Bitcoin Investment: Exploring A Potential 1,500% Return

Table of Contents

Understanding Bitcoin's Price Volatility and Historical Performance

Bitcoin's price history is a rollercoaster. Analyzing the Bitcoin price history reveals periods of explosive growth alongside dramatic crashes. Understanding this Bitcoin price volatility is key to making informed investment decisions. The Bitcoin price prediction market is notoriously unpredictable, making accurate forecasting extremely difficult. However, studying historical Bitcoin chart analysis can provide valuable insights.

- Factors Influencing Bitcoin's Price: Several factors contribute to Bitcoin's fluctuating value. These include:

- Supply and Demand: Like any asset, Bitcoin's price is influenced by the interplay of supply (a fixed, finite amount) and demand (driven by investor sentiment and adoption).

- Regulation: Governmental regulations and policies around the world significantly impact Bitcoin's price and overall market sentiment.

- Adoption: Wider acceptance by businesses, institutions, and governments drives demand and increases Bitcoin's value.

- Market Sentiment: News events, technological advancements, and overall market trends greatly influence investor confidence and, consequently, the price.

- Examples of Substantial Price Increases: Bitcoin has seen periods of incredible growth. Its price surged from under $1 in 2010 to over $60,000 in late 2021, representing staggering returns for early investors. However, it's crucial to remember that these gains were interspersed with significant corrections.

- HODLing and Long-Term Returns: The strategy of "HODLing" (holding onto Bitcoin despite price fluctuations) is often touted as a way to potentially benefit from long-term growth. However, this approach requires significant patience and risk tolerance.

Assessing the Risk Factors Involved in Bitcoin Investment

Investing in Bitcoin carries significant risks. The cryptocurrency market is known for its volatility, meaning prices can swing wildly in short periods. A 1,500% Bitcoin return is a possibility, but substantial losses are equally likely. Understanding these Bitcoin investment risks is paramount.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains unclear in many jurisdictions, creating uncertainty and potential for future restrictions or bans.

- Scams and Security Breaches: The cryptocurrency space is unfortunately prone to scams and security breaches. Investors need to be vigilant and utilize secure storage methods to protect their assets.

- Market Manipulation: The relatively smaller size of the cryptocurrency market makes it susceptible to manipulation by large holders ("whales"), who can significantly impact prices with their trading activities.

- Diversification: Never put all your eggs in one basket. Diversifying your investment portfolio across different asset classes, including traditional investments, is crucial to mitigating overall risk.

Strategies for Mitigating Risk and Maximizing Potential Returns in Bitcoin

While the potential for a 1,500% Bitcoin return is enticing, responsible investment strategies are essential. These strategies can help mitigate risk and maximize your chances of success.

- Dollar-Cost Averaging (DCA): Instead of investing a lump sum, DCA involves investing a fixed amount at regular intervals, regardless of price. This strategy reduces the impact of volatility and mitigates the risk of buying high.

- Realistic Investment Goals and Time Horizons: Set realistic expectations for your Bitcoin investment. High returns often require a long-term perspective, and it’s crucial to accept short-term volatility.

- Invest Only What You Can Afford to Lose: Only invest money you're comfortable losing completely. Never invest borrowed money or funds essential for other needs.

- Secure Storage: Use secure storage methods like hardware wallets to protect your Bitcoin from theft or hacking.

Diversification: Spreading Your Investment Across Assets

Diversification is key to managing risk in any investment portfolio, and this includes cryptocurrency investments. Don't rely solely on Bitcoin for your high-return investment goals. Spread your investments across a variety of assets to reduce overall portfolio volatility and enhance risk mitigation. Consider including other cryptocurrencies, stocks, bonds, and real estate in your portfolio.

Conclusion

The possibility of a 1,500% return on a Bitcoin investment is certainly captivating. However, it's crucial to approach this market with realistic expectations and a thorough understanding of the risks involved. Bitcoin's price volatility is a significant factor, and potential losses can be substantial. By employing responsible investment strategies, such as dollar-cost averaging and diversification, and by thoroughly researching the market, you can improve your chances of success. While a 1,500% return on a Bitcoin investment is possible, it's crucial to understand the associated risks. Learn more about responsible Bitcoin investment strategies and start your research today! We encourage you to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Kripto Para Yatirimlarinda Risk Duesuesler Ve Satis Stratejileri

May 08, 2025

Kripto Para Yatirimlarinda Risk Duesuesler Ve Satis Stratejileri

May 08, 2025 -

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025 -

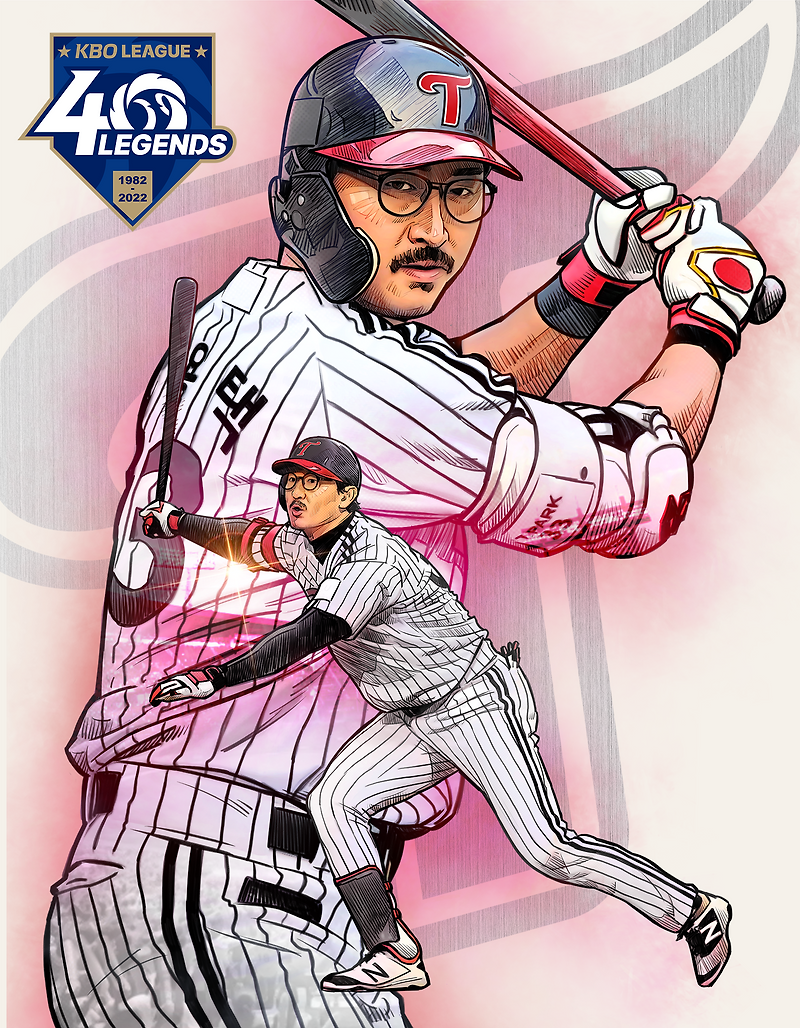

Kbo 5 0 355 3

May 08, 2025

Kbo 5 0 355 3

May 08, 2025 -

March 29th Nba Thunder Vs Pacers Injury News And Analysis

May 08, 2025

March 29th Nba Thunder Vs Pacers Injury News And Analysis

May 08, 2025 -

Saturday Night Live A Pivotal Platform For Counting Crows Success 1995

May 08, 2025

Saturday Night Live A Pivotal Platform For Counting Crows Success 1995

May 08, 2025

Latest Posts

-

7 Hidden Gems Streaming On Paramount Right Now

May 08, 2025

7 Hidden Gems Streaming On Paramount Right Now

May 08, 2025 -

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan A Ranked List

May 08, 2025

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan A Ranked List

May 08, 2025 -

7 Paramount Movies You Didnt Know Existed But Should Watch Now

May 08, 2025

7 Paramount Movies You Didnt Know Existed But Should Watch Now

May 08, 2025 -

Saving Private Ryan 20 Behind The Scenes Facts

May 08, 2025

Saving Private Ryan 20 Behind The Scenes Facts

May 08, 2025 -

Exploring Warfare 5 Movies That Capture Action And Heart

May 08, 2025

Exploring Warfare 5 Movies That Capture Action And Heart

May 08, 2025