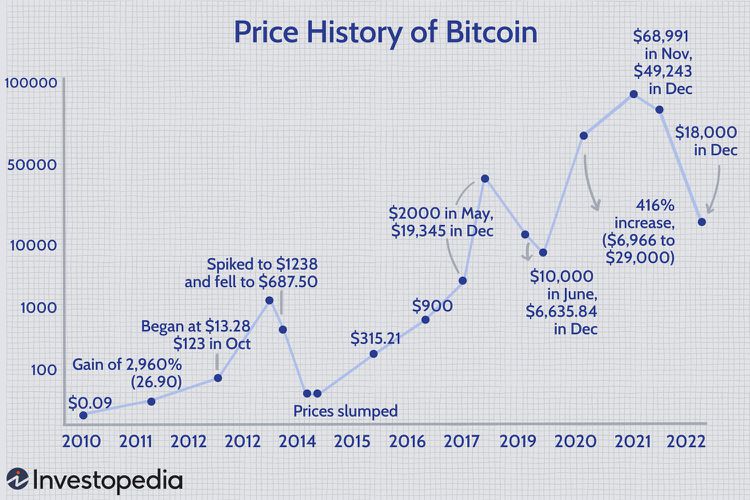

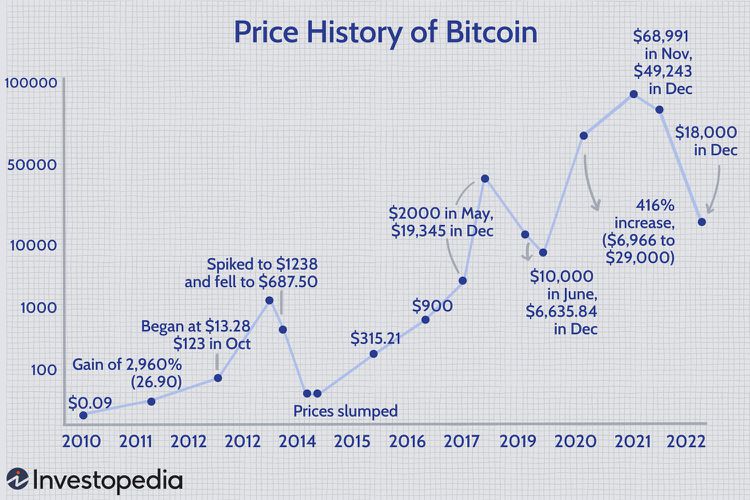

Bitcoin's 10-Week High: Implications For The $100,000 Target

Table of Contents

Factors Contributing to Bitcoin's 10-Week High

Several interconnected factors have contributed to Bitcoin's impressive 10-week high and renewed optimism surrounding the cryptocurrency's potential.

Macroeconomic Conditions

The current macroeconomic climate has played a significant role in Bitcoin's price surge. Global inflation, recessionary fears, and the underperformance of traditional markets have driven investors towards alternative assets.

- Safe-haven asset appeal: Bitcoin, often viewed as a hedge against inflation and economic uncertainty, has seen increased demand as investors seek to protect their portfolios from traditional market volatility.

- Inflation hedge: With inflation eroding the purchasing power of fiat currencies, Bitcoin's fixed supply and deflationary nature make it an attractive alternative.

- Dollar devaluation: Concerns about the weakening US dollar have also pushed investors towards Bitcoin as a store of value.

- Decreased investor confidence in traditional assets: Poor performance in stock markets and bond yields has encouraged diversification into cryptocurrencies, boosting Bitcoin's price.

Institutional Adoption and Investment

The growing adoption of Bitcoin by institutional investors is another key driver of the recent rally. Large-scale investments from corporations and financial institutions signal increasing confidence in Bitcoin's long-term prospects.

- Increased regulatory clarity: Although regulatory landscapes remain complex globally, a degree of increased clarity in some jurisdictions has encouraged institutional participation.

- Grayscale Bitcoin Trust (GBTC): The ongoing performance of GBTC, a significant Bitcoin investment vehicle, influences market sentiment and institutional participation.

- Corporate treasury holdings: Companies like MicroStrategy continue to accumulate Bitcoin as part of their treasury reserves, driving demand.

- ETF approval speculation: The ongoing debate and potential approval of Bitcoin Exchange-Traded Funds (ETFs) in major markets could significantly boost institutional investment.

Growing Network Activity and Developer Engagement

Increased network activity and ongoing development efforts further strengthen Bitcoin's position as a viable and robust digital asset.

- On-chain metrics: A rise in on-chain metrics, such as transaction volume and network hash rate, demonstrates growing usage and network security.

- Lightning Network adoption: The increasing adoption of the Lightning Network, a layer-2 scaling solution, enhances Bitcoin's transaction speed and efficiency.

- Bitcoin development updates: Continuous development and upgrades, such as the Taproot upgrade, improve Bitcoin's functionality and security, fostering confidence.

- Taproot upgrade impact: The Taproot upgrade has improved Bitcoin's scalability and privacy features, attracting more users and developers.

Assessing the Viability of the $100,000 Bitcoin Target

While the recent rally is encouraging, reaching the $100,000 Bitcoin target requires considering various factors.

Technical Analysis

Technical analysis provides insights into potential price movements based on historical data and chart patterns.

- Moving averages: Analysis of moving averages can signal potential trend reversals or continuations.

- Relative Strength Index (RSI): The RSI helps to identify overbought or oversold conditions, hinting at potential corrections or further price increases.

- Bollinger Bands: Bollinger Bands help gauge price volatility and identify potential breakout points.

- Fibonacci retracements: These retracement levels can predict potential support and resistance levels during price fluctuations.

Market Sentiment and Investor Psychology

Market sentiment, driven by factors like FOMO (fear of missing out) and overall investor psychology, can significantly impact Bitcoin's price.

- Social media sentiment: Tracking social media sentiment can gauge the overall optimism or pessimism surrounding Bitcoin.

- Google Trends data: Analyzing Google Trends data helps understand the public's interest in Bitcoin and potential shifts in demand.

- Fear & Greed Index: The crypto Fear & Greed Index provides a measure of market sentiment, indicating whether investors are driven by fear or greed.

- Whale activity: The actions of large Bitcoin holders ("whales") can impact price movements significantly.

Regulatory Landscape and Geopolitical Events

Global regulatory changes and geopolitical events can significantly influence Bitcoin's price trajectory.

- US regulatory uncertainty: The evolving regulatory landscape in the US remains a crucial factor affecting Bitcoin's price.

- China's crypto policies: China's policies continue to impact the overall cryptocurrency market.

- Global economic stability: Global economic stability and instability significantly affect investor confidence in Bitcoin.

- El Salvador's Bitcoin adoption: Developments in countries like El Salvador, which have adopted Bitcoin as legal tender, influence market sentiment.

Conclusion: Bitcoin's Future and the Path to $100,000

Bitcoin's recent 10-week high is driven by a confluence of factors: macroeconomic uncertainty, institutional adoption, and positive network developments. While the $100,000 Bitcoin target remains ambitious, the current trajectory suggests a potential path forward. However, inherent volatility within the cryptocurrency market necessitates a cautious outlook. Understanding technical analysis, market sentiment, and the regulatory landscape is critical for navigating the complexities of Bitcoin's price fluctuations. To successfully invest in Bitcoin and navigate its potential, continued research into Bitcoin price trends and the wider cryptocurrency market is crucial. Consider the implications of Bitcoin investment for your portfolio and make informed decisions. Bitcoin's potential is undeniable, but smart, informed participation is key to successfully navigating the journey toward – and beyond – the $100,000 Bitcoin price target.

Featured Posts

-

Strengthened Partnership Royal Air Maroc And Mauritania Airlines Announce New Agreement

May 07, 2025

Strengthened Partnership Royal Air Maroc And Mauritania Airlines Announce New Agreement

May 07, 2025 -

New York Yankees 2000 Failed Comeback 500 Season Summary

May 07, 2025

New York Yankees 2000 Failed Comeback 500 Season Summary

May 07, 2025 -

Ovechkin V Zale Slavy Iihf Podtverzhdenie Krikunova

May 07, 2025

Ovechkin V Zale Slavy Iihf Podtverzhdenie Krikunova

May 07, 2025 -

The Baba Yaga Role A Unique John Wick Experience In Las Vegas

May 07, 2025

The Baba Yaga Role A Unique John Wick Experience In Las Vegas

May 07, 2025 -

How Zendaya Learned About Her Spider Man Audition Last Minute

May 07, 2025

How Zendaya Learned About Her Spider Man Audition Last Minute

May 07, 2025