Bitcoin Price Prediction: Analyzing The Potential Impact Of Trump's 100-Day Plan On BTC

Table of Contents

Understanding Trump's 100-Day Plan and its Economic Implications

Trump's 100-Day Plan, while ultimately not fully implemented as initially proposed, laid out several key economic policies with potential implications for Bitcoin. These policies included significant tax cuts, deregulation across various sectors, and a focus on renegotiating trade deals. Let's consider the relevant aspects for our Bitcoin price prediction:

- Tax Cuts: Lower capital gains taxes, a core element of the plan, could incentivize increased investment in cryptocurrencies like Bitcoin, potentially driving up demand and price.

- Regulatory Changes (or Lack Thereof): The plan's stance on regulation, or rather, the lack of clearly defined regulatory frameworks for cryptocurrencies during that period, could have either boosted or hindered adoption. Less regulation could lead to increased adoption and speculation, while uncertainty could lead to hesitation.

- Impact on the US Dollar: The plan aimed to boost the US economy, potentially strengthening the dollar. A stronger dollar could, in theory, negatively impact Bitcoin's price, as investors might shift away from alternative assets.

The following bullet points summarize the potential effects:

- Positive: Increased investment due to tax cuts, potentially leading to higher BTC price.

- Negative: A stronger dollar potentially reducing demand for Bitcoin.

- Neutral: A wait-and-see approach by investors due to regulatory uncertainty.

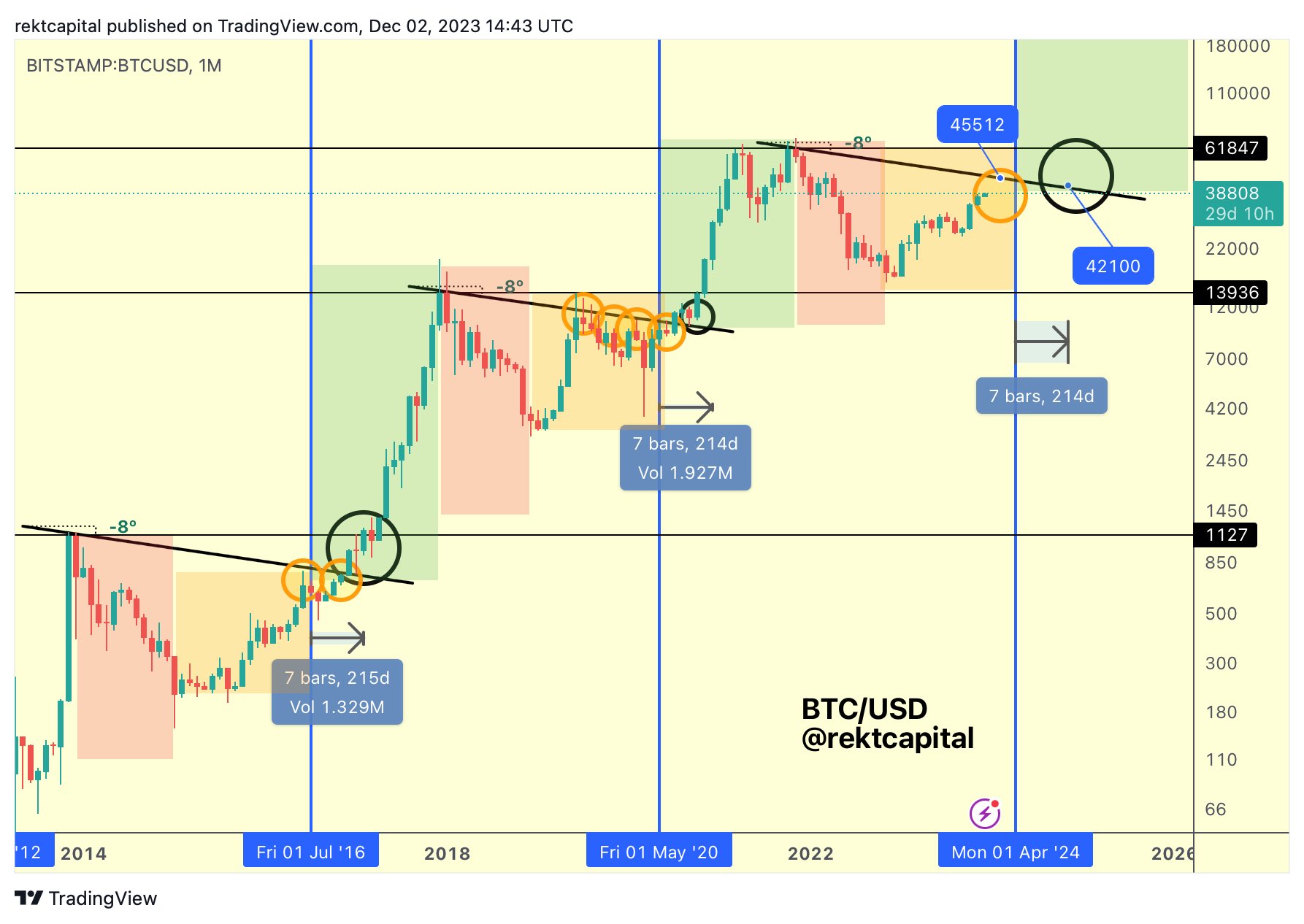

Historical Correlation Between Political Events and Bitcoin Price

Examining the historical relationship between political events and Bitcoin's price is crucial for any Bitcoin price prediction. We've seen significant price fluctuations in response to various political events:

- Previous Presidential Elections: The 2016 and 2020 US Presidential elections, for example, saw noticeable shifts in Bitcoin's price, driven by uncertainty and speculation surrounding the potential impact of policy changes.

- Significant Policy Changes: Announcements concerning cryptocurrency regulation or taxation have often triggered significant price movements.

- Geopolitical Events: Global political instability and uncertainty can increase demand for safe-haven assets, potentially boosting Bitcoin's price.

Analyzing this historical data (using charts and graphs would enhance this section visually) allows for a more informed Bitcoin price prediction, highlighting the sensitivity of the cryptocurrency market to political factors. Keywords like Bitcoin price history, political influence on crypto, and market volatility are key here.

Potential Scenarios for Bitcoin Price Under Trump's Policies (or the echoes of them)

Considering the potential influence of (the echoes of) Trump's 100-Day Plan, we can outline a few plausible scenarios for Bitcoin's price:

-

Scenario 1: Positive Impact: Increased investment driven by tax cuts and minimal regulation leads to significant price increases. This scenario assumes widespread adoption and a positive economic climate. The Bitcoin price forecast in this scenario would be bullish.

-

Scenario 2: Negative Impact: Increased regulatory scrutiny, economic downturn, or a strengthening dollar could negatively impact Bitcoin's price, potentially resulting in a significant drop. This scenario assumes negative investor sentiment and reduced market confidence. The BTC future price would be bearish.

-

Scenario 3: Neutral Impact: Minimal change in policy or a balanced effect of various factors could lead to price stability or only moderate fluctuations. This scenario envisions a relatively calm market with steady, albeit potentially slow, growth. The Bitcoin price forecast would be relatively flat.

Factors Beyond Trump's Plan Affecting Bitcoin Price Prediction

While (the echoes of) Trump's 100-Day Plan had a potential influence, several other significant factors must be considered for a comprehensive Bitcoin price prediction:

-

Technological Advancements: Network upgrades, scalability solutions, and the development of new applications all affect Bitcoin's long-term value and adoption.

-

Adoption Rates: Increased adoption by businesses, institutions, and governments significantly impacts demand and price.

-

Overall Cryptocurrency Market Trends: The performance of other cryptocurrencies and overall market sentiment also influence Bitcoin's price.

-

Global Economic Conditions: Recessions, inflation, and global geopolitical events play a substantial role.

These factors interact with each other and the lingering impacts of the Trump administration's policies, leading to a complex interplay of influences on Bitcoin's price.

Conclusion: Final Thoughts on Bitcoin Price Prediction and Trump's Legacy

Analyzing the potential impact of (the echoes of) Trump's 100-Day Plan on Bitcoin's price reveals the complex interplay between political events, economic conditions, and technological developments. It's crucial to remember that this analysis is speculative and shouldn't be taken as financial advice. Accurate Bitcoin price prediction requires a holistic view, considering multiple factors. The impact of the Trump administration's policies, while significant, is only one piece of a much larger puzzle.

To improve your understanding of Bitcoin Price Prediction, conduct thorough research, stay informed about market trends, and monitor political and economic developments closely. Only through diligent analysis and a comprehensive understanding of the influencing factors can you develop a more informed perspective on the future price of Bitcoin.

Featured Posts

-

Where To Watch The Thunder Vs Trail Blazers Game On March 7th

May 08, 2025

Where To Watch The Thunder Vs Trail Blazers Game On March 7th

May 08, 2025 -

Lahore School Timetable Changes Due To Psl

May 08, 2025

Lahore School Timetable Changes Due To Psl

May 08, 2025 -

Ptt Personel Alimi 2025 Basvuru Kilavuzu Ve Oenemli Tarihler

May 08, 2025

Ptt Personel Alimi 2025 Basvuru Kilavuzu Ve Oenemli Tarihler

May 08, 2025 -

Psg Nice Macini Nereden Canli Izleyebilirim

May 08, 2025

Psg Nice Macini Nereden Canli Izleyebilirim

May 08, 2025 -

Predicting The Arsenal Vs Psg Semi Final A More Difficult Challenge Than Real Madrid

May 08, 2025

Predicting The Arsenal Vs Psg Semi Final A More Difficult Challenge Than Real Madrid

May 08, 2025

Latest Posts

-

Voter Fraud Case Whittier Residents Rally Behind American Samoan Family

May 09, 2025

Voter Fraud Case Whittier Residents Rally Behind American Samoan Family

May 09, 2025 -

Opinion Celebrating Anchorages Arts And Local Medias Role

May 09, 2025

Opinion Celebrating Anchorages Arts And Local Medias Role

May 09, 2025 -

Anchorage Arts Scene Strong Local Coverage Deserves Recognition

May 09, 2025

Anchorage Arts Scene Strong Local Coverage Deserves Recognition

May 09, 2025 -

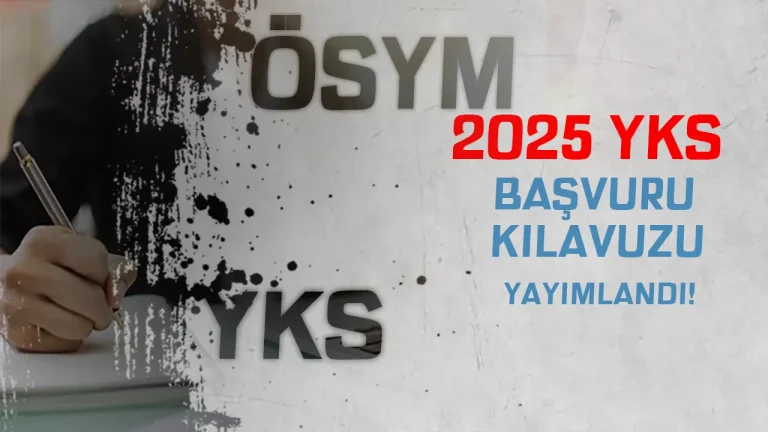

Wireless Mesh Networks Market Growth Drivers And 9 8 Cagr Prediction

May 09, 2025

Wireless Mesh Networks Market Growth Drivers And 9 8 Cagr Prediction

May 09, 2025 -

Rising Temperatures And Soft Mud Challenges In Recovering Anchorage Fin Whale Remains

May 09, 2025

Rising Temperatures And Soft Mud Challenges In Recovering Anchorage Fin Whale Remains

May 09, 2025