BigBear.ai Stock: Buy, Sell, Or Hold?

Table of Contents

BigBear.ai's Financial Performance and Valuation

Understanding BigBear.ai's financial health is paramount to any investment decision. Analyzing its financials provides crucial insights into its stability and future potential. Let's examine key financial metrics:

- Revenue Growth: Analyze recent quarterly and annual reports to determine the trend in revenue generation. Is revenue increasing steadily, indicating strong growth, or stagnating, raising concerns?

- Profitability: Examine profit margins, focusing on gross profit margin and operating profit margin. Is BigBear.ai consistently profitable, or is it operating at a loss? This is a critical indicator of its financial sustainability.

- Debt Levels: Assessing the level of debt BigBear.ai carries is essential. High debt levels can signify financial risk and potentially hinder future growth.

- Cash Flow: Strong positive cash flow demonstrates the company's ability to generate cash from its operations, indicating financial health and investment capacity.

Comparing BigBear.ai's valuation metrics (like Price-to-Earnings ratio (P/E) and Price-to-Sales ratio (P/S)) to its competitors within the artificial intelligence and big data analytics sector is also vital. Are its valuation multiples significantly higher or lower than those of its peers? This comparison provides context for its current valuation. Analyzing recent earnings calls and announcements is crucial, as these often provide insights into management's outlook and expectations for future performance impacting BBAI stock. This deep dive into BigBear.ai financials provides a strong basis for assessing the BBAI valuation.

Growth Prospects and Market Opportunities

BigBear.ai operates in the rapidly expanding artificial intelligence and big data analytics market, focusing heavily on government contracts. Evaluating its growth prospects requires examining several key factors:

- Market Position: What is BigBear.ai's competitive advantage in this crowded marketplace? What are its key strengths (e.g., specialized AI algorithms, strong government relationships) and weaknesses (e.g., reliance on government contracts, competition from larger players)?

- Market Potential: The AI market is experiencing exponential growth. BigBear.ai's ability to capitalize on this growth, particularly within the government sector, will significantly impact its future success. Consider factors like increasing government spending on technology and the growing demand for AI-powered solutions.

- Risks and Challenges: Several potential risks could hinder BigBear.ai's growth. These include:

- Intense competition from larger, more established companies in the AI sector.

- Potential for technological disruption rendering its current offerings obsolete.

- Regulatory hurdles and changes in government procurement policies.

- Dependence on a limited number of large government contracts.

Understanding these factors is crucial for assessing BigBear.ai growth and the BBAI market opportunity. A thorough analysis of BigBear.ai's competitive landscape is critical to understanding its long-term viability.

Analyst Ratings and Investor Sentiment

Understanding the collective opinion of financial analysts and the overall investor sentiment towards BigBear.ai is crucial.

- Analyst Ratings: Consult reputable financial news sources to get a consensus view on BBAI stock. What is the average price target for BBAI? What is the prevalent buy/sell/hold recommendation among analysts? A strong consensus indicating a positive outlook could positively influence the stock price.

- Investor Sentiment: Is the stock currently overbought or oversold? Are there significant short positions? Analyzing indicators like the Relative Strength Index (RSI) can help assess investor sentiment. News articles and press releases concerning BigBear.ai often reflect the prevailing investor sentiment. Understanding BigBear.ai analyst ratings and investor sentiment is crucial to getting a complete picture of the current state of affairs.

Risks and Considerations for Investors

Investing in BigBear.ai, like any stock, carries inherent risks. Understanding these is essential for making an informed investment decision. Key considerations include:

- High Volatility: BigBear.ai's stock price has historically exhibited significant volatility. This high volatility translates to substantial potential gains but also considerable potential losses.

- Government Contract Dependence: A large portion of BigBear.ai's revenue comes from government contracts. This reliance exposes the company to potential risks associated with government budget changes or shifting procurement priorities.

- Competition: The AI and big data analytics space is highly competitive. BigBear.ai faces competition from both established tech giants and smaller, more agile companies.

- Profitability Concerns: Evaluate the company's track record of profitability. Sustained losses or inconsistent profitability present significant financial risks.

- Potential for Dilution: The issuance of new shares can dilute existing shareholders' ownership, potentially affecting the stock price.

These are just some of the potential risks involved with investing in BigBear.ai stock. Understanding the BBAI potential risks is crucial before considering an investment.

Conclusion: BigBear.ai Stock: Your Investment Decision

Our analysis of BigBear.ai stock reveals a company operating in a high-growth sector but facing significant challenges and risks. While the potential for significant returns exists, the high volatility and dependence on government contracts are significant considerations. The decision to buy, sell, or hold BigBear.ai stock depends on your individual risk tolerance and investment goals. Consider the financial health, growth prospects, analyst sentiment, and inherent risks discussed above. Remember that this analysis is not financial advice; conduct your own thorough research before making any investment decisions. Share your thoughts on BigBear.ai stock in the comments below and continue researching BigBear.ai stock diligently to refine your investment strategy. Ultimately, the decision to buy, sell, or hold BigBear.ai stock is yours, but careful consideration of these factors should guide your investment strategy.

Featured Posts

-

Philippines And Us To Conduct Super Bowl Scale Balikatan Military Drills

May 20, 2025

Philippines And Us To Conduct Super Bowl Scale Balikatan Military Drills

May 20, 2025 -

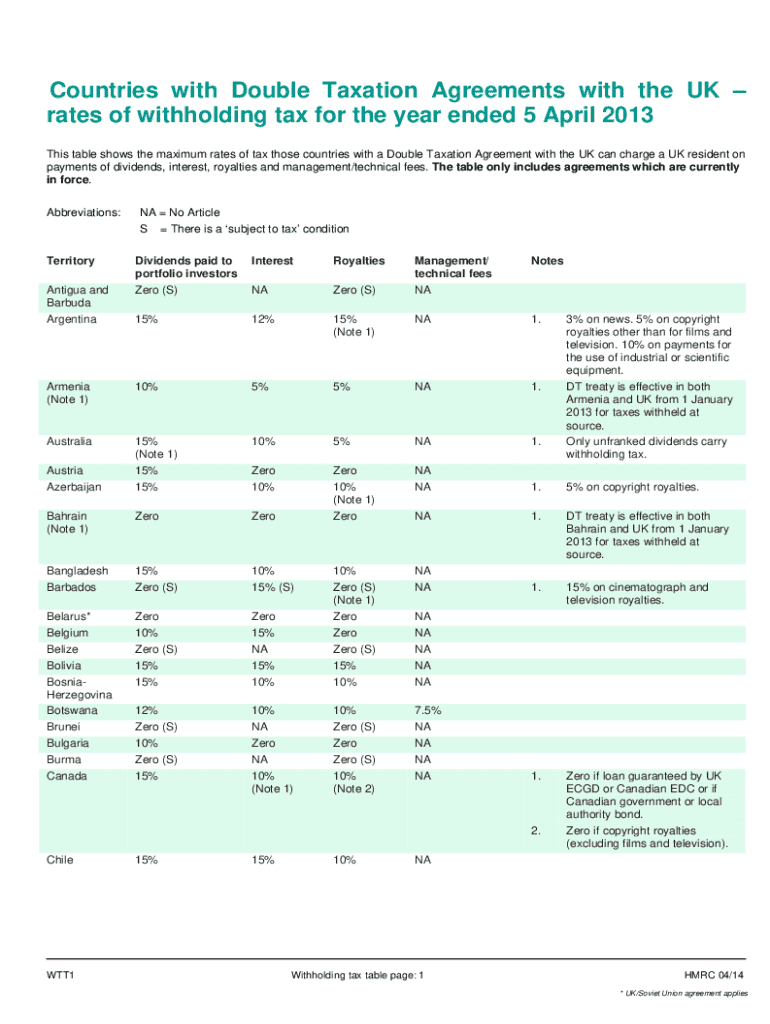

Hmrc Tax Return Changes Thousands Exempt This Week

May 20, 2025

Hmrc Tax Return Changes Thousands Exempt This Week

May 20, 2025 -

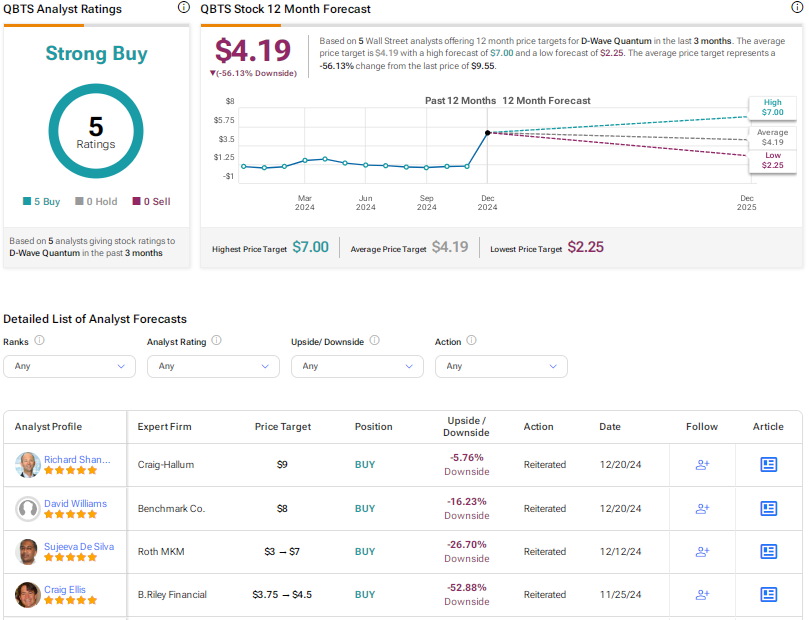

The D Wave Quantum Qbts Stock Drop On Monday Causes And Consequences

May 20, 2025

The D Wave Quantum Qbts Stock Drop On Monday Causes And Consequences

May 20, 2025 -

The Future Of An Abc News Show A Look At Post Layoff Plans

May 20, 2025

The Future Of An Abc News Show A Look At Post Layoff Plans

May 20, 2025 -

New Cliff Richard Musical The Challenge For Lucas And Walliams

May 20, 2025

New Cliff Richard Musical The Challenge For Lucas And Walliams

May 20, 2025