Big Oil Defiant: Production Levels Unchanged Before OPEC+ Announcement

Table of Contents

OPEC+ Meeting Looms Large: Anticipation and Uncertainty

The OPEC+ alliance, comprising the Organization of the Petroleum Exporting Countries (OPEC) and other major oil-producing nations like Russia, plays a pivotal role in shaping global oil markets. Their decisions on production quotas significantly influence crude oil prices, impacting economies worldwide. The anticipation leading up to this meeting is immense, fueled by fluctuating global demand, ongoing geopolitical tensions, particularly the ongoing conflict in Ukraine, and the ever-present uncertainty surrounding the global economy. Market speculation runs rampant, with predictions ranging from significant production cuts to surprising increases, creating a volatile environment for investors and consumers alike.

- Rising global oil demand: A recovering global economy, particularly in Asia, is driving up the demand for oil.

- Geopolitical instability impacting supply: The war in Ukraine continues to disrupt supply chains and create uncertainty in the global energy market. Sanctions on Russian oil have further tightened the supply.

- Investor anticipation of OPEC+ decision: Investors are closely watching the OPEC+ meeting, anticipating its impact on their portfolios.

- Potential price volatility: The uncertainty surrounding the OPEC+ decision contributes to significant price volatility in the oil markets.

Major Oil Producers Maintain Status Quo: Production Levels Remain Steady

Despite the looming OPEC+ meeting and the considerable market speculation, major oil producers, including Saudi Arabia and Russia, have seemingly chosen to maintain their current production levels. While precise figures vary depending on the source and the specific producer, initial reports suggest no significant changes in output. This decision is puzzling to many analysts. Are they confident in the strength of future market demand, or is there a more complex strategic game at play, possibly designed to influence the OPEC+ meeting itself? This unexpected stance highlights a significant departure from previous behavior where anticipation often preceded any production adjustments.

- Specific production numbers from key players: While precise, publicly available data may lag, initial reports suggest a continued status quo for Saudi Arabia and Russia's oil production. Further data will be released post-meeting.

- Reasons for unchanged production: Possible explanations range from a belief in sustained high demand to a strategic move to exert influence within the OPEC+ negotiations.

- Potential impact on global oil prices in the short term: The short-term impact is likely to be heightened volatility, as the market processes this unexpected decision.

Analysis of Market Reactions: Stock Prices and Investor Sentiment

The news of unchanged production levels has sent ripples through the financial markets. Initial reactions have been mixed, with some analysts interpreting the decision as bullish, while others remain cautious. Crude oil prices have experienced some volatility in response to the announcement. Similarly, stock prices of major oil companies have seen a fluctuating response, reflecting the uncertainty surrounding the future direction of the market. Investor sentiment appears divided, with some expressing surprise and concern while others maintain a more optimistic outlook.

- Changes in crude oil prices post-announcement: Initial reports show a moderate fluctuation in oil prices. Further monitoring is needed to assess the longer-term impact.

- Stock performance of major oil companies: Stock prices of major oil companies reflect the ongoing market uncertainty.

- Analyst comments and predictions: Analysts are offering a range of interpretations and forecasts, highlighting the complexity of the situation.

Potential Implications of Unchanged Production: A Look Ahead

The decision to maintain production levels before the OPEC+ announcement carries significant potential implications. Continued high production could lead to increased supply, potentially putting downward pressure on oil prices in the long term. Conversely, it could also signal a strategic move to influence negotiations and future price stability. The economic effects will be felt differently by oil-importing and oil-exporting nations, impacting inflation and energy security. Furthermore, this decision has long-term implications for investments in renewable energy sources and the overall energy transition.

- Impact on global oil supply and demand: Maintaining production levels could exacerbate existing supply and demand imbalances.

- Economic effects on oil-importing and oil-exporting nations: Oil-importing nations may benefit from lower prices, while oil-exporting nations may face revenue challenges.

- Future projections for oil prices: Predicting future oil prices remains challenging, given the various factors at play.

Big Oil's Defiance and the Road Ahead

In conclusion, major oil producers have defied expectations by not adjusting their production levels before the crucial OPEC+ meeting. This decision carries significant implications for global oil markets, potentially impacting prices, investor confidence, and the global economy. The upcoming OPEC+ announcement remains highly significant and will undoubtedly shape the future trajectory of oil prices and the energy sector. Stay informed about the OPEC+ decisions, oil production levels, and their impact on global oil markets by following updates on [Website Name/Relevant News Source]. Understanding these developments is critical for navigating the complexities of the global energy landscape.

Featured Posts

-

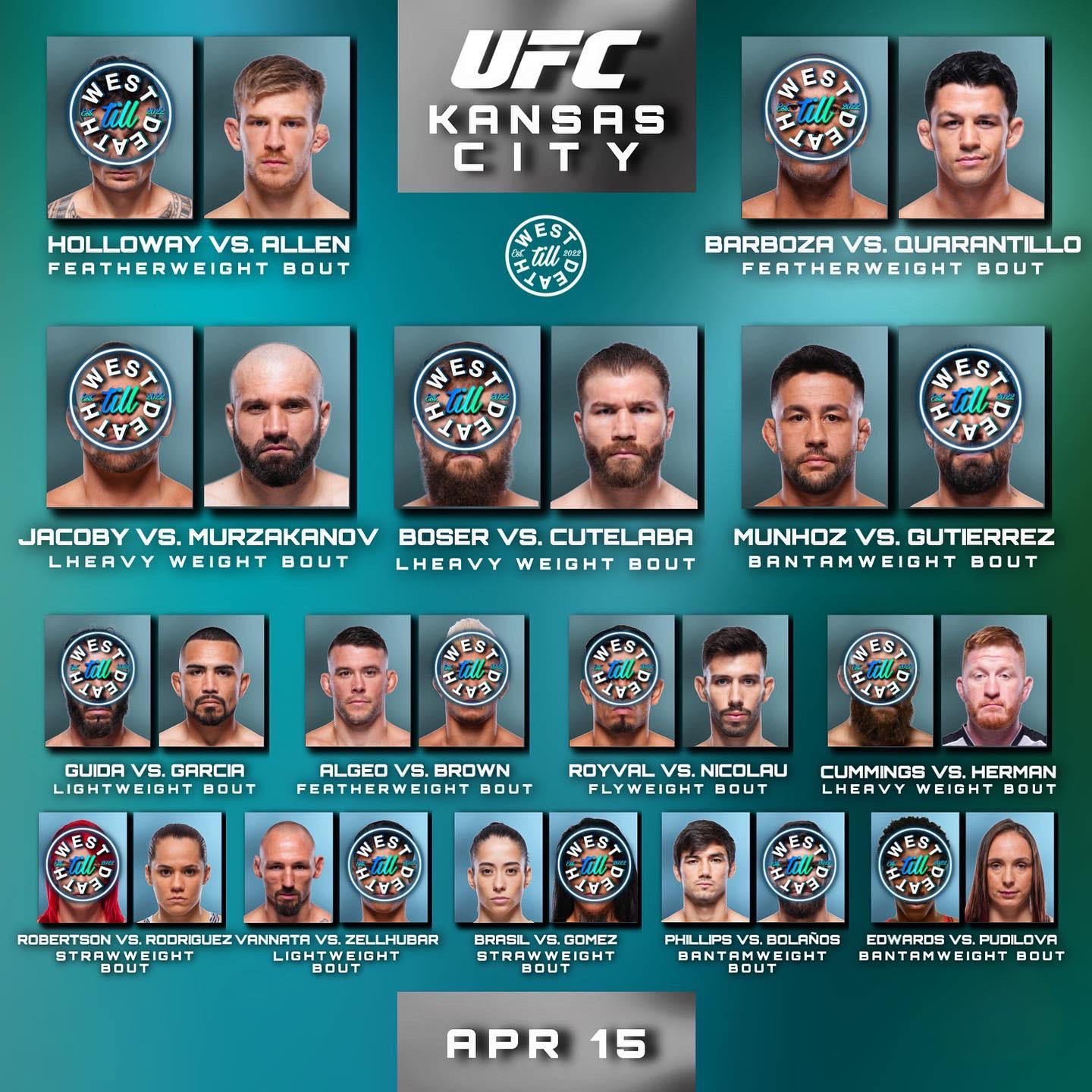

Ufc Kansas City Main Card Betting Odds Fighter Analysis And Predictions

May 05, 2025

Ufc Kansas City Main Card Betting Odds Fighter Analysis And Predictions

May 05, 2025 -

An In Depth Analysis Of The Count Of Monte Cristo

May 05, 2025

An In Depth Analysis Of The Count Of Monte Cristo

May 05, 2025 -

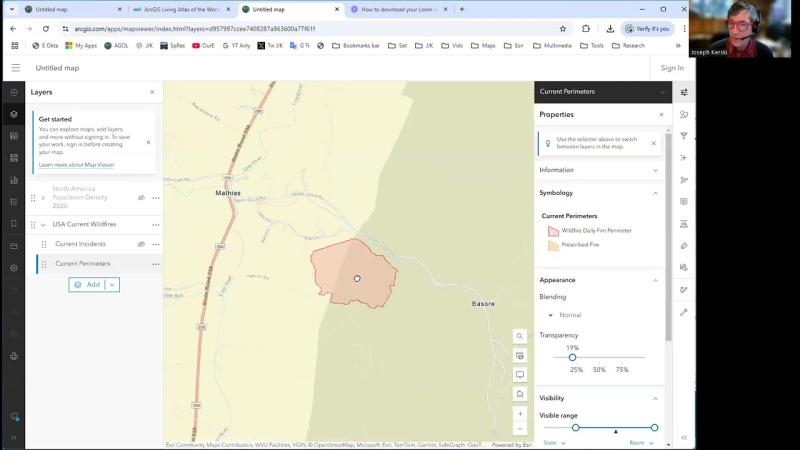

Gambling On Catastrophe Examining The Los Angeles Wildfires Betting Phenomenon

May 05, 2025

Gambling On Catastrophe Examining The Los Angeles Wildfires Betting Phenomenon

May 05, 2025 -

Britains Got Talent Ant And Dec Halt Live Show Twice Simon Cowell Furious

May 05, 2025

Britains Got Talent Ant And Dec Halt Live Show Twice Simon Cowell Furious

May 05, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6 Falsehoods Alleged

May 05, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6 Falsehoods Alleged

May 05, 2025