Bitcoin Price Rebound: Analyzing The Potential For Further Growth

Table of Contents

H2: Factors Contributing to the Bitcoin Price Rebound

Several interconnected factors have contributed to the recent Bitcoin price rebound. Understanding these dynamics is crucial for navigating the complexities of the cryptocurrency market and making informed investment decisions.

H3: Macroeconomic Factors

Global macroeconomic instability often plays a significant role in Bitcoin's price fluctuations. The current environment of high inflation, fluctuating interest rates, and geopolitical uncertainty has driven many investors towards alternative assets. Bitcoin, often touted as a hedge against inflation and a safe haven asset, has seen increased demand during these turbulent times.

- Increased institutional investment driven by macroeconomic uncertainty: Large financial institutions are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a diversification strategy to mitigate risks associated with traditional markets.

- Safe haven asset appeal during times of global instability: Investors seeking refuge from volatile stock markets and weakening currencies are turning to Bitcoin as a store of value.

- Correlation with the stock market and its recent performance: Although Bitcoin is not always directly correlated with traditional markets, recent positive movements in the stock market have generally had a positive impact on Bitcoin's price.

H3: Technological Advancements

Significant technological improvements within the Bitcoin ecosystem have also boosted investor confidence and contributed to the recent Bitcoin price rebound. These enhancements improve the network's efficiency, scalability, and usability.

- Improved transaction speeds and lower fees: Layer-2 scaling solutions like the Lightning Network are significantly reducing transaction fees and processing times, making Bitcoin more practical for everyday use.

- Increased scalability and network capacity: Technological advancements are continually enhancing Bitcoin's ability to handle a growing number of transactions, ensuring network stability even during periods of high activity.

- Development of new use cases and applications: The emergence of innovative applications built on the Bitcoin blockchain, such as decentralized finance (DeFi) projects and non-fungible tokens (NFTs), is expanding Bitcoin's utility and attracting a wider range of users.

H3: Regulatory Developments

While regulatory uncertainty remains a significant factor, the absence of major negative regulatory news has positively impacted investor sentiment. Gradual acceptance and clarification of Bitcoin's legal status in various jurisdictions are contributing to increased confidence.

- Positive regulatory statements from major economies: Although varying across jurisdictions, some governments' more positive stances towards cryptocurrency regulation have helped alleviate fears and encourage investment.

- Gradual acceptance of Bitcoin by financial institutions: The increasing acceptance of Bitcoin by established financial institutions signals a growing level of legitimacy and fosters confidence among investors.

- Growing clarity around Bitcoin's legal status globally: Though still evolving, increasing clarity on Bitcoin's legal standing in different countries contributes to a more predictable investment landscape.

H2: Assessing the Potential for Further Growth

While the Bitcoin price rebound is encouraging, it's essential to consider both bullish and bearish indicators to form a balanced perspective.

H3: Bullish Indicators

Several factors suggest the potential for continued Bitcoin price appreciation.

- Strong network fundamentals: Bitcoin's robust and secure blockchain network, coupled with its decentralized nature, provides a solid foundation for long-term growth.

- Growing institutional adoption: Continued institutional investment signals a growing belief in Bitcoin's long-term viability as an asset class.

- Positive sentiment among investors: Increased investor confidence, fueled by recent price increases and technological advancements, is a positive sign for future growth. On-chain metrics like transaction volume and hash rate also support this bullish sentiment.

H3: Bearish Considerations

Despite the positive indicators, potential risks and challenges remain.

- Potential for future regulatory crackdowns: The regulatory landscape is constantly evolving, and stricter regulations in some jurisdictions could negatively impact Bitcoin's price.

- Competition from other cryptocurrencies: The emergence of competing cryptocurrencies with potentially superior technologies poses a challenge to Bitcoin's dominance.

- Impact of global economic downturns: A significant global economic downturn could negatively impact investor sentiment and lead to a decline in Bitcoin's price.

H2: Investment Strategies for a Bitcoin Price Rebound

Navigating the volatile cryptocurrency market requires careful consideration of investment strategies.

H3: Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, mitigates the risk of investing a large sum at a market peak.

H3: Long-Term Holding: Bitcoin's price has historically shown significant long-term growth, suggesting that a long-term investment horizon can help weather short-term volatility.

H3: Risk Management: Diversification across multiple asset classes and only investing what one can afford to lose are crucial aspects of responsible risk management.

3. Conclusion

The recent Bitcoin price rebound is the result of a confluence of factors, including macroeconomic conditions, technological advancements, and evolving regulatory landscapes. While bullish indicators suggest further growth potential, it's crucial to acknowledge the inherent risks and volatility associated with Bitcoin. Understanding the forces driving the Bitcoin price rebound is crucial for navigating the crypto market. Stay informed and continue researching the potential of Bitcoin to make informed investment decisions. Remember to always conduct thorough research and consider your personal risk tolerance before making any investment decisions related to Bitcoin and other cryptocurrencies.

Featured Posts

-

Analiza E Ndeshjes Psg Fiton Minimalisht

May 08, 2025

Analiza E Ndeshjes Psg Fiton Minimalisht

May 08, 2025 -

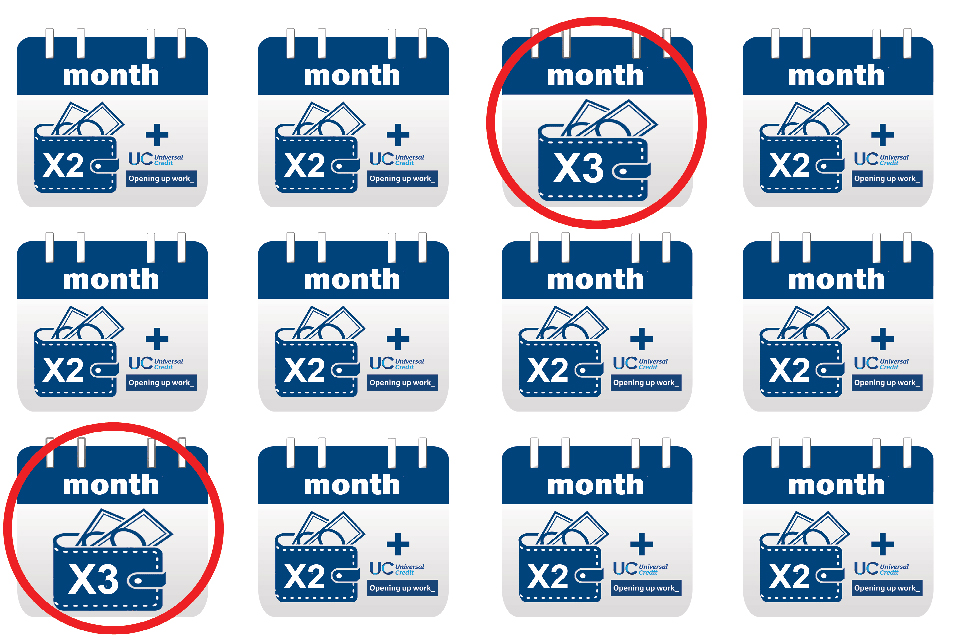

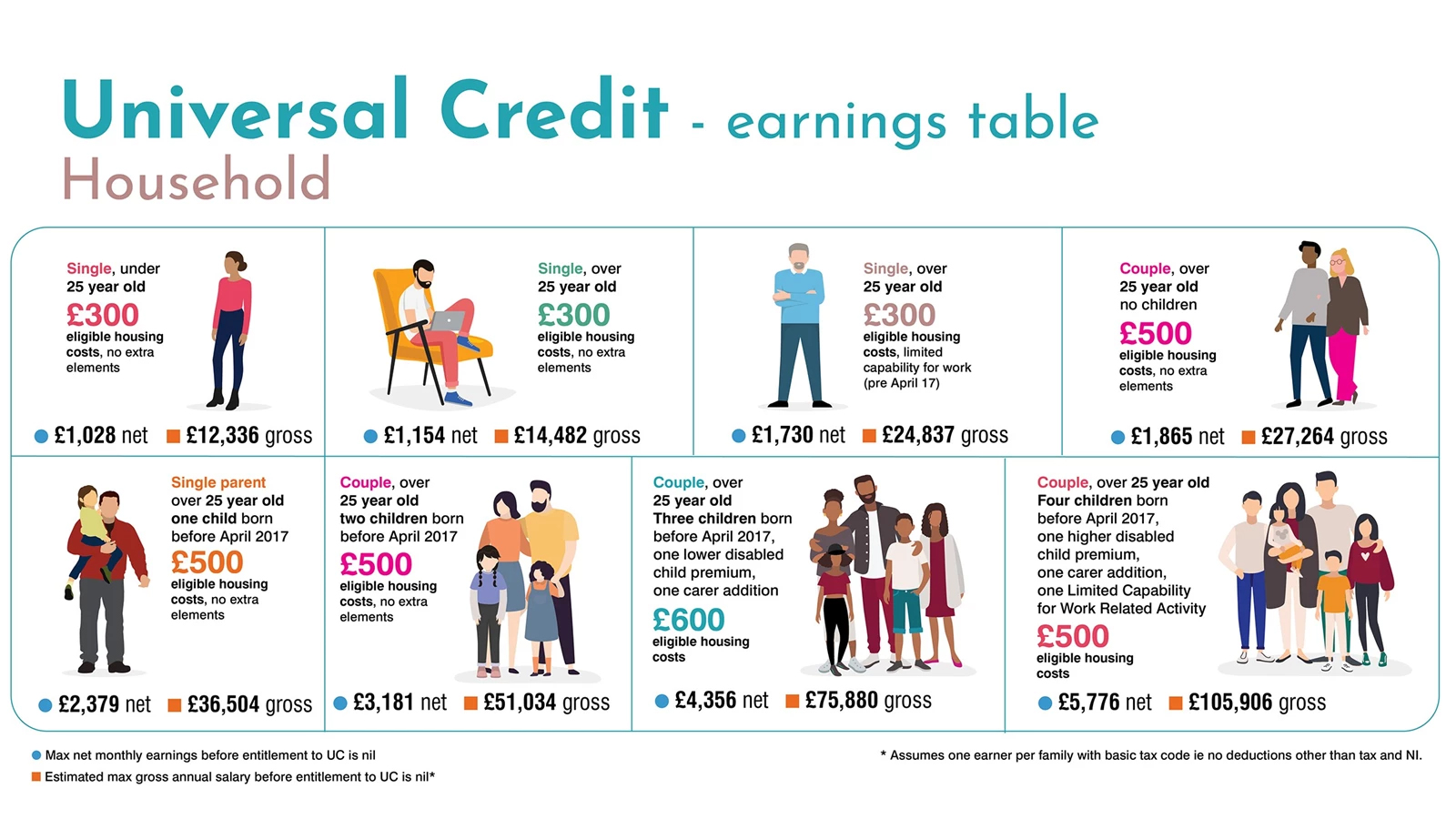

Universal Credit Back Payments Are You Eligible For A Refund

May 08, 2025

Universal Credit Back Payments Are You Eligible For A Refund

May 08, 2025 -

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025 -

Soulja Boy Ordered To Pay 6 Million In Sexual Assault Case

May 08, 2025

Soulja Boy Ordered To Pay 6 Million In Sexual Assault Case

May 08, 2025 -

Shreveport Police Announce Arrests In Extensive Car Theft Case

May 08, 2025

Shreveport Police Announce Arrests In Extensive Car Theft Case

May 08, 2025

Latest Posts

-

The Andor Season 2 Trailer Delay A Deep Dive Into Fan Reactions And Predictions

May 08, 2025

The Andor Season 2 Trailer Delay A Deep Dive Into Fan Reactions And Predictions

May 08, 2025 -

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025 -

Andor Season 2 Trailer Delay Fueling Fan Frustration And Theories

May 08, 2025

Andor Season 2 Trailer Delay Fueling Fan Frustration And Theories

May 08, 2025 -

Andor Season 1 Where To Stream Episodes 1 3 Hulu And You Tube

May 08, 2025

Andor Season 1 Where To Stream Episodes 1 3 Hulu And You Tube

May 08, 2025 -

Andors First Look Everything We Hoped For And More In The Star Wars Universe

May 08, 2025

Andors First Look Everything We Hoped For And More In The Star Wars Universe

May 08, 2025