Bitcoin Price Prediction: Could Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Trump's Potential Policies and Their Impact on Bitcoin

Trump's potential policies could significantly influence the cryptocurrency market, and specifically the Bitcoin price. His past actions and statements provide clues, but predicting the exact impact remains a challenge.

H3: Fiscal Policy and Inflation: A Trump administration might favor expansive fiscal policies, potentially including increased government spending or substantial tax cuts. Such actions could lead to inflationary pressures. Bitcoin, often touted as an inflation hedge, could see increased demand if inflation rises significantly.

- Inflation's Effect on Bitcoin: When inflation erodes the purchasing power of fiat currencies, investors may seek alternative assets to preserve their wealth. Bitcoin's limited supply makes it an attractive option in inflationary environments.

- Investor Behavior: Historically, during periods of high inflation, investors have shown a greater interest in alternative assets like gold and, increasingly, Bitcoin. This increased demand can drive up the BTC price.

- Example: During periods of high inflation in the past, the price of gold has often increased. A similar effect could be observed with Bitcoin if significant inflationary pressures emerge under a Trump administration.

H3: Regulation and Legal Framework: Trump's stance on cryptocurrency regulation could drastically alter the Bitcoin landscape. A favorable regulatory environment could boost investor confidence and drive wider adoption, leading to a price increase. Conversely, stricter regulations could dampen enthusiasm and suppress the BTC price.

- Favorable Regulation: Clear, consistent, and favorable regulations could encourage institutional investment in Bitcoin, significantly increasing market liquidity and driving price appreciation.

- Unfavorable Regulation: Conversely, overly restrictive regulations or a crackdown on cryptocurrency exchanges could trigger a sell-off, leading to a price decline. The uncertainty itself can negatively impact the Bitcoin price.

- Example: The regulatory clarity provided by some jurisdictions has positively impacted the adoption of Bitcoin in those areas.

H3: Geopolitical Uncertainty and Safe-Haven Assets: A Trump administration might bring about increased geopolitical uncertainty. During times of global instability, Bitcoin, like gold, can act as a safe-haven asset, attracting investors seeking refuge from market turmoil.

- Bitcoin as a Safe Haven: Investors often view Bitcoin as a hedge against geopolitical instability, as it's decentralized and less susceptible to government control than traditional assets.

- Uncertainty and Bitcoin Investment: Increased global uncertainty can trigger a flight to safety, pushing investors toward assets perceived as less risky, including Bitcoin. This surge in demand can lead to a significant price increase.

- Historical Example: Bitcoin's price often rises during periods of global uncertainty, demonstrating its role as a safe-haven asset.

Market Sentiment and Speculation Around Trump's Announcements

Market sentiment and speculation play a crucial role in determining Bitcoin's price. Trump's pronouncements, regardless of their direct impact on Bitcoin, can significantly influence investor behavior.

H3: The Psychology of Market Reactions: News, social media, and Trump's public statements can heavily influence market sentiment. Positive news can trigger a buying spree, while negative news can lead to a sell-off. Herd mentality and FOMO (Fear Of Missing Out) amplify these effects.

- News and Social Media Impact: Rapidly spreading news and social media chatter can significantly impact Bitcoin's price, often leading to sharp price swings.

- Herd Mentality: Investors often follow the crowd, amplifying price movements. If there's a perceived rush into Bitcoin, many will follow suit, driving the price even higher.

- FOMO: The fear of missing out can also fuel rapid price increases, as investors jump in late to avoid missing potential profits.

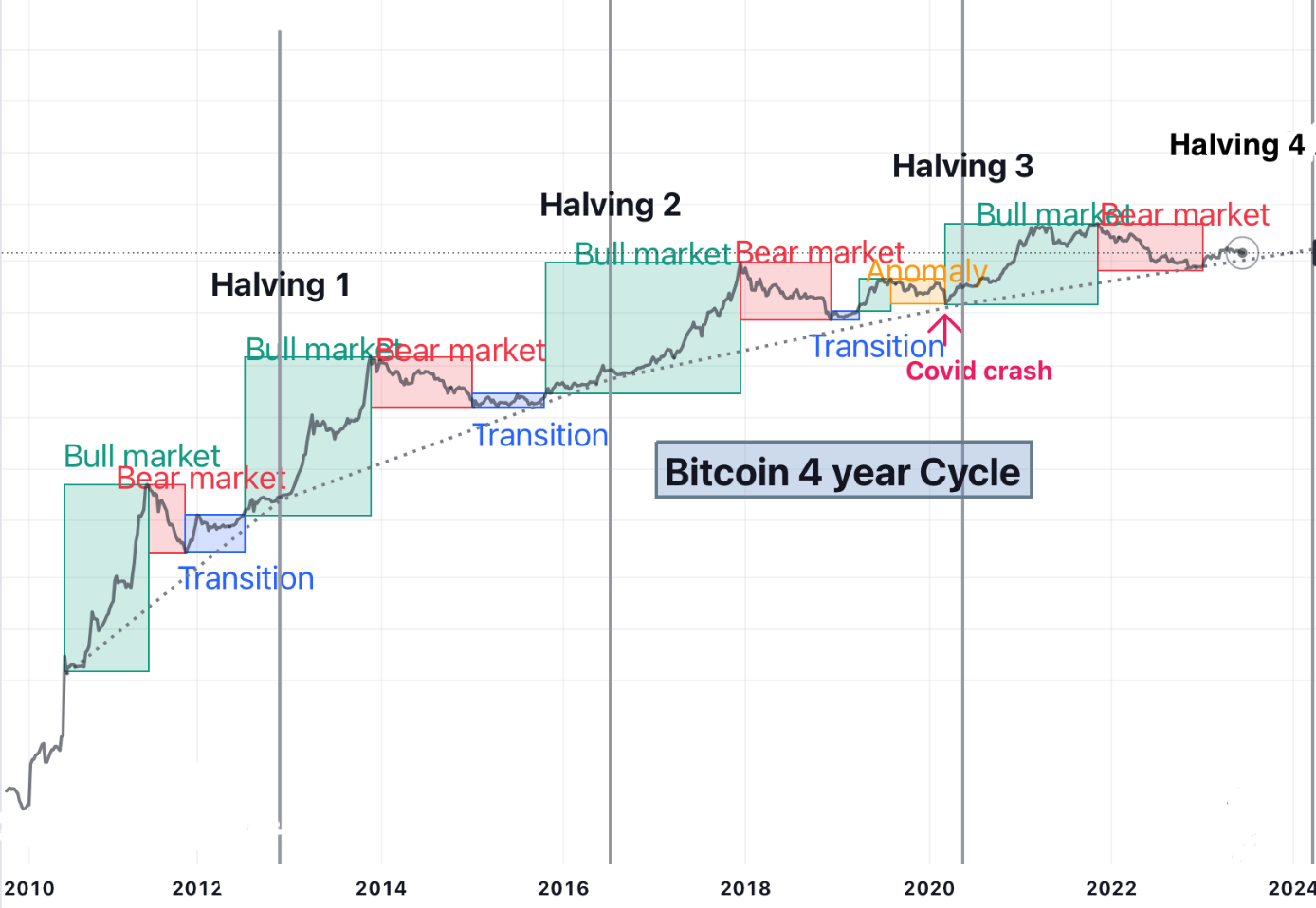

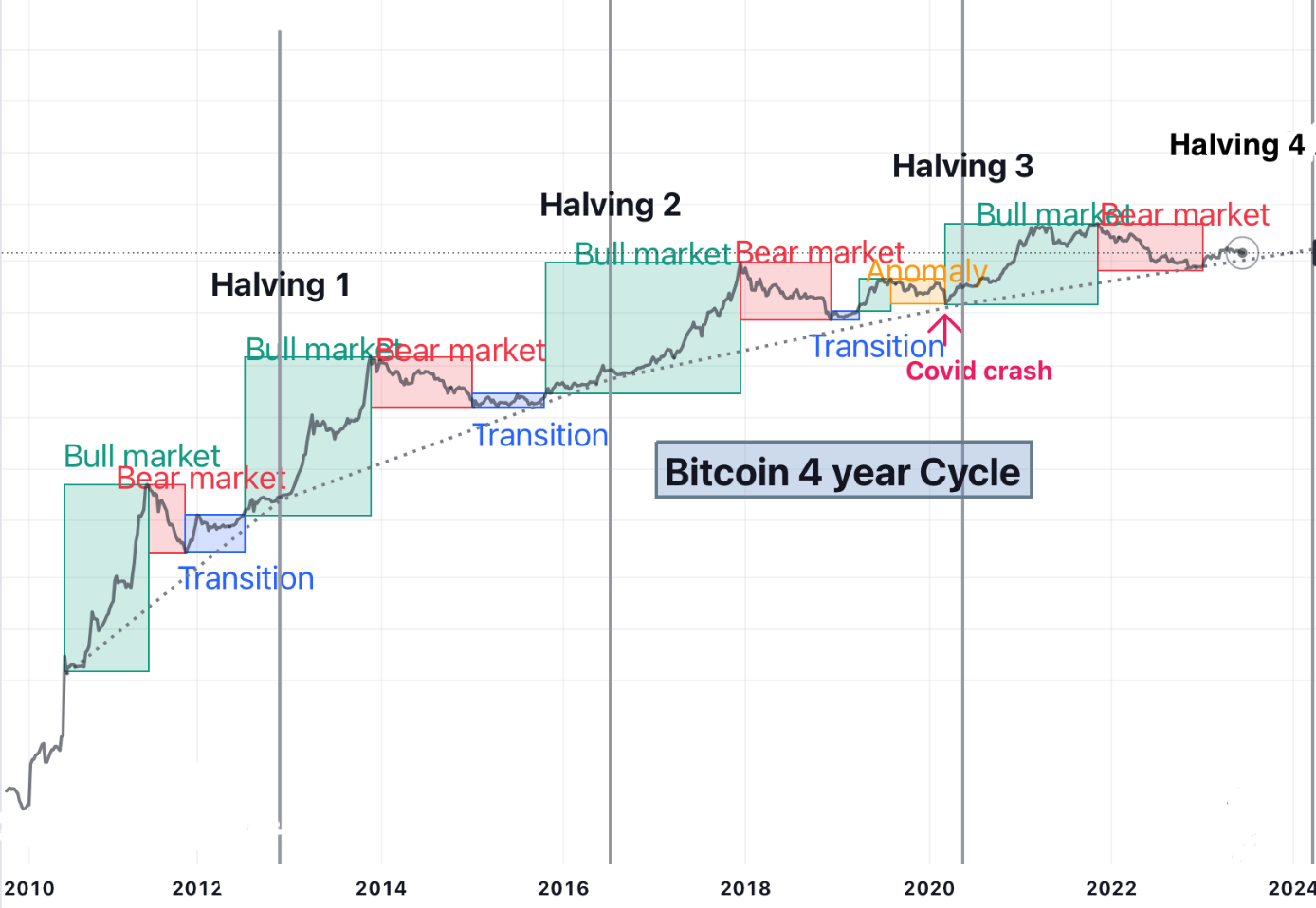

H3: Technical Analysis and Price Predictions: While predicting the future price of Bitcoin is impossible, technical analysis can offer insights into potential price movements.

- Support and Resistance Levels: Technical analysts look for support and resistance levels on price charts to identify potential price reversals.

- Moving Averages: Moving averages help to smooth out price fluctuations and identify trends.

- Cautious Price Predictions: Based on various scenarios and technical analysis, some analysts might predict potential price increases. However, it's crucial to remember that these are just possibilities, not guarantees. A move beyond $100,000 is certainly possible, but not guaranteed.

Factors Beyond Trump's Influence Affecting Bitcoin Price

While Trump's influence is significant, it's not the sole determining factor of Bitcoin's price.

H3: Technological Advancements: Ongoing developments in blockchain technology, such as layer-2 scaling solutions and network upgrades, can have a substantial positive effect on Bitcoin's adoption and price.

- Bitcoin Scaling Solutions: Improvements to Bitcoin's scalability can enhance transaction speed and reduce fees, making it more attractive for everyday use.

- Institutional Adoption: Increasing institutional interest and adoption can drive demand and raise prices.

H3: Overall Market Conditions: Broader economic conditions also influence Bitcoin's price. Factors like global economic growth, interest rates, and inflation rates play a significant role.

- Global Economic Growth: Periods of strong global economic growth can positively influence Bitcoin's price.

- Interest Rates: Interest rate hikes can decrease demand for risky assets like Bitcoin, potentially lowering its price.

Conclusion: Bitcoin Price Prediction and Future Outlook

The hypothetical impact of a 100-day Trump speech on the Bitcoin price depends on a multitude of interacting factors. His potential fiscal policies, regulatory approaches, and foreign policy could all influence investor sentiment and market behavior. However, it’s crucial to remember that Bitcoin's price is driven by a complex interplay of technological advancements, market conditions, and speculative trading. While a surge past $100,000 is a possibility under specific scenarios, significant volatility remains inherent to the cryptocurrency market.

Therefore, rather than offering a definitive Bitcoin price prediction, we encourage you to conduct thorough research, analyzing various viewpoints and considering multiple factors—including but not limited to political events and market trends—to form your own informed opinion on the future of Bitcoin's price. Stay updated on Bitcoin price forecasts, BTC future price predictions, and Bitcoin market analysis to navigate this dynamic market effectively.

Featured Posts

-

Ultimate Nba Playoffs Triple Doubles Quiz Can You Ace It

May 08, 2025

Ultimate Nba Playoffs Triple Doubles Quiz Can You Ace It

May 08, 2025 -

Analysis The Factors Contributing To This Weeks Bitcoin Mining Boom

May 08, 2025

Analysis The Factors Contributing To This Weeks Bitcoin Mining Boom

May 08, 2025 -

Corporate Espionage Office365 Hacks Result In Multi Million Dollar Losses

May 08, 2025

Corporate Espionage Office365 Hacks Result In Multi Million Dollar Losses

May 08, 2025 -

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025 -

Ethereum Price Breakout Is 2 000 The Next Target

May 08, 2025

Ethereum Price Breakout Is 2 000 The Next Target

May 08, 2025

Latest Posts

-

T

May 08, 2025

T

May 08, 2025 -

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025 -

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025 -

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025