Bitcoin Golden Cross: A Rare Signal - What To Expect Next

Table of Contents

Understanding the Bitcoin Golden Cross

The Bitcoin Golden Cross is a technical analysis pattern that occurs when the 50-day moving average crosses above the 200-day moving average. These moving averages are widely used indicators that smooth out price fluctuations, providing a clearer picture of the overall trend.

- 50-day MA: This represents the average closing price of Bitcoin over the past 50 days. It's a shorter-term indicator, more sensitive to recent price movements.

- 200-day MA: This represents the average closing price over the past 200 days. It's considered a long-term indicator, reflecting the overall long-term trend.

When the faster-moving 50-day MA crosses above the slower 200-day MA, it suggests a potential shift in momentum from bearish to bullish. This crossover is visually represented as a "cross" on a price chart.

[Insert chart illustrating a Bitcoin Golden Cross here]

Historically, Bitcoin Golden Crosses have often (but not always!) been followed by periods of price appreciation. However, it's crucial to remember that past performance is not indicative of future results. Analyzing past occurrences requires careful consideration of the broader market context at the time of each crossover. For example, a Golden Cross occurring during a period of high regulatory uncertainty might yield different results than one during a period of widespread institutional adoption.

Interpreting the Signal: Bullish or Bearish Trap?

While the Bitcoin Golden Cross is often considered a bullish signal, it's not a foolproof predictor. Interpreting the signal requires a nuanced approach, considering several factors beyond just the technical indicator:

- Market Sentiment: Is the overall cryptocurrency market sentiment positive or negative? High fear and uncertainty could dampen the positive effects of a Golden Cross.

- Regulatory News: New regulations or policy changes can significantly impact Bitcoin's price, regardless of technical indicators.

- Bitcoin Adoption Rates: Increased adoption by institutions and mainstream users can fuel price increases, potentially amplifying the Golden Cross's effect.

A Golden Cross could signal:

- Sustained Bull Run: A prolonged period of price increases.

- Temporary Bounce: A short-lived price increase followed by a further decline.

- Bull Trap: A deceptive price increase that lures investors into buying before a significant price drop.

Therefore, relying solely on the Golden Cross signal for Bitcoin trading decisions is risky. Fundamental analysis, which considers macroeconomic factors and Bitcoin's underlying value proposition, is equally important.

Trading Strategies After a Bitcoin Golden Cross

The optimal trading strategy after a Bitcoin Golden Cross depends on your investment horizon and risk tolerance.

- Long-term Investors (Buy and Hold): A Golden Cross can reinforce a long-term bullish outlook, providing further confidence in a buy-and-hold strategy.

- Short-term Traders (Scalping, Swing Trading): Short-term traders might look for opportunities to capitalize on short-term price fluctuations following the crossover. However, this requires careful monitoring of price action and skillful risk management.

Risk Management Strategies for Bitcoin Trading

Regardless of your trading style, robust risk management is crucial, especially after a potentially volatile event like a Bitcoin Golden Cross.

- Stop-Loss Orders: These orders automatically sell your Bitcoin if the price drops to a predetermined level, limiting potential losses.

- Position Sizing: Never invest more than you can afford to lose. Diversify your cryptocurrency portfolio across different assets to reduce risk.

- Dollar-Cost Averaging (DCA): Instead of investing a lump sum, gradually invest smaller amounts over time, reducing your exposure to market volatility.

- Emotional Discipline: Avoid impulsive trading decisions driven by fear or greed. Stick to your pre-defined trading plan.

Conclusion

The Bitcoin Golden Cross is a significant technical indicator that suggests a potential bullish shift in the market. However, it's not a crystal ball. It's crucial to consider other factors, including market sentiment, regulatory news, and Bitcoin adoption rates, alongside technical analysis. Combining technical and fundamental analysis, coupled with sound risk management strategies such as stop-loss orders, position sizing, and dollar-cost averaging, is essential for navigating this potentially volatile period. Stay informed about the latest developments surrounding the Bitcoin Golden Cross and its impact on the market. Continue researching and learning about effective Bitcoin trading strategies to make informed decisions. Remember to conduct thorough research before making any investment decisions. Understanding the Bitcoin Golden Cross is a critical step in your cryptocurrency journey, but remember that it's just one piece of a larger puzzle.

Featured Posts

-

Dijital Miras Planlamasi Kripto Varliklarinizi Guevende Tutun

May 08, 2025

Dijital Miras Planlamasi Kripto Varliklarinizi Guevende Tutun

May 08, 2025 -

Dodgers Star Mookie Betts Sidelined By Illness

May 08, 2025

Dodgers Star Mookie Betts Sidelined By Illness

May 08, 2025 -

Psg Vence Al Lyon En Su Propio Estadio

May 08, 2025

Psg Vence Al Lyon En Su Propio Estadio

May 08, 2025 -

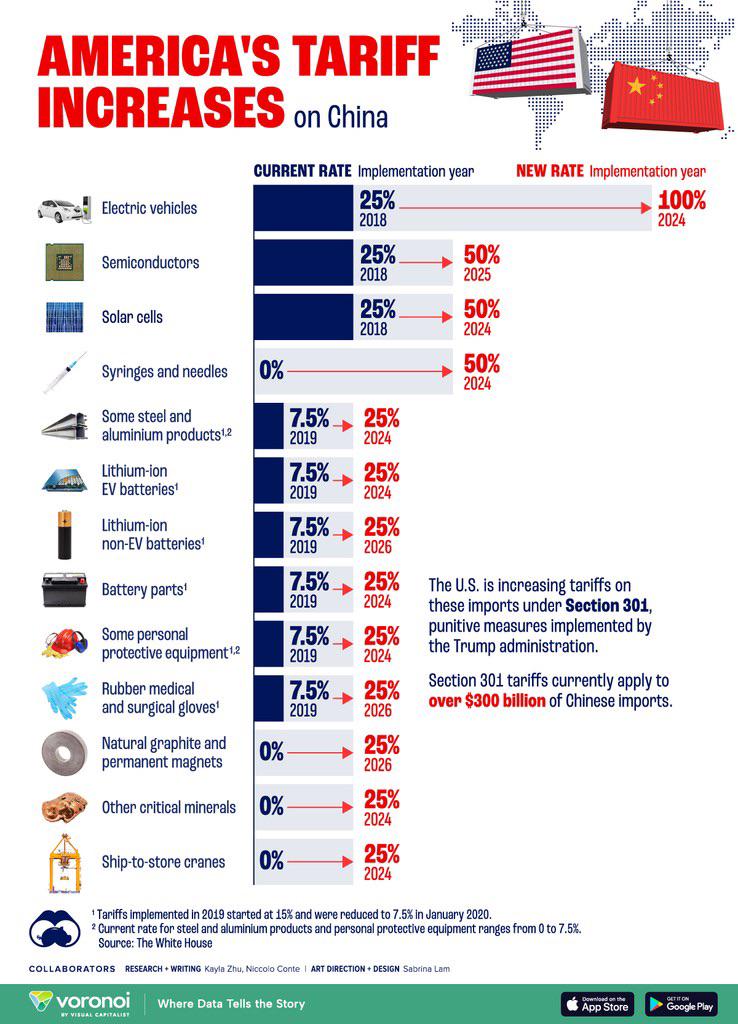

The Us Tariff Impact On Gms Canadian Operations An Expert View

May 08, 2025

The Us Tariff Impact On Gms Canadian Operations An Expert View

May 08, 2025 -

Feyenoord Eliminated Inter Milan Secure Europa League Quarter Final Spot

May 08, 2025

Feyenoord Eliminated Inter Milan Secure Europa League Quarter Final Spot

May 08, 2025

Latest Posts

-

Superman Vs Darkseids Legion July 2025 Dc Comic Book Preview

May 08, 2025

Superman Vs Darkseids Legion July 2025 Dc Comic Book Preview

May 08, 2025 -

James Gunns Daily Planet Photo A Subtle Superman Easter Egg For Jimmy Olsens 85th

May 08, 2025

James Gunns Daily Planet Photo A Subtle Superman Easter Egg For Jimmy Olsens 85th

May 08, 2025 -

Summer Of Superman Kryptos Whistle Worthy Appearance Next Week

May 08, 2025

Summer Of Superman Kryptos Whistle Worthy Appearance Next Week

May 08, 2025 -

Krypto Joins Superman A Whistle Stop Summer Special Next Week

May 08, 2025

Krypto Joins Superman A Whistle Stop Summer Special Next Week

May 08, 2025 -

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025