Bitcoin Rally Predicted: Analyst's May 6th Chart Interpretation

Table of Contents

The Analyst's Methodology

Doe's analysis primarily utilizes technical analysis, focusing on historical price action and volume to predict future price movements. She employs a combination of indicators to form a holistic perspective. Specific indicators used include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), various moving averages (20-day, 50-day, 200-day), trading volume, and Bitcoin dominance.

Key chart patterns identified by Doe on May 6th included:

- A clear double bottom formation, suggesting a potential reversal of the recent downtrend.

- A bullish divergence between the price and the RSI, indicating a weakening bearish momentum.

- A positive crossover of the 20-day and 50-day moving averages, a classic bullish signal.

Supporting data included an increase in trading volume during the period of price consolidation preceding the predicted rally, suggesting accumulating buying pressure. News events surrounding regulatory developments (or lack thereof) were also considered in the overall assessment.

Key Chart Indicators Pointing to a Bitcoin Rally

Several key indicators from Doe's May 6th chart strongly suggest an upcoming Bitcoin rally.

RSI Oversold Conditions

The RSI, a momentum oscillator, had fallen into oversold territory on May 6th, indicating that the selling pressure had become excessive. Historically, oversold conditions often precede a price reversal, suggesting a potential bounce back for Bitcoin.

Bullish Moving Average Crossover

The 20-day moving average crossed above the 50-day moving average, forming a "golden cross," a widely recognized bullish signal. This crossover, combined with the double bottom formation, strengthened the prediction of an impending rally.

Increasing Trading Volume

A notable increase in trading volume accompanied the price consolidation period prior to May 6th. This heightened trading activity indicates increased investor interest and potential buying pressure, supporting the likelihood of a price surge. Specific spikes in volume around certain price levels further corroborate this analysis.

On-Chain Metrics

Doe's analysis incorporated on-chain data, specifically focusing on miner behavior and exchange balances. Decreasing exchange balances, indicating less Bitcoin being held on exchanges ready for sale, and consistently high miner revenue suggested a robust underlying support for the Bitcoin price.

Potential Price Targets and Timeline

Doe's analysis suggests a potential price target of $35,000-$40,000 for Bitcoin within the next 3-6 months. This prediction is based on the confluence of technical indicators and on-chain data. However, it's crucial to remember that price predictions are inherently uncertain. Resistance levels around $30,000 and $35,000 could potentially hinder the rally's progress.

Risks and Considerations

It is essential to acknowledge several factors that could invalidate Doe's prediction. Unforeseen macroeconomic events, significant regulatory changes, or a sudden surge in selling pressure could negatively impact Bitcoin's price. Furthermore, investing in cryptocurrency is inherently risky, and prices can be highly volatile. It is crucial to conduct thorough independent research and only invest what you can afford to lose. Diversification across different asset classes is a key risk management strategy.

Conclusion: Bitcoin Rally Predicted: A Closer Look at the May 6th Analysis

Jane Doe's analysis, based on her May 6th chart interpretation, strongly suggests a potential Bitcoin rally driven by oversold RSI conditions, a bullish moving average crossover, increasing trading volume, and supportive on-chain metrics. Potential price targets range from $35,000 to $40,000 within a 3-6 month timeframe. However, potential risks and the inherent volatility of the cryptocurrency market necessitate careful consideration and independent research before making any investment decisions. Stay tuned for more in-depth analysis of Bitcoin price predictions and market trends. Share your thoughts on this predicted Bitcoin rally and your own Bitcoin chart interpretation in the comments below!

Featured Posts

-

Knee Injury Forces Mike Trout Out Angels Extend Losing Streak To Five Games

May 08, 2025

Knee Injury Forces Mike Trout Out Angels Extend Losing Streak To Five Games

May 08, 2025 -

Debate Heats Up Car Dealers Challenge Electric Vehicle Regulations

May 08, 2025

Debate Heats Up Car Dealers Challenge Electric Vehicle Regulations

May 08, 2025 -

Denver Nuggets Jokic Among Starters Benched After Grueling Game

May 08, 2025

Denver Nuggets Jokic Among Starters Benched After Grueling Game

May 08, 2025 -

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Uyari

May 08, 2025

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Uyari

May 08, 2025 -

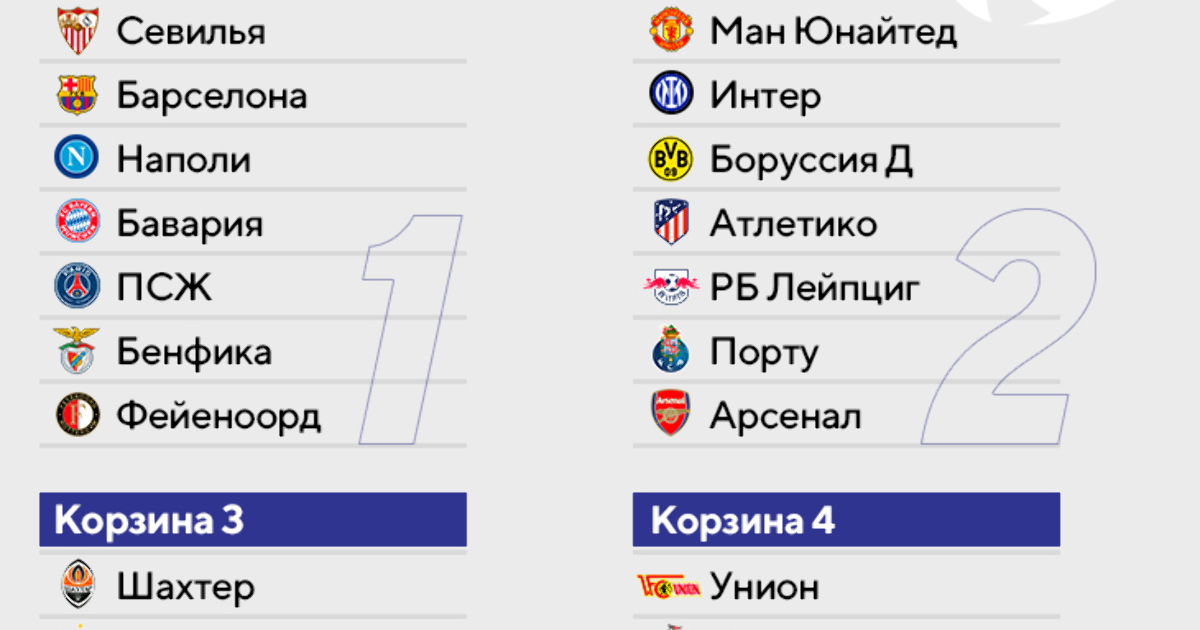

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter 2024 2025

May 08, 2025

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter 2024 2025

May 08, 2025

Latest Posts

-

7 Hidden Gems Streaming On Paramount Right Now

May 08, 2025

7 Hidden Gems Streaming On Paramount Right Now

May 08, 2025 -

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan A Ranked List

May 08, 2025

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan A Ranked List

May 08, 2025 -

7 Paramount Movies You Didnt Know Existed But Should Watch Now

May 08, 2025

7 Paramount Movies You Didnt Know Existed But Should Watch Now

May 08, 2025 -

Saving Private Ryan 20 Behind The Scenes Facts

May 08, 2025

Saving Private Ryan 20 Behind The Scenes Facts

May 08, 2025 -

Exploring Warfare 5 Movies That Capture Action And Heart

May 08, 2025

Exploring Warfare 5 Movies That Capture Action And Heart

May 08, 2025