Big Wall Street Comeback: Bear Market Bets Upended

Table of Contents

This article will delve into the factors behind this surprising rally, analyze the miscalculations of those who bet against the market, and explore the outlook for sustained growth in the wake of this significant Wall Street rebound.

Unexpected Market Rally: Factors Driving the Big Wall Street Comeback

The recent market rally has surprised many, driven by a confluence of factors that exceeded even the most optimistic predictions. This "Big Wall Street Comeback" wasn't a singular event but a result of several positive economic shifts. The speed and intensity of the recovery have led to a reassessment of market forecasts and strategies.

-

Stronger-than-expected corporate earnings reports: Many major corporations exceeded expectations, showcasing resilience and adaptability in the face of economic headwinds. This positive news fueled investor confidence and spurred buying activity, contributing to the market rally. Data from Q2 2024 (replace with actual data when available) indicated a significant jump in earnings across various sectors, significantly exceeding analyst projections.

-

Easing inflation concerns: Although inflation remains a concern, recent data suggests a potential cooling trend. The Federal Reserve's interest rate hikes, while impacting borrowing costs, seem to be having a moderating effect on inflation. This has helped to alleviate some investor anxieties, boosting market sentiment and contributing to the Wall Street rebound.

-

Positive consumer sentiment data: Indicators of consumer spending and confidence show a surprising uptick. Despite persistent economic uncertainties, consumers continue to spend, suggesting a resilience that analysts had underestimated. This consumer confidence bolsters the economic recovery narrative, further fueling the market rally.

-

Government intervention/stimulus packages (if applicable): Depending on the actual time period, government interventions or stimulus packages may have played a significant role. If applicable, detail those initiatives and their influence on the market’s revival. These may include targeted financial aid for certain industries or broad-based economic stimulus measures.

-

Technological advancements and innovation driving growth in specific sectors: Innovation in key sectors like AI, renewable energy, and biotechnology continues to generate considerable excitement and investment, further propelling market growth and fostering this "Big Wall Street Comeback."

Bear Market Bets Gone Wrong: Analyzing the Miscalculations

The "Big Wall Street Comeback" has left many investors who bet against the market significantly disappointed. Strategies like short selling and purchasing put options, predicated on further market declines, have resulted in substantial losses. Several key miscalculations contributed to these failures:

-

Underestimation of resilience in certain sectors: The strength shown by some sectors, notably technology and consumer staples, significantly exceeded pessimistic forecasts. This highlights the limitations of broad market predictions and the importance of sector-specific analysis.

-

Overestimation of the impact of negative economic factors: While negative economic factors like inflation and interest rate hikes are real, their impact on the market was ultimately less severe than anticipated by many bear market investors. This underscores the complexities of economic forecasting and the potential for unforeseen market responses.

-

Unforeseen geopolitical events impacting the market: Geopolitical events can significantly influence market sentiment. While some events may have been predicted, their actual impact on investor behavior and market performance often defies accurate forecasting.

-

Market volatility and unexpected shifts in investor sentiment: Market volatility is inherent, and investor sentiment can shift rapidly based on new information or changing economic conditions. Predicting these shifts with complete accuracy is virtually impossible.

The Role of Institutional Investors in the Big Wall Street Comeback

Institutional investors, with their significant capital and resources, played a pivotal role in the recent market rebound. Their actions significantly influenced market sentiment and price movements.

-

Large-scale buying of undervalued assets: Institutional investors identified undervalued assets and engaged in large-scale buying, driving up prices and contributing to the overall market rally.

-

Shift in investment strategies from defensive to growth-oriented: As market sentiment improved, institutional investors shifted their strategies from defensive positions to more growth-oriented investments, further fueling the "Big Wall Street Comeback."

-

Impact of institutional investor confidence on smaller investors: The confidence displayed by institutional investors had a ripple effect, influencing the decisions of smaller investors and reinforcing positive market sentiment.

The Future Outlook: Sustaining the Big Wall Street Comeback

While the recent market rally is encouraging, it's crucial to acknowledge the uncertainties that remain. Sustaining this "Big Wall Street Comeback" will depend on several factors:

-

Ongoing inflation concerns and interest rate hikes: Inflation remains a significant concern, and further interest rate hikes by central banks could dampen economic growth and potentially trigger a market correction.

-

Geopolitical risks and global economic uncertainty: Geopolitical instability and global economic uncertainty pose significant challenges, potentially influencing investor sentiment and market performance.

-

Potential for future market corrections: Market corrections are a normal part of the investment cycle, and the possibility of a future correction remains a significant consideration.

-

Long-term growth prospects and opportunities: Despite the challenges, long-term growth prospects in certain sectors remain strong, presenting opportunities for investors with a long-term perspective.

Conclusion: Navigating the Aftermath of the Big Wall Street Comeback

The "Big Wall Street Comeback" has been a surprising and significant market event, upending many predictions and highlighting the complexities of economic forecasting. The factors driving this rally—stronger-than-expected earnings, easing inflation concerns, and positive consumer sentiment—have all contributed to this unexpected recovery. However, investors must remain vigilant, acknowledging the potential for future corrections and the continued presence of economic uncertainties. Understanding the dynamics of this Wall Street's surprising comeback is crucial for navigating the current market landscape. By carefully analyzing the market situation, adjusting investment strategies accordingly, and staying informed about the latest economic developments, you can effectively navigate the ongoing market dynamics and capitalize on future opportunities presented by a robust Wall Street. Don't let this "Big Wall Street Comeback" catch you off guard; stay informed and adapt your investment strategies to harness the potential of this dynamic market.

Featured Posts

-

Blowout Win Propels Celtics To Division Title

May 11, 2025

Blowout Win Propels Celtics To Division Title

May 11, 2025 -

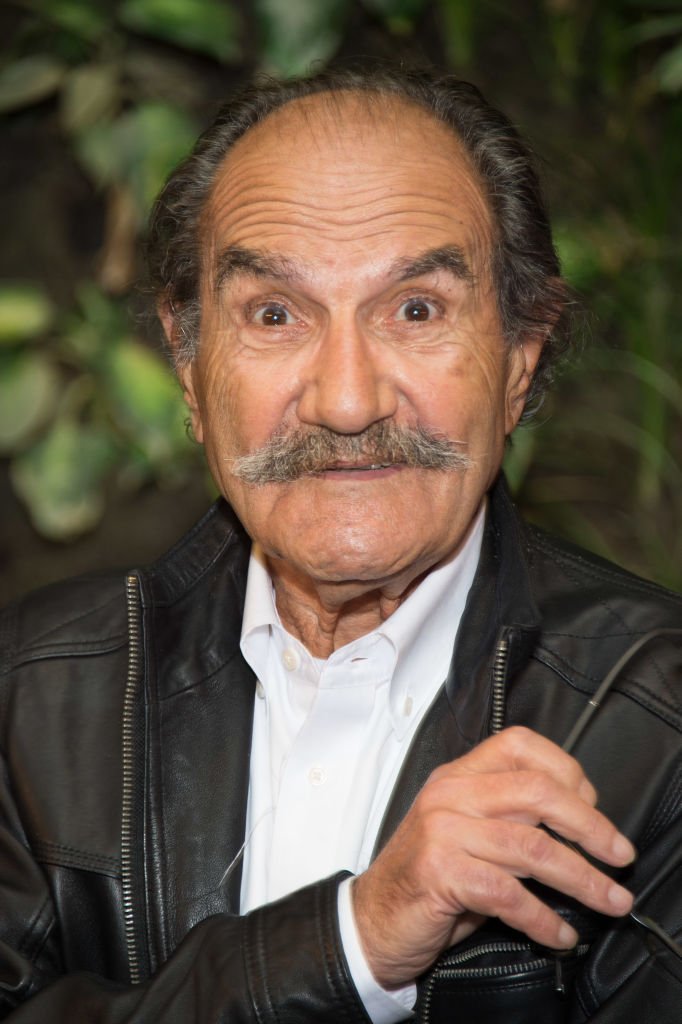

Scenes De Menages Gerard Hernandez Raconte Sa Relation Avec Chantal Ladesou

May 11, 2025

Scenes De Menages Gerard Hernandez Raconte Sa Relation Avec Chantal Ladesou

May 11, 2025 -

Juan Soto From Questioned Loyalty To Offensive Powerhouse

May 11, 2025

Juan Soto From Questioned Loyalty To Offensive Powerhouse

May 11, 2025 -

Landmark Agreement Ottawa Indigenous Capital Group And 10 Year Partnership

May 11, 2025

Landmark Agreement Ottawa Indigenous Capital Group And 10 Year Partnership

May 11, 2025 -

Ufc 315 Early Predictions Potential Fight Outcomes And Betting Odds

May 11, 2025

Ufc 315 Early Predictions Potential Fight Outcomes And Betting Odds

May 11, 2025