BOE Rate Cut Odds Fall: Pound Climbs Following Lower-Than-Expected UK Inflation

Table of Contents

Lower-Than-Expected UK Inflation: A Surprise Market Shift

Unexpected Inflation Figures Fuel Pound Sterling Surge

The Office for National Statistics (ONS) reported UK inflation at [Insert actual inflation figure]% for [Insert month and year], significantly lower than the [Insert predicted percentage]% anticipated by analysts. This unexpected drop represents a [Insert percentage difference] decrease compared to previous projections and marks a surprising turn in the inflationary trend. Was this a temporary dip, or is it a sign of a broader shift in the UK's economic landscape? Several contributing factors might be at play:

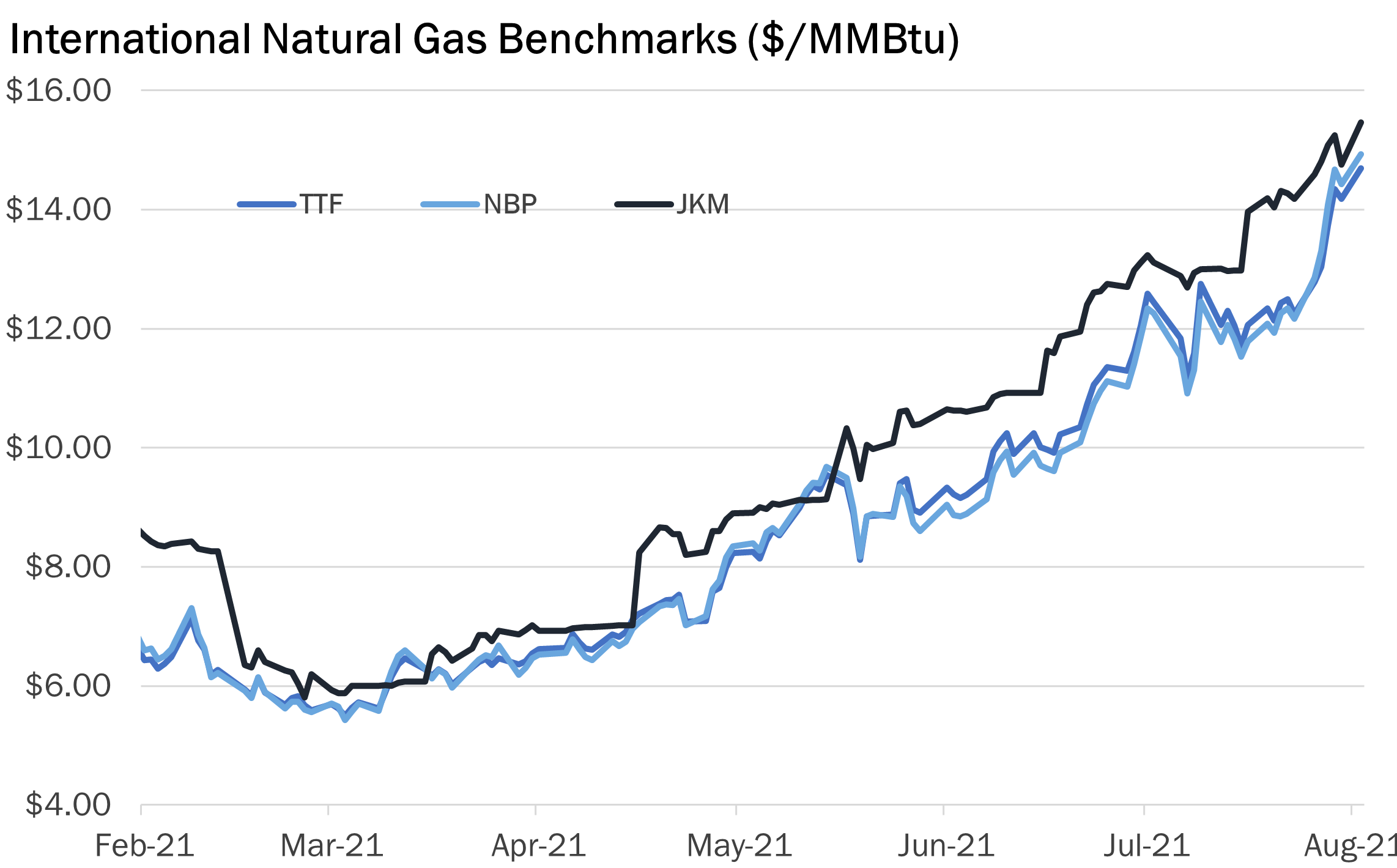

- Easing Energy Prices: The decline in global energy prices, particularly natural gas, has undoubtedly played a significant role in easing inflationary pressures.

- Slowing Demand: A potential slowdown in consumer spending and business investment could be contributing to the reduced demand-pull inflation.

- Supply Chain Improvements: While still volatile, global supply chains are showing signs of improvement, potentially reducing price pressures.

[Insert a relevant chart or graph visually representing the inflation data, clearly labeled and sourced].

Impact on Market Sentiment and Investor Confidence

The lower-than-expected inflation figures triggered a positive shift in market sentiment and boosted investor confidence in the UK economy. The immediate market reactions were swift:

- Pound Sterling Surge: The pound experienced a noticeable rise against major currencies, reflecting renewed optimism about the UK's economic outlook.

- Fall in Gilt Yields: The yield on UK government bonds (gilts) fell, suggesting investors are less concerned about future inflation.

- Shift in BOE Policy Expectations: The market's expectation of further BOE rate cuts diminished significantly, as the need for aggressive monetary easing to combat inflation lessened.

BOE Rate Cut Odds Fall: Implications for Monetary Policy

Reduced Likelihood of Further Interest Rate Cuts by the Bank of England

The unexpected drop in inflation significantly reduces the probability of the Bank of England implementing further interest rate cuts. The BOE's primary mandate is to maintain price stability, and with inflation falling, the urgency to stimulate the economy through lower interest rates has lessened. Maintaining or even raising interest rates could have several implications:

- Impact on Borrowing Costs: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth.

- Impact on Economic Growth: While controlling inflation is crucial, higher interest rates could stifle economic growth if applied too aggressively.

However, it's crucial to consider alternative scenarios. If inflation unexpectedly rises again in the coming months, the BOE might need to revisit its monetary policy stance.

Future BOE Meetings and Market Predictions

The next BOE meeting is scheduled for [Insert date], and market analysts are closely monitoring the situation. Predictions vary, but many now believe that a rate cut is less likely in the near future. Experts suggest that [mention expert opinions and forecasts, sourcing them], highlighting the uncertainty surrounding the long-term trajectory of inflation. Potential risks include unforeseen global economic shocks or renewed inflationary pressures from unexpected sources.

Pound Climbs: Strength Against Major Currencies

Pound Sterling Gains Momentum Following Inflation Report

Following the release of the inflation data, the pound strengthened significantly against major global currencies:

- USD: The GBP/USD exchange rate experienced a notable increase.

- EUR: The GBP/EUR exchange rate also showed improvement.

- JPY: Similar positive movement was observed against the Japanese Yen.

This strengthening reflects improved investor sentiment and the decreased likelihood of BOE rate cuts.

Long-Term Outlook for the Pound

The long-term outlook for the pound is complex and depends on a multitude of factors beyond just inflation. While the recent rise is encouraging, potential risks and challenges remain:

- Global Economic Uncertainty: Global economic headwinds could negatively impact the pound's value.

- Brexit-Related Issues: Lingering uncertainties related to Brexit could continue to exert pressure on the pound.

- Geopolitical Factors: International political instability can also affect currency markets.

Conclusion: Navigating the Shifting Landscape of BOE Rate Cut Odds

In summary, lower-than-expected UK inflation has significantly altered the landscape of BOE rate cut odds, leading to a fall in expectations and a subsequent rise in the value of the pound. This unexpected shift has significant implications for investors, businesses, and the UK economy as a whole. While the immediate outlook seems positive, it's crucial to remain vigilant and monitor the evolving economic situation closely. The uncertainty surrounding future inflation and BOE policy requires careful navigation. Stay informed about the changing "BOE Rate Cut Odds" and related economic indicators by subscribing to our newsletter [link to newsletter] for regular updates and in-depth analysis.

Featured Posts

-

January 6th Conspiracy Theories Ray Epps Defamation Suit Against Fox News

May 22, 2025

January 6th Conspiracy Theories Ray Epps Defamation Suit Against Fox News

May 22, 2025 -

Illinois Gas Prices Drop Following National Trend

May 22, 2025

Illinois Gas Prices Drop Following National Trend

May 22, 2025 -

Mas Alla Del Arandano El Mejor Aliado Para Una Vida Larga Y Saludable

May 22, 2025

Mas Alla Del Arandano El Mejor Aliado Para Una Vida Larga Y Saludable

May 22, 2025 -

Thames Water Executive Compensation An Analysis Of Recent Figures

May 22, 2025

Thames Water Executive Compensation An Analysis Of Recent Figures

May 22, 2025 -

Solve Wordle 1352 Hints Clues And The Answer For March 2nd

May 22, 2025

Solve Wordle 1352 Hints Clues And The Answer For March 2nd

May 22, 2025