Bitcoin Price Analysis: The Trump Factor And The Road To $100,000

Table of Contents

The Trump Factor: Political Uncertainty and Bitcoin's Safe Haven Status

Donald Trump's presence, even post-presidency, casts a long shadow over global markets. His actions and pronouncements continue to impact investor sentiment, and understanding this impact is crucial for any Bitcoin price analysis.

Trump's Economic Policies and Bitcoin's Price: Trump's economic policies, characterized by trade wars and deregulation, have historically created periods of both market boom and bust. These periods have significantly influenced Bitcoin's price.

- Past Reactions: The imposition of tariffs, for instance, often led to increased investor uncertainty, pushing investors towards safe-haven assets like Bitcoin, causing price increases. Conversely, periods of relative market stability saw some investors moving away from Bitcoin.

- Future Predictions: Trump's potential future influence, including endorsements or commentary on economic policy, will likely remain a significant factor. Any suggestion of increased regulatory scrutiny could negatively impact the price, while periods of global economic instability could again see Bitcoin benefiting from its safe-haven status. This makes understanding the nuances of his influence critical for any robust Bitcoin price analysis. Related keywords: Trump administration, regulatory uncertainty, safe-haven asset, inflation hedge.

Trump's Social Media Influence and Market Sentiment: Trump's prolific use of social media adds another layer of complexity to the equation. His tweets and statements can dramatically shift market sentiment towards Bitcoin and other cryptocurrencies.

- Past Impacts: Instances where Trump has mentioned Bitcoin (or cryptocurrency in general), even indirectly, have historically caused significant price swings. A positive mention could trigger a FOMO (fear of missing out) rally, while negative comments can fuel FUD (fear, uncertainty, and doubt), leading to price drops.

- FUD and FOMO: Understanding the power of these psychological factors is essential to predicting Bitcoin’s price movements in relation to Trump's public pronouncements. The rapid dissemination of information through social media means even seemingly insignificant statements can have a powerful impact. Related keywords: Market sentiment, social media impact, crypto news, price volatility.

Technical Analysis: Chart Patterns and Indicators Pointing to $100,000

Technical analysis provides another lens through which to view Bitcoin's price trajectory. Several indicators suggest a potential path to $100,000, although it's important to remember that technical analysis is not a foolproof predictor.

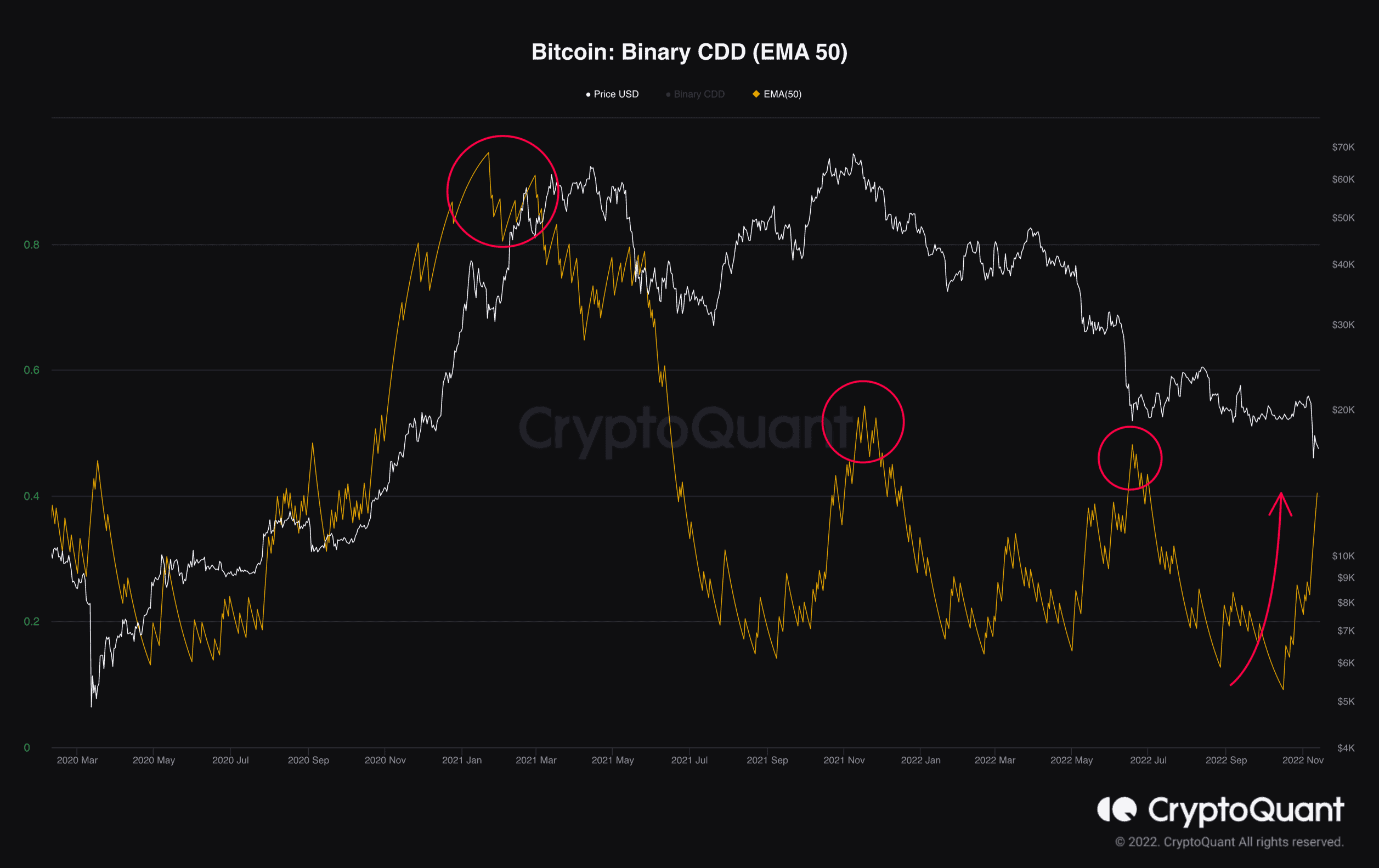

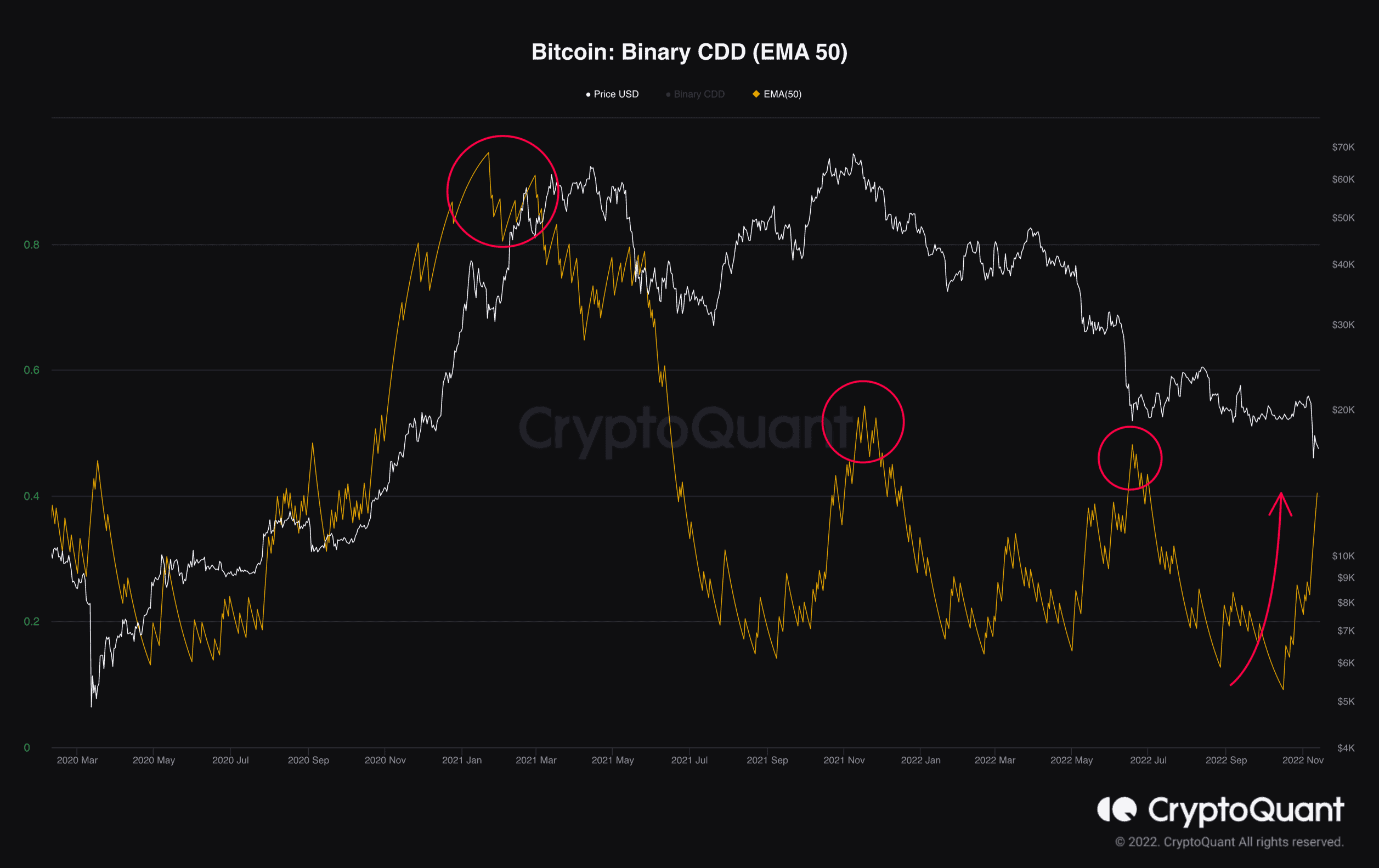

Key Technical Indicators: Analyzing key technical indicators helps assess Bitcoin's short-to-medium term price movements.

- Moving Averages: The 50-day and 200-day moving averages can provide insights into short-term trends. A bullish crossover (when the 50-day MA crosses above the 200-day MA) is often considered a positive signal. (Illustrative chart would be inserted here)

- RSI (Relative Strength Index): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 suggests an overbought market, while below 30 indicates an oversold market. (Illustrative chart would be inserted here)

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. A bullish crossover (MACD line crossing above the signal line) can be a buy signal. (Illustrative chart would be inserted here) Related keywords: Technical analysis, moving averages, RSI, MACD, support levels, resistance levels, chart patterns.

Adoption and Market Capitalization: The increasing adoption of Bitcoin by institutional investors and the growth of its market capitalization are strong indicators of long-term price potential.

- Institutional Adoption: As more institutional investors, such as hedge funds and corporations, add Bitcoin to their portfolios, demand increases, driving price upward.

- Retail Investor Interest: Growing retail investor interest, fueled by increased awareness and accessibility, further contributes to market demand.

- Market Cap Comparison: Comparing Bitcoin's market capitalization to other established assets highlights its potential for significant future growth. Related keywords: Market capitalization, institutional adoption, retail investors, Bitcoin adoption.

Fundamental Analysis: Factors Driving Bitcoin's Long-Term Value

Beyond technical indicators, a fundamental analysis reveals the intrinsic value proposition of Bitcoin.

Scarcity and Deflationary Nature: Bitcoin's fixed supply of 21 million coins makes it a deflationary asset. This scarcity, combined with increasing demand, is a key driver of its long-term value.

- Halving Events: The Bitcoin halving events, which reduce the rate of new Bitcoin creation, contribute to this scarcity. Each halving has historically been followed by a period of price appreciation. Related keywords: Bitcoin supply, halving, scarcity, deflationary asset.

Technological Advancements and Network Security: Bitcoin's ongoing development and robust network security underpin its long-term viability.

- Lightning Network: The Lightning Network, a layer-2 scaling solution, significantly improves transaction speed and efficiency. This makes Bitcoin more practical for everyday use and boosts adoption. Related keywords: Bitcoin technology, Lightning Network, scalability, network security.

Conclusion:

This Bitcoin price analysis highlights the complex interplay of factors influencing Bitcoin's price, including the unpredictable yet significant impact of Donald Trump's influence, key technical indicators suggesting potential upward momentum, and the fundamental drivers of its long-term value. While predicting the exact price is impossible, the confluence of these factors points towards a possible path to $100,000. However, remember that market volatility is inherent to Bitcoin. Stay updated on Bitcoin price analysis, learn more about the Trump factor and its impact on Bitcoin, and dive deeper into the potential of Bitcoin reaching $100,000. Conduct thorough research and develop your own informed perspective before making any investment decisions. Continued monitoring of Bitcoin price analysis is crucial for navigating this dynamic market.

Featured Posts

-

The Crossroads Of Ai Apples Next Move

May 09, 2025

The Crossroads Of Ai Apples Next Move

May 09, 2025 -

Is The Recent Bitcoin Rebound Sustainable Expert Predictions

May 09, 2025

Is The Recent Bitcoin Rebound Sustainable Expert Predictions

May 09, 2025 -

Mans Expensive Babysitting Choice Results In Higher Daycare Bill

May 09, 2025

Mans Expensive Babysitting Choice Results In Higher Daycare Bill

May 09, 2025 -

Is Daycare Harmful A Psychologists Claims And The Expert Response

May 09, 2025

Is Daycare Harmful A Psychologists Claims And The Expert Response

May 09, 2025 -

Daycare Vs Stay At Home Parenting Making The Right Choice

May 09, 2025

Daycare Vs Stay At Home Parenting Making The Right Choice

May 09, 2025

Latest Posts

-

Kimbal Musk A Look Into The Life And Career Of Elon Musks Brother

May 09, 2025

Kimbal Musk A Look Into The Life And Career Of Elon Musks Brother

May 09, 2025 -

Tech Billionaires 194 Billion Loss 100 Days Of Pain After Trump Inauguration Donation

May 09, 2025

Tech Billionaires 194 Billion Loss 100 Days Of Pain After Trump Inauguration Donation

May 09, 2025 -

Unmasking David 5 Prominent Theories Regarding The He Morgan Brother In High Potential

May 09, 2025

Unmasking David 5 Prominent Theories Regarding The He Morgan Brother In High Potential

May 09, 2025 -

High Potential Episode 13 The Significance Of Davids Actor

May 09, 2025

High Potential Episode 13 The Significance Of Davids Actor

May 09, 2025 -

He Morgan Brother Deciphering Davids Identity In High Potential 5 Leading Theories

May 09, 2025

He Morgan Brother Deciphering Davids Identity In High Potential 5 Leading Theories

May 09, 2025