BigBear.ai Stock: Current Valuation And Future Potential

Table of Contents

Current Valuation of BigBear.ai Stock

Analyzing the Stock Price

As of [Insert Date], the BigBear.ai stock price is [Insert Current Price]. This compares to a 52-week high of [Insert 52-Week High] and a 52-week low of [Insert 52-Week Low]. Recent price movements have shown [Describe recent trends – e.g., a steady increase, a period of consolidation, a recent dip]. Understanding this historical context is vital when assessing the current valuation.

- Market Capitalization: [Insert Market Cap and source]

- P/E Ratio: [Insert P/E Ratio and source, explain significance]

- Analyst Ratings: [Summarize analyst ratings from reputable sources like Yahoo Finance, Bloomberg, etc., mentioning average target price if available].

Factors Affecting Current Valuation

Several factors contribute to BigBear.ai's current stock valuation. Positive influences include:

- Contract Wins: BigBear.ai's success in securing government and commercial contracts significantly impacts investor confidence and directly affects revenue projections. [Include specific examples of recent large contracts if available and their estimated value].

- Revenue Growth: Consistent revenue growth demonstrates the company's ability to generate income and expand its market share. [Cite revenue figures from financial reports and compare year-over-year growth].

However, negative factors include:

- Competition: The AI and cybersecurity sectors are highly competitive. BigBear.ai faces competition from established players with substantial resources. [Name key competitors and briefly describe their competitive advantages].

- Market Sentiment: Overall market conditions and investor sentiment towards the technology sector can heavily influence BigBear.ai's stock price, regardless of the company's performance. [Mention any relevant market trends that may be affecting the stock].

BigBear.ai's Business Model and Competitive Landscape

Core Business and Technology

BigBear.ai offers a range of solutions leveraging AI, data analytics, and cybersecurity expertise. Its core offerings include:

- Advanced Analytics: Utilizing AI and machine learning for data analysis and predictive modeling.

- Cybersecurity Solutions: Providing advanced threat detection and response capabilities.

- Data-Driven Decision Making: Helping clients utilize data to improve operations and strategic planning.

BigBear.ai primarily targets government agencies and commercial enterprises seeking cutting-edge data analytics and cybersecurity solutions. Its client base includes [Mention notable clients if publicly available].

Competitive Analysis

BigBear.ai operates in a competitive market, facing challenges from established players like [List major competitors, e.g., Palantir, Booz Allen Hamilton]. However, BigBear.ai possesses certain competitive advantages:

- Specialized Expertise: Its focus on niche areas within AI and cybersecurity provides a degree of specialization that differentiates it from broader competitors.

- Government Contracts: A strong portfolio of government contracts provides a stable revenue stream and credibility within the sector.

- Technological Innovation: Continuous investment in R&D allows BigBear.ai to remain at the forefront of technological advancements.

Future Potential and Growth Prospects for BigBear.ai

Growth Drivers

Several factors could drive future growth for BigBear.ai:

- New Contract Acquisitions: Securing additional large contracts, particularly in high-growth areas, will significantly boost revenue.

- Market Expansion: Expanding into new markets (both geographically and sector-wise) presents substantial growth opportunities.

- Technological Advancements: Continuous innovation and development of new AI and cybersecurity solutions will attract new clients and enhance its competitive position.

- Strategic Partnerships: Collaborations with other technology companies could expand its reach and capabilities. [Mention any existing or potential partnerships].

Risks and Challenges

Despite its potential, BigBear.ai faces significant risks:

- Intense Competition: The competitive landscape could pressure profit margins and hinder growth.

- Regulatory Hurdles: Government regulations and compliance requirements could impact operations and growth prospects.

- Financial Performance: Maintaining consistent profitability and financial stability is crucial for long-term success.

- Technological Disruption: Rapid technological advancements could render existing technologies obsolete, requiring significant investment in adaptation.

Conclusion

BigBear.ai stock presents a complex investment proposition. While its technological capabilities and government contracts provide a foundation for growth, the competitive landscape and inherent risks in the technology sector must be considered. The current valuation reflects a mix of positive and negative factors, making thorough due diligence essential before investing.

While BigBear.ai stock presents intriguing potential, thorough due diligence is crucial before making any investment decisions. Continue your research on BigBear.ai stock and consider consulting with a financial advisor before investing. Remember that this analysis is for informational purposes only and not financial advice.

Featured Posts

-

Manchester City Eyes Arsenal Great To Take Over From Guardiola

May 21, 2025

Manchester City Eyes Arsenal Great To Take Over From Guardiola

May 21, 2025 -

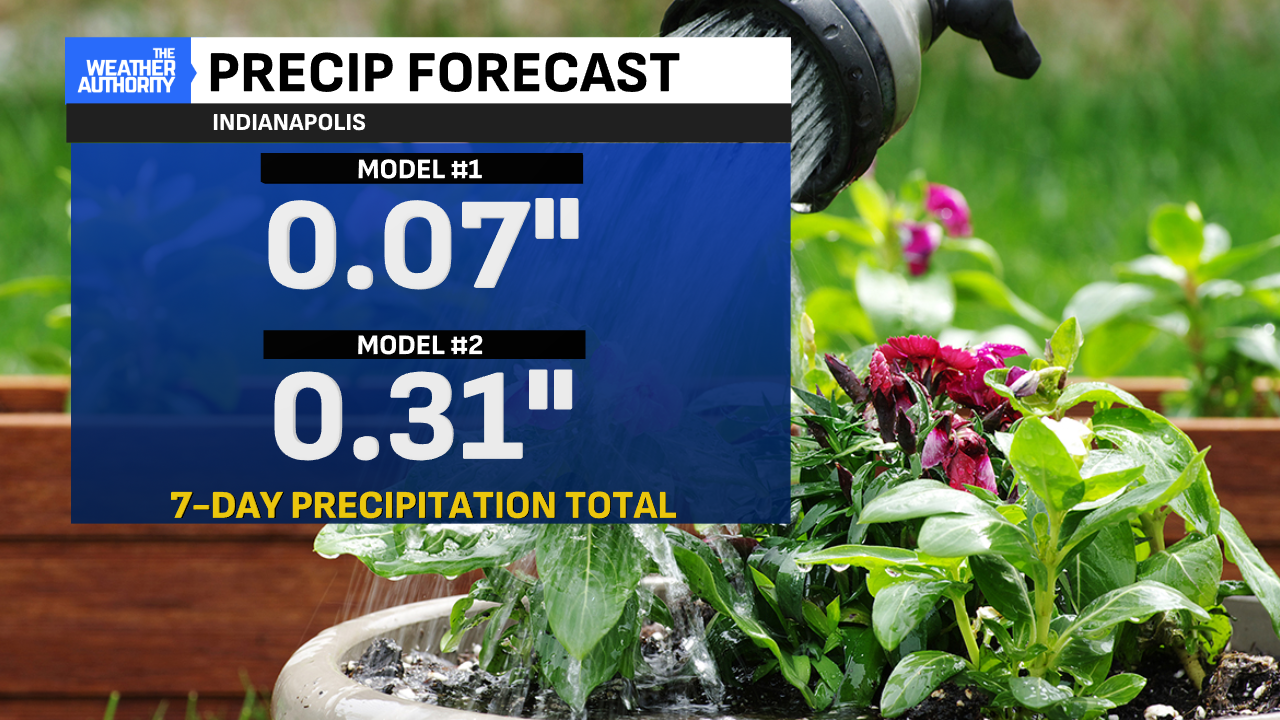

Rain Predictions The Most Accurate Timing For Showers

May 21, 2025

Rain Predictions The Most Accurate Timing For Showers

May 21, 2025 -

Nyt Mini Crossword April 26 2025 Helpful Hints

May 21, 2025

Nyt Mini Crossword April 26 2025 Helpful Hints

May 21, 2025 -

Southern French Alps Experience A Report On Recent Storm And Snow

May 21, 2025

Southern French Alps Experience A Report On Recent Storm And Snow

May 21, 2025 -

Abn Amro Kwartaalcijfers Impact Op De Aex Index

May 21, 2025

Abn Amro Kwartaalcijfers Impact Op De Aex Index

May 21, 2025