Bitcoin Or MicroStrategy Stock: The Better Investment Strategy For 2025

Table of Contents

Understanding Bitcoin's Potential in 2025

Bitcoin's Price Volatility and Market Predictions

Bitcoin's price history is a rollercoaster. While it's shown immense growth potential, it’s equally prone to dramatic drops. Predicting its price in 2025 is inherently speculative, with experts offering widely varying forecasts. Some predict astronomical prices, while others foresee a significant correction.

-

Factors influencing Bitcoin's price:

- Adoption rate: Wider acceptance by institutions and individuals directly impacts demand.

- Regulatory changes: Government regulations can significantly influence Bitcoin's price and accessibility.

- Macroeconomic conditions: Global economic events (inflation, recession) can affect investor sentiment and Bitcoin's value.

-

Potential upside and downside scenarios for Bitcoin’s price in 2025:

- Upside: Widespread adoption, positive regulatory developments, and a bullish global economy could push Bitcoin's price significantly higher.

- Downside: Negative regulatory actions, a global economic downturn, or a major security breach could trigger a substantial price drop.

Bitcoin's Technological Advantages and Limitations

Bitcoin's underlying technology, the blockchain, offers several compelling advantages:

- Advantages of Bitcoin:

- Decentralization: No single entity controls Bitcoin, making it resistant to censorship.

- Scarcity: A fixed supply of 21 million Bitcoins limits its potential inflation.

- Security: Cryptographic security makes Bitcoin transactions highly secure.

However, Bitcoin also faces limitations:

- Limitations of Bitcoin:

- Transaction speed: Bitcoin transactions can be relatively slow compared to traditional payment systems.

- Energy consumption: The energy used for Bitcoin mining is a significant environmental concern.

Bitcoin's Role in the Future of Finance

Bitcoin's potential impact on traditional finance is substantial. Its increasing acceptance by institutional investors suggests a growing recognition of its value as a store of value or an alternative asset class.

- Examples of Bitcoin's growing acceptance by institutional investors: Large companies and investment firms are increasingly allocating funds to Bitcoin.

- Potential for Bitcoin to become a mainstream payment method: While still limited, the use of Bitcoin for everyday transactions is gradually increasing.

Evaluating MicroStrategy's Stock Performance and Outlook for 2025

MicroStrategy's Business Model and Financial Health

MicroStrategy is a publicly traded business intelligence company. Its core business revolves around analytics and cloud-based services. Analyzing its financial health requires examining several key metrics:

- Key aspects of MicroStrategy's business: Data analytics software, cloud services, and mobile analytics solutions.

- Analysis of MicroStrategy's financial statements: Evaluating revenue growth, profit margins, and debt levels is crucial for assessing its financial strength and sustainability.

MicroStrategy's Bitcoin Holdings and Their Impact on Stock Price

MicroStrategy's significant Bitcoin holdings are a defining feature of the company. This strategy introduces both substantial risks and potential rewards.

- Impact of Bitcoin price fluctuations on MicroStrategy's stock price: The price of Bitcoin directly influences MicroStrategy's valuation.

- Potential benefits and risks associated with MicroStrategy's Bitcoin strategy: While it could lead to significant gains if Bitcoin's price rises, it also exposes the company to substantial losses if the price falls.

MicroStrategy's Future Growth Prospects

MicroStrategy’s future growth depends on its ability to compete in the dynamic business intelligence and analytics market:

- Competitive landscape and market trends: Analyzing the competitive landscape and identifying future market trends is essential to assess MicroStrategy's growth potential.

- Potential for innovation and new product development: MicroStrategy's capacity for innovation and new product development will significantly impact its future growth trajectory.

Bitcoin vs. MicroStrategy Stock: A Comparative Analysis for 2025

Risk Tolerance and Investment Goals

The choice between Bitcoin and MicroStrategy stock hinges on your risk tolerance and investment objectives.

- Comparing the risk profiles of Bitcoin and MicroStrategy stock: Bitcoin is significantly riskier than MicroStrategy stock, due to its high volatility.

- Suitable investor profiles for each asset: Bitcoin suits investors with a high-risk tolerance and a long-term horizon. MicroStrategy stock might be more suitable for investors seeking a blend of growth and relative stability.

Diversification and Portfolio Management

Diversification is crucial for managing risk. Bitcoin and MicroStrategy stock can play different roles in a diversified portfolio.

- Potential benefits and drawbacks of including both assets in a portfolio: Holding both can offer diversification benefits, but it also increases overall portfolio volatility.

- Strategies for managing risk with both investments: Dollar-cost averaging and diversification across other asset classes are crucial risk management strategies.

Conclusion: Making Informed Investment Decisions: Bitcoin or MicroStrategy in 2025?

This analysis highlights the contrasting characteristics of Bitcoin and MicroStrategy stock. Bitcoin presents high-risk, high-reward potential, while MicroStrategy offers a potentially less volatile but still growth-oriented investment linked to Bitcoin's performance. The best choice depends entirely on your individual risk tolerance and investment goals. Consider your long-term financial objectives and comfort level with volatility before making any investment decisions. Continue your research into Bitcoin and MicroStrategy investments for 2025, consulting with a financial advisor if needed, to make an informed decision about your Bitcoin vs. MicroStrategy investment strategy for 2025.

Featured Posts

-

Arsenal Vs Psg In Depth Preview Of The Champions League Semi Final Clash

May 08, 2025

Arsenal Vs Psg In Depth Preview Of The Champions League Semi Final Clash

May 08, 2025 -

The Long Walk Trailer A Glimpse Into Stephen Kings Dystopian Thriller

May 08, 2025

The Long Walk Trailer A Glimpse Into Stephen Kings Dystopian Thriller

May 08, 2025 -

Ps 5 Pro Sales Slow Down Is The Hype Dying

May 08, 2025

Ps 5 Pro Sales Slow Down Is The Hype Dying

May 08, 2025 -

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025 -

Psg Nantes Maci 1 1 Berabere Sonuc

May 08, 2025

Psg Nantes Maci 1 1 Berabere Sonuc

May 08, 2025

Latest Posts

-

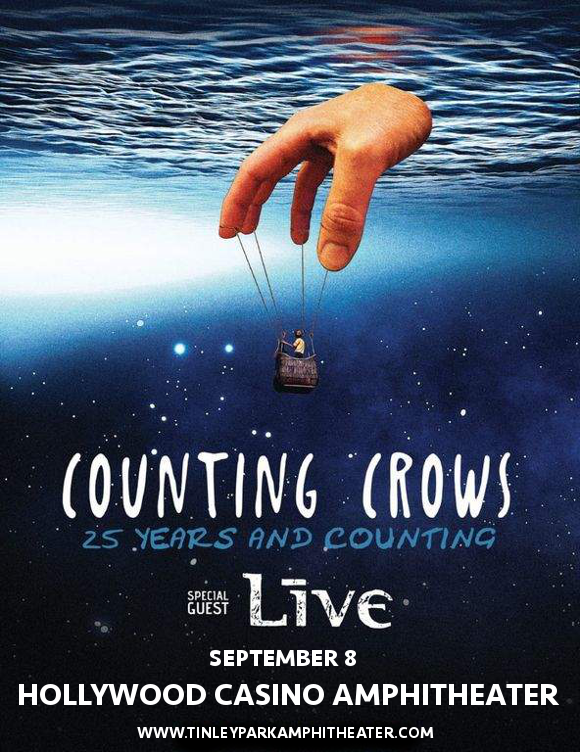

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025 -

Cleveland Browns Land De Andre Carter To Enhance Wide Receiver Depth

May 08, 2025

Cleveland Browns Land De Andre Carter To Enhance Wide Receiver Depth

May 08, 2025 -

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025 -

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025 -

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025