BigBear.ai Stock Price Drops Following Below-Expectations Q1 Report

Table of Contents

Q1 Earnings Miss Expectations: A Detailed Breakdown

BigBear.ai's Q1 2024 financial performance significantly missed analyst predictions, triggering the subsequent stock price volatility. Let's break down the key figures:

-

Revenue Shortfall: BigBear.ai reported Q1 revenue of [Insert Actual Revenue Figure Here], falling substantially short of the consensus analyst estimate of [Insert Analyst Estimate Here]. This represents a [Calculate Percentage] shortfall and a significant deviation from expectations.

-

EPS Disappointment: Earnings per share (EPS) came in at [Insert Actual EPS Figure Here], considerably lower than the anticipated [Insert Analyst Estimate Here]. This further fueled investor concerns regarding the company's profitability and financial health.

-

Year-over-Year Growth Stagnation: Year-over-year revenue growth was essentially flat, or even negative [Insert Percentage or state "negative growth"], highlighting a failure to gain significant traction in the market during the quarter. This lack of growth compared unfavorably to many competitors in the rapidly expanding AI sector.

-

Unexpected Expenses: The company cited [Insert Reason for Unexpected Expenses, e.g., increased R&D costs, one-time charges] as a contributing factor to the disappointing financial performance. This underscores the need for improved cost management and strategic resource allocation.

-

Competitive Landscape: Compared to competitors like [Mention 1-2 Competitors and their Q1 Performance], BigBear.ai's performance lagged behind, exacerbating investor apprehension.

Impact on Investor Sentiment and Stock Price Volatility

The disappointing Q1 earnings report triggered a significant negative reaction in the market, impacting both investor sentiment and BigBear.ai's stock price volatility.

-

Stock Price Plunge: Following the release of the earnings report, BigBear.ai's stock price plummeted by [Insert Percentage] within [ timeframe, e.g., a single trading day].

-

Increased Trading Volume: Trading volume surged significantly, indicating a heightened level of investor activity and a clear sell-off in response to the poor performance.

-

Analyst Downgrades: Several analysts downgraded their ratings and price targets for BigBear.ai stock, reflecting a diminished outlook for the company's near-term prospects. [Mention specific analysts and their actions if available].

-

Negative Media Coverage: Financial news outlets widely reported on the disappointing results, further contributing to the negative investor sentiment and reinforcing the market's pessimistic view.

-

Overall AI Sector Sentiment: While the broader AI sector is experiencing significant growth, BigBear.ai’s underperformance highlights the importance of strong execution and financial stability within even a booming market.

Management's Response and Future Outlook

BigBear.ai's management addressed the disappointing Q1 results, offering explanations and outlining their strategy for future growth.

-

Management Explanation: The company attributed the poor performance to [Summarize Management's Explanation - e.g., delays in contract awards, challenges in scaling operations].

-

Revised Guidance: Management offered revised guidance for the remainder of the year, suggesting [State the revised guidance – e.g., a more cautious outlook, lower revenue projections].

-

Growth Strategies: BigBear.ai outlined plans to improve performance, including [Mention Specific Strategies e.g., focusing on key market segments, streamlining operations, investing in new technologies].

-

Risk Factors: The company acknowledged several risk factors, such as [Mention Key Risk Factors, e.g., competition, economic uncertainty, dependence on specific contracts].

Long-Term Implications for BigBear.ai and the AI Sector

While the Q1 results were undeniably disappointing, the long-term implications for BigBear.ai and the broader AI sector remain complex and require careful consideration.

-

Long-Term Growth Potential: Despite the recent setback, BigBear.ai still possesses significant long-term growth potential within the rapidly expanding AI market. Its technology and expertise hold promise for future success.

-

Competitive Landscape: The AI industry is highly competitive, and BigBear.ai will need to innovate and differentiate itself to thrive.

-

Technological Advancements: Rapid technological advancements will continue to shape the AI landscape, presenting both opportunities and challenges for BigBear.ai.

-

Strategic Partnerships: Strategic partnerships and acquisitions could play a crucial role in enhancing BigBear.ai's capabilities and market reach.

Conclusion

BigBear.ai's disappointing Q1 2024 earnings report resulted in a significant stock price drop, driven by a revenue shortfall, lower-than-expected EPS, and a lack of year-over-year growth. While management has offered explanations and outlined strategies for improvement, investors remain cautious. The long-term prospects for BigBear.ai depend on its ability to execute its revised strategy, navigate the competitive landscape, and adapt to rapid technological advancements within the AI industry. Keep an eye on the BigBear.ai stock price, monitor BigBear.ai's Q2 earnings, and stay updated on the latest developments in BigBear.ai's AI solutions to make informed investment decisions.

Featured Posts

-

Top Ranked Sabalenka Triumphs At Madrid Open Overcoming Mertens

May 21, 2025

Top Ranked Sabalenka Triumphs At Madrid Open Overcoming Mertens

May 21, 2025 -

D Wave Quantum Qbts Stock Market Performance This Week Causes And Analysis

May 21, 2025

D Wave Quantum Qbts Stock Market Performance This Week Causes And Analysis

May 21, 2025 -

Four Star Admiral Burke Found Guilty Of Bribery

May 21, 2025

Four Star Admiral Burke Found Guilty Of Bribery

May 21, 2025 -

La Petite Italie De L Ouest Une Exploration De Son Architecture Toscane

May 21, 2025

La Petite Italie De L Ouest Une Exploration De Son Architecture Toscane

May 21, 2025 -

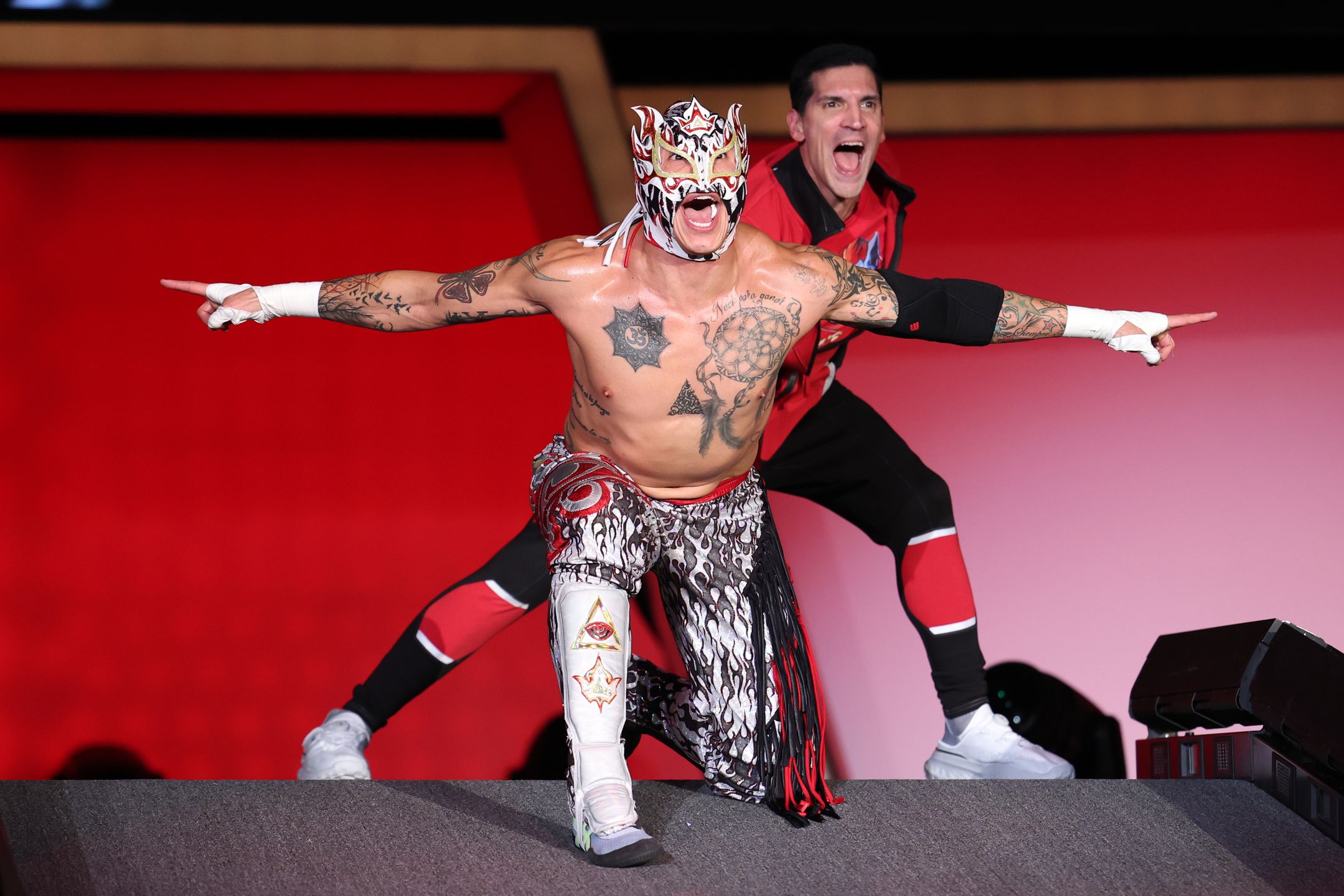

Rey Fenix Wwe Debut Smack Down Arrival And New Ring Name Confirmed

May 21, 2025

Rey Fenix Wwe Debut Smack Down Arrival And New Ring Name Confirmed

May 21, 2025