Bitcoin's Price Trajectory: Trump's Influence And The Path To $100,000

Table of Contents

Trump's Potential Impact on Bitcoin's Price

Donald Trump's presence on the political stage has undeniably introduced an element of unpredictability into various markets, and the cryptocurrency world is no exception. His pronouncements and policies could significantly influence Bitcoin's price trajectory in several ways.

Regulatory Uncertainty and its Effect

Trump's past statements on Bitcoin and cryptocurrencies have been mixed, ranging from cautious skepticism to hints of potential support. This regulatory ambiguity creates both opportunities and challenges for Bitcoin's future.

- Trump's past rhetoric: While he hasn't explicitly endorsed Bitcoin, his administration's approach to regulation has been inconsistent, leading to uncertainty among investors. Some interpret this as potential for favorable regulation, while others see it as a risk.

- Potential regulatory changes: A Trump administration might favor a lighter regulatory touch, potentially fostering innovation and attracting more investment. Conversely, a stricter regulatory environment could stifle growth and negatively impact the Bitcoin price.

- International comparisons: Comparing the US regulatory landscape to those of other countries, such as El Salvador which has adopted Bitcoin as legal tender, reveals the significant impact of government policy on cryptocurrency adoption and price.

- Investor confidence: Clear and consistent regulatory frameworks are vital for building investor confidence. Uncertainty breeds volatility, potentially leading to both sharp price increases and significant drops.

Macroeconomic Factors and Trump's Policies

Trump's economic policies, particularly those related to fiscal spending and trade, have far-reaching consequences, impacting inflation, the value of the US dollar, and ultimately, Bitcoin's price.

- Inflation and the US dollar: Expansionary fiscal policies can lead to inflation, potentially eroding the purchasing power of the US dollar. This could increase Bitcoin's appeal as a hedge against inflation, driving up demand.

- Bitcoin as a safe haven: During times of economic uncertainty or geopolitical instability, investors often seek safe haven assets. Bitcoin's decentralized nature and limited supply could make it an attractive option, boosting its price.

- Trade wars and geopolitical events: Trump's trade policies and confrontational foreign policy have created periods of market volatility. Such instability can lead to increased demand for Bitcoin as a store of value, impacting its price.

- Macroeconomic instability: Periods of significant macroeconomic instability often correlate with increased Bitcoin volatility. Understanding this relationship is crucial for navigating the market effectively.

Other Factors Influencing Bitcoin's Path to $100,000

While Trump's influence is a significant factor, other elements are crucial to Bitcoin's price trajectory and its potential to reach $100,000.

Technological Advancements and Adoption

Technological innovations and increased adoption are key drivers of Bitcoin's potential price appreciation.

- Lightning Network and scalability: The Lightning Network and other layer-two solutions address Bitcoin's scalability challenges, making transactions faster and cheaper, enhancing its usability.

- Institutional adoption: Growing institutional investment from corporations and financial institutions signals increasing legitimacy and trust in Bitcoin, contributing to price increases.

- Mainstream adoption: Wider public acceptance and adoption are fundamental to Bitcoin's long-term success and price appreciation.

- Future technological developments: Continued innovation in Bitcoin's underlying technology, such as improved privacy features, will enhance its appeal and potentially drive up its price.

Market Sentiment and Speculation

Market sentiment, driven by news, social media, and speculation, plays a pivotal role in Bitcoin's price volatility.

- Social media and news: Positive or negative news coverage and social media trends can significantly influence investor sentiment, leading to price swings.

- Historical price bubbles and corrections: Studying past Bitcoin price bubbles and subsequent corrections is crucial for understanding the market's cyclical nature and managing risk.

- Whale activity: Large-scale trades by "whales" (individuals or entities holding substantial amounts of Bitcoin) can trigger significant price movements.

- Psychological factors: Fear, greed, and herd mentality strongly influence investor behavior and Bitcoin's price.

Addressing the Challenges to Reaching $100,000

Reaching the $100,000 mark is not guaranteed. Several challenges could hinder Bitcoin's price trajectory.

Volatility and Market Corrections

Bitcoin's inherent volatility remains a significant risk.

- Significant price drops: Bitcoin is known for its dramatic price swings, and sharp corrections are a possibility.

- Risk management: Effective risk management strategies are crucial for investors navigating the volatile Bitcoin market.

- Historical examples: Examining past market corrections provides valuable insights into the potential for future downturns.

Competition from other Cryptocurrencies

The cryptocurrency landscape is constantly evolving, with new competitors emerging.

- Alternative cryptocurrencies: The emergence of alternative cryptocurrencies with potentially superior technologies or features poses a threat to Bitcoin's dominance.

- Bitcoin's strengths and weaknesses: A comparative analysis of Bitcoin's strengths and weaknesses against its competitors is vital for assessing its future prospects.

- Market dominance: Bitcoin's current market dominance is not guaranteed, and competition could erode its value.

Conclusion

Bitcoin's price trajectory is a complex interplay of various factors, including the potential influence of Donald Trump's policies and actions. While Trump's administration could significantly impact macroeconomic conditions and potentially boost Bitcoin's price, other crucial elements like technological advancements, market sentiment, and competition from other cryptocurrencies will determine whether Bitcoin reaches $100,000. Understanding these interwoven forces is critical for navigating the Bitcoin market and making informed investment decisions. Stay informed about Bitcoin price predictions and political developments to optimize your Bitcoin investment strategy. Learn more about Bitcoin's price trajectory and how to navigate the market effectively.

Featured Posts

-

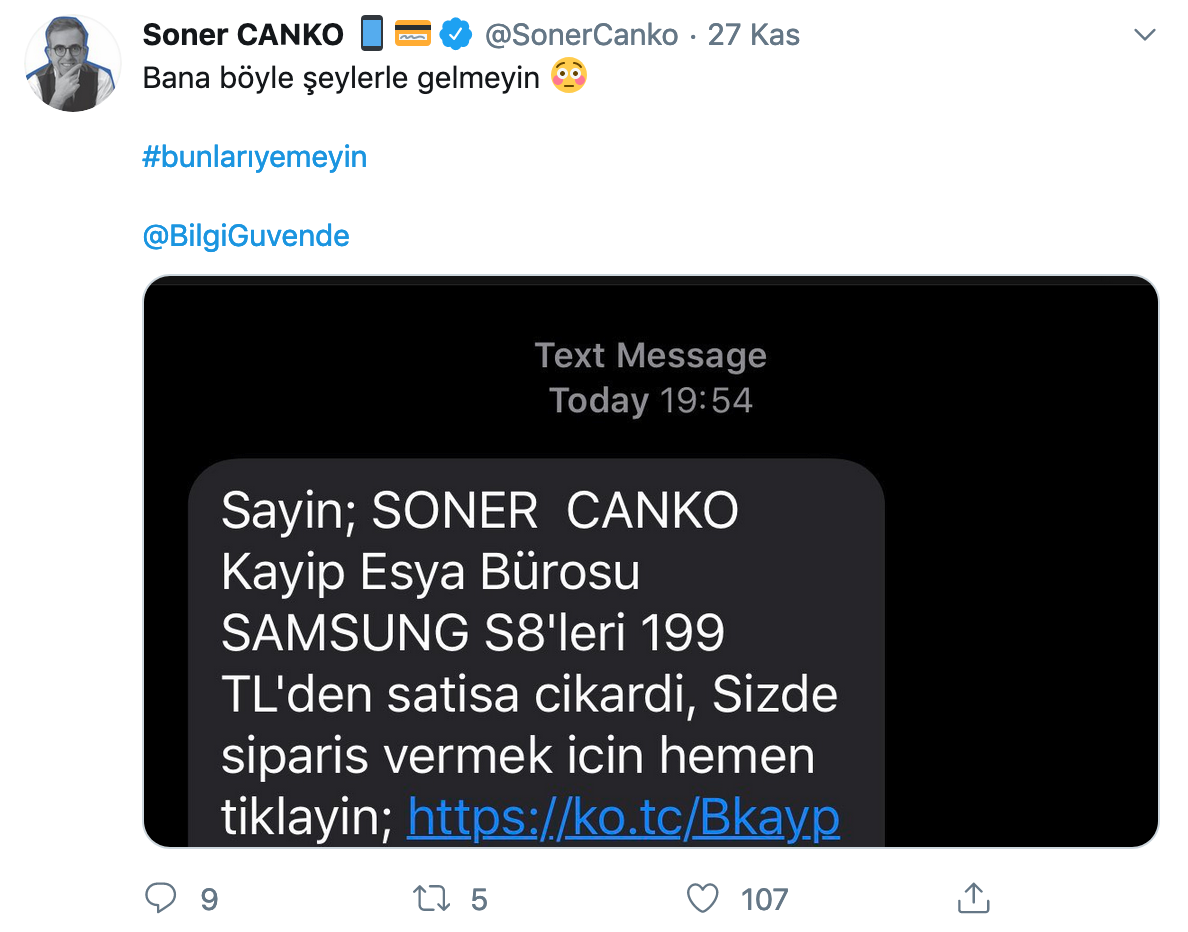

Sms Dolandiriciligi Kurbani Oldunuz Mu Sikayetinizi Nasil Bildirebilirsiniz

May 08, 2025

Sms Dolandiriciligi Kurbani Oldunuz Mu Sikayetinizi Nasil Bildirebilirsiniz

May 08, 2025 -

Kripto Lider Kripto Para Yatirimlarinda Yeni Bir Perspektif

May 08, 2025

Kripto Lider Kripto Para Yatirimlarinda Yeni Bir Perspektif

May 08, 2025 -

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Arrested

May 08, 2025

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Arrested

May 08, 2025 -

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025 -

Nba Basketball Thunder Vs Trail Blazers Game Details For March 7th

May 08, 2025

Nba Basketball Thunder Vs Trail Blazers Game Details For March 7th

May 08, 2025

Latest Posts

-

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025 -

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025 -

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025 -

3 Reasons A Princess Leia Cameo In The New Star Wars Show Is Likely

May 08, 2025

3 Reasons A Princess Leia Cameo In The New Star Wars Show Is Likely

May 08, 2025