BigBear.ai Stock Plunges Following Disappointing Q1 Earnings

Table of Contents

Q1 Earnings Miss Expectations: A Detailed Breakdown

BigBear.ai's Q1 2024 earnings report revealed several key metrics that fell significantly short of analysts' expectations, leading to the BigBear.ai stock plunge. The revenue shortfall was particularly striking, with reported revenue of [Insert Actual Revenue] against analyst consensus estimates of [Insert Analyst Estimate]. This represents a [Insert Percentage]% difference. Furthermore, the company's earnings per share (EPS) also missed projections, coming in at [Insert Actual EPS] compared to the anticipated [Insert Analyst Estimate]. This disappointing performance was exacerbated by lower-than-expected gross margins.

Key disappointments from the Q1 earnings report include:

- Revenue significantly below projections: A substantial gap between actual and projected revenue highlights challenges in securing and delivering contracts.

- Lower-than-expected gross margins: This suggests potential issues with cost management and pricing strategies.

- Increased operating expenses: Rising operational costs further compressed profitability.

The company's official press release stated, "[Insert relevant quote from the company's press release regarding the Q1 results and outlook. Attribute the quote properly – e.g., 'According to CEO [CEO Name], ...']". This statement underscores the company's acknowledgement of the challenges faced during the quarter. The combination of lower revenue, compressed margins, and increased expenses created a perfect storm resulting in the BigBear.ai stock plummet.

Market Reaction and Investor Sentiment: The BigBear.ai Stock Plummet

The announcement of BigBear.ai's disappointing Q1 earnings immediately sent shockwaves through the market. The BigBear.ai stock price plummeted [Insert Percentage]% in a single day, accompanied by a surge in trading volume. Investor sentiment shifted dramatically, with fear, uncertainty, and doubt (FUD) pervading the market. This negative sentiment was further fueled by several analyst downgrades and price target reductions. The overall market reaction reflected a significant loss of confidence in the company's short-term prospects.

The market's reaction to the BigBear.ai stock plunge can be summarized as follows:

- Sharp decline in stock price: A dramatic and immediate drop in the share price.

- Increased trading volume: High trading activity suggests significant investor reaction and repositioning.

- Negative media coverage: Widespread negative news coverage amplified the negative sentiment.

- Analyst reactions and ratings changes: Several analysts downgraded the stock, reflecting their diminished outlook.

Analysis of Contributing Factors: Why Did BigBear.ai Stock Fall?

Several factors likely contributed to BigBear.ai's disappointing Q1 results and the subsequent BigBear.ai stock plunge. Macroeconomic headwinds, such as a potential economic slowdown and persistent inflation, may have impacted customer spending and contract signings. Additionally, increased competition within the AI market and challenges in securing new contracts likely played a significant role. Furthermore, unexpected delays in project execution and higher-than-anticipated operating costs likely further strained profitability.

Potential factors contributing to the BigBear.ai stock fall include:

- Increased competition in the AI market: Intense competition from established players and emerging startups.

- Challenges in securing new contracts: Difficulty winning new business in a competitive landscape.

- Unexpected delays in project execution: Project setbacks impacting revenue recognition and timelines.

- Higher-than-anticipated operating costs: Inefficient cost management impacting profitability.

Long-Term Outlook for BigBear.ai Stock: Future Predictions and Opportunities

While the Q1 results were undoubtedly disappointing, it's crucial to consider the long-term outlook for BigBear.ai. The company operates in a rapidly growing market with significant potential for future growth. Strategic initiatives, such as [mention specific initiatives if available], and potential partnerships could offer avenues for improved performance. However, the company needs to address the challenges highlighted in the Q1 report to regain investor confidence. Successfully navigating the competitive landscape and improving operational efficiency will be critical for future success.

Assessing the BigBear.ai Stock Situation and Next Steps

In conclusion, the BigBear.ai stock plunge following the release of disappointing Q1 earnings reflects a significant market reaction to the company's underperformance. The combination of missed revenue projections, lower-than-expected gross margins, increased operating expenses, and intense market competition contributed to the sharp decline. While the short-term outlook remains uncertain, the long-term potential of BigBear.ai within the AI and big data analytics sector warrants continued monitoring. To stay informed about BigBear.ai's stock performance and future announcements, follow the company's investor relations website and reputable financial news outlets. Keep a close eye on BigBear.ai stock for further updates and developments.

Featured Posts

-

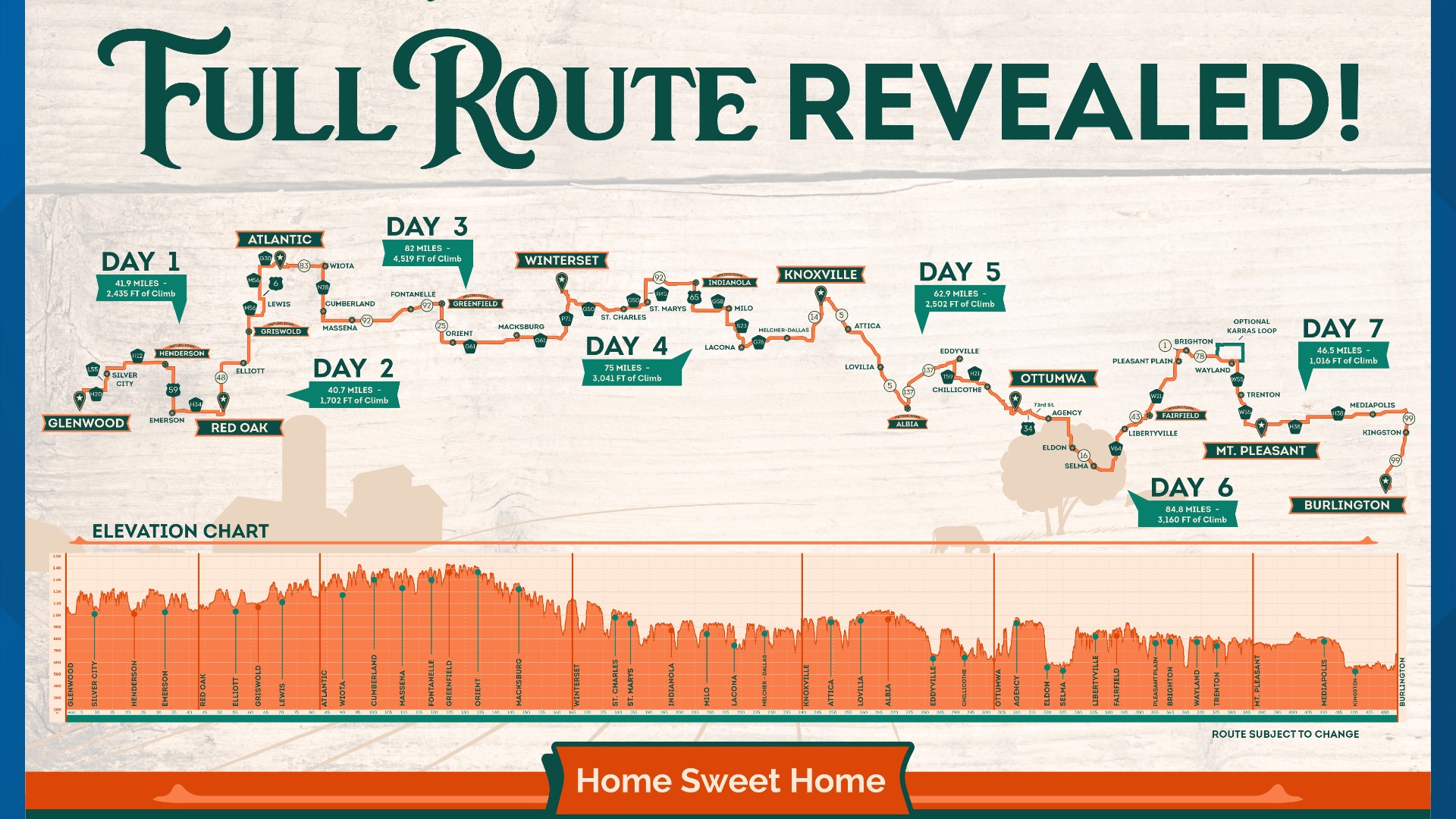

Scott Savilles Cycling Journey From Ragbrai To Daily Commute

May 20, 2025

Scott Savilles Cycling Journey From Ragbrai To Daily Commute

May 20, 2025 -

Cunha To Man Utd Transfer Latest And Potential Alternatives

May 20, 2025

Cunha To Man Utd Transfer Latest And Potential Alternatives

May 20, 2025 -

Familia Schumacher Se Mareste Prima Fotografie Cu Noul Membru

May 20, 2025

Familia Schumacher Se Mareste Prima Fotografie Cu Noul Membru

May 20, 2025 -

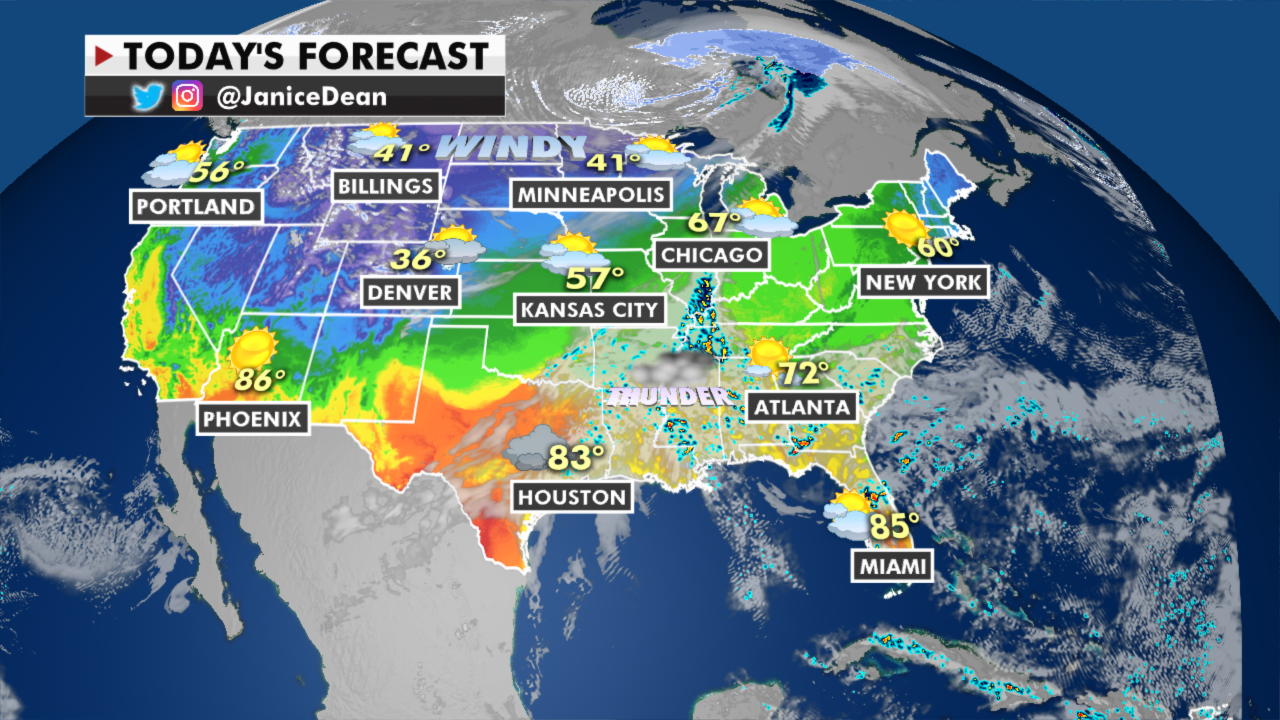

Updated Rain Forecast Check The Latest Predictions

May 20, 2025

Updated Rain Forecast Check The Latest Predictions

May 20, 2025 -

Update On Matheus Cunhas Potential Move To Man United

May 20, 2025

Update On Matheus Cunhas Potential Move To Man United

May 20, 2025