BofA On High Stock Market Valuations: A Reason For Investor Calm

Table of Contents

BofA's Rationale Behind the Relatively High Stock Market Valuations

BofA's justification for the current high stock market valuations rests on several key pillars. Their analysis points to a confluence of factors that, in their view, support these valuations, at least for now. These include:

-

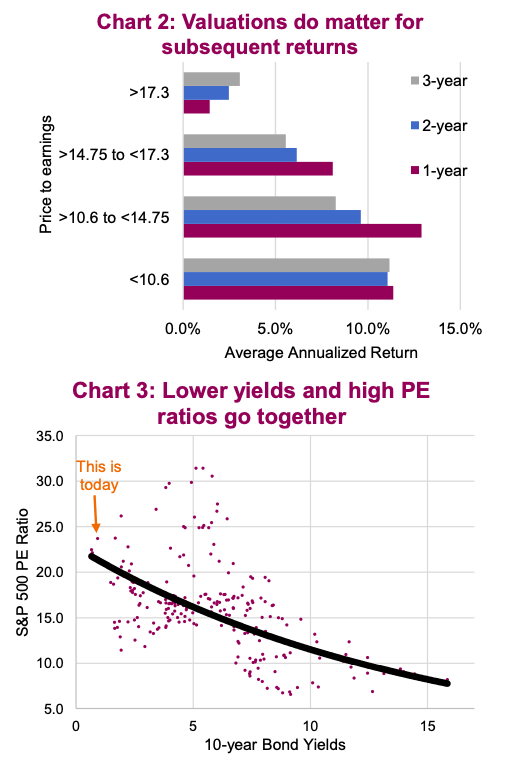

Low Interest Rates: Persistently low interest rates globally incentivize investment in riskier assets like stocks, pushing valuations higher. The reduced returns from safer, fixed-income investments make equities a more attractive option. This dynamic, according to BofA's research, is a significant contributor to the current market landscape.

-

Strong Corporate Earnings Growth: BofA highlights robust corporate earnings growth as a key factor underpinning high stock valuations. Many companies have exceeded expectations, demonstrating resilience and strong financial performance. This positive trend, according to their analysis, justifies a higher price-to-earnings ratio (P/E). (Source: [Insert citation to BofA report here – e.g., BofA Global Research Report, Date])

-

Technological Innovation Driving Future Growth: The ongoing wave of technological innovation, especially in sectors like AI and renewable energy, is seen by BofA as a catalyst for long-term growth. Investment in these sectors is driving valuations higher, reflecting anticipated future returns.

-

Positive Economic Indicators: BofA points to several positive economic indicators, such as [Insert specific economic indicators cited by BofA, e.g., strong consumer spending, robust employment figures], as evidence of underlying economic strength supporting higher stock prices. These indicators suggest continued, albeit potentially slower, economic growth.

BofA acknowledges counterarguments, such as potential inflationary pressures or geopolitical instability. However, their analysis suggests that these risks are currently factored into the market, and the positive factors outweigh the negatives in their assessment.

Understanding the Long-Term Perspective: Why a Calm Approach is Warranted

BofA's long-term outlook for the market appears cautiously optimistic. While acknowledging the possibility of short-term corrections, their analysis suggests a sustained, albeit potentially slower, growth trajectory. This long-term perspective underscores the importance of maintaining a calm approach to investing. Panicking and making impulsive decisions based on short-term market fluctuations can be detrimental to long-term investment goals.

-

Importance of diversified portfolios: Diversification across asset classes and sectors helps mitigate risk and reduce the impact of short-term market volatility.

-

Benefits of dollar-cost averaging: Investing a fixed amount at regular intervals, regardless of market fluctuations, helps average out the cost per share over time.

-

Risks of emotional investing decisions based on short-term market swings: Fear and greed can lead to poor investment decisions. A disciplined, long-term approach is crucial.

-

Focus on fundamental analysis rather than reacting to daily market noise: Concentrate on the underlying value of companies and their long-term prospects, rather than reacting to short-term price movements.

Key Indicators BofA Uses to Justify Investor Calm

BofA employs several key economic and market indicators to support its conclusion that investor calm is warranted, despite high stock market valuations. Their analysis incorporates:

-

Price-to-earnings ratios (P/E) and their historical context: BofA compares current P/E ratios to historical averages, acknowledging that they are elevated but not necessarily unsustainable.

-

Shiller P/E (CAPE) ratio analysis: The cyclically adjusted price-to-earnings ratio (CAPE) offers a smoother measure of valuation, taking into account economic cycles. BofA likely utilizes this to contextualize current valuations.

-

Other relevant valuation metrics used by BofA: [Mention other metrics if specified in the BofA report, e.g., dividend yield, price-to-sales ratio]

-

Comparison to previous periods of high valuations: BofA likely compares the current situation to past periods of high valuations, analyzing market behavior and outcomes in those instances.

Addressing Investor Concerns About High Stock Market Valuations

Understandably, high stock market valuations raise concerns about a potential market correction. BofA addresses these anxieties by emphasizing risk mitigation strategies and offering a balanced perspective.

-

Risk mitigation strategies suggested by BofA: [mention strategies like diversification, hedging, etc., as suggested by BofA's report]

-

Potential downsides and how to prepare for them: BofA likely acknowledges potential downsides but emphasizes the importance of having a well-defined investment strategy that accounts for various market scenarios.

-

The importance of professional financial advice: BofA likely advocates for seeking professional financial advice tailored to individual circumstances and risk tolerance.

Conclusion: Maintaining Investor Calm in the Face of High Stock Market Valuations

BofA's analysis suggests that while high stock market valuations are a valid concern, a balanced and informed approach is crucial. Their assessment, based on factors like low interest rates, strong corporate earnings, technological innovation, and positive economic indicators, provides a reasoned perspective supporting investor calm. By understanding the long-term outlook and utilizing appropriate risk mitigation strategies, investors can navigate this market environment effectively. Remember to consider BofA's perspective on managing high stock market valuations, prioritizing investor calm and BofA's insights when making your investment decisions. Seek professional financial advice to tailor a strategy that aligns with your individual financial goals and risk tolerance in light of these high stock market valuations.

Featured Posts

-

Decouvrir La Vie Et L Uvre D Arnarulunguaq Pionniere Inuit

May 31, 2025

Decouvrir La Vie Et L Uvre D Arnarulunguaq Pionniere Inuit

May 31, 2025 -

Find Glastonbury 2025 Coach Travel Locations Prices And Resale Tickets

May 31, 2025

Find Glastonbury 2025 Coach Travel Locations Prices And Resale Tickets

May 31, 2025 -

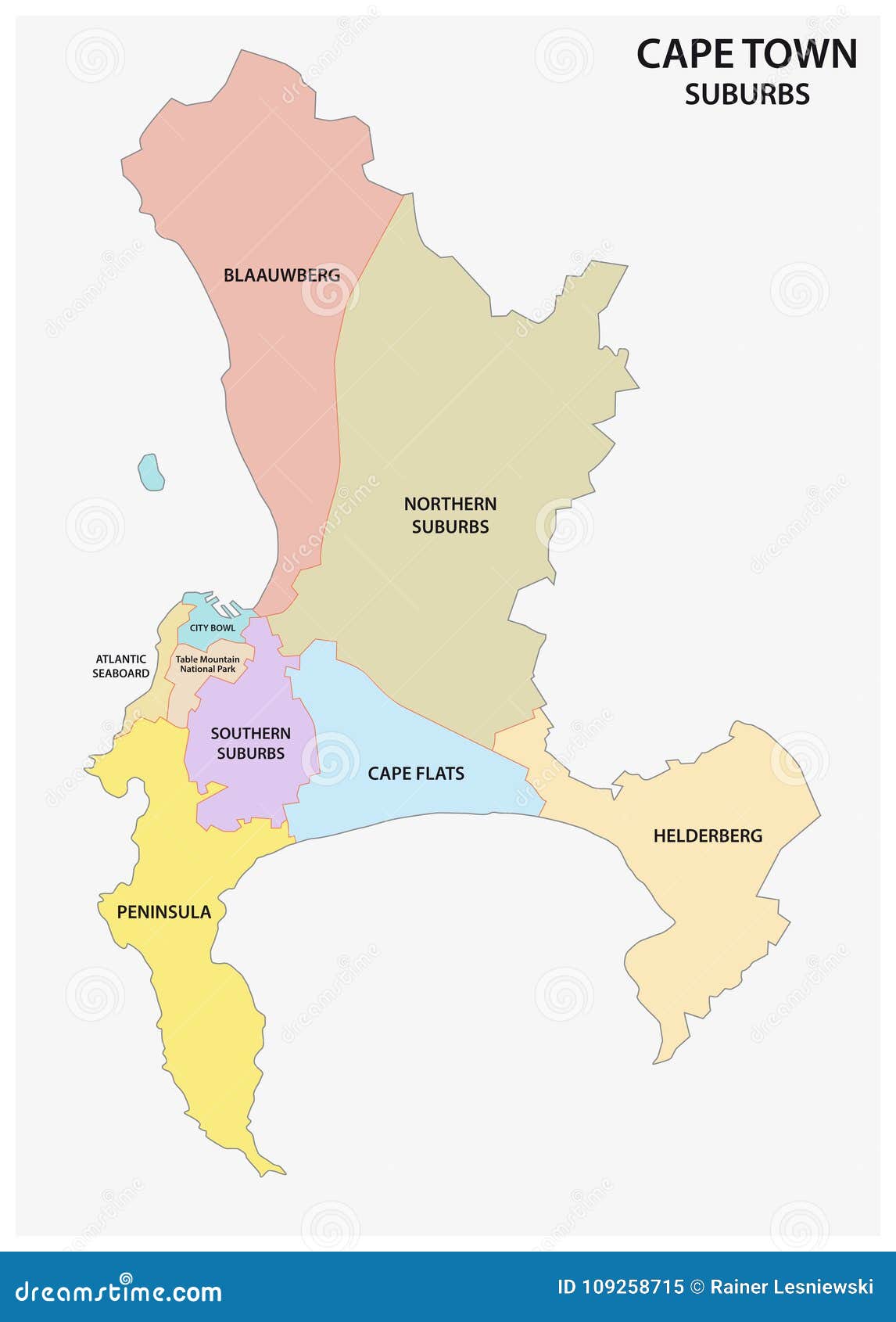

Elephant Seal In Cape Town Suburb Causes Traffic Chaos

May 31, 2025

Elephant Seal In Cape Town Suburb Causes Traffic Chaos

May 31, 2025 -

What Is The Good Life Defining And Pursuing Your Ideal Lifestyle

May 31, 2025

What Is The Good Life Defining And Pursuing Your Ideal Lifestyle

May 31, 2025 -

India Faces Rapid Spread Of Covid 19 Jn 1 Variant Key Symptoms And Prevention

May 31, 2025

India Faces Rapid Spread Of Covid 19 Jn 1 Variant Key Symptoms And Prevention

May 31, 2025