BigBear.ai Stock Performance And Future Outlook

Table of Contents

BigBear.ai's Recent Stock Performance

Analyzing Price Fluctuations

BigBear.ai's stock price, like many AI stocks, has exhibited volatility. Analyzing its performance requires examining both short-term and long-term trends. To accurately assess the BigBear.ai stock price, we need to consider several key data points from reliable financial sources like Yahoo Finance and Google Finance.

- Stock price on October 26, 2023: [Insert current price – requires real-time data]. This should be checked and updated regularly.

- Year-to-date performance (as of October 26, 2023): [Insert YTD percentage change – requires real-time data]. This will fluctuate daily.

- Quarterly performance (Q3 2023): [Insert Q3 percentage change – requires real-time data]. This should be updated when Q3 results are officially released.

- One-year performance: [Insert one-year percentage change – requires real-time data]. This is a key metric for long-term investors.

Key Factors Influencing Stock Price

Several factors contribute to the fluctuations in BigBear.ai's stock price:

- Market trends: The overall performance of the stock market and the broader technology sector, particularly the AI sub-sector, significantly impacts BigBear.ai's stock price. A bullish market generally benefits tech stocks.

- Company news: Positive news, such as winning significant government contracts, forging strategic partnerships, or announcing technological breakthroughs, tends to boost investor confidence and the stock price. Conversely, negative news can lead to price drops.

- Investor sentiment: Investor sentiment, influenced by news, financial reports, and analyst ratings, plays a crucial role. High trading volume often suggests strong investor interest, though it can be bullish or bearish depending on the context. Analyzing analyst ratings from reputable firms can also provide valuable insights into investor sentiment and expectations.

BigBear.ai's Competitive Landscape

Market Position and Share

BigBear.ai operates within a competitive AI and data analytics market. Precise market share figures are often difficult to obtain definitively. However, analyzing its position requires considering:

- Market share analysis: While precise figures are hard to find publicly, analyzing its customer base size, contract values, and public statements gives an indication of its market standing compared to competitors like Palantir Technologies or CACI International.

- Competitive advantages: BigBear.ai's strengths may include its specialized AI solutions for government and defense sectors, its proprietary technology, and its strong client relationships.

- Competitive disadvantages: Potential disadvantages might involve competition from larger, more established players with broader resources and a potentially larger market reach.

Growth Opportunities and Challenges

BigBear.ai faces both significant opportunities and considerable challenges:

- New market entry strategies: Expanding into new sectors like healthcare or finance could offer considerable growth potential.

- Technological innovation pipeline: Continuous investment in R&D is essential to maintain a competitive edge and develop cutting-edge AI solutions.

- Potential threats to market share: Intense competition and rapid technological advancements pose ongoing risks to BigBear.ai's market position. Maintaining a strong innovation pipeline is therefore critical.

Future Outlook and Investment Considerations

Growth Projections and Financial Forecasts

Projecting BigBear.ai's future growth requires considering several factors:

- Revenue projections: Analyzing financial statements and analyst reports provides estimates of future revenue growth. (Note: This requires accessing and analyzing financial reports, which are readily available online).

- Earnings per share (EPS) estimates: EPS projections indicate the company's profitability and are a key metric for investors. (Note: This requires accessing and analyzing financial reports).

- Potential for dividend payouts: This is highly dependent on the company's financial performance and strategic objectives and should be reviewed in their financial reports.

Risk Assessment and Investment Advice

Investing in BigBear.ai stock involves inherent risks:

- Market risk: The overall stock market's volatility affects BigBear.ai's price.

- Company-specific risks: Failure to secure new contracts, competition, technological disruption, and regulatory changes all pose risks.

- Diversification strategies: To mitigate risk, diversification of investments across different asset classes is highly recommended.

Conclusion

BigBear.ai's stock performance is influenced by a complex interplay of market trends, company-specific events, and investor sentiment. While the company possesses promising growth opportunities in the AI sector, investing in BigBear.ai stock carries inherent risks. This analysis highlights the importance of conducting thorough due diligence, understanding the competitive landscape, and assessing your personal risk tolerance before making any investment decisions. Remember to consult a financial advisor for personalized investment guidance and always refer to BigBear.ai's investor relations website for the most up-to-date information. This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in BigBear.ai stock or any other security.

Featured Posts

-

Cours D Ecriture Inspires D Agatha Christie Par Ia Une Analyse

May 20, 2025

Cours D Ecriture Inspires D Agatha Christie Par Ia Une Analyse

May 20, 2025 -

Old North State Report Key Findings For May 9 2025

May 20, 2025

Old North State Report Key Findings For May 9 2025

May 20, 2025 -

Port Autonome D Abidjan Bilan 2022 Et Perspectives

May 20, 2025

Port Autonome D Abidjan Bilan 2022 Et Perspectives

May 20, 2025 -

Sasol Sol Investor Concerns Following 2023 Strategy Presentation

May 20, 2025

Sasol Sol Investor Concerns Following 2023 Strategy Presentation

May 20, 2025 -

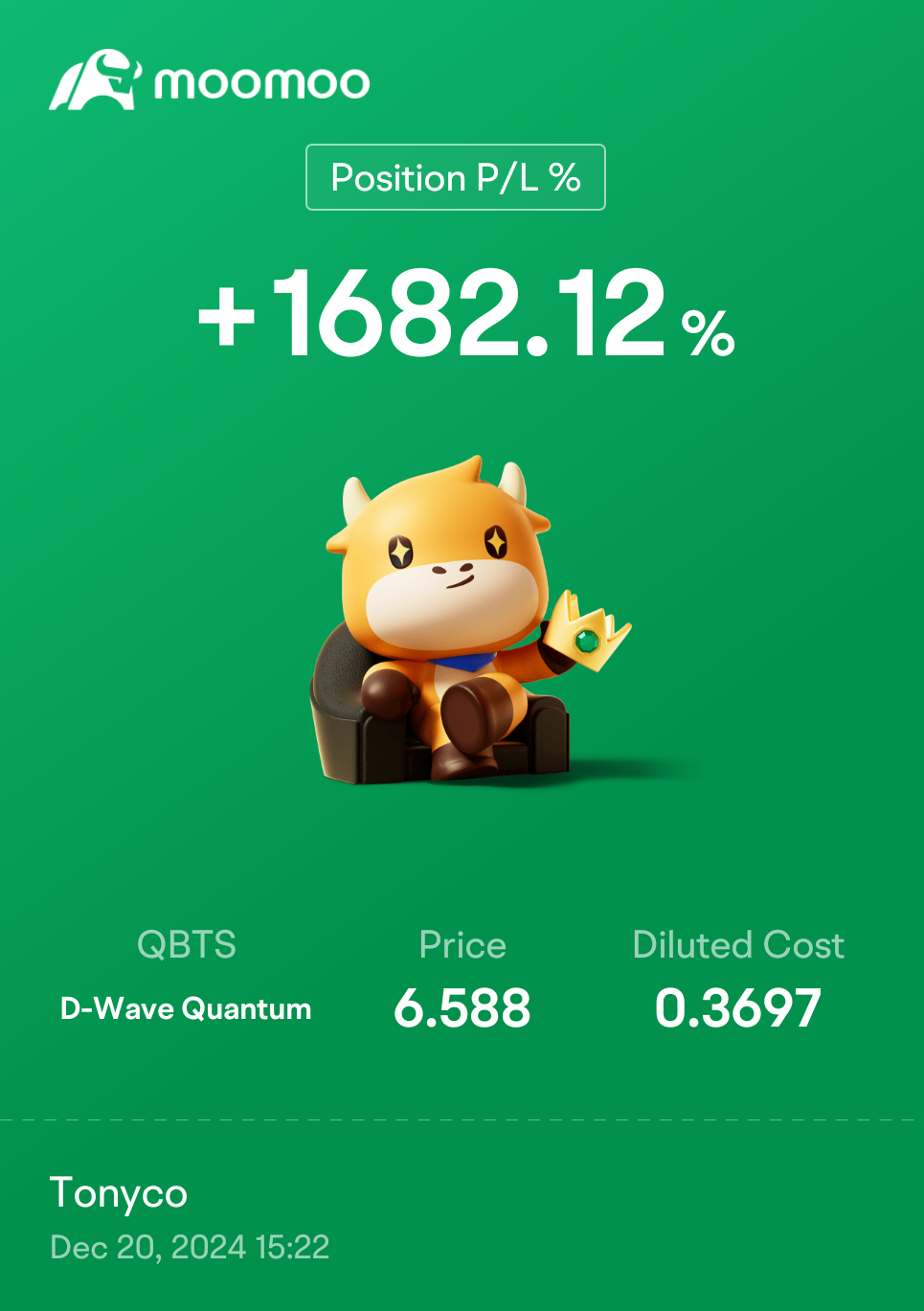

What Drove The Increase In D Wave Quantum Qbts Stock Price Today

May 20, 2025

What Drove The Increase In D Wave Quantum Qbts Stock Price Today

May 20, 2025