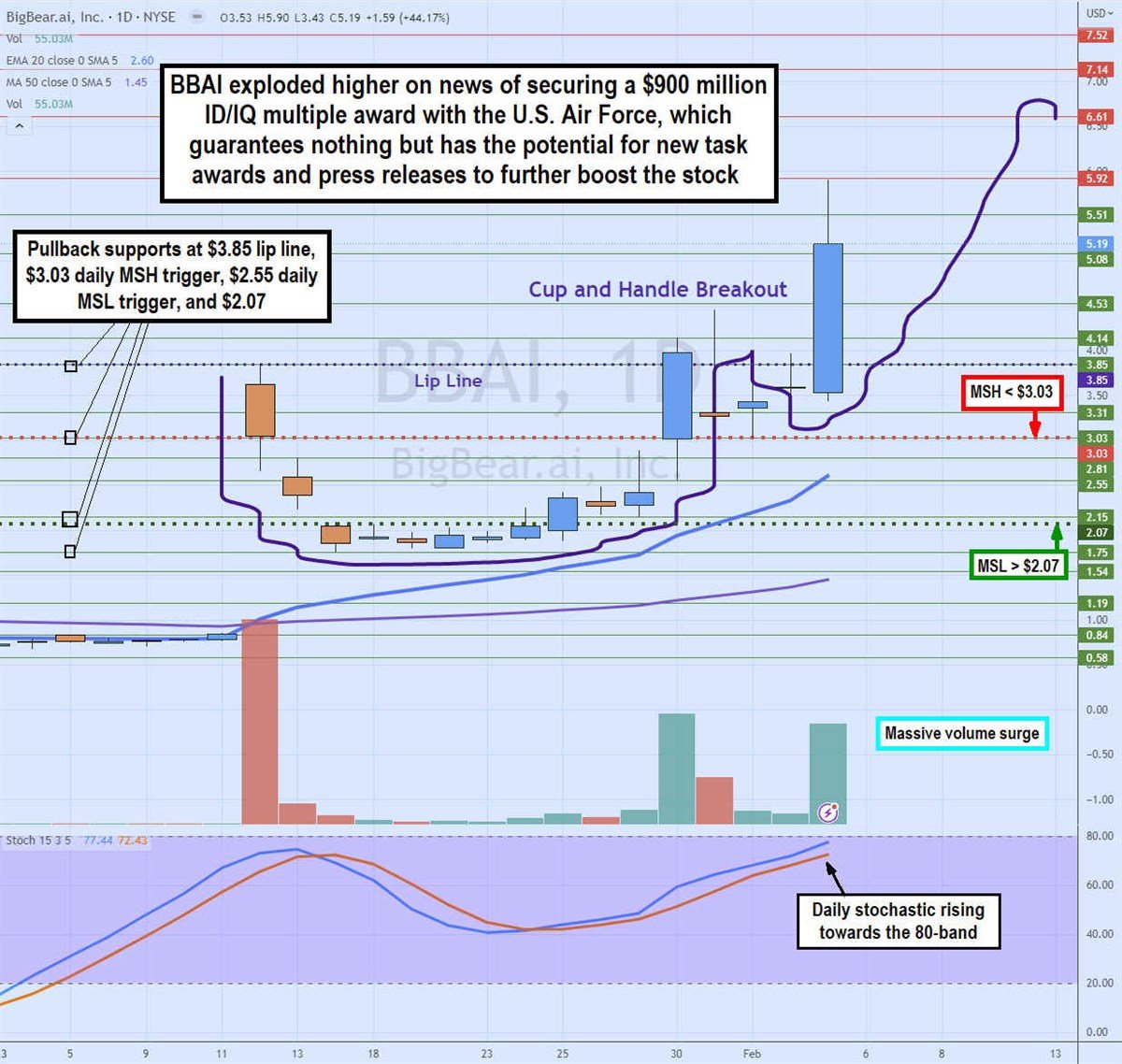

BigBear.ai (BBAI) is a leading provider of AI-powered solutions for government and commercial clients. The company leverages advanced technologies to deliver critical insights and drive decision-making across various sectors. This analysis delves into BigBear.ai's business model, financial performance, competitive landscape, and potential risks to help investors assess the viability of investing in BBAI stock.

2. Main Points:

H2: BigBear.ai's Business Model and Competitive Landscape:

H3: Government Contracts and Revenue Streams:

BigBear.ai significantly relies on government contracts for its revenue generation. While this provides a degree of stability, it also introduces inherent risks associated with government budget cycles and potential contract delays or cancellations. The company's success hinges on its ability to secure and maintain these contracts.

- Significant Contracts: BigBear.ai has secured numerous substantial contracts with various government agencies, including contracts related to national security and intelligence.

- Revenue Split: A large percentage of BigBear.ai's revenue stems from government contracts, making it crucial to monitor the stability of these partnerships. The proportion allocated to commercial clients needs careful consideration.

- Contract Renewals: The likelihood of contract renewals is a critical factor influencing the long-term financial stability of BigBear.ai.

H3: Competition and Market Share:

BigBear.ai operates in a competitive landscape, facing established players and emerging startups in both the AI and government technology sectors. Understanding the competitive dynamics is vital for evaluating BBAI's market share and growth prospects.

- Key Competitors: Competitors include companies offering similar AI-powered solutions, particularly within the government and defense sectors. Direct comparisons require in-depth analysis of their market capitalization and technological capabilities.

- Market Capitalization: Analyzing the market capitalization of BigBear.ai relative to its competitors provides context for its valuation and growth potential within the AI market.

- Competitive Advantages: BigBear.ai's success depends on maintaining a competitive edge, either through technological innovation, specialized expertise, or strong client relationships.

H2: Financial Performance and Valuation:

H3: Revenue Growth and Profitability:

Analyzing BigBear.ai's financial statements—revenue, earnings, and cash flow—is essential to understanding its past performance and projecting future potential. Consistent revenue growth and improving profitability are key indicators of a healthy and sustainable business.

- Key Financial Metrics: Investors should closely monitor key metrics such as revenue growth rate, earnings per share (EPS), and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) to assess financial health.

- Financial Ratios: Analyzing financial ratios like profit margins and return on equity provides insights into BigBear.ai's operational efficiency and profitability.

- Industry Benchmarks: Comparing BigBear.ai's financial performance to industry averages helps gauge its relative strength and potential for future growth.

H3: Stock Valuation and Price-to-Earnings Ratio (P/E):

Evaluating BigBear.ai's stock valuation involves assessing its price-to-earnings (P/E) ratio and comparing it to industry benchmarks and competitors. A high P/E ratio might suggest overvaluation, while a low P/E ratio could indicate undervaluation. However, this needs to be considered in conjunction with growth prospects.

- P/E Ratio: The P/E ratio is a crucial metric for comparing BigBear.ai's valuation to its competitors and the broader market.

- Competitor Comparison: A comparative analysis of P/E ratios among BigBear.ai and its competitors helps determine whether BBAI is overvalued or undervalued relative to its peers.

- Future Earnings: Growth prospects and projected future earnings play a vital role in determining the reasonableness of BigBear.ai's current valuation.

H2: Risks and Potential Downsides of Investing in BigBear.ai Stock:

H3: Dependence on Government Contracts:

BigBear.ai's substantial reliance on government contracts exposes it to significant risks, including budget cuts, contract delays, and potential cancellations. Diversification into commercial clients is crucial for mitigating these risks.

- Contract Loss Risk: The potential loss of major government contracts could have a substantial negative impact on BigBear.ai's revenue and financial stability.

- Government Policy Changes: Shifts in government priorities and policy changes could significantly influence the demand for BigBear.ai's services.

- Diversification Strategies: The company's efforts to diversify its revenue streams beyond government contracts are crucial for long-term sustainability.

H3: Competition and Market Saturation:

The AI market is highly competitive, with numerous established players and new entrants constantly emerging. Market saturation poses a significant risk, potentially leading to price wars and reduced profit margins.

- New Entrants: The entry of new competitors with innovative technologies could put pressure on BigBear.ai's market share and profitability.

- Price Wars: Intense competition could trigger price wars, eroding profit margins and impacting the financial performance of BigBear.ai.

- Continuous Innovation: To maintain a competitive edge, BigBear.ai needs to continuously innovate and adapt to the evolving technological landscape.

H3: Technological Disruptions:

Rapid advancements in AI technology could render BigBear.ai's current offerings obsolete, requiring substantial investment in research and development (R&D) to remain competitive.

- Emerging Technologies: The emergence of new and disruptive technologies poses a significant threat to BigBear.ai's long-term viability.

- R&D Investment: Significant R&D investment is crucial for BigBear.ai to stay at the forefront of technological advancements and maintain its competitive position.

- Adaptability: The company's ability to adapt to technological changes and incorporate new innovations into its products and services is critical for its survival.

3. Conclusion:

Investing in BigBear.ai stock (BBAI) presents both opportunities and significant risks. The company's strong reliance on government contracts, while providing stability, also exposes it to the volatility of government spending. The competitive landscape demands continuous innovation and adaptation. Thorough due diligence, including a careful review of financial statements, competitive analysis, and risk assessment, is crucial before making any investment decision. Remember, this analysis is for educational purposes only and does not constitute financial advice. Consult with a financial advisor before investing in BigBear.ai stock or any other AI stock, considering the potential rewards and inherent risks involved. Always perform your own thorough research before investing in BigBear.ai stock.

Featured Posts

-

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Retinere

May 21, 2025

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Retinere

May 21, 2025 -

Occasionverkoop Abn Amro Stijgt Significant Analyse Van De Markt

May 21, 2025

Occasionverkoop Abn Amro Stijgt Significant Analyse Van De Markt

May 21, 2025 -

Former Navy Second In Command Sentenced In Major Corruption Scandal

May 21, 2025

Former Navy Second In Command Sentenced In Major Corruption Scandal

May 21, 2025 -

Occasionverkoop Abn Amro Neemt Flink Toe Analyse Van De Markt

May 21, 2025

Occasionverkoop Abn Amro Neemt Flink Toe Analyse Van De Markt

May 21, 2025 -

Understanding The Enduring Appeal Of The Goldbergs

May 21, 2025

Understanding The Enduring Appeal Of The Goldbergs

May 21, 2025