BOE Rate Cut Speculation Falls Following UK Inflation Figures: Pound Gains

Table of Contents

UK Inflation Figures Exceed Expectations

The recently released UK inflation figures significantly exceeded analyst predictions, painting a picture far more complex than the anticipated slowdown. The Consumer Price Index (CPI) rose to [Insert Actual CPI Percentage]% in [Insert Month, Year], surpassing the forecast of [Insert Analyst Forecast Percentage]%. This unexpected increase adds a new layer of complexity to the current economic situation. Contributing factors to this higher-than-expected inflation include persistent energy price increases, ongoing supply chain disruptions, and robust consumer demand in certain sectors.

- CPI: [Insert Actual CPI Percentage]% (vs. [Insert Analyst Forecast Percentage]% forecast)

- Comparison to Previous Month: Increased by [Insert Percentage]% compared to [Insert Previous Month, Year]'s figure of [Insert Previous Month's CPI Percentage]%.

- Key Sectors Driving Inflation: Energy, food, and transportation costs were the primary drivers of the increased inflation rate. The RPI (Retail Price Index), another key inflation measure, also showed a similar upward trend.

These figures provide a clear snapshot of the UK's inflationary pressures, complicating the narrative around a potential easing of monetary policy by the BOE. The implications of this higher-than-expected UK inflation data for the wider economy are substantial, particularly regarding future interest rate decisions.

Impact on BOE Rate Cut Speculation

The higher-than-expected UK inflation figures have significantly impacted BOE interest rate cut speculation. The BOE's primary mandate is to maintain price stability and control inflation. With inflation stubbornly above the target rate, the likelihood of a rate cut has diminished considerably. A rate cut, in this environment, would risk further fueling inflation, undermining the BOE's core objective. Therefore, the market's expectation of a rate cut has been substantially revised downwards.

- Inflation and Interest Rates: Higher inflation typically necessitates higher interest rates to cool down the economy and curb spending, thereby reducing demand-pull inflation.

- Market Reactions: Following the release of the inflation data, financial markets reacted swiftly, with a noticeable decrease in the probability of a rate cut priced into the markets. Government bond yields rose, reflecting investor expectations of higher interest rates in the future.

- Potential Future BOE Actions: While a rate cut is now less likely in the near term, the BOE may still consider other monetary policy tools, such as quantitative easing or adjustments to its forward guidance, depending on future economic indicators. The possibility of a rate hike also cannot be ruled out if inflation continues its upward trajectory.

The unexpected inflation figures have shifted the focus from imminent rate cuts towards a more cautious approach, highlighting the complexities of monetary policy decision-making in the current climate.

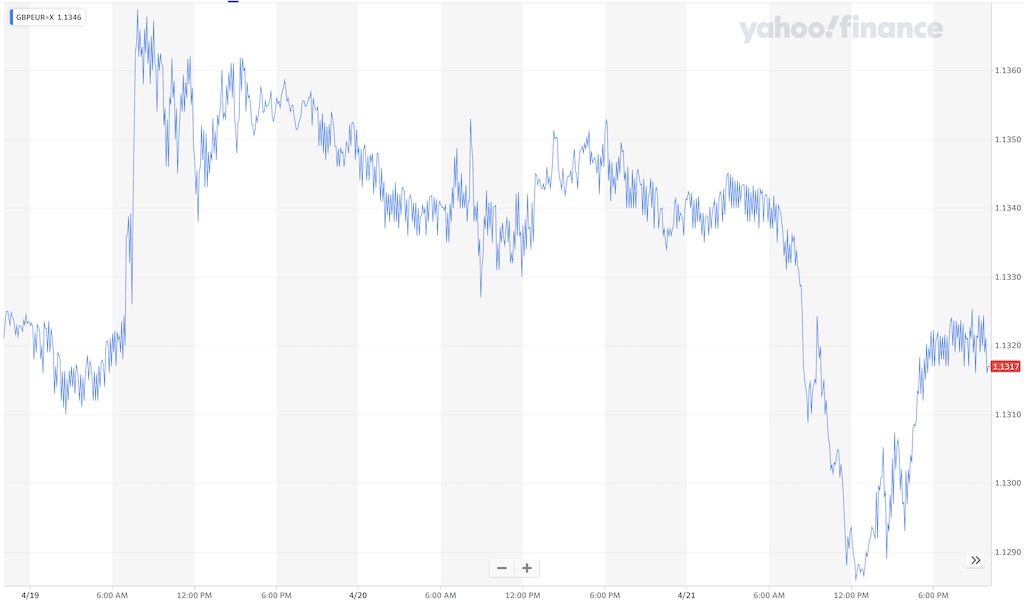

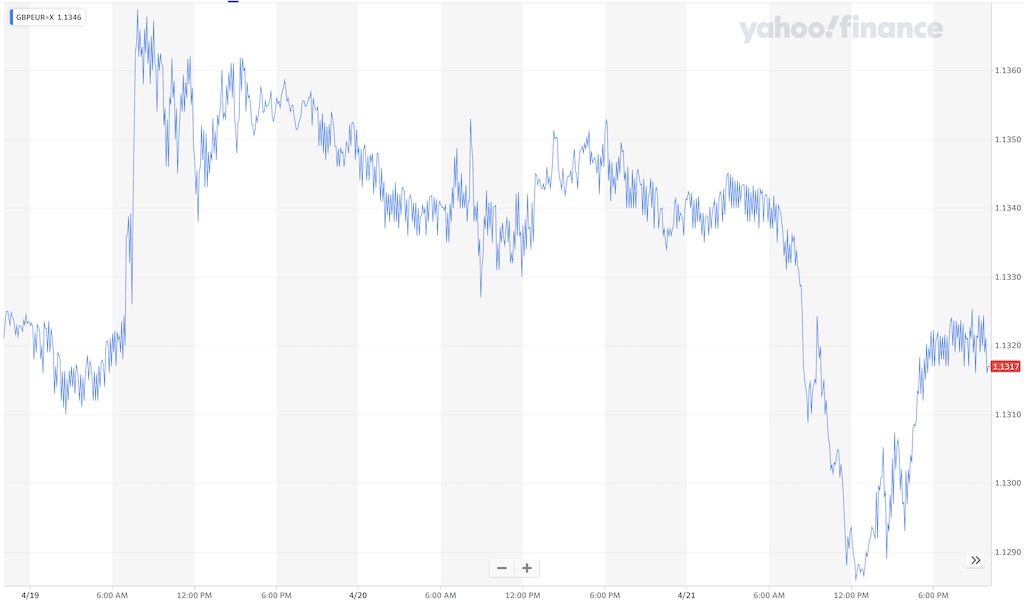

Pound Sterling Strengthens – GBP Exchange Rate Analysis

The reduced BOE rate cut speculation has had a direct positive impact on the value of the Pound Sterling (GBP). The prospect of lower interest rates typically makes a currency less attractive to investors, as returns on investments become lower. However, with the likelihood of a rate cut decreasing, the GBP has gained strength against major currencies.

- GBP/USD Exchange Rate Change: The GBP/USD exchange rate has seen an appreciation of approximately [Insert Percentage]% since the release of the inflation data.

- GBP/EUR Exchange Rate Change: The GBP/EUR exchange rate also saw a positive shift, gaining roughly [Insert Percentage]%.

- Impact on International Trade and Investment: The stronger Pound will likely impact UK exports, making them more expensive for international buyers, while simultaneously making imports cheaper. This could have significant ramifications for the UK's trade balance and overall economic growth.

This strengthening of the Pound Sterling highlights the close relationship between BOE interest rate expectations and currency trading, demonstrating the impact of economic data on exchange rates and the broader forex market.

Conclusion: The Future of BOE Rate Cut Speculation and the Pound

In conclusion, the unexpected rise in UK inflation figures has dramatically altered the outlook for BOE rate cut speculation. The higher-than-expected inflation rate makes a rate cut less likely in the near term, contributing to the strengthening of the Pound Sterling. The future trajectory of inflation, BOE interest rates, and the GBP will depend heavily on upcoming economic data and the BOE's response to evolving market conditions. To make informed financial decisions, staying updated on the latest economic news and BOE rate cut speculation is crucial. Subscribe to our updates or follow reputable financial news sources to stay informed about future developments related to the UK economy and the Pound Sterling. Further research into UK inflation, monetary policy, and exchange rate dynamics is also highly recommended.

Featured Posts

-

La Chine Et La Repression Des Voix Dissidentes En France

May 25, 2025

La Chine Et La Repression Des Voix Dissidentes En France

May 25, 2025 -

Apple Stock Sell Off 900 Million Tariff Hit Projected

May 25, 2025

Apple Stock Sell Off 900 Million Tariff Hit Projected

May 25, 2025 -

Apple Stock Plunges On 900 Million Tariff Projection

May 25, 2025

Apple Stock Plunges On 900 Million Tariff Projection

May 25, 2025 -

Open Ai Facing Ftc Investigation Concerns And Potential Outcomes

May 25, 2025

Open Ai Facing Ftc Investigation Concerns And Potential Outcomes

May 25, 2025 -

Mercati Azionari Europei Aspettative Fed Analisi Banche E Italgas

May 25, 2025

Mercati Azionari Europei Aspettative Fed Analisi Banche E Italgas

May 25, 2025