Bitcoin's Price Surge: Understanding The Factors Driving The Rebound

Table of Contents

Institutional Adoption and Investment

The growing interest from institutional investors is a major catalyst for Bitcoin's price surge. Hedge funds, corporations, and other large financial players are increasingly allocating assets to Bitcoin, viewing it as a potential long-term investment and a hedge against inflation. This institutional adoption signifies a shift from the early days of Bitcoin, dominated by individual investors, towards a more mature and established asset class.

Examples abound. MicroStrategy, a publicly traded business intelligence company, has made significant Bitcoin purchases, holding a substantial portion of its treasury reserves in BTC. Similarly, Tesla, the electric vehicle giant, added Bitcoin to its balance sheet, demonstrating confidence in the cryptocurrency's long-term potential. Furthermore, the Grayscale Bitcoin Trust (GBTC), a publicly traded investment vehicle, provides institutional investors with a regulated pathway to gain exposure to Bitcoin, further driving demand.

- Increased institutional demand directly translates to higher prices due to increased buying pressure.

- Sophisticated investment strategies employed by institutions add another layer of stability and price support to the market.

- Growing regulatory clarity globally reduces the perceived risk for institutional investors, making Bitcoin a more attractive investment option.

Growing Regulatory Clarity and Acceptance

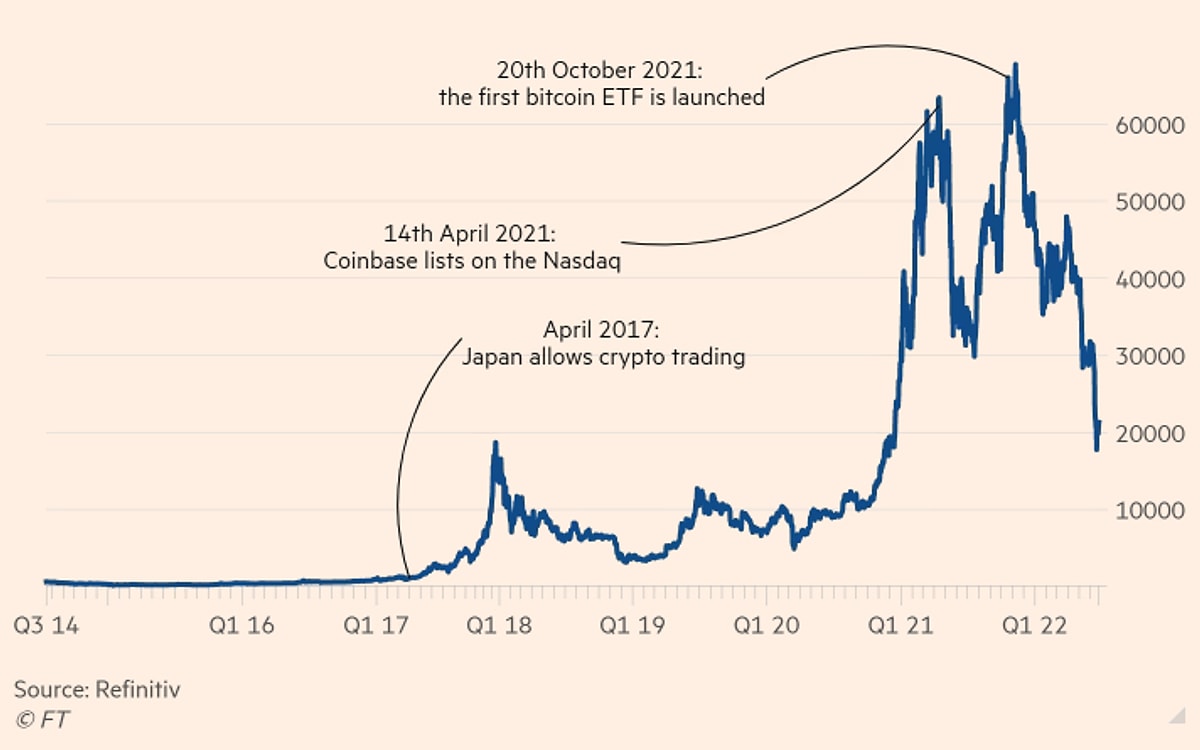

The evolving regulatory landscape surrounding Bitcoin globally is another significant factor driving its price upward. Increased regulatory clarity reduces uncertainty and encourages further investment. While regulatory approaches vary across jurisdictions, positive developments in certain regions are fueling confidence. For example, the increasing acceptance of Bitcoin as a legitimate asset class in some countries is signaling a shift towards a more regulated and transparent ecosystem.

- Several countries are actively developing and implementing clearer Bitcoin regulations, minimizing ambiguity and potential legal risks.

- Reduced fear of government crackdowns boosts investor confidence and encourages more participation in the market.

- Increased legitimacy from regulatory acceptance enhances Bitcoin's credibility as a viable investment and store of value.

Macroeconomic Factors and Inflation Concerns

Macroeconomic factors, particularly concerns about inflation and economic uncertainty, have significantly influenced Bitcoin's price. Many investors view Bitcoin as a hedge against inflation, believing its limited supply will protect its value against fiat currency devaluation. This perception has intensified as global inflation rates have risen, leading investors to seek alternative assets beyond traditional markets.

- Rising inflation rates drive investors to seek assets that are less susceptible to inflationary pressures, leading them to Bitcoin.

- Bitcoin's inherent scarcity, with a fixed supply of 21 million coins, makes it an attractive asset during times of economic instability.

- Bitcoin's increasing recognition as a safe-haven asset contributes significantly to its price appreciation during periods of market volatility.

Technological Advancements and Network Upgrades

Significant upgrades to the Bitcoin network, such as improvements to the Lightning Network, have enhanced its scalability and usability. These advancements reduce transaction fees and increase transaction speeds, making Bitcoin more practical for everyday use. As the network becomes more efficient and user-friendly, adoption rates increase, directly impacting its price.

- Improved transaction speed and significantly lower fees attract more users and businesses to the Bitcoin network.

- Increased scalability addresses previous limitations and makes Bitcoin more viable for large-scale transactions and everyday payments.

- Positive network effects, where increased adoption leads to further adoption, contribute to a positive feedback loop boosting the Bitcoin price.

Social Media Influence and Market Sentiment

Social media plays a powerful role in shaping public perception of Bitcoin and driving price fluctuations. Positive news, hype, and endorsements from influential figures in the crypto space can generate significant buying pressure, leading to price surges. Conversely, negative news or regulatory uncertainty can create sell-offs.

- Social media sentiment significantly impacts market psychology, influencing trading decisions and overall market trends.

- Influencer marketing and social media campaigns can drastically affect Bitcoin’s short-term price volatility.

- News cycles and social media discussions directly affect short-term price movements, highlighting the importance of discerning credible information.

Conclusion: Understanding the Drivers Behind Bitcoin's Price Surge

Bitcoin's recent price rebound is a complex phenomenon driven by a confluence of factors, including increased institutional adoption, growing regulatory clarity, macroeconomic conditions, technological advancements, and market sentiment fueled by social media. Understanding these interconnected elements is crucial for making informed decisions in the ever-evolving Bitcoin market. Stay informed about the factors driving Bitcoin's price surge and make well-researched decisions regarding your Bitcoin investments. Further research into Bitcoin price trends, Bitcoin market analysis, and Bitcoin price prediction models can help you navigate this dynamic landscape.

Featured Posts

-

Resurgimiento Del Psg Derrota Del Lyon En Casa

May 08, 2025

Resurgimiento Del Psg Derrota Del Lyon En Casa

May 08, 2025 -

John Fetterman Responds To Ny Magazine Article Questioning His Health

May 08, 2025

John Fetterman Responds To Ny Magazine Article Questioning His Health

May 08, 2025 -

Etf

May 08, 2025

Etf

May 08, 2025 -

Bitcoin In Buguenkue Durumu Fiyat Hareketleri Ve Gelecek Tahminleri

May 08, 2025

Bitcoin In Buguenkue Durumu Fiyat Hareketleri Ve Gelecek Tahminleri

May 08, 2025 -

Assassins Creed Shadows Of Mordor Ps 5 Pro Enhanced Visuals With Ray Tracing

May 08, 2025

Assassins Creed Shadows Of Mordor Ps 5 Pro Enhanced Visuals With Ray Tracing

May 08, 2025

Latest Posts

-

Minecraft Superman Thailand Theater Shows 5 Minute Preview

May 08, 2025

Minecraft Superman Thailand Theater Shows 5 Minute Preview

May 08, 2025 -

James Gunns Superman Movie First Look At Krypto

May 08, 2025

James Gunns Superman Movie First Look At Krypto

May 08, 2025 -

Lidl Faces Lawsuit From Consumer Group Regarding Its Plus App

May 08, 2025

Lidl Faces Lawsuit From Consumer Group Regarding Its Plus App

May 08, 2025 -

Superman Minecraft 5 Minute Preview Thailand Theater Teaser

May 08, 2025

Superman Minecraft 5 Minute Preview Thailand Theater Teaser

May 08, 2025 -

Consumer Organisation Takes Lidl To Court Over Plus App

May 08, 2025

Consumer Organisation Takes Lidl To Court Over Plus App

May 08, 2025